Scalper1 News

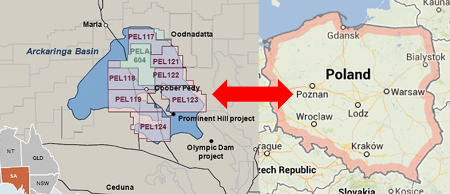

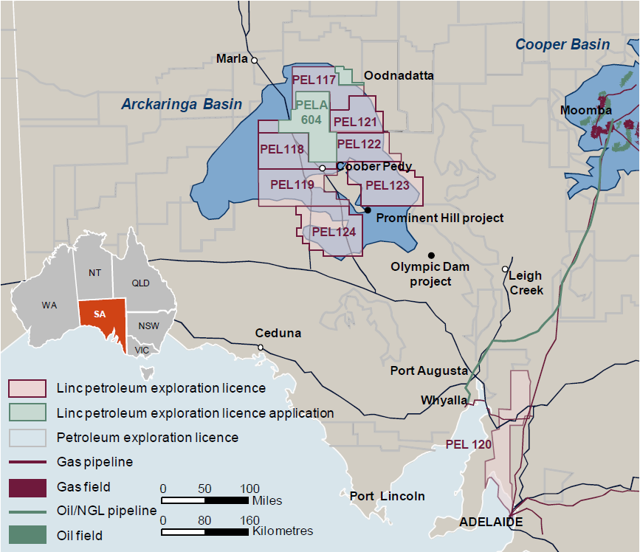

Summary The Arckaringa Basin is estimated to hold billions of barrels of oil. Linc Energy has almost exclusive rights to this region and its vast reserves. The company has had a difficult time recently but has huge future potential. Introduction The Arckaringa Basin is an endorheic basin – that is a closed drainage basin that does not allow the outflow of water. Located in Southern Australia, the basin used to be seen as a giant 31,000 square mile chunk of land. That was until they discovered oil. Arckaringa Basin v. Poland – Property Correspondent The Arckaringa Basin is quite huge with the above map showing a comparison to the country of Poland. More so, the basin already has some huge mining projects in place. On the bottom right of the map you see the Olympic Dam Project, which is a mining project run by BHP Billiton. The mine area contains the world’s single largest uranium deposit and fourth largest copper deposit. Oil Discovery Before we go onwards to talking about the potential of the Arckaringa Basin and its huge oil reserves, we must first talk about the discovery of oil in the region. Oil was first discovered in the region by a company known as Linc Energy (OTCQX: LNCGY ). The company first discovered oil in the region in 2010 and then underwent further analysis of the oil it found in 2011. Current estimates for the total amount of un-risked prospective resources in the basin are at 95 billion barrels of oil equivalent. On a risked basis, based on the probability of geological success, the area is expected to have roughly 3.5 billion barrels of oil on a risked basis . Oil Location and Amount Either way you slice it, this is an impressive amount of oil for a company currently trading with a market cap of less than $100 million. Should the company manage to recover only a hundred million barrels of oil – a pittance compared to the estimated reserves, the company could earn its entire market cap back earning just $1 per barrel. More realistically assuming a 10% recovery rate and $10 per barrel (roughly half of what the majors make) that would still turn out to almost $4 billion in profit for such a small company. (click to enlarge) Arckaringa Basin Licenses and Infrastructure – Linc Energy SAPEX The above map shows the current map of the area along with the different infrastructure in place along with the locations where Linc Energy has either a petroleum exploration license or is currently in the process of applying for one. One important thing to note is the company already has most of the basin covered in terms of licenses. Linc Energy Situation Now that we have talked about Linc Energy’s stake in the Arckaringa Basin along with talking about the discovery of the formation it is now time to talk about Linc Energy’s situation specifically. Linc Energy’s stock has seen a difficult time with much fluctuation. The company saw its stocks hit highs of $43.50 per barrel in 2008 before dropping down to as low as $7.36 during the crash lows. The company then saw a broader recovery in its stock price following the 2010 discovery up to a high of $30.83 in 2011. The company then saw its share price crash down to settle at around $7 for the second-half of 2012. The company then saw a spike to $29.55 in 2013. However, since then, and continuing throughout the current oil crash, the company has seen its stock price drop down over time to recent lows of $1.30 per barrel. Invest Linc Energy has been a falling knife in terms of share prices especially over the past two years where the company has lost almost 96% of its value. However, the company has a present market cap of just $79.3 million. Much of the long-term crash has been a result of the company’s delay in investing in the Arckaringa Basin. However such a delay will not last forever. Assuming the company continues working, it will eventually start producing significant amount of oils in the region which should provide a significant boost in the company’s stock price. More so, the current oil crash has helped exacerbate the trouble that the company’s current stock price is facing. That means that the company’s stock price is artificially low even based on its current troubles and as a result, the company represents a solid investment at current prices. Conclusion Linc Energy has had a difficult time recently. However, the Arckaringa Basin where it has significant shale stakes with impressive potential for future growth. The company has taken its time developing this resource but currently has all of the necessary permits in place to properly use it (with the exception of a few that are currently in process). More so, due to other major projects in the region, significant infrastructure already exists for when the project gets running and the company can start producing oil. For investors looking for a relatively risky investment with huge potential, Linc Energy represents one great choice. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The Arckaringa Basin is estimated to hold billions of barrels of oil. Linc Energy has almost exclusive rights to this region and its vast reserves. The company has had a difficult time recently but has huge future potential. Introduction The Arckaringa Basin is an endorheic basin – that is a closed drainage basin that does not allow the outflow of water. Located in Southern Australia, the basin used to be seen as a giant 31,000 square mile chunk of land. That was until they discovered oil. Arckaringa Basin v. Poland – Property Correspondent The Arckaringa Basin is quite huge with the above map showing a comparison to the country of Poland. More so, the basin already has some huge mining projects in place. On the bottom right of the map you see the Olympic Dam Project, which is a mining project run by BHP Billiton. The mine area contains the world’s single largest uranium deposit and fourth largest copper deposit. Oil Discovery Before we go onwards to talking about the potential of the Arckaringa Basin and its huge oil reserves, we must first talk about the discovery of oil in the region. Oil was first discovered in the region by a company known as Linc Energy (OTCQX: LNCGY ). The company first discovered oil in the region in 2010 and then underwent further analysis of the oil it found in 2011. Current estimates for the total amount of un-risked prospective resources in the basin are at 95 billion barrels of oil equivalent. On a risked basis, based on the probability of geological success, the area is expected to have roughly 3.5 billion barrels of oil on a risked basis . Oil Location and Amount Either way you slice it, this is an impressive amount of oil for a company currently trading with a market cap of less than $100 million. Should the company manage to recover only a hundred million barrels of oil – a pittance compared to the estimated reserves, the company could earn its entire market cap back earning just $1 per barrel. More realistically assuming a 10% recovery rate and $10 per barrel (roughly half of what the majors make) that would still turn out to almost $4 billion in profit for such a small company. (click to enlarge) Arckaringa Basin Licenses and Infrastructure – Linc Energy SAPEX The above map shows the current map of the area along with the different infrastructure in place along with the locations where Linc Energy has either a petroleum exploration license or is currently in the process of applying for one. One important thing to note is the company already has most of the basin covered in terms of licenses. Linc Energy Situation Now that we have talked about Linc Energy’s stake in the Arckaringa Basin along with talking about the discovery of the formation it is now time to talk about Linc Energy’s situation specifically. Linc Energy’s stock has seen a difficult time with much fluctuation. The company saw its stocks hit highs of $43.50 per barrel in 2008 before dropping down to as low as $7.36 during the crash lows. The company then saw a broader recovery in its stock price following the 2010 discovery up to a high of $30.83 in 2011. The company then saw its share price crash down to settle at around $7 for the second-half of 2012. The company then saw a spike to $29.55 in 2013. However, since then, and continuing throughout the current oil crash, the company has seen its stock price drop down over time to recent lows of $1.30 per barrel. Invest Linc Energy has been a falling knife in terms of share prices especially over the past two years where the company has lost almost 96% of its value. However, the company has a present market cap of just $79.3 million. Much of the long-term crash has been a result of the company’s delay in investing in the Arckaringa Basin. However such a delay will not last forever. Assuming the company continues working, it will eventually start producing significant amount of oils in the region which should provide a significant boost in the company’s stock price. More so, the current oil crash has helped exacerbate the trouble that the company’s current stock price is facing. That means that the company’s stock price is artificially low even based on its current troubles and as a result, the company represents a solid investment at current prices. Conclusion Linc Energy has had a difficult time recently. However, the Arckaringa Basin where it has significant shale stakes with impressive potential for future growth. The company has taken its time developing this resource but currently has all of the necessary permits in place to properly use it (with the exception of a few that are currently in process). More so, due to other major projects in the region, significant infrastructure already exists for when the project gets running and the company can start producing oil. For investors looking for a relatively risky investment with huge potential, Linc Energy represents one great choice. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News