Scalper1 News

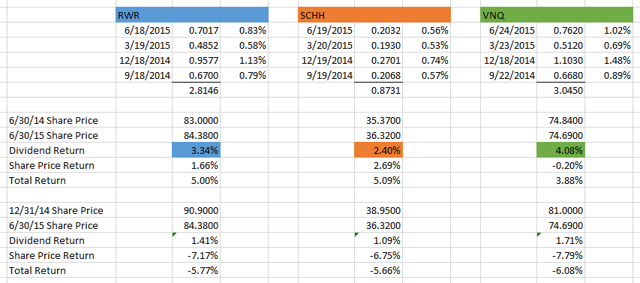

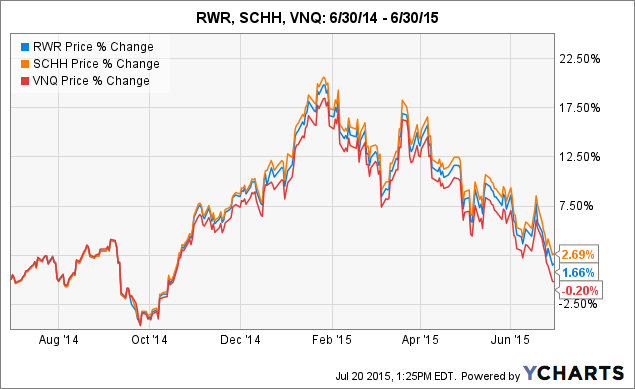

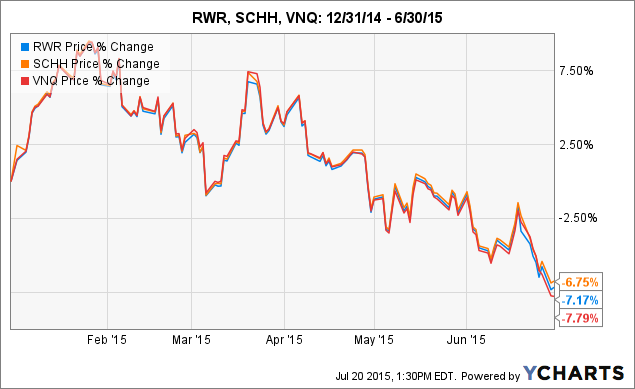

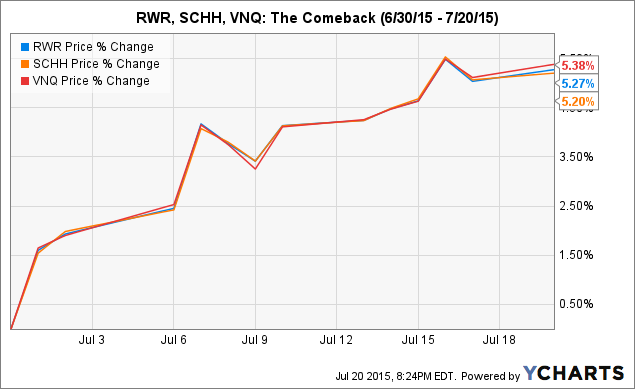

Summary REITs can enhance your core portfolio by helping you diversify into an added asset class. In this article, we will examine three worthy competitors, examining both their similarities and differences. Along the way, the author will have a preconceived notion disturbed, and discover some surprises with respect to recent performance. Now that I have spent a little time covering some basic core ETFs with which to build a simple, though well-diversified, portfolio , I thought I would branch out into an asset class that you may wish to consider as an added component. That asset class is REITS. For a little background on REITS, as well as a link to further reading if desired, feel free to check out this article on my personal blog. Presenting The Competitors In doing some research in preparation for this article, I consistently encountered information featuring three ETFs as preeminent contenders in this space; the Vanguard REIT Index ETF (NYSEARCA: VNQ ), the SPDR Dow Jones REIT ETF (NYSEARCA: RWR ), and the Schwab U.S. REIT ETF (NYSEARCA: SCHH ). I listed them in the order I did based on some commonalities I encountered in my research. VNQ is often described as sort of the pre-eminent player in the field, the “big daddy” if you will. With an inception date of 9/23/04, 145 REITs in the portfolio, $23.7 billion in Assets Under Management (AUM) , a low .12% expense ratio, and great daily trading volume leading to a wonderful average price spread of .01%, there are many reasons this ETF has been described using terms such as “the king” and “top of the charts.” RWR , in contrast, might be termed the “grand old man.” This venerable ETF is the oldest of the three, with an inception date of 4/23/01. RWR features 94 REITs in its portfolio. It has approximately $3.1 billion in AUM , an expense ratio of .25% and an average price spread of .03%. SCHH might be thought of as the “new, but competitive, kid on the block.” With an inception date of 1/13/11, it has only been around a little over 4 years. It features 95 REITs in its portfolio. It is also the smallest of the three, with $1.3 billion in AUM . Due to its smaller size and lower daily volume, it has a price spread of .05%. But here’s the kicker. Though it tracks the same index as RWR, it does so with an incredibly low .07% expense ratio. That’s right, not only does it handily beat out RWR in this area, but it also beats the much larger VNQ! Similarities and Differences As you might quickly gather, VNQ is the obvious winner in terms of greatest diversification. VNQ tracks the MCSI US Reit Index , which contains 144 constituents, whereas both RWR and SCHH track the Dow Jones U.S. Select REIT Index , which contains 92 constituents. One similarity is that the Top-10 holdings are almost exactly the same in all 3 ETFs; with General Growth Properties (NYSE: GGP ) just slipping out of the 10th spot in VNQ, replaced by Vornado Realty (NYSE: VNO ). However, here are two data points that highlight VNQ’s greater diversification. Simon Property Group (NYSE: SPG ) is the top-weighted holding in each ETF. However, while it comprises 9.83% of both RWR and SCHH, it only comprises 8.39% of VNQ. Clearly, how SPG performs will have a greater effect on RWR and SCHH. As of the latest published data, the total weight of the Top-10 holdings in RWR and SCHH is 44.63% and 44.61%, respectively. In contrast the total weight of the Top-10 holdings in VNQ is a lower 36.4%. In terms of sectors, all three track fairly closely, with a slightly higher percentage of residential REITs being featured in RWR and SCHH; approximately 20.2% vs. 17.3% in VNQ. This is offset by a slightly higher weighting in specialized REITs in the index tracked by VNQ. Recent Performance – And A Few Surprises To be honest, I came into this evaluation with somewhat of a preconceived notion. Perhaps you are already sensing it, from what you read above? I sort of felt like VNQ was going to be the runaway winner. I mean, its size, better diversification (including smaller REITs), great expense ratio, what could be better? The fact that I own VNQ in my own portfolio perhaps contributed to my viewpoint (bias?) as well. But then I started to dig into some numbers over the past year. I looked at the dividend distributions for each fund and compared them against the respective share prices. Something interesting leaped out at me right off the bat. Have a look at the picture below: (click to enlarge) First of all, you might note that VNQ (highlighted in green) is the winner as far as dividend distributions over the past year, at 4.08%. “Yep, pretty much confirms that VNQ is the king,” I proudly thought to myself. But then something caught my attention with respect to RWR (in blue) and SCHH (in brown). Both ETFs track the same index, yet RWR returned almost a full percentage point more in dividend distributions! How could that be? I next started wondering how the comparative share prices had performed over that period? In other words, was there a greater increase in the share price of SCHH that would offset the higher dividend paid by RWR? And that’s when the surprises started. Have a look at this 1-year chart: RWR data by YCharts The first item that jumped out at me was that SCHH’s share price had appreciated by 2.69% over that year, compared to 1.66% for RWR. Not only did that offset the larger dividend, in terms of total return it meant that SCHH outperformed RWR, 5.09% to 5.00% (you can see that back on the spreadsheet). That didn’t necessarily surprise me so much, as SCHH carries a lower expense ratio. You’re probably already noticing the second surprise, aren’t you? VNQ’s share price performance substantially trailed the other two; losing .20% over the period. Surely the greater dividend compensated for this? Sorry, it didn’t. To my great surprise, VNQ came in dead last in terms of total return. “Perhaps,” I thought, “this was just an aberration, something about the timing.” So I ran the same chart, but YTD through June 30. Here it is: RWR data by YCharts The first thing you will likely note is that the entire REIT sector took a pretty big hit between approximately February and June. The second thing you might note, though, is that the order of performance is the same. SCHH actually performed the best (in this case, losing the least), followed by RWR, with VNQ once again bringing up the rear. Have another look back at the spreadsheet. Even with its larger Q1 and Q2 distributions, VNQ still trails the pack in total YTD return. OK, last picture, I promise. The REIT sector has actually staged a nice comeback in July, so I thought I would see how this has played out for our 3 competitors: RWR data by YCharts Interestingly, this time the order is precisely reversed. VNQ is the strongest, with RWR in the middle and SCHH bringing up the rear. Summary & Conclusion Along the way, this became quite the interesting exercise for me, and reminded me to take nothing for granted, but instead to dig into the numbers, ask questions about details that did not appear to make sense, and follow the trail wherever it lead. At the end of the day, I’m going to call this one a tie between VNQ and SCHH. Ironically, during this latest downturn, it would appear that the smaller REITs in VNQ’s portfolio actually hurt its performance. Still, I like VNQ’s extra diversification, size and tradeability, low .12% expense ratio, and lengthy track record. At the same time, SCHH is a worthy competitor. Though not having as extensive a track record, it sure appears that Charles Schwab has succeeded in offering a quality, competitive ETF in the REIT space. That low .07% expense ratio is not to be ignored, particularly if one is a long-term investor and the slightly higher price spread is not a concern for you. And, with 95 REITs in the portfolio, it certainly offers solid diversification. RWR comes in last in my view simply because it appears clear that SCHH’s lower expense ratio is giving it a slight edge in performance. Still, if one currently holds RWR, I don’t see any particular need to sell it in favor of either VNQ or SCHH, particularly if this would create a tax impact due to unrealized gains. One last thing, if at all possible it is preferable to hold REITs in tax-deferred accounts. Since REITs receive preferred tax status as entities, their dividends are deemed non-qualified to the investor, meaning they do not benefit from the lower “qualified” dividend tax rate granted to firms that are double-taxed. As an investor, this means that you would pay tax at your highest marginal tax rate . Disclosure: I am/we are long VNQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Summary REITs can enhance your core portfolio by helping you diversify into an added asset class. In this article, we will examine three worthy competitors, examining both their similarities and differences. Along the way, the author will have a preconceived notion disturbed, and discover some surprises with respect to recent performance. Now that I have spent a little time covering some basic core ETFs with which to build a simple, though well-diversified, portfolio , I thought I would branch out into an asset class that you may wish to consider as an added component. That asset class is REITS. For a little background on REITS, as well as a link to further reading if desired, feel free to check out this article on my personal blog. Presenting The Competitors In doing some research in preparation for this article, I consistently encountered information featuring three ETFs as preeminent contenders in this space; the Vanguard REIT Index ETF (NYSEARCA: VNQ ), the SPDR Dow Jones REIT ETF (NYSEARCA: RWR ), and the Schwab U.S. REIT ETF (NYSEARCA: SCHH ). I listed them in the order I did based on some commonalities I encountered in my research. VNQ is often described as sort of the pre-eminent player in the field, the “big daddy” if you will. With an inception date of 9/23/04, 145 REITs in the portfolio, $23.7 billion in Assets Under Management (AUM) , a low .12% expense ratio, and great daily trading volume leading to a wonderful average price spread of .01%, there are many reasons this ETF has been described using terms such as “the king” and “top of the charts.” RWR , in contrast, might be termed the “grand old man.” This venerable ETF is the oldest of the three, with an inception date of 4/23/01. RWR features 94 REITs in its portfolio. It has approximately $3.1 billion in AUM , an expense ratio of .25% and an average price spread of .03%. SCHH might be thought of as the “new, but competitive, kid on the block.” With an inception date of 1/13/11, it has only been around a little over 4 years. It features 95 REITs in its portfolio. It is also the smallest of the three, with $1.3 billion in AUM . Due to its smaller size and lower daily volume, it has a price spread of .05%. But here’s the kicker. Though it tracks the same index as RWR, it does so with an incredibly low .07% expense ratio. That’s right, not only does it handily beat out RWR in this area, but it also beats the much larger VNQ! Similarities and Differences As you might quickly gather, VNQ is the obvious winner in terms of greatest diversification. VNQ tracks the MCSI US Reit Index , which contains 144 constituents, whereas both RWR and SCHH track the Dow Jones U.S. Select REIT Index , which contains 92 constituents. One similarity is that the Top-10 holdings are almost exactly the same in all 3 ETFs; with General Growth Properties (NYSE: GGP ) just slipping out of the 10th spot in VNQ, replaced by Vornado Realty (NYSE: VNO ). However, here are two data points that highlight VNQ’s greater diversification. Simon Property Group (NYSE: SPG ) is the top-weighted holding in each ETF. However, while it comprises 9.83% of both RWR and SCHH, it only comprises 8.39% of VNQ. Clearly, how SPG performs will have a greater effect on RWR and SCHH. As of the latest published data, the total weight of the Top-10 holdings in RWR and SCHH is 44.63% and 44.61%, respectively. In contrast the total weight of the Top-10 holdings in VNQ is a lower 36.4%. In terms of sectors, all three track fairly closely, with a slightly higher percentage of residential REITs being featured in RWR and SCHH; approximately 20.2% vs. 17.3% in VNQ. This is offset by a slightly higher weighting in specialized REITs in the index tracked by VNQ. Recent Performance – And A Few Surprises To be honest, I came into this evaluation with somewhat of a preconceived notion. Perhaps you are already sensing it, from what you read above? I sort of felt like VNQ was going to be the runaway winner. I mean, its size, better diversification (including smaller REITs), great expense ratio, what could be better? The fact that I own VNQ in my own portfolio perhaps contributed to my viewpoint (bias?) as well. But then I started to dig into some numbers over the past year. I looked at the dividend distributions for each fund and compared them against the respective share prices. Something interesting leaped out at me right off the bat. Have a look at the picture below: (click to enlarge) First of all, you might note that VNQ (highlighted in green) is the winner as far as dividend distributions over the past year, at 4.08%. “Yep, pretty much confirms that VNQ is the king,” I proudly thought to myself. But then something caught my attention with respect to RWR (in blue) and SCHH (in brown). Both ETFs track the same index, yet RWR returned almost a full percentage point more in dividend distributions! How could that be? I next started wondering how the comparative share prices had performed over that period? In other words, was there a greater increase in the share price of SCHH that would offset the higher dividend paid by RWR? And that’s when the surprises started. Have a look at this 1-year chart: RWR data by YCharts The first item that jumped out at me was that SCHH’s share price had appreciated by 2.69% over that year, compared to 1.66% for RWR. Not only did that offset the larger dividend, in terms of total return it meant that SCHH outperformed RWR, 5.09% to 5.00% (you can see that back on the spreadsheet). That didn’t necessarily surprise me so much, as SCHH carries a lower expense ratio. You’re probably already noticing the second surprise, aren’t you? VNQ’s share price performance substantially trailed the other two; losing .20% over the period. Surely the greater dividend compensated for this? Sorry, it didn’t. To my great surprise, VNQ came in dead last in terms of total return. “Perhaps,” I thought, “this was just an aberration, something about the timing.” So I ran the same chart, but YTD through June 30. Here it is: RWR data by YCharts The first thing you will likely note is that the entire REIT sector took a pretty big hit between approximately February and June. The second thing you might note, though, is that the order of performance is the same. SCHH actually performed the best (in this case, losing the least), followed by RWR, with VNQ once again bringing up the rear. Have another look back at the spreadsheet. Even with its larger Q1 and Q2 distributions, VNQ still trails the pack in total YTD return. OK, last picture, I promise. The REIT sector has actually staged a nice comeback in July, so I thought I would see how this has played out for our 3 competitors: RWR data by YCharts Interestingly, this time the order is precisely reversed. VNQ is the strongest, with RWR in the middle and SCHH bringing up the rear. Summary & Conclusion Along the way, this became quite the interesting exercise for me, and reminded me to take nothing for granted, but instead to dig into the numbers, ask questions about details that did not appear to make sense, and follow the trail wherever it lead. At the end of the day, I’m going to call this one a tie between VNQ and SCHH. Ironically, during this latest downturn, it would appear that the smaller REITs in VNQ’s portfolio actually hurt its performance. Still, I like VNQ’s extra diversification, size and tradeability, low .12% expense ratio, and lengthy track record. At the same time, SCHH is a worthy competitor. Though not having as extensive a track record, it sure appears that Charles Schwab has succeeded in offering a quality, competitive ETF in the REIT space. That low .07% expense ratio is not to be ignored, particularly if one is a long-term investor and the slightly higher price spread is not a concern for you. And, with 95 REITs in the portfolio, it certainly offers solid diversification. RWR comes in last in my view simply because it appears clear that SCHH’s lower expense ratio is giving it a slight edge in performance. Still, if one currently holds RWR, I don’t see any particular need to sell it in favor of either VNQ or SCHH, particularly if this would create a tax impact due to unrealized gains. One last thing, if at all possible it is preferable to hold REITs in tax-deferred accounts. Since REITs receive preferred tax status as entities, their dividends are deemed non-qualified to the investor, meaning they do not benefit from the lower “qualified” dividend tax rate granted to firms that are double-taxed. As an investor, this means that you would pay tax at your highest marginal tax rate . Disclosure: I am/we are long VNQ. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Scalper1 News