Scalper1 News

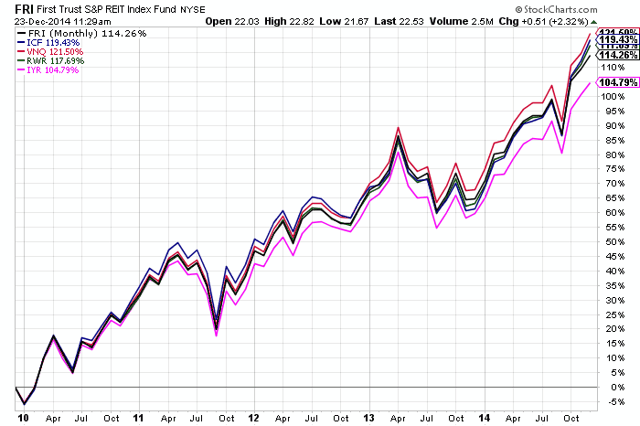

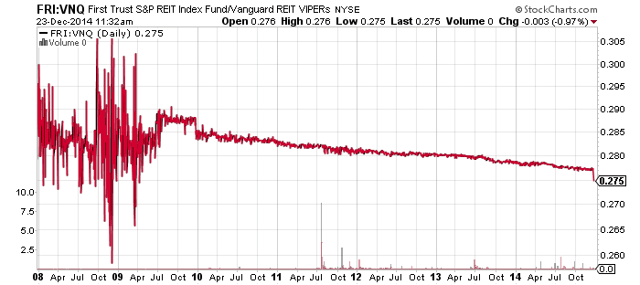

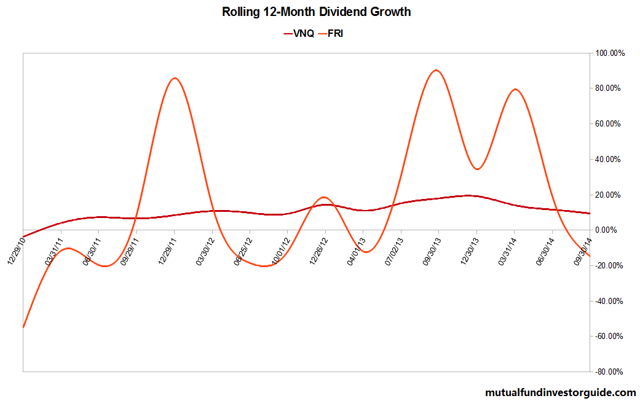

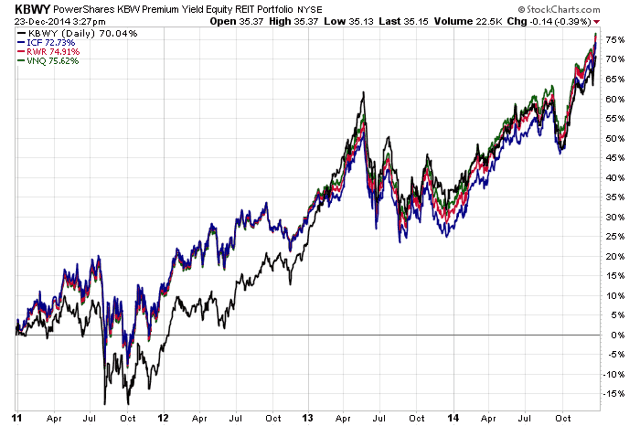

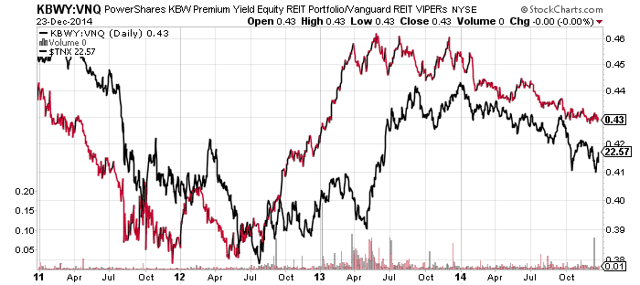

Summary FRI offers similar exposure to VNQ, but at five times the cost. Small-cap KBWY delivers a full percentage point more in yield. KBWY has outperformed large-cap REITs when interest rates increased in the past. There are two more ETFs to cover on the domestic side. The first is the First Trust S&P REIT Index ETF (NYSEARCA: FRI ). This one of the smaller REIT ETFs on the market, but has amassed nearly $300 million since inception in 2007. Index & Strategy FRI tracks the S&P United States REIT Index. The index covers U.S. REIT shares, including some specialty REITs such as prisons, but holds no timber REITs. Due to criteria that the companies own properties, the index also excludes mortgage REITs. The holdings are weighted by market cap. The holdings and the weightings in FRI are most similar to those of the Vanguard REIT Index ETF (NYSEARCA: VNQ ), which tracks the MSCI US REIT Index. Performance FRI has slightly trailed other pure real estate REIT ETFs over the past five years. (click to enlarge) The fund most similar to FRI is VNQ. Since FRI costs 0.40 percent more to hold, it has consistently underperformed VNQ. The line is almost perfectly straight, reflecting the extremely tight correlation between the funds. (The dip at the end of the chart is due to FRI going ex-dividend today.) (click to enlarge) Expenses FRI charges 0.50 percent versus the 0.10 percent charged by VNQ. Income FRI has a 30-day SEC yield of 3.23 percent. The yield is solid, but its payouts have been more erratic than VNQ (data from Yahoo Finance). (click to enlarge) Conclusion Investors should stick with Vanguard REIT Index ETF, which delivers almost exactly the same exposure, but at a lower cost and steadier income stream. A more attractive REIT ETF is an offering from PowerShares with a portfolio heavily tilted towards small-caps, the PowerShares KBW Premium Yield Equity REIT Portfolio ETF (NYSEARCA: KBWY ). Index & Strategy KBWY tracks the KBW Premium Yield Equity REIT Index, which is “a dividend yield weighted methodology that seeks to reflect the performance of approximately 24 to 40 small- and mid-cap equity REITs in the United States.” The portfolio is currently about 75 percent invested in small-caps, 22 percent in mid caps and 3 percent in large-caps. The portfolio is diversified, but has only 31 holdings. The largest holding, Government Properties Income Trust (NYSE: GOV ), has 5.14 percent of assets, and the smallest holding, STAG Industrial (NYSE: STAG ), has 1.20 percent. Similar to other REIT ETFs, retail makes up the largest slice of assets at about 27 percent, but healthcare is close behind, with nearly 26 percent of assets as of September 30. Diversified REITs make up 20 percent of assets, followed by 14 percent of assets in office REITs. Performance KBWY has kept pace with other REIT ETFs over the past five years, but trailed from 2011 through 2012. (click to enlarge) KBWY has shown some sensitivity to rates, but it has generally under performed as rates decreased, as shown in this comparison with VNQ. The 10-year Treasury yield is in black. (click to enlarge) Expenses KBWY charges 0.35 percent. It is a relatively low expense ratio adjusting for the fact that the portfolio is in small-caps. Income KBWY has a 30-day SEC yield of 4.74 percent, making it the highest-yielding non-mortgage REIT ETF we’ve covered. KBWY pays monthly dividends. Payouts have been consistent from month to month, and have been generally rising since the end of 2011. Conclusion KBWY has been a consistent performer. It has been more volatile than REIT ETFs which fall in the large-cap category, but its performance hasn’t deviated widely from the pack. KBWY has a three-year standard deviation of 14.64 versus VNQ’s 13.42 standard deviation. The big difference so far has been that more of KBWY’s return comes in the form of income. Investors interested in higher income or monthly payouts can pair KBWY with a fund such as VNQ to up the total payout from their REIT exposure. It remains to be seen if KBWY can outperform when interest rates increase. If it can, it would make the fund a compelling option in a rising rate environment. Scalper1 News

Summary FRI offers similar exposure to VNQ, but at five times the cost. Small-cap KBWY delivers a full percentage point more in yield. KBWY has outperformed large-cap REITs when interest rates increased in the past. There are two more ETFs to cover on the domestic side. The first is the First Trust S&P REIT Index ETF (NYSEARCA: FRI ). This one of the smaller REIT ETFs on the market, but has amassed nearly $300 million since inception in 2007. Index & Strategy FRI tracks the S&P United States REIT Index. The index covers U.S. REIT shares, including some specialty REITs such as prisons, but holds no timber REITs. Due to criteria that the companies own properties, the index also excludes mortgage REITs. The holdings are weighted by market cap. The holdings and the weightings in FRI are most similar to those of the Vanguard REIT Index ETF (NYSEARCA: VNQ ), which tracks the MSCI US REIT Index. Performance FRI has slightly trailed other pure real estate REIT ETFs over the past five years. (click to enlarge) The fund most similar to FRI is VNQ. Since FRI costs 0.40 percent more to hold, it has consistently underperformed VNQ. The line is almost perfectly straight, reflecting the extremely tight correlation between the funds. (The dip at the end of the chart is due to FRI going ex-dividend today.) (click to enlarge) Expenses FRI charges 0.50 percent versus the 0.10 percent charged by VNQ. Income FRI has a 30-day SEC yield of 3.23 percent. The yield is solid, but its payouts have been more erratic than VNQ (data from Yahoo Finance). (click to enlarge) Conclusion Investors should stick with Vanguard REIT Index ETF, which delivers almost exactly the same exposure, but at a lower cost and steadier income stream. A more attractive REIT ETF is an offering from PowerShares with a portfolio heavily tilted towards small-caps, the PowerShares KBW Premium Yield Equity REIT Portfolio ETF (NYSEARCA: KBWY ). Index & Strategy KBWY tracks the KBW Premium Yield Equity REIT Index, which is “a dividend yield weighted methodology that seeks to reflect the performance of approximately 24 to 40 small- and mid-cap equity REITs in the United States.” The portfolio is currently about 75 percent invested in small-caps, 22 percent in mid caps and 3 percent in large-caps. The portfolio is diversified, but has only 31 holdings. The largest holding, Government Properties Income Trust (NYSE: GOV ), has 5.14 percent of assets, and the smallest holding, STAG Industrial (NYSE: STAG ), has 1.20 percent. Similar to other REIT ETFs, retail makes up the largest slice of assets at about 27 percent, but healthcare is close behind, with nearly 26 percent of assets as of September 30. Diversified REITs make up 20 percent of assets, followed by 14 percent of assets in office REITs. Performance KBWY has kept pace with other REIT ETFs over the past five years, but trailed from 2011 through 2012. (click to enlarge) KBWY has shown some sensitivity to rates, but it has generally under performed as rates decreased, as shown in this comparison with VNQ. The 10-year Treasury yield is in black. (click to enlarge) Expenses KBWY charges 0.35 percent. It is a relatively low expense ratio adjusting for the fact that the portfolio is in small-caps. Income KBWY has a 30-day SEC yield of 4.74 percent, making it the highest-yielding non-mortgage REIT ETF we’ve covered. KBWY pays monthly dividends. Payouts have been consistent from month to month, and have been generally rising since the end of 2011. Conclusion KBWY has been a consistent performer. It has been more volatile than REIT ETFs which fall in the large-cap category, but its performance hasn’t deviated widely from the pack. KBWY has a three-year standard deviation of 14.64 versus VNQ’s 13.42 standard deviation. The big difference so far has been that more of KBWY’s return comes in the form of income. Investors interested in higher income or monthly payouts can pair KBWY with a fund such as VNQ to up the total payout from their REIT exposure. It remains to be seen if KBWY can outperform when interest rates increase. If it can, it would make the fund a compelling option in a rising rate environment. Scalper1 News

Scalper1 News