Scalper1 News

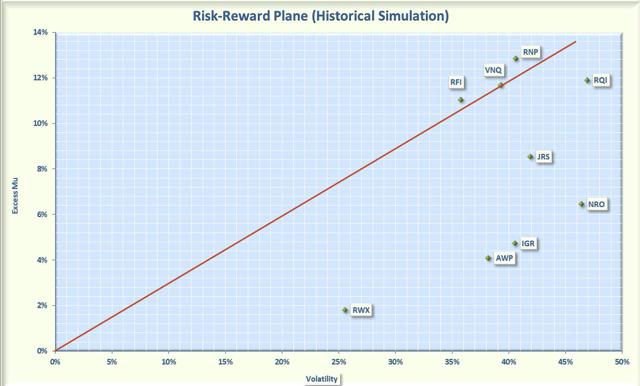

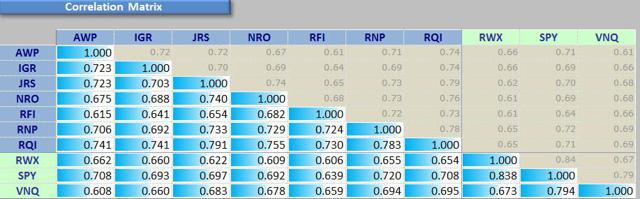

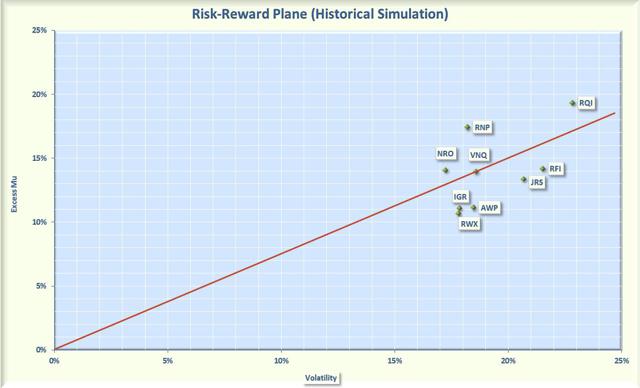

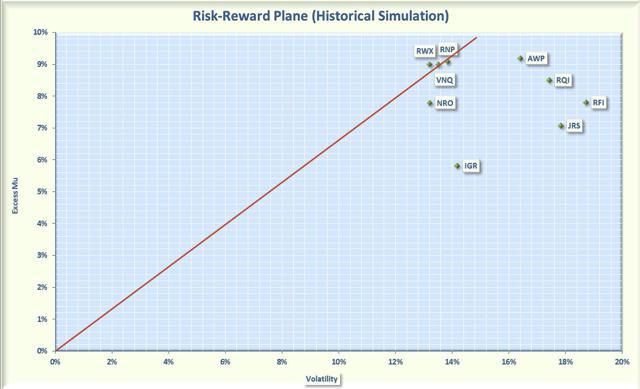

Summary Over the past 8 years, only RNP has consistently outperformed VNQ on a risk-adjusted basis. REIT CEFs help diversify an S&P 500 focused portfolio. Domestic REIT funds outperformed international REIT funds over most of the timeframes analyzed. In November, 2014, I wrote an article expounding the benefits of Real Estate Investment Trusts (REITs). Unfortunately, in late January of this year, REITs hit a speed bump, many dropping by 15% or more. The likely reason was the fear that REIT prices would fall when the Fed raised interest rates. However, since the Fed will likely not raise rates unless the economy is thriving, increased rates may not be all bad for REITs. A robust economy typically bodes well for real estate and according to REIT.com , during the 16 periods since 1995 where interest rates rose significantly, equity REITs generated positive returns in 12 of the periods. As a retiree looking for income, I am a fan of REITs. I own some individual REITs but I tend to gravitate to REIT funds, especially Closed-End Funds (CEFs) because of their high distributions. As prices have decreased, the discounts associated with REIT CEFs have widened and the distribution percentages have increased. If you believe the weakness is temporary, now may be a good time to consider adding REITs to your portfolio. There are currently 12 CEFs focused on REITs, so the question is, which funds are “best.” There are many ways to define “best.” Some investors may use total return as a metric, but as a retiree, risk is as important to me as return. Therefore, I define “best” as the fund that provides the most reward for a given level of risk and I measure risk by the volatility. Please note that I am not advocating that this is the way everyone should define “best”; I am just saying that this is the definition that works for me. This article will analyze the REIT CEFs to assess relative risk-adjusted performance since the bear market of 2008. Along the way, I will also compare the REIT CEFs to Exchange Traded Funds (ETFs). However, before jumping into the analysis, it will be useful to review some of the characteristics of this asset class. In 1960, Congress created a new type of security called REITs that allowed real estate investments to be traded as a stock. The objective of this landmark legislation was to provide a way for small investors to participate in the income from large scale real estate projects. A REIT is a company that specializes in real estate, either through properties or mortgages. There are two major types of REITs: Equity REITs purchase and operate real estate properties. Income usually comes through the collection of rents. About 90% of REITs are equity REITs. Mortgage REITs invest in mortgages or mortgage-backed securities. Income is generated primarily from the interest that is earned on mortgage loans. The risks and rewards associated with mortgage REITs are very different than those associated with equity REITs. This article will only consider equity REITs. One of the reasons REITs are so popular is that they receive special tax treatment, and as a result, are required to distribute at least 90% of their taxable income each year. This usually translates into relatively large yields. But because REITs must pay out 90% of their income, they rely on debt for growth. This means that REITs are sensitive to interest rates. If the interest rates rise, the cost of debt increases and the REITs have less money for business investment. However, as we have discussed, rising rates usually imply increased economic activity, and as the economy expands, there is a higher demand for real estate, which is positive for REITs. To narrow the analysis space, I used the following selection criteria: A history that goes back to 2007 (to see how the fund reacted during the 2008 bear market). Generally, REITs were devastated in 2008, but, like other equities, they have recovered strongly since 2009. A market cap of at least $100M An average daily trading volume of at least 50,000 shares The 7 CEFs that passed the screen are summarized below. Nuveen Real Estate Income ( JRS ). This CEF sells for a discount of 7.6%, which is unusual since over the past 5 years the fund has sold at an average premium of 3.3%. The fund has 93 holdings with 57% invested in REITs and the rest in preferred stock. The REIT’s holdings are spread over all types of properties (retail, office, residential, healthcare, hotels). As with most REITs, the price of the fund dropped over 60% in 2008, but rebounded strongly in 2009, gaining 89%. The fund utilizes 29% leverage and has an expense ratio of 1.8%, including interest payments. This distribution is 9%, funded from income and capital gains, with no return of capital (NYSE: ROC ) over the past year. Neuberger Berman Real Estate Securities Income Fund ( NRO ). This CEF sells for a discount of 16.3%, which is larger than its 5-year average discount of 12.8%. The fund consists of 70 holdings with 66% in diversified REITs and 33% in preferred shares. The price of the fund fell a whopping 78% in 2008, but rebounded over 100% in 2009. The fund uses leverage of 27% and has an expense ratio of 1.7%, including interest payments. The yield is 7.4% funded primarily from income with no ROC. Cohen and Steers Quality Income Realty Fund ( RQI ). This CEF sells for a 13% discount, which is larger than its 5-year average discount of 8.4%. The fund has 126 holdings consisting of REITs (82%) and preferred stock (16%). The price of this fund fell 68% in 2008 and gained 80% in 2009. The fund utilizes 24% leverage and has an expense ratio of 1.9%, including interest payments. The distribution is 8.5%, consisting primarily of income and long-term gains with no ROC. Cohen and Steers Total Return Reality (NYSE: RFI ). This CEF sells for a discount 9%, which is larger than the 5 year average discount of 0.9%. The portfolio consists of 143 securities with 80% in diversified REITs and 19% in preferred stocks. This fund does not use leverage and has an expense ratio of 0.9%. The distribution is 7.7% with no ROC. Cohen and Steers REIT and Preferred Income Fund ( RNP ). This CEF sells for a discount of 15.6%, which is larger than its 5-year average discount of 9.9%. The portfolio consists of 206 holdings with 50% in REITs and 48% in preferred shares. The fund lost 60% in 2008 and rebounded strongly in 2009, gaining over 90%. The fund uses 25% leverage and has an expense ratio of 1.7%, including interest payments. The distribution is 8.3%, consisting primarily of income with about 40% ROC over the past 6 months. The undistributed net investment income (UNII) is positive so I would consider the ROC to be non-destructive. CBRE Clarion Global Real Estate Income ( IGR ). This CEF sells for a discount of 15.1%, which is larger than its 5-year average discount of 9.7%. The portfolio consists of 57 securities with 90% in REITs and the rest in preferred shares. About 50% of the holdings are from the United States with the rest spread over Asia, Europe, Australia, and Canada. The fund dropped 67% in 2008 and gained 79% in 2009. This fund uses only a small amount of leverage (9.6%) and has an expense ratio of 1.1%. The distribution is 7.4%, consisting of income and ROC in roughly equal parts. Some of the distribution appears to be destructive since UNII is negative and is large when compared to the distribution. Alpine Global Premier Properties Fund ( AWP ). This CEF sells for a discount of 13.8%, which is larger than its 5-year average discount of 11.4%. The portfolio consists of 105 holdings with almost all (99%) in REITs. Only 30% of the holdings are domiciled in the United States. The next largest geographical weightings are Japan at 15% followed by the UK at 10% and China at 8%. The fund lost 63% in 2008 and rebounded 79% in 2009. The fund uses only a small amount (2%) of leverage and has an expense ratio of 1.3%, including interest payments. The distribution is 9.2% consisting primarily of income and about 40% ROC. Some of the distribution appears to be destructive since UNII is negative and is large when compared to the distribution. For comparison, I used the following Exchange Traded Funds (ETFs). Vanguard REIT Index ETF ( VNQ ). This ETF was launched in 2004 and tracks the MSCI US REIT Index, which is a pure equity REIT index. The index is diversified across real estate sectors with retail being the largest constituent at 27% followed by Office (15%), residential (15%), and health care (15%). The fund lost a relatively low 37% in 2008 and recovered 30% in 2009. The fund charges a miniscule 0.12%, which is substantially less than most of its competitors. The fund yields 4.1%. SPDR Dow Jones International Real Estate (NYSEARCA: RWX ). This ETF offers exposure to foreign real estate REITs. It holds 120 securities with 54% domiciled in the Pacific region (21% from Japan and 12% from Australia) and 36% domiciled in Europe. This fund lost 50% in 2008 and recovered 36% in 2009. The fund has an expense ratio of 0.59% and yields 3%. For the funds that met my criteria, I plotted the annualized rate of return in excess of the risk-free rate (called Excess Mu on the charts) versus the volatility for each fund. This data is shown in Figure 1. The risk-free rate was assumed to be 1%. The Smartfolio 3 program was used to generate this chart. (click to enlarge) Figure 1. Risk versus reward over bear-bull cycle Figure 1 illustrates that REIT funds have had a large range of returns and volatilities. To better assess the relative performance of these funds, I calculated the Sharpe Ratio. The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with VNQ. If an asset is above the line, it has a higher Sharpe Ratio than VNQ. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY. Some interesting observations are evident from the figure. With the exception of RWX, REIT funds had similar volatilities but significantly different returns. Somewhat surprisingly, RWX was by far the least volatile fund but it also had the least return. RQI and NRO were the most volatile. Over the bear-bull cycle, three funds (RFI, VNQ, and RNP) outperformed the other funds on a risk-adjusted basis with RNP eking out the best performance by a small margin. The international REIT funds (RWX, AWP, and IGR) substantially lagged the domestic REIT funds. RQI had relative good absolute performance but, when coupled with the high volatility, had the fourth best risk-adjusted performance. One of the reasons often touted for owning REITs is the diversification they provide. To be “diversified,” you want to choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. To assess the degree of diversification, I calculated the pair-wise correlations associated with the REIT funds. To round out the analysis, I also included SPDR S&P 500 (NYSEARCA: SPY ) to represent the overall stock market. The results are provided as a correlation matrix in Figure 2. (click to enlarge) Figure 2. Correlation matrix over bear-bull cycle As is apparent from the matrix, REITs did provide a reasonable amount of portfolio diversification. The REIT CEFs were about 70% correlated with SPY. The CEFs were also not highly correlated with each other or with the REIT ETFs (with correlations ranging from 60% to 80%). As you might expect, the Cohen and Steers REIT funds were more correlated with each other than with others funds, but they still offered relatively good diversification. Next, I looked at the past 5-year period to see if the REIT performance had significantly changed. The results are shown in Figure 3. The performances were tightly bunched, but RNP was still the best performer with NRO and RQI both beating VNQ. The international funds improved but still lagged. (click to enlarge) Figure 3. Risk versus reward over past 5 years As a final test, I re-ran the analysis over the past 3 years and the results are shown in Figure 4. What a difference a couple of years made! Over this period, the two ETFs (RWX and VNQ) plus RNP have generated the best risk-adjusted performance. AWP and NRO also had relatively good performance with RQI, RFI, JRS, and IGR lagging. IGR had the worst performance among all the funds. (click to enlarge) Figure 4. Risk versus reward over past 3 years Bottom Line REITs have had good performance in the past but have recently fallen on hard times. If you believe that REITs currently offer a buying opportunity, I recommend either VNQ or RNP, depending on whether you prefer ETFs or CEFs. I would steer clear of international funds since their performance has not be consistent over the years. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VNQ,RNP over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Over the past 8 years, only RNP has consistently outperformed VNQ on a risk-adjusted basis. REIT CEFs help diversify an S&P 500 focused portfolio. Domestic REIT funds outperformed international REIT funds over most of the timeframes analyzed. In November, 2014, I wrote an article expounding the benefits of Real Estate Investment Trusts (REITs). Unfortunately, in late January of this year, REITs hit a speed bump, many dropping by 15% or more. The likely reason was the fear that REIT prices would fall when the Fed raised interest rates. However, since the Fed will likely not raise rates unless the economy is thriving, increased rates may not be all bad for REITs. A robust economy typically bodes well for real estate and according to REIT.com , during the 16 periods since 1995 where interest rates rose significantly, equity REITs generated positive returns in 12 of the periods. As a retiree looking for income, I am a fan of REITs. I own some individual REITs but I tend to gravitate to REIT funds, especially Closed-End Funds (CEFs) because of their high distributions. As prices have decreased, the discounts associated with REIT CEFs have widened and the distribution percentages have increased. If you believe the weakness is temporary, now may be a good time to consider adding REITs to your portfolio. There are currently 12 CEFs focused on REITs, so the question is, which funds are “best.” There are many ways to define “best.” Some investors may use total return as a metric, but as a retiree, risk is as important to me as return. Therefore, I define “best” as the fund that provides the most reward for a given level of risk and I measure risk by the volatility. Please note that I am not advocating that this is the way everyone should define “best”; I am just saying that this is the definition that works for me. This article will analyze the REIT CEFs to assess relative risk-adjusted performance since the bear market of 2008. Along the way, I will also compare the REIT CEFs to Exchange Traded Funds (ETFs). However, before jumping into the analysis, it will be useful to review some of the characteristics of this asset class. In 1960, Congress created a new type of security called REITs that allowed real estate investments to be traded as a stock. The objective of this landmark legislation was to provide a way for small investors to participate in the income from large scale real estate projects. A REIT is a company that specializes in real estate, either through properties or mortgages. There are two major types of REITs: Equity REITs purchase and operate real estate properties. Income usually comes through the collection of rents. About 90% of REITs are equity REITs. Mortgage REITs invest in mortgages or mortgage-backed securities. Income is generated primarily from the interest that is earned on mortgage loans. The risks and rewards associated with mortgage REITs are very different than those associated with equity REITs. This article will only consider equity REITs. One of the reasons REITs are so popular is that they receive special tax treatment, and as a result, are required to distribute at least 90% of their taxable income each year. This usually translates into relatively large yields. But because REITs must pay out 90% of their income, they rely on debt for growth. This means that REITs are sensitive to interest rates. If the interest rates rise, the cost of debt increases and the REITs have less money for business investment. However, as we have discussed, rising rates usually imply increased economic activity, and as the economy expands, there is a higher demand for real estate, which is positive for REITs. To narrow the analysis space, I used the following selection criteria: A history that goes back to 2007 (to see how the fund reacted during the 2008 bear market). Generally, REITs were devastated in 2008, but, like other equities, they have recovered strongly since 2009. A market cap of at least $100M An average daily trading volume of at least 50,000 shares The 7 CEFs that passed the screen are summarized below. Nuveen Real Estate Income ( JRS ). This CEF sells for a discount of 7.6%, which is unusual since over the past 5 years the fund has sold at an average premium of 3.3%. The fund has 93 holdings with 57% invested in REITs and the rest in preferred stock. The REIT’s holdings are spread over all types of properties (retail, office, residential, healthcare, hotels). As with most REITs, the price of the fund dropped over 60% in 2008, but rebounded strongly in 2009, gaining 89%. The fund utilizes 29% leverage and has an expense ratio of 1.8%, including interest payments. This distribution is 9%, funded from income and capital gains, with no return of capital (NYSE: ROC ) over the past year. Neuberger Berman Real Estate Securities Income Fund ( NRO ). This CEF sells for a discount of 16.3%, which is larger than its 5-year average discount of 12.8%. The fund consists of 70 holdings with 66% in diversified REITs and 33% in preferred shares. The price of the fund fell a whopping 78% in 2008, but rebounded over 100% in 2009. The fund uses leverage of 27% and has an expense ratio of 1.7%, including interest payments. The yield is 7.4% funded primarily from income with no ROC. Cohen and Steers Quality Income Realty Fund ( RQI ). This CEF sells for a 13% discount, which is larger than its 5-year average discount of 8.4%. The fund has 126 holdings consisting of REITs (82%) and preferred stock (16%). The price of this fund fell 68% in 2008 and gained 80% in 2009. The fund utilizes 24% leverage and has an expense ratio of 1.9%, including interest payments. The distribution is 8.5%, consisting primarily of income and long-term gains with no ROC. Cohen and Steers Total Return Reality (NYSE: RFI ). This CEF sells for a discount 9%, which is larger than the 5 year average discount of 0.9%. The portfolio consists of 143 securities with 80% in diversified REITs and 19% in preferred stocks. This fund does not use leverage and has an expense ratio of 0.9%. The distribution is 7.7% with no ROC. Cohen and Steers REIT and Preferred Income Fund ( RNP ). This CEF sells for a discount of 15.6%, which is larger than its 5-year average discount of 9.9%. The portfolio consists of 206 holdings with 50% in REITs and 48% in preferred shares. The fund lost 60% in 2008 and rebounded strongly in 2009, gaining over 90%. The fund uses 25% leverage and has an expense ratio of 1.7%, including interest payments. The distribution is 8.3%, consisting primarily of income with about 40% ROC over the past 6 months. The undistributed net investment income (UNII) is positive so I would consider the ROC to be non-destructive. CBRE Clarion Global Real Estate Income ( IGR ). This CEF sells for a discount of 15.1%, which is larger than its 5-year average discount of 9.7%. The portfolio consists of 57 securities with 90% in REITs and the rest in preferred shares. About 50% of the holdings are from the United States with the rest spread over Asia, Europe, Australia, and Canada. The fund dropped 67% in 2008 and gained 79% in 2009. This fund uses only a small amount of leverage (9.6%) and has an expense ratio of 1.1%. The distribution is 7.4%, consisting of income and ROC in roughly equal parts. Some of the distribution appears to be destructive since UNII is negative and is large when compared to the distribution. Alpine Global Premier Properties Fund ( AWP ). This CEF sells for a discount of 13.8%, which is larger than its 5-year average discount of 11.4%. The portfolio consists of 105 holdings with almost all (99%) in REITs. Only 30% of the holdings are domiciled in the United States. The next largest geographical weightings are Japan at 15% followed by the UK at 10% and China at 8%. The fund lost 63% in 2008 and rebounded 79% in 2009. The fund uses only a small amount (2%) of leverage and has an expense ratio of 1.3%, including interest payments. The distribution is 9.2% consisting primarily of income and about 40% ROC. Some of the distribution appears to be destructive since UNII is negative and is large when compared to the distribution. For comparison, I used the following Exchange Traded Funds (ETFs). Vanguard REIT Index ETF ( VNQ ). This ETF was launched in 2004 and tracks the MSCI US REIT Index, which is a pure equity REIT index. The index is diversified across real estate sectors with retail being the largest constituent at 27% followed by Office (15%), residential (15%), and health care (15%). The fund lost a relatively low 37% in 2008 and recovered 30% in 2009. The fund charges a miniscule 0.12%, which is substantially less than most of its competitors. The fund yields 4.1%. SPDR Dow Jones International Real Estate (NYSEARCA: RWX ). This ETF offers exposure to foreign real estate REITs. It holds 120 securities with 54% domiciled in the Pacific region (21% from Japan and 12% from Australia) and 36% domiciled in Europe. This fund lost 50% in 2008 and recovered 36% in 2009. The fund has an expense ratio of 0.59% and yields 3%. For the funds that met my criteria, I plotted the annualized rate of return in excess of the risk-free rate (called Excess Mu on the charts) versus the volatility for each fund. This data is shown in Figure 1. The risk-free rate was assumed to be 1%. The Smartfolio 3 program was used to generate this chart. (click to enlarge) Figure 1. Risk versus reward over bear-bull cycle Figure 1 illustrates that REIT funds have had a large range of returns and volatilities. To better assess the relative performance of these funds, I calculated the Sharpe Ratio. The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. In Figure 1, I plotted a red line that represents the Sharpe Ratio associated with VNQ. If an asset is above the line, it has a higher Sharpe Ratio than VNQ. Conversely, if an asset is below the line, the reward-to-risk is worse than SPY. Some interesting observations are evident from the figure. With the exception of RWX, REIT funds had similar volatilities but significantly different returns. Somewhat surprisingly, RWX was by far the least volatile fund but it also had the least return. RQI and NRO were the most volatile. Over the bear-bull cycle, three funds (RFI, VNQ, and RNP) outperformed the other funds on a risk-adjusted basis with RNP eking out the best performance by a small margin. The international REIT funds (RWX, AWP, and IGR) substantially lagged the domestic REIT funds. RQI had relative good absolute performance but, when coupled with the high volatility, had the fourth best risk-adjusted performance. One of the reasons often touted for owning REITs is the diversification they provide. To be “diversified,” you want to choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. To assess the degree of diversification, I calculated the pair-wise correlations associated with the REIT funds. To round out the analysis, I also included SPDR S&P 500 (NYSEARCA: SPY ) to represent the overall stock market. The results are provided as a correlation matrix in Figure 2. (click to enlarge) Figure 2. Correlation matrix over bear-bull cycle As is apparent from the matrix, REITs did provide a reasonable amount of portfolio diversification. The REIT CEFs were about 70% correlated with SPY. The CEFs were also not highly correlated with each other or with the REIT ETFs (with correlations ranging from 60% to 80%). As you might expect, the Cohen and Steers REIT funds were more correlated with each other than with others funds, but they still offered relatively good diversification. Next, I looked at the past 5-year period to see if the REIT performance had significantly changed. The results are shown in Figure 3. The performances were tightly bunched, but RNP was still the best performer with NRO and RQI both beating VNQ. The international funds improved but still lagged. (click to enlarge) Figure 3. Risk versus reward over past 5 years As a final test, I re-ran the analysis over the past 3 years and the results are shown in Figure 4. What a difference a couple of years made! Over this period, the two ETFs (RWX and VNQ) plus RNP have generated the best risk-adjusted performance. AWP and NRO also had relatively good performance with RQI, RFI, JRS, and IGR lagging. IGR had the worst performance among all the funds. (click to enlarge) Figure 4. Risk versus reward over past 3 years Bottom Line REITs have had good performance in the past but have recently fallen on hard times. If you believe that REITs currently offer a buying opportunity, I recommend either VNQ or RNP, depending on whether you prefer ETFs or CEFs. I would steer clear of international funds since their performance has not be consistent over the years. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in VNQ,RNP over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News