Scalper1 News

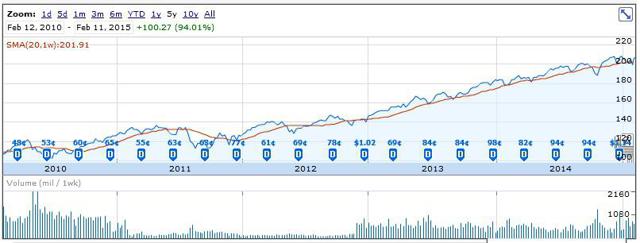

Professionals refuse to lose money. They pay attention to the downside far more than the upside. What they make in the markets – they usually keep. Professionals are always looking for extra leverage. Leverage is when you have the possibility of making a lot of money by investing very little. Professionals never stop learning and analyzing data. There is no such thing as a “sure thing”. Professionals outwork individual investors and in the process gain the “edge” in their investments. I have written before that success in investing is 80% psychology and 20% mechanics. This is why it is so important that you are a mentally strong investor. Investing will test you. Do you have the staying power? Can you keep your emotions in check? How do you feel about large draw downs? Mentally strong investors stick to their strategies when the going gets tough. If you want above average returns, do your utmost to stick to the 3 points below. The first rule that professional investors swear by is “Don’t lose Money”. Average investors look at what they can make. Professional investors look at what they could lose. Defense for the professionals is far more important than offence. Professionals are always ultra focused on the downside. Here is why. If you don’t use stop losses in your portfolio and you lose 50% of its value, you need to make 100% (double your money) to get back to where you started. Professionals never allow this to happen. Apart from the money lost, valuable time is lost – time that could have been used for compounding. When you look at the following chart of SPDR S&P 500 ETF Trust (NYSEARCA: SPY ) over the last 5 years, its obvious that professionals are lightening up by rebalancing into other sectors. The more the market rises, the more the professionals will sell their holdings. Try and adopt the same mind-set no matter how difficult it is to sell your holdings. (click to enlarge) The second rule that professionals stick to is “Risk a little to make a lot”. While most investors look for safe solid returns year after year, professionals aim to hit home runs but by taking very little risk. So how does the individual investor invest like this? Well one has to take more risk but more calculated risk. Paul Tudor Jones for example aims to make $5 for every $1 he risks! Therefore he only needs to be right one time out of five and still break even. So where can investor find such opportunities? I believe they are all around us but we just have to look for them. For example, Let’s take Silver Standard Resources Inc. (NYSE: USA ) (NASDAQ: SSRI ). This stock is currently trading under $6 a share. When Silver was trading at $49 a shares back in April 2011, this stock traded at $35 which is around 6 times its current trade price (see chart). (click to enlarge) This in my opinion would qualify for this type of investment (Risk $1 to potentially make $5). Another would be FALCON OIL & GAS LTD(OTCMKTS: FOLGF ). (click to enlarge) This company is trading at multi-year lows but farmed out a $200 million deal last year to two oil companies for their acreage in Australia. Moreover the stock has traded at over $4 a share in the past when Australia wasn’t even in the picture. Drilling is about to commence in Australia so this stock could easily go up 500% from here. The benefit of this mind-set is that you really need to research your stocks . You need to be at least 20% correct or otherwise you go out of business. On the flip side, good stock pickers who use this method can easily outperform the market over the long term as long as they are diversified across all asset classes. The final rule that professionals swear by is “Relentless Continuous Improvement In Themselves”. Nowadays we live in an extremely fast paced society. Information is money so professionals constantly seek out new information, new strategies, new company’s, etc. The “edge” in investing comes when you know information that the masses don’t. A true professional investor essentially has a company or product dissected before the masses. The money is made when they buy. Always remember that the price you pay for an investment is far more important than the investment itself. Professionals know this so they position themselves accordingly when opportunities arise. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Professionals refuse to lose money. They pay attention to the downside far more than the upside. What they make in the markets – they usually keep. Professionals are always looking for extra leverage. Leverage is when you have the possibility of making a lot of money by investing very little. Professionals never stop learning and analyzing data. There is no such thing as a “sure thing”. Professionals outwork individual investors and in the process gain the “edge” in their investments. I have written before that success in investing is 80% psychology and 20% mechanics. This is why it is so important that you are a mentally strong investor. Investing will test you. Do you have the staying power? Can you keep your emotions in check? How do you feel about large draw downs? Mentally strong investors stick to their strategies when the going gets tough. If you want above average returns, do your utmost to stick to the 3 points below. The first rule that professional investors swear by is “Don’t lose Money”. Average investors look at what they can make. Professional investors look at what they could lose. Defense for the professionals is far more important than offence. Professionals are always ultra focused on the downside. Here is why. If you don’t use stop losses in your portfolio and you lose 50% of its value, you need to make 100% (double your money) to get back to where you started. Professionals never allow this to happen. Apart from the money lost, valuable time is lost – time that could have been used for compounding. When you look at the following chart of SPDR S&P 500 ETF Trust (NYSEARCA: SPY ) over the last 5 years, its obvious that professionals are lightening up by rebalancing into other sectors. The more the market rises, the more the professionals will sell their holdings. Try and adopt the same mind-set no matter how difficult it is to sell your holdings. (click to enlarge) The second rule that professionals stick to is “Risk a little to make a lot”. While most investors look for safe solid returns year after year, professionals aim to hit home runs but by taking very little risk. So how does the individual investor invest like this? Well one has to take more risk but more calculated risk. Paul Tudor Jones for example aims to make $5 for every $1 he risks! Therefore he only needs to be right one time out of five and still break even. So where can investor find such opportunities? I believe they are all around us but we just have to look for them. For example, Let’s take Silver Standard Resources Inc. (NYSE: USA ) (NASDAQ: SSRI ). This stock is currently trading under $6 a share. When Silver was trading at $49 a shares back in April 2011, this stock traded at $35 which is around 6 times its current trade price (see chart). (click to enlarge) This in my opinion would qualify for this type of investment (Risk $1 to potentially make $5). Another would be FALCON OIL & GAS LTD(OTCMKTS: FOLGF ). (click to enlarge) This company is trading at multi-year lows but farmed out a $200 million deal last year to two oil companies for their acreage in Australia. Moreover the stock has traded at over $4 a share in the past when Australia wasn’t even in the picture. Drilling is about to commence in Australia so this stock could easily go up 500% from here. The benefit of this mind-set is that you really need to research your stocks . You need to be at least 20% correct or otherwise you go out of business. On the flip side, good stock pickers who use this method can easily outperform the market over the long term as long as they are diversified across all asset classes. The final rule that professionals swear by is “Relentless Continuous Improvement In Themselves”. Nowadays we live in an extremely fast paced society. Information is money so professionals constantly seek out new information, new strategies, new company’s, etc. The “edge” in investing comes when you know information that the masses don’t. A true professional investor essentially has a company or product dissected before the masses. The money is made when they buy. Always remember that the price you pay for an investment is far more important than the investment itself. Professionals know this so they position themselves accordingly when opportunities arise. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News