Scalper1 News

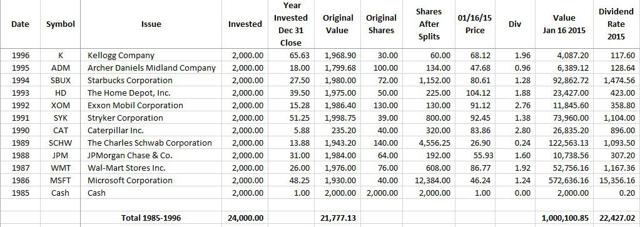

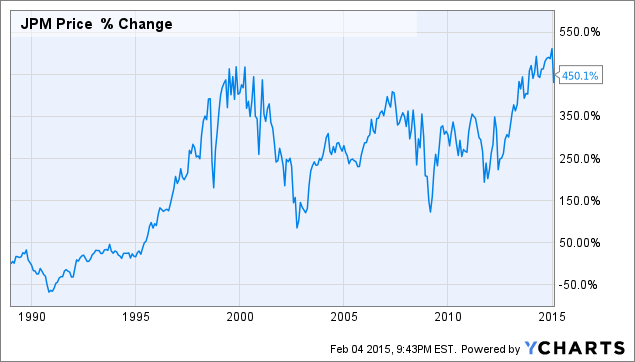

Summary Start in 1985 with a $2,000 investment in cash. Make one $2,000 investment at the end of the year from 1986 through 1996. Investments are assumed to be made in an IRA to shelter from taxes. The first $2,000 was invested in cash to pay for commissions and other fees. The average investor can save a tidy sum for retirement. It takes some luck, perseverance, and a buy and hold approach. The portfolio constructed would generate $22,400 in dividends for 2015. The portfolio was constructed by entering stock symbols into a spreadsheet in random order. The model assumed a $2,000 a year investment from 1985 through 1996 or 12 years. The first – year investment of $2,000 was invested in cash to account for commissions and other fees. The results are not actual results, but hypothetical results. Dividends that would have been earned on investments have been ignored or assumed to have been invested in stocks that blew up and went to zero ($0.00). The results generated most likely are influenced by a survivor basis. Nevertheless, the exercise proved useful. Data was obtained from company websites and or Yahoo Finance. The performance results are handicapped by not accounting for dividends paid since purchase nor assuming they are reinvested. The portfolio results presented are conservative to consider a worst case rather than an unrealistic best case. This is part one. The second part will cover the years 1998 through 2014. The model portfolio is shown below. (click to enlarge) Chart of the stock performance since inclusion into the model portfolio is shown below. Kellogg (NYSE: K ) K data by YCharts Archer Daniels Midland (NYSE: ADM ) ADM data by YCharts Starbucks (NASDAQ: SBUX ) SBUX data by YCharts The Home Depot (NYSE: HD ) HD data by YCharts Exxon Mobil (NYSE: XOM ) XOM data by YCharts Stryker (NYSE: SYK ) SYK data by YCharts Caterpillar (NYSE: CAT ) CAT data by YCharts Charles Schwab (NYSE: SCHW ) SCHW data by YCharts JPMorgan (NYSE: JPM ) JPM data by YCharts Wal-Mart (NYSE: WMT ) WMT data by YCharts Microsoft (NASDAQ: MSFT ) MSFT data by YCharts Bottom line: With a little luck and experience, it is possible for a modest investment to grow into a nice nest egg. What do you think? Disclosure: The author is long ADM, SYK, SCHW, JPM, MSFT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Summary Start in 1985 with a $2,000 investment in cash. Make one $2,000 investment at the end of the year from 1986 through 1996. Investments are assumed to be made in an IRA to shelter from taxes. The first $2,000 was invested in cash to pay for commissions and other fees. The average investor can save a tidy sum for retirement. It takes some luck, perseverance, and a buy and hold approach. The portfolio constructed would generate $22,400 in dividends for 2015. The portfolio was constructed by entering stock symbols into a spreadsheet in random order. The model assumed a $2,000 a year investment from 1985 through 1996 or 12 years. The first – year investment of $2,000 was invested in cash to account for commissions and other fees. The results are not actual results, but hypothetical results. Dividends that would have been earned on investments have been ignored or assumed to have been invested in stocks that blew up and went to zero ($0.00). The results generated most likely are influenced by a survivor basis. Nevertheless, the exercise proved useful. Data was obtained from company websites and or Yahoo Finance. The performance results are handicapped by not accounting for dividends paid since purchase nor assuming they are reinvested. The portfolio results presented are conservative to consider a worst case rather than an unrealistic best case. This is part one. The second part will cover the years 1998 through 2014. The model portfolio is shown below. (click to enlarge) Chart of the stock performance since inclusion into the model portfolio is shown below. Kellogg (NYSE: K ) K data by YCharts Archer Daniels Midland (NYSE: ADM ) ADM data by YCharts Starbucks (NASDAQ: SBUX ) SBUX data by YCharts The Home Depot (NYSE: HD ) HD data by YCharts Exxon Mobil (NYSE: XOM ) XOM data by YCharts Stryker (NYSE: SYK ) SYK data by YCharts Caterpillar (NYSE: CAT ) CAT data by YCharts Charles Schwab (NYSE: SCHW ) SCHW data by YCharts JPMorgan (NYSE: JPM ) JPM data by YCharts Wal-Mart (NYSE: WMT ) WMT data by YCharts Microsoft (NASDAQ: MSFT ) MSFT data by YCharts Bottom line: With a little luck and experience, it is possible for a modest investment to grow into a nice nest egg. What do you think? Disclosure: The author is long ADM, SYK, SCHW, JPM, MSFT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News