Scalper1 News

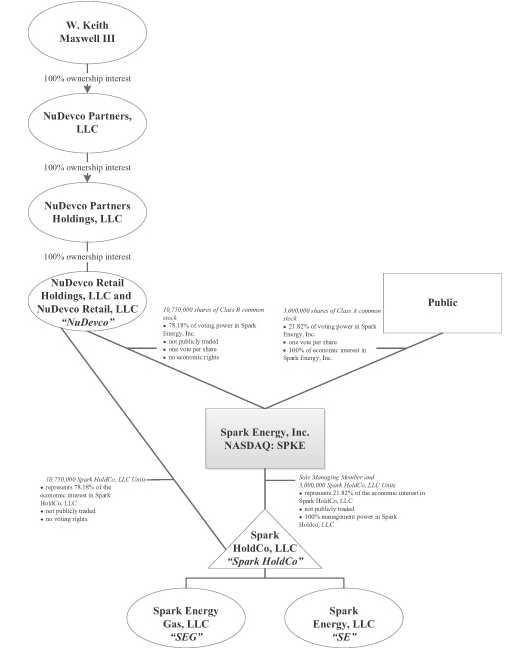

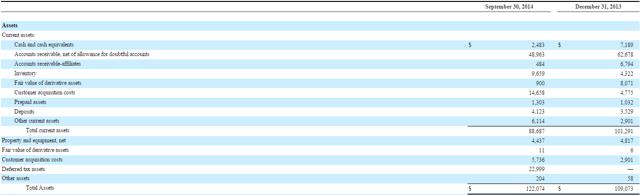

Summary Ownership structure is highly stacked against the public shareholder’s favor. Energy retailing business is extremely risk prone and price competitive. The company does not own any hard assets to generate value added profits. The business is very scalable and not aggressively leveraged so it’s likely to grow in the medium term. The business growth will be proportional to risk growth. This is not a regulated utility company so investors should beware of how they price any payout of dividends. Spark Energy, Inc. (NASDAQ: SPKE ) is an energy retailing company that operates in 46 so called utility service territories across 16 states and serves over 400,000 residential customer equivalents (RCEs). While SPKE’s business model is scalable, that is exactly the problem because all its competitor’s business models are also scalable as well. The business model of SPKE can be explained fairly simply and consists of two moving parts. The first part is the company’s customer acquisitions and retention model. It acquires customers through various sales channels such as door-to-door vendors, outbound telephone marketing vendors, an inbound customer care call center and online marketing. The company aggressively acquires its customer base to increase its revenue stream and then hedges its exposure to commodity price risk which leads to the second moving part. The in-house energy supply team roughly houses 18 energy professionals that are constantly trying to hedge SPKE’s exposure to commodity price at all times. Their task is to essentially protect the company from any significant losses during times of heavy energy volatility. Ownership structure subjects public shareholders to potential conflict of interest While the public owns only 3,000,000 Class A common stock of SPKE, W. Keith Maxwell III, the founder of the company, will actually own all the outstanding shares of Class B common stock of SPKE through a series of holding companies which will represent no economic interest in SPKE but will have a 78.18% voting power in SPKE which will leave the public with only 21.82% voting power. In essence, the company is adamantly controlled by one person and the remaining voting power of the public is meaningless. Furthermore, NuDevco, the holding company of the Class B shares wholly owned by W. Keith Maxwell III owns 78.18% of the economic interest in Spark HoldCo which is essentially the business that is shown in SPKE’s financial statements. This would imply that SPKE only owns a 21.82% economic interest of what is presented in its own financial statements and although it is evident if you look closely at the financial statements, it may be overlooked if one only glances through it quickly or uses a third party financial information source since SPKE is a recent IPO and the records available for its historical results does not show any noncontrolling interest. What this implies is that although Maxwell controls the publicly listed corporation SPKE in terms of voting rights, his financial benefits actually come from the direct ownership of Spark HoldCo through NuDevco meaning that he loses nothing if SPKE as an entity fails but Spark HoldCo remains intact. This is suspect to abuses such as the issuance of debt under the name of the public company SPKE while the actual company with the real assets Spark HoldCo remains unexposed to the debt. Another potentially negative impact is that although SPKE is the entity that will be wholly paying for management and executive pay in the form of cash and stock options, all dilution and expenses will be paid for by the public shareholders and Maxwell holds a position of immunity to these costs. While these costs are certainly paid for by the earnings of Spark HoldCo, they are disproportionately paid for by the public’s share of ownership. A diagram of the ownership structure can be found in the prospectus but its words are not even very legible when you look at it. You had to have read the explanatory notes in detail in order to clearly understand what this diagram is about. Source: SPKE’s prospectus The likely purpose of setting up a public corporation for this energy retailing company is to obtain further sources of financing. Like Just Energy (NYSE: JE ), SPKE will probably attempt to stack up further financing through convertible debt issuances which would be impossible if the company were to stay private. Qualitative analysis The energy retailing business is the result of utility energy deregulation throughout the U.S. It has caused numerous companies to pop up in an attempt to serve this new deregulated sector and overall, the sector has done quite poorly for a few very fundamental reasons. The main reason is that SPKE, like all its competitors provide no value added services to their customers. Instead, the operation represents more of an energy trading business than a utility business. The only resemblance that SPKE has to a utility concern is the customer base of residential homes and commercial businesses. That is where the similarity ends. Utility companies are heavily regulated by the government so as to secure a certain rate of return on the capital that’s deployed. While it is highly unlikely to make much money in the regulated utility sector, it is just as unlikely to lose a large amount of money in it although there have been rare occurrences. While Warren Buffett’s old adages of saying that if you want to stay rich, you should invest in utility companies; this advice should be kept far away from energy retailing companies such as SPKE. SPKE has no fixed capital investment on its balance sheet. In essence, the only asset of value that is generated from this business are the energy contracts that are sold to its residential and commercial customers through cold calls, door to door, online advertising, etc. It does not generate any value added profits from a utility asset that it owns. Instead, it earns the spread between what it can receive through its contracted revenues and what it must pay for the energy it sells. Therefore, in order to protect itself from volatile energy prices, it must maintain an extensive derivative hedging program. Even with an adequate hedging program in place, SPKE is still exposed to losses from volatile energy prices that occur outside of their expected boundaries. It is simply impossible and too expensive to hedge against all risks. In terms of a score on the qualitative aspects for SPKE’s assets, there is nothing of much substance to be said for it. SPKE has receivables and derivative instruments as assets. Both of them are depreciating assets and there is no possibility of hedging against inflation. This again shows the diametric difference between this company and what a real utility company should behave like in terms of financial performance. The debt, however, is very real and very dangerous for such a company. Although the revenue stream from a book of energy contracts should be considered to be relatively stable, what isn’t stable is the price that SPKE will pay on energy for cost of goods sold. While volatile energy prices will put significant pressure on SPKE’s costs in the long run, the commodity like nature and the ease of entry in the energy retailing business will continue to push down on its revenue per customer in the long term likewise. Financial analysis As mentioned earlier, to take a look at the asset part of the balance sheet of the company shows how weak it is in terms of its composition. The majority of its assets consist of accounts receivable, customer acquisition costs and deferred assets. Two of those items are intangible. The book value of the company is really a meaningless measure for the company and the value of the company could very well evaporate completely during extraordinary circumstances since there are no hard assets backing up SPKE’s indebtedness. Furthermore, the debt situation is complicated by the fact that SPKE only owns 21.82% of the consolidated assets and yet it may be forced to be the entity that takes on a disproportionate amount of debt relative to its asset ownership. This can be very easily forced onto SPKE since public shareholders effectively have no voting power in the company and SPKE is actually controlled by Maxwell, a person who derives his economic interest in an entity separate from SPKE. In fact, after the share offering, SPKE entered into a new $70.0 million senior secured revolving credit facility of which $10.0 million was immediately used to pay down the debt of its subsidiary. While this may benefit Spark HoldCo as a whole, it basically adds risk to the public SPKE entity and decreases Maxwell’s personal risk. Although it is possible that no abuses will go on throughout the existence of this company, it should be recognized that as long as the controller of SPKE and the actual shareholders of SPKE benefit financially through different entities, there is always a risk of moral hazard. (click to enlarge) Source: SPKE’s fourth quarter 2014 10-Q The earnings picture so far appears to be a healthy, one has to realize that in order to maintain their business, SPKE has to constantly acquire customers to replace those who leave whether it is due to dissatisfied service or finding a retailer that offers them a cheaper price. So with a year over year price to EBIT ratio of roughly 7.15 or so and not a huge amount of debt on its balance sheet, SPKE does look superficially cheap. However, if you combine this with the qualitative analysis done earlier, you must ask yourself the question of whether or not it really is cheap relative to the riskiness of the business. I remind the reader that this is not a utility company that owns hard assets and earns a fair regulated rate of return on its invested capital. Instead, all revenues generated come with the immediate price of a matching liability to fulfill the energy requirements later on. To compare the earnings of SPKE to those of regular utilities is illogical to the utmost. Since the market seems to be hungry for dividends at the moment, a later increase in dividends for SPKE will probably be met with irrational enthusiasm. (click to enlarge) Source: Author’s own work from SPKE’s Prospectus and 10-Qs Conclusion SPKE is indeed very likely to grow from this point on because it is a very scalable business and its size is moderately small at the moment. Furthermore, not a lot of debt has been used so it can certainly grow its business just by leveraging up. When the company does happen to do well, it will most likely attract a group of investors who believe that SPKE is a utility company because it is listed as one under most third party financial service providers. This may prompt share price appreciation which allows for further use of convertible debt and share issuances to further capitalize the company if necessary. The company can easily make its share price higher from any increase in the dividend payout but the conservative and intelligent investor should recognize that such a dividend will lack sustainability over the long run and should take caution to buying stock purely based on current dividends paid. I believe that there could be a lot of capital appreciation from the current levels based on the nature of the business and the relatively small size of the company at the current stage. However, I am not at all comfortable with the long term prospects of this industry or this company and cannot recommend participation in such an ownership structure that’s so heavily stacked against the public investor’s favor. Scalper1 News

Summary Ownership structure is highly stacked against the public shareholder’s favor. Energy retailing business is extremely risk prone and price competitive. The company does not own any hard assets to generate value added profits. The business is very scalable and not aggressively leveraged so it’s likely to grow in the medium term. The business growth will be proportional to risk growth. This is not a regulated utility company so investors should beware of how they price any payout of dividends. Spark Energy, Inc. (NASDAQ: SPKE ) is an energy retailing company that operates in 46 so called utility service territories across 16 states and serves over 400,000 residential customer equivalents (RCEs). While SPKE’s business model is scalable, that is exactly the problem because all its competitor’s business models are also scalable as well. The business model of SPKE can be explained fairly simply and consists of two moving parts. The first part is the company’s customer acquisitions and retention model. It acquires customers through various sales channels such as door-to-door vendors, outbound telephone marketing vendors, an inbound customer care call center and online marketing. The company aggressively acquires its customer base to increase its revenue stream and then hedges its exposure to commodity price risk which leads to the second moving part. The in-house energy supply team roughly houses 18 energy professionals that are constantly trying to hedge SPKE’s exposure to commodity price at all times. Their task is to essentially protect the company from any significant losses during times of heavy energy volatility. Ownership structure subjects public shareholders to potential conflict of interest While the public owns only 3,000,000 Class A common stock of SPKE, W. Keith Maxwell III, the founder of the company, will actually own all the outstanding shares of Class B common stock of SPKE through a series of holding companies which will represent no economic interest in SPKE but will have a 78.18% voting power in SPKE which will leave the public with only 21.82% voting power. In essence, the company is adamantly controlled by one person and the remaining voting power of the public is meaningless. Furthermore, NuDevco, the holding company of the Class B shares wholly owned by W. Keith Maxwell III owns 78.18% of the economic interest in Spark HoldCo which is essentially the business that is shown in SPKE’s financial statements. This would imply that SPKE only owns a 21.82% economic interest of what is presented in its own financial statements and although it is evident if you look closely at the financial statements, it may be overlooked if one only glances through it quickly or uses a third party financial information source since SPKE is a recent IPO and the records available for its historical results does not show any noncontrolling interest. What this implies is that although Maxwell controls the publicly listed corporation SPKE in terms of voting rights, his financial benefits actually come from the direct ownership of Spark HoldCo through NuDevco meaning that he loses nothing if SPKE as an entity fails but Spark HoldCo remains intact. This is suspect to abuses such as the issuance of debt under the name of the public company SPKE while the actual company with the real assets Spark HoldCo remains unexposed to the debt. Another potentially negative impact is that although SPKE is the entity that will be wholly paying for management and executive pay in the form of cash and stock options, all dilution and expenses will be paid for by the public shareholders and Maxwell holds a position of immunity to these costs. While these costs are certainly paid for by the earnings of Spark HoldCo, they are disproportionately paid for by the public’s share of ownership. A diagram of the ownership structure can be found in the prospectus but its words are not even very legible when you look at it. You had to have read the explanatory notes in detail in order to clearly understand what this diagram is about. Source: SPKE’s prospectus The likely purpose of setting up a public corporation for this energy retailing company is to obtain further sources of financing. Like Just Energy (NYSE: JE ), SPKE will probably attempt to stack up further financing through convertible debt issuances which would be impossible if the company were to stay private. Qualitative analysis The energy retailing business is the result of utility energy deregulation throughout the U.S. It has caused numerous companies to pop up in an attempt to serve this new deregulated sector and overall, the sector has done quite poorly for a few very fundamental reasons. The main reason is that SPKE, like all its competitors provide no value added services to their customers. Instead, the operation represents more of an energy trading business than a utility business. The only resemblance that SPKE has to a utility concern is the customer base of residential homes and commercial businesses. That is where the similarity ends. Utility companies are heavily regulated by the government so as to secure a certain rate of return on the capital that’s deployed. While it is highly unlikely to make much money in the regulated utility sector, it is just as unlikely to lose a large amount of money in it although there have been rare occurrences. While Warren Buffett’s old adages of saying that if you want to stay rich, you should invest in utility companies; this advice should be kept far away from energy retailing companies such as SPKE. SPKE has no fixed capital investment on its balance sheet. In essence, the only asset of value that is generated from this business are the energy contracts that are sold to its residential and commercial customers through cold calls, door to door, online advertising, etc. It does not generate any value added profits from a utility asset that it owns. Instead, it earns the spread between what it can receive through its contracted revenues and what it must pay for the energy it sells. Therefore, in order to protect itself from volatile energy prices, it must maintain an extensive derivative hedging program. Even with an adequate hedging program in place, SPKE is still exposed to losses from volatile energy prices that occur outside of their expected boundaries. It is simply impossible and too expensive to hedge against all risks. In terms of a score on the qualitative aspects for SPKE’s assets, there is nothing of much substance to be said for it. SPKE has receivables and derivative instruments as assets. Both of them are depreciating assets and there is no possibility of hedging against inflation. This again shows the diametric difference between this company and what a real utility company should behave like in terms of financial performance. The debt, however, is very real and very dangerous for such a company. Although the revenue stream from a book of energy contracts should be considered to be relatively stable, what isn’t stable is the price that SPKE will pay on energy for cost of goods sold. While volatile energy prices will put significant pressure on SPKE’s costs in the long run, the commodity like nature and the ease of entry in the energy retailing business will continue to push down on its revenue per customer in the long term likewise. Financial analysis As mentioned earlier, to take a look at the asset part of the balance sheet of the company shows how weak it is in terms of its composition. The majority of its assets consist of accounts receivable, customer acquisition costs and deferred assets. Two of those items are intangible. The book value of the company is really a meaningless measure for the company and the value of the company could very well evaporate completely during extraordinary circumstances since there are no hard assets backing up SPKE’s indebtedness. Furthermore, the debt situation is complicated by the fact that SPKE only owns 21.82% of the consolidated assets and yet it may be forced to be the entity that takes on a disproportionate amount of debt relative to its asset ownership. This can be very easily forced onto SPKE since public shareholders effectively have no voting power in the company and SPKE is actually controlled by Maxwell, a person who derives his economic interest in an entity separate from SPKE. In fact, after the share offering, SPKE entered into a new $70.0 million senior secured revolving credit facility of which $10.0 million was immediately used to pay down the debt of its subsidiary. While this may benefit Spark HoldCo as a whole, it basically adds risk to the public SPKE entity and decreases Maxwell’s personal risk. Although it is possible that no abuses will go on throughout the existence of this company, it should be recognized that as long as the controller of SPKE and the actual shareholders of SPKE benefit financially through different entities, there is always a risk of moral hazard. (click to enlarge) Source: SPKE’s fourth quarter 2014 10-Q The earnings picture so far appears to be a healthy, one has to realize that in order to maintain their business, SPKE has to constantly acquire customers to replace those who leave whether it is due to dissatisfied service or finding a retailer that offers them a cheaper price. So with a year over year price to EBIT ratio of roughly 7.15 or so and not a huge amount of debt on its balance sheet, SPKE does look superficially cheap. However, if you combine this with the qualitative analysis done earlier, you must ask yourself the question of whether or not it really is cheap relative to the riskiness of the business. I remind the reader that this is not a utility company that owns hard assets and earns a fair regulated rate of return on its invested capital. Instead, all revenues generated come with the immediate price of a matching liability to fulfill the energy requirements later on. To compare the earnings of SPKE to those of regular utilities is illogical to the utmost. Since the market seems to be hungry for dividends at the moment, a later increase in dividends for SPKE will probably be met with irrational enthusiasm. (click to enlarge) Source: Author’s own work from SPKE’s Prospectus and 10-Qs Conclusion SPKE is indeed very likely to grow from this point on because it is a very scalable business and its size is moderately small at the moment. Furthermore, not a lot of debt has been used so it can certainly grow its business just by leveraging up. When the company does happen to do well, it will most likely attract a group of investors who believe that SPKE is a utility company because it is listed as one under most third party financial service providers. This may prompt share price appreciation which allows for further use of convertible debt and share issuances to further capitalize the company if necessary. The company can easily make its share price higher from any increase in the dividend payout but the conservative and intelligent investor should recognize that such a dividend will lack sustainability over the long run and should take caution to buying stock purely based on current dividends paid. I believe that there could be a lot of capital appreciation from the current levels based on the nature of the business and the relatively small size of the company at the current stage. However, I am not at all comfortable with the long term prospects of this industry or this company and cannot recommend participation in such an ownership structure that’s so heavily stacked against the public investor’s favor. Scalper1 News

Scalper1 News