Scalper1 News

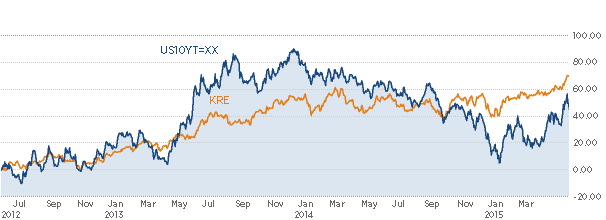

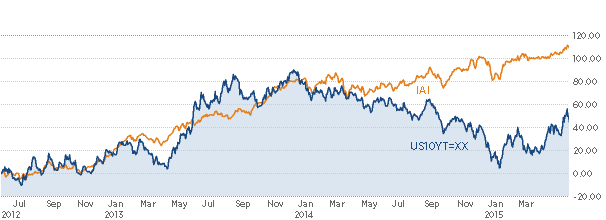

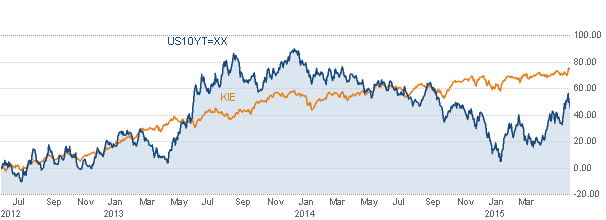

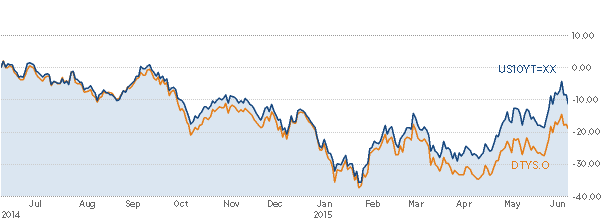

Summary Interest rates will rise eventually. Every investor should have the tools to combat interest rates. Bonds will take a hit, and fixed-income investors should be prepared. Weapons for Battling an Interest Rate Hike An Interest rate hike looms over the U.S. economy. This will have a wide-reaching impact on the financial markets. One potential issue is that bond heavy portfolios may be at risk. I compiled a basket of equities I believe can be utilized to fight and prosper in a climate of rising interest rates. Many of these equities are by no means perfectly correlated, but historically they tend to follow a general, comprehensible trend. Financials First I believe financial groups tend to do well in periods of rising interest rates. Many financial entities achieve higher margins as interest rates rise. Three groups in particular tend to see significant growth . These groups are banks (particularly regional banks), brokers, and insurance companies. Banks (Mainly Regional Banks) Regional banks tend to be less widespread and more reliant on net interest margins than their larger competitors. A larger more diversified bank such as Bank of America will have around 48 percent of its Income Break-up in net interest income. While 48 percent is clearly significant, many regional banks have an average net interest income around 55 percent. Other regional banks have net interest incomes as high as 60-65%. Four such stocks are Comerica (NYSE: CMA ), SunTrust Banks (NYSE: STI ), MB Financial (NASDAQ: MBFI ), and Huntington Bancshares (NASDAQ: HBAN ). A more comprehensive list of regional banks for the inquisitive investor include can be found on the bull sector . Those looking for more coverage might be interested in SPDR S&P Regional Banking ETF, KRE . Due to a prolonged low interest rate environment, many banks are relying on fees and low margins from loans to maintain profitability. Gradually rising rates could certainly benefit regional banks. I made a comparison graph using CNBC to compare the U.S. 10 Year Treasury to KRE: Brokers Often interest rate hikes signal a healthy economy because the Fed believes the economy is in a stable condition to raise rates. A healthy economy will often see increased faith in, and volume of, investment activity. In theory, Charles Schwab (NYSE: SCHW ), E*TRADE Financial (NASDAQ: ETFC ), T. Rowe Price (NASDAQ: TROW ), etc. would receive higher cash flows from increased usage. I used Ishares U.S. Broker-Dealers ETF (NYSEARCA: IAI ) to do a side by side comparison of interest rates and brokerage growth. The ETF is exposed to U.S. investment banks, discount brokerages, and stock exchanges. The two benchmarks are roughly correlated, and brokers have been performing very well in recent years: Insurance Companies While insurance companies certainly have vast and well-diversified portfolios, it seems clear that they are interlinked to low and high interest rates. They are incentivized to hold safe investments with steady cash flows to pay for the insurance policies they write. Their safe investments pay off when interest rates rise and suggest that insurance could see potential growth in the near future. To show this correlation I chose KIE , an insurance ETF. It is not a perfect representation of the insurance market, but it is a good basket of stocks that better represent the market than choosing an individual stock. Individual stocks may be subject to outside forces that could affect the data: The general trend follows interest rates well. Of all the correlations, the insurance ETF is very significant. My personal favorite insurance stocks are Allstate (NYSE: ALL ) and MetLife (NYSE: MET ). Inverse Hedging Tools There are equities that are created specifically to hedge treasury bonds. Since treasury bonds and interest rates are essentially inversely correlated one to one, they can be used extremely effectively. They are ETNs, electronically traded notes, that are leveraged through credit default swaps, and futures to attain (-1x), (-2x), and (-3x) returns. However, any investor should beware that there are serious risk s associated with investing in inverse ETNs. Anyone considering investing in an ETN should weigh the risks beforehand. That being said, there are a few that I recommend. Proshares Short 7-10 Year Treasury ( TBX ) and iPath US Treasury 10-year Bear ETN (NASDAQ: DTYS ) are very good tools for shorting the 10 year bond in particular. There are others such as TBT and TBF for the 20 year. Each one has its risks and rewards, and each is correlated directly to yields. Use with caution. Conclusion For those going to battle against rising interest rates, it is important to have a few weapons in your arsenal. Each weapon is best used for different styles of investing, but it never hurts to have a plan for any situation. I urge everyone to construct a personal plan for combating a potential interest rate hike. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Interest rates will rise eventually. Every investor should have the tools to combat interest rates. Bonds will take a hit, and fixed-income investors should be prepared. Weapons for Battling an Interest Rate Hike An Interest rate hike looms over the U.S. economy. This will have a wide-reaching impact on the financial markets. One potential issue is that bond heavy portfolios may be at risk. I compiled a basket of equities I believe can be utilized to fight and prosper in a climate of rising interest rates. Many of these equities are by no means perfectly correlated, but historically they tend to follow a general, comprehensible trend. Financials First I believe financial groups tend to do well in periods of rising interest rates. Many financial entities achieve higher margins as interest rates rise. Three groups in particular tend to see significant growth . These groups are banks (particularly regional banks), brokers, and insurance companies. Banks (Mainly Regional Banks) Regional banks tend to be less widespread and more reliant on net interest margins than their larger competitors. A larger more diversified bank such as Bank of America will have around 48 percent of its Income Break-up in net interest income. While 48 percent is clearly significant, many regional banks have an average net interest income around 55 percent. Other regional banks have net interest incomes as high as 60-65%. Four such stocks are Comerica (NYSE: CMA ), SunTrust Banks (NYSE: STI ), MB Financial (NASDAQ: MBFI ), and Huntington Bancshares (NASDAQ: HBAN ). A more comprehensive list of regional banks for the inquisitive investor include can be found on the bull sector . Those looking for more coverage might be interested in SPDR S&P Regional Banking ETF, KRE . Due to a prolonged low interest rate environment, many banks are relying on fees and low margins from loans to maintain profitability. Gradually rising rates could certainly benefit regional banks. I made a comparison graph using CNBC to compare the U.S. 10 Year Treasury to KRE: Brokers Often interest rate hikes signal a healthy economy because the Fed believes the economy is in a stable condition to raise rates. A healthy economy will often see increased faith in, and volume of, investment activity. In theory, Charles Schwab (NYSE: SCHW ), E*TRADE Financial (NASDAQ: ETFC ), T. Rowe Price (NASDAQ: TROW ), etc. would receive higher cash flows from increased usage. I used Ishares U.S. Broker-Dealers ETF (NYSEARCA: IAI ) to do a side by side comparison of interest rates and brokerage growth. The ETF is exposed to U.S. investment banks, discount brokerages, and stock exchanges. The two benchmarks are roughly correlated, and brokers have been performing very well in recent years: Insurance Companies While insurance companies certainly have vast and well-diversified portfolios, it seems clear that they are interlinked to low and high interest rates. They are incentivized to hold safe investments with steady cash flows to pay for the insurance policies they write. Their safe investments pay off when interest rates rise and suggest that insurance could see potential growth in the near future. To show this correlation I chose KIE , an insurance ETF. It is not a perfect representation of the insurance market, but it is a good basket of stocks that better represent the market than choosing an individual stock. Individual stocks may be subject to outside forces that could affect the data: The general trend follows interest rates well. Of all the correlations, the insurance ETF is very significant. My personal favorite insurance stocks are Allstate (NYSE: ALL ) and MetLife (NYSE: MET ). Inverse Hedging Tools There are equities that are created specifically to hedge treasury bonds. Since treasury bonds and interest rates are essentially inversely correlated one to one, they can be used extremely effectively. They are ETNs, electronically traded notes, that are leveraged through credit default swaps, and futures to attain (-1x), (-2x), and (-3x) returns. However, any investor should beware that there are serious risk s associated with investing in inverse ETNs. Anyone considering investing in an ETN should weigh the risks beforehand. That being said, there are a few that I recommend. Proshares Short 7-10 Year Treasury ( TBX ) and iPath US Treasury 10-year Bear ETN (NASDAQ: DTYS ) are very good tools for shorting the 10 year bond in particular. There are others such as TBT and TBF for the 20 year. Each one has its risks and rewards, and each is correlated directly to yields. Use with caution. Conclusion For those going to battle against rising interest rates, it is important to have a few weapons in your arsenal. Each weapon is best used for different styles of investing, but it never hurts to have a plan for any situation. I urge everyone to construct a personal plan for combating a potential interest rate hike. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News