Scalper1 News

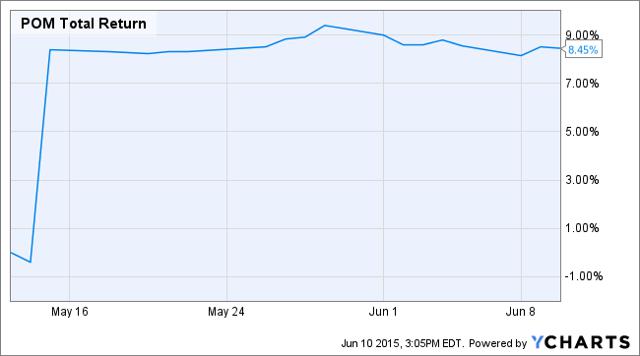

Summary A mid-day update on arbitrage, event-driven opportunities, and value. Details of price changes and progress on POM, TWC, and DTV. In each case, there are still double-digit returns available. Lunch is for wimps. – Gordon Gekko Arbitrage Here are my collected thoughts on arbitrage, wandering from the academic to the practical definitions, with a heavy dose of the middle ground. The definition is indeed a tortured one. However, in both its strong and weak forms, the idea focuses on the key to investing: mispricing. In the recently launched Sifting the World , arbitrage will be a major focus. What arbitrage opportunities are available today? *Available as of today. The word “arbitrage” in academia means “certain profits,” whereas in practical investing, arbitrage often means “a trade we kind of like.” Some in the industry adhere to a perhaps reasonable middle ground: that arbitrage is not riskless, but unlike much of investing, it involves going long and short very similar securities and betting on a price difference. I can live with that. But it is clear that many use it in the loosest sense and, therefore, strip it of its meaning. – Cliff Asness Dresser-Rand / Siemens Update DHR has returned 4% since the last update. (click to enlarge) The buyer completed a $7.7 billion note placement as a component of the acquisition financing. The EU review is going well and is likely to result in approval this summer. Pepco / Exelon Update POM has returned over 8% since I last discussed it. (click to enlarge) Since then, it has remained an attractive long opportunity with a positive expected value. I have not added to my position, but I am holding onto it. From the outside looking in, this situation involves a lot of political noise. From the inside looking out, it is a negotiation like any other. There is a regulatory cost that needs to be paid, and both the applicants and the regulators have preferences on what that cost would be. The difference was surmountable. In the Maryland PSC approval, the commission majority split the difference with an order that was acceptable to both sides. Subsequent to the Maryland PSC approval, the deal was also approved in Delaware. Additionally, EXC completed its five-tranche $4.2 billion senior notes acquisition financing through Barclays (NYSE: BCS ) and Goldman Sachs (NYSE: GS ). Time Warner Cable / Charter Update TWC returned over 30% since I first discussed it. (click to enlarge) It remains a safe position; I still have $13 million of TWC, based on confidence in the current deal. DirecTV / AT&T Update This position is up over 5% since the last update. (click to enlarge) The parties appear to be progressing towards regulatory approvals later this summer. Event-Driven Event-driven, my wife was sorry to learn, is not used in the same sense as event planning. It involves few parties or cocktails in the backyard. Instead, the ones I focus on tend to involve: Mutual conversions Odd lot tender offers Merger securities Squeeze outs Here is how it worked out so far. I am thrilled that Seeking Alpha’s exclusive research program will include several such authors. Value Value is like honesty and fidelity – few people own up to being in the opposite camp. Also, like honesty and fidelity, talking about it a lot does not make it so. The core of value investing is thinking about securities as pieces of a business, valuing that business, and then underpaying for it. The remaining problem involves finding a counterparty with something at stake besides the same value that you are trying to capture. Today, my favorite values include this and this . Conclusion Arbitrage, event-driven, and value are often categorized separately, but I think of them as points on a spectrum. In the case of arbitrage, the investment opportunity has an explicit process for unlocking value. In event-driven opportunities, there is still a catalyst, but it is somewhat less explicit and there is greater variance in the outcomes. Value investing has the greatest range in outcomes. However, successful value investing frequently results in securities becoming targeted by M&A and other corporate events. These events often unlock value, whether or not that was explicitly part of the original investment thesis. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: The author is long TEG, POM, IGTE, HE, TWC, OWW, OVTI, BRLI, ODP, BHI, DTV, PRGO, KRFT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Summary A mid-day update on arbitrage, event-driven opportunities, and value. Details of price changes and progress on POM, TWC, and DTV. In each case, there are still double-digit returns available. Lunch is for wimps. – Gordon Gekko Arbitrage Here are my collected thoughts on arbitrage, wandering from the academic to the practical definitions, with a heavy dose of the middle ground. The definition is indeed a tortured one. However, in both its strong and weak forms, the idea focuses on the key to investing: mispricing. In the recently launched Sifting the World , arbitrage will be a major focus. What arbitrage opportunities are available today? *Available as of today. The word “arbitrage” in academia means “certain profits,” whereas in practical investing, arbitrage often means “a trade we kind of like.” Some in the industry adhere to a perhaps reasonable middle ground: that arbitrage is not riskless, but unlike much of investing, it involves going long and short very similar securities and betting on a price difference. I can live with that. But it is clear that many use it in the loosest sense and, therefore, strip it of its meaning. – Cliff Asness Dresser-Rand / Siemens Update DHR has returned 4% since the last update. (click to enlarge) The buyer completed a $7.7 billion note placement as a component of the acquisition financing. The EU review is going well and is likely to result in approval this summer. Pepco / Exelon Update POM has returned over 8% since I last discussed it. (click to enlarge) Since then, it has remained an attractive long opportunity with a positive expected value. I have not added to my position, but I am holding onto it. From the outside looking in, this situation involves a lot of political noise. From the inside looking out, it is a negotiation like any other. There is a regulatory cost that needs to be paid, and both the applicants and the regulators have preferences on what that cost would be. The difference was surmountable. In the Maryland PSC approval, the commission majority split the difference with an order that was acceptable to both sides. Subsequent to the Maryland PSC approval, the deal was also approved in Delaware. Additionally, EXC completed its five-tranche $4.2 billion senior notes acquisition financing through Barclays (NYSE: BCS ) and Goldman Sachs (NYSE: GS ). Time Warner Cable / Charter Update TWC returned over 30% since I first discussed it. (click to enlarge) It remains a safe position; I still have $13 million of TWC, based on confidence in the current deal. DirecTV / AT&T Update This position is up over 5% since the last update. (click to enlarge) The parties appear to be progressing towards regulatory approvals later this summer. Event-Driven Event-driven, my wife was sorry to learn, is not used in the same sense as event planning. It involves few parties or cocktails in the backyard. Instead, the ones I focus on tend to involve: Mutual conversions Odd lot tender offers Merger securities Squeeze outs Here is how it worked out so far. I am thrilled that Seeking Alpha’s exclusive research program will include several such authors. Value Value is like honesty and fidelity – few people own up to being in the opposite camp. Also, like honesty and fidelity, talking about it a lot does not make it so. The core of value investing is thinking about securities as pieces of a business, valuing that business, and then underpaying for it. The remaining problem involves finding a counterparty with something at stake besides the same value that you are trying to capture. Today, my favorite values include this and this . Conclusion Arbitrage, event-driven, and value are often categorized separately, but I think of them as points on a spectrum. In the case of arbitrage, the investment opportunity has an explicit process for unlocking value. In event-driven opportunities, there is still a catalyst, but it is somewhat less explicit and there is greater variance in the outcomes. Value investing has the greatest range in outcomes. However, successful value investing frequently results in securities becoming targeted by M&A and other corporate events. These events often unlock value, whether or not that was explicitly part of the original investment thesis. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: The author is long TEG, POM, IGTE, HE, TWC, OWW, OVTI, BRLI, ODP, BHI, DTV, PRGO, KRFT. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep discounts to their intrinsic value and unlocking that value through corporate events. In order to maximize total returns for our investors, we reserve the right to make investment decisions regarding any security without further notification except where such notification is required by law. Scalper1 News

Scalper1 News