Tungsten: Under Appreciated And Incredibly Valuable

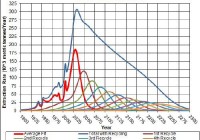

Summary Tungsten is a valuable and under appreciated commodity. Tungsten has certain properties such as durability, a high melting point, and extreme hardness that allow it act as an unparalleled resource in manufacturing. Currently Tungsten supply is diminishing and will likely experience a price hike. Introduction In the midst of environmental concerns and resource scarcity, one valuable commodity often goes overlooked. Generally when people think of diminishing resources, their minds wander to gold, oil (or somewhat recently with California) water. Interestingly, there are dozens of valuable and economically important resources that are getting extracted at unsustainable levels. I will include a link here . I will also spend time (in separate articles) discussing each commodity, its current condition, and its future economic impact. I have already discussed the importance of lithium (particularly in regards to the rise of lithium-ion batteries and consumer electronics). Today I will discuss, what I believe to be, an economically, militarily, and geopolitically essential commodity. The resource I am talking about is the underappreciated metal Tungsten. What is Tungsten? Tungsten is one of the hardest and most durable substances on Earth. Its MOHR’s hardness level falls only beneath diamonds. Tungsten is only economically exploitable in a few specific regions (which I will get to in a minute) due to the geologic conditions necessary for its formation. It can be manufactured into incredibly durable products. Tungsten’s value comes from its hardness. Tungsten is virtually immune to corrosion, and it has a very high melting temperature ( 3,422 degrees celsius ). From the mid-19th century to the mid 20th century, Tungsten was study and utilized as an alloy to improve steel making processes. It was unrivaled until WW2 when supply shortages caused countries to look for alternatives. In some capacity, Molybdenum, Chromium, Corundum, Vanadium, and Nickel were/are utilized as alternatives or additives to tungsten. Tungsten still remains a crucial part of steel making, and the aforementioned metals also have their own supply issues. Formation The formation of economically viable tungsten deposits is related to the intrusion of granites during the formation of mountain ranges (orogenic process) resulting from colliding tectonic plates. Tungsten gets enriched during granite crystallization, and can form a pegmatic tungsten deposit from the last bit of granitic melt. It is released into a hot hydrothermal fluid. Uses for Tungsten Here are a few highly useful sites for studying tungsten: here & here & here . Tungsten is used in the filaments of incandescent light bulbs. Tungsten can also be made into tungsten carbide (a tungsten/carbon compound), which is essential in creating cutting tools, industrial machinery, armor-piercing rounds, abrasives, jewelry, and other assorted tools and instruments. Tungsten’s high melting point allows it to be utilized in arc wielding electrodes and forging processes. Tungsten is also important to the petroleum industry for drill bit manufacturing. Recycling Efforts Based on present and projected tungsten production and usage and maximum recycling efforts, the world will run out of tungsten by 2300. This chart assumes tungsten is recycled to its full-extent and does not take into account future economic factors, pricing, innovation, need, etc. A visual example of diminishing returns. Tungsten World Supply & Regional Concentration According to British Geologic Survey tungsten is one of the most at risk metals on Earth, and look who the leading producer is. Tungsten is most heavily concentrated in notoriously anti-U.S. regions such as China and Russia. While there are some notable reserves in the United States, there is simply not enough tungsten in the U.S. alone to match demand. 83.3% of production comes from China. Regional conflict could affect the inflow or pricing of tungsten. The U.S. imports the vast majority of tungsten, and the U.S. relies on trade deals with China (which could be affected by geopolitical factors). Who is Affected Most & How to Invest Any manufacturer that relies on tungsten will shoulder a cut into marginal profits from a commodity price hike. As economically extractable supply diminishes, miner’s will be forced to raise rates and increase prices to compensate for the additional cost of extraction. Sectors and companies that rely on tungsten include: Defense: Lockheed Martin (NYSE: LMT ) Boeing (NYSE: BA ) Orbital ATK (NYSE: OA ) General Dynamics (NYSE: GD ) iShares U.S. Aerospace & Defense ETF (NYSEARCA: ITA ) Steel: Market Vectors Steel ETF (NYSEARCA: SLX ) U.S. Steel Corporation (NYSE: X ) Solar Energy: Guggenheim Solar ETF (NYSEARCA: TAN ) First Solar (NASDAQ: FSLR ) Drill bit Manufacturers: Schlumberger (NYSE: SLB ) National Oilwell Varco (NYSE: NOV ) Halliburton (NYSE: HAL ) How to Invest It is difficult to invest directly in tungsten. There are a variety of penny stocks, “golden opportunities”, and other risky money losers out there. Instead I will offer a few indirect plays to consider. Examples of Penny Stocks I’m not going to bother analyzing them because I think they’re all bad plays. Forgive me for not dealing with penny stocks. The Safest Idea for Investing in Tungsten The Market Vectors Rare Earth/Strategic Metals ETF (NYSEARCA: REMX ) is the best option I could find for investing in tungsten and rare earth metals. Historically, as technology and extraction methods have improved, REMX has seen a decline in price from increased supply. As tungsten supply continues to diminish, prices should start to increase dramatically in the long run. I believe this will occur once total extraction exceeds total remaining supply (roughly 2021). I prefer the ETF format because it helps reduce investing risk through diversification. REMX data by YCharts REMX REMX is designed to give investors a means of tracking the performance of publicly traded companies engaged in a variety of activities that are related to the mining, refining, and manufacturing of rare earth/strategic metals. It does not necessarily directly track commodity pricing, and it is considered an indirect investment in tungsten. REMX is a small-cap ETF with 42.71 million in total assets and an SEC yield of 0.81%. I personally feel rare earth metals are in decreasing supply and invaluable in today’s economy. However, it should be noted that tungsten is only one part of REMX’s overall holdings. REMX does not specify how much it of the portfolio is based on tungsten, tungsten is named as one of the top four materials including: cerium, manganese, titanium, and tungsten. 95% of REMX is allocated in basic materials, giving it more of a pure play into the rare earth metals market. REMX is internationally diversified as well, and its primarily regional focus is China (22%). Conclusion Tungsten is a valuable commodity that is diminishing in supply. Tungsten has unique properties that make it an invaluable resource in today’s economy. It is possible to capitalize on a market inevitability through buying tungsten exposure. It is important to avoid undue risk inherent in penny stocks with low AUM, so consider a larger mining ETF with indirect tungsten exposure. Images Citations: roperld.com British Geological Survey USGS.gov Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.