Shares of premium basic materials company, Vale S.A. VALE , hit a fresh 52-week high of $ 9.55 per share on Jan 12, 2017. However, the stock closed the trading session slightly lower, at $ 9.44.

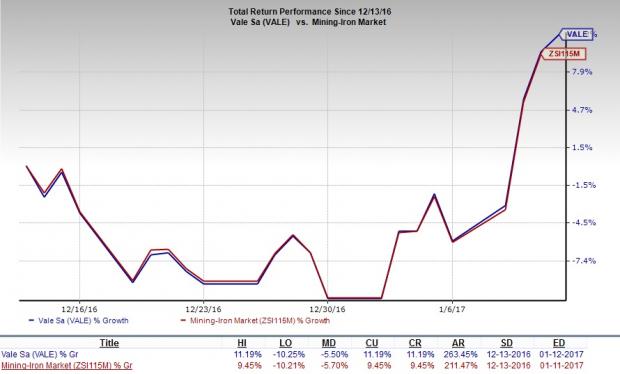

Vale’s stock is a promising investment bet at the moment. Over the last one year, shares of this Zacks Rank #1 (Strong Buy) stock remarkably surged by 300%. Over the last month, Vale’s shares recorded a return of 11.19% – outperforming 9.45% return provided by the Zacks categorized Mining-Iron industry.

In addition, the stock is currently trading at a forward P/E (price/earnings) multiple of 10.10x.

Notably, the stock’s projected earnings per share (‘EPS’) growth and sales growth for 2017 are currently pegged at 10.16% and 16.94%, respectively.

Growth Drivers

Vale has been steadily boosting its competency in the market on environmental licenses, lower expenses & costs, strategic portfolio management and productive project implementation. Also, higher demand for core metals and gradual global economic recovery is likely to bolster Vale’s top-line growth in the quarters ahead.

Vale has even claimed that that its major projects are highly sustainable and cause minimum harm to the environment. In order to enhance competency in the highly competitive mining industry, the company is optimizing its worldwide supply chain and ramping-up operations at the S11D mine. Through these measures, Vale intends to boost its productivity by lowering costs.

Notably, by the fall of 2017, Vale intends to trim its net debt to $ 15-$ 17 billion, by lowering its leverage through resources derived from meaningful disinvestments and cash generation.

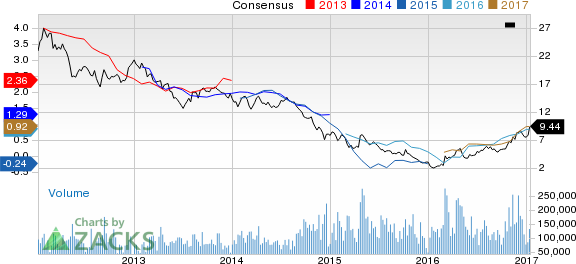

Over the last 60 days, the Zacks Consensus Estimate for the stock moved north by 53.3% to $ 0.92 from $ 0.60 for 2017.

VALE S.A. Price and Consensus

VALE S.A. Price and Consensus | VALE S.A. Quote

Key Picks

Some other similarly-ranked stocks within the industry are listed below:

BASF SE BASFY has an average earnings surprise of 34.34% for the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here .

The Chemours Company CC has an average earnings surprise of 153.83%, for the last four quarters.

CF Industries Holdings, Inc. CF has an average earnings surprise of 18.83%, for the trailing four quarters.

The Best Place to Start Your Stock Search

Today, you are invited to download the full list of 220 Zacks Rank #1 “”Strong Buy”” stocks – absolutely free of charge. Since 1988, Zacks Rank #1 stocks have nearly tripled the market, with average gains of +26% per year. Plus, you can access the list of portfolio-killing Zacks Rank #5 “”Strong Sells”” and other private research. See these stocks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BASF SE (BASFY): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

VALE S.A. (VALE): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International