Shares of Deere & CompanyDE attained a fresh 52-week high of $ 88.43 on Aug 22, before closing lower at $ 87.96. This stock price appreciation came on the back of improved third-quarter fiscal 2016 earnings and raised guidance.

Deere has a market capitalization of roughly $ 27.6 billion. Average volume of shares traded over the last three months is around 3.51 million. The stock flaunts a one-year return of about 8.9% and a year-to-date return of over 15%. Moreover, it has beaten the Zacks Consensus Estimate in each of the trailing four quarters, with an average positive surprise of 32.16%.

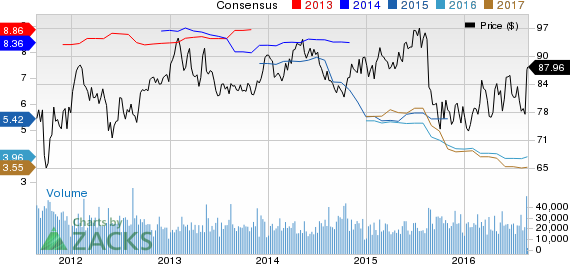

DEERE & CO Price and Consensus

DEERE & CO Price and Consensus | DEERE & CO Quote

Driving Factors

Despite posting a decline in sales, Deere’s third-quarter earnings improved around 1.3% year over year to $ 1.55 per share which topped the Zacks Consensus Estimate of 95 cents. The company benefited from sound execution of operating plans and the impact of a broad product portfolio, partly offset by global farm recession.

For fiscal 2016, management raised its net income outlook to about $ 1.35 billion from the prior guidance of $ 1.2 billion. Deere continues to perform well in the face of challenging market conditions. Continued focus on making its operations more efficient and acting to extract cost reduction benefits will drive growth.

Notably, Deere remains optimistic based on steady investments in new products and geographies. It expects to be increasingly profitable, backed by higher global demand for food, shelter and infrastructure. Also, favorable trends derived from a growing and more aware population and their rising living standards, will provide ample opportunity for growth.

Further, the U.S. Architecture Billings Index (ABI), an economic indicator that provides an approximate 9-to-12-month glimpse into the future of non-residential construction spending activity, has remained above 50 in recent months, signaling robust conditions ahead for the industry. This bodes well for Deere as well.

Deere currently has a Zacks Rank #3 (Hold).

Stocks to Consider

Better-ranked stocks in the sector include Berry Plastics Group, Inc. BERY , Columbus McKinnon Corporation CMCO and DXP Enterprises, Inc. DXPE . All these stocks sport a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days . Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DEERE & CO (DE): Free Stock Analysis Report

DXP ENTERPRISES (DXPE): Free Stock Analysis Report

COLUMBUS MCKINN (CMCO): Free Stock Analysis Report

BERRY PLASTICS (BERY): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International