Scalper1 News

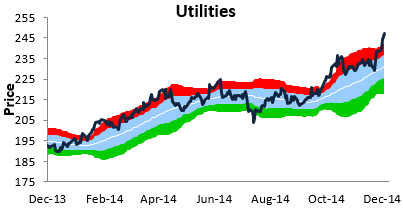

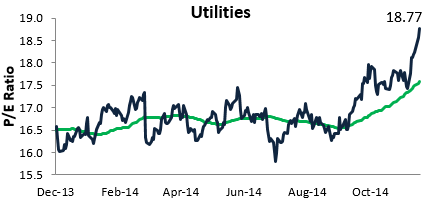

The S&P 500 Utilities sector is closing out 2014 with a bang. As shown below, the sector is currently in the midst of another big momentum move higher into extreme overbought territory – currently trading more than two standard deviations above its 50-day moving average. The sector is up a whopping 28% year-to-date – easily the top performing sector of 2014. No wonder so many portfolio managers are underperforming this year. Utilities – the most defensive, low-growth sector of the market – has been leading the way. It’s tough to sell investors on a big overweight position in utilities, especially in a rising rate (at least those are the expectations) environment. But if you haven’t owned utilities, chances are you’ve lost ground to the S&P this year. After this recent move into the stratosphere, the P/E ratio for the utilities sector has jumped up to 18.77. That’s high, especially in relation to the P/E ratio of the S&P 500 as a whole. At 18.77, the P/E for utilities is actually 0.27 points higher than the P/E for the S&P 500 (18.50). Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

The S&P 500 Utilities sector is closing out 2014 with a bang. As shown below, the sector is currently in the midst of another big momentum move higher into extreme overbought territory – currently trading more than two standard deviations above its 50-day moving average. The sector is up a whopping 28% year-to-date – easily the top performing sector of 2014. No wonder so many portfolio managers are underperforming this year. Utilities – the most defensive, low-growth sector of the market – has been leading the way. It’s tough to sell investors on a big overweight position in utilities, especially in a rising rate (at least those are the expectations) environment. But if you haven’t owned utilities, chances are you’ve lost ground to the S&P this year. After this recent move into the stratosphere, the P/E ratio for the utilities sector has jumped up to 18.77. That’s high, especially in relation to the P/E ratio of the S&P 500 as a whole. At 18.77, the P/E for utilities is actually 0.27 points higher than the P/E for the S&P 500 (18.50). Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News