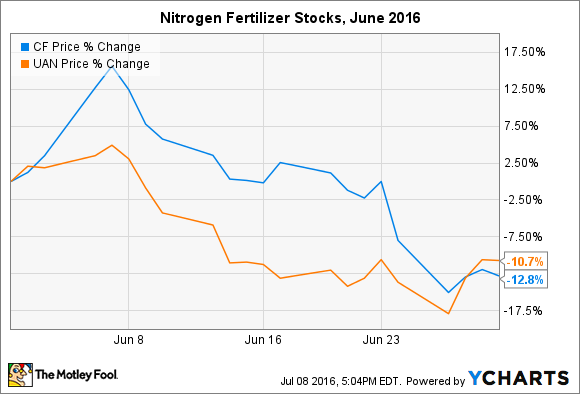

< div i.d. =" articleText" legibility=" 96.322095291167" > Picture source: United Soybean Board/< a href=" https://www.flickr.com/photos/unitedsoybean/10994536835/" rel=" nofollow ” > Flickr. What: It was a harsh month for nitrogen plant food contractors CF Industries (NYSE: CF) and also CVR Partners (NYSE: UAN), which both dropped additional in comparison to 10% in June. A mixture of variables seem to have influenced the decrease for each inventory, however Mr. Market may be actually panicing a little. Therefore what: Organic gasoline prices have in the past produced up about 75% of the production cost of the main nitrogen-fertilizer product, alkali. When < a href= "http://www.nasdaq.com/markets/natural-gas.aspx" > all-natural gas prices are reduced, nitrogen-fertilizer producers commonly experience the best earnings– and also could “improve” alkali into higher-value nitrogen products including urea ammonium nitrate to catch also much larger scopes. That’s how it is actually supposed to function, anyway. Despite historically low natural gas costs in the last few years, particularly 2015, CF Industries as well as CVR Partners have been faced with significantly oversupplied global markets, and plunging nitrogen-fertilizer prices. That has barred both business from extracting any kind of gain from reduced natural-gas prices. However the condition has actually deviated for the worse in 2016. Organic fuel prices have actually been steadily rising– obtaining 63% because early March– while nitrogen fertilizer costs have continuouslied glide. The styles boosted in June, which startled entrepreneurs. ” CF Chart” src=” https://www.scalper1.com/wp-content/uploads/2016/07/5770b5bcdf95e975e867c4e473048780.png”/ > CF data by< a href=" http://ycharts.com/ "rel=" nofollow" > YCharts. Entrepreneurs correct to stress: It might take a number of a lot more quarters for nitrogen markets to maintain, which is actually required for costs to rise. Nevertheless, investors might additionally locate some solace in that both CF Industries as well as CVR Partners hedge versus volatility in the natural-gas market by obtaining futures arrangements. At the end from 1Q16, CF Industries had 85% of its natural-gas criteria dodged. CVR Allies bushes a part from its natural-gas requirements for its own East Dubuque center, while its Coffeyville Facility utilizes no natural fuel whatsoever, instead relying upon oil coke (a result from refining petroleum). These deals must assist cover both providers coming from much higher rates– in the meantime. CVR Partners additionally shut a $ 645 million financial obligation offering last month. While undoubtedly needed to have to support the balance slab in the existing rates setting, the details are actually gone along with by a tasteless 9.25% rates of interest. A number of that is because of the business’s structure, and a few of that results from the high-risk nature of its own company version. Entrepreneurs might be a little nervous regarding the added financial obligation– as well as truly so. Currently exactly what: Hedging practices can operate each methods: aiding providers defeat volatility, or securing them in to higher-than-market rates when they wager wrongly. However existing agreements should help CF Industries and also CVR Partners to endure volatility in natural-gas costs for at the very least a handful of parts. If nitrogen-fertilizer costs don’t bounce back by after that, financiers might remain in for some fairly sharp inventory downtrends. A top secret billion-dollar stock possibility =” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow “> just click on listed here.< a href=" http://my.fool.com/profile/TMFBlacknGold/info.aspx" rel =" nofollow "> Maxx Chatsko has no position in any type of supplies stated. The Motley Fool possesses no stance in any one of the supplies discussed. Try any one of our Senseless bulletin companies< a href=" http://www.fool.com/shop/newsletters/index.aspx?source=isiedilnk018048" rel =" nofollow "> free of cost for 1 Month. Our company Blockheads may certainly not all keep the same viewpoints, but we all believe that taking into consideration an unique range from knowledges produces our company better investors. The Motley Fool has a < a href=" http://www.fool.com/Legal/fool-disclosure-policy.aspx" rel=" nofollow "

The globe’s biggest technician business failed to remember to present you one thing, but a few Wall Road professionals and the Blockhead failed to miss a beat: There’s a little business that’s powering their brand-new electronic devices and also the coming reformation in modern technology. As well as our company assume its own stock rate possesses nearly unrestricted space to compete very early in-the-know investors! To be some of all of them, < a href

These Nitrogen Fertilizer Stocks Fell Over 10% in June

> declaration policy. The views and also viewpoints conveyed here are the point of views and viewpoints of the writer as well as do certainly not automatically express those of Nasdaq, Inc.

Latest Contents Plantations International