< div id =" articleText" readability=" 85.565948855989" >< img

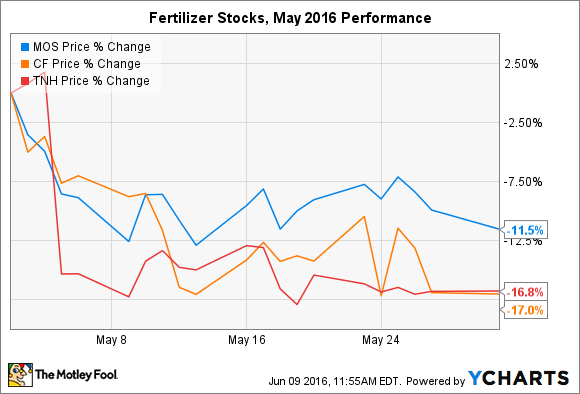

class =” articleImgLg “alt=” Fertilizer” src=” https://www.scalper1.com/wp-content/uploads/2016/06/fertilizer_large.jpg “/ > Photo resource: Getty Images. What: The plant food industry has possessed a tough going in the last a number of years. Unfortunately, May wasn’t any far better for The Variety Provider (NYSE: MONTHS), CF Industries (NYSE: CF), and also Terra Nitrogen Company L.P. (NYSE: TNH)– which all dropped a minimum of 11%.

< img course=" articleImgLg "alt =" MOS Graph" src=

” https://www.scalper1.com/wp-content/uploads/2016/06/0876b1687f73d0b2ac19c91461e57aa2.png”/ > MOS records by YCharts. Therefore what: There was actually no singular catalyst for the decreases, but entrepreneurs are effectively informed of the consistent headwinds encountering the field. American stocks from the 3 significant plant nutrients– nitrogen, potash, as well as phosphate– were all much higher in the very first zone of 2016 than in previous years. That has actually helped to push costs even lesser than the multiyear lows experienced in 2012, while India and also China waiting to authorize bring in contracts thus much (which is actually months later on in comparison to usual) have stired grief over the path rates will move coming from below.

Terra Nitrogen, the limited alliance hooked up to CF Industries, likewise introduced Q1 profits in very early May. Clients got slapped with lower leading- and vital end results matched up to the year-ago duration. While that has ended up being the brand new regular since late, the firm revealed its lowest money circulation given that early 2011. The news caused the biggest single-day decline in the stock due to the fact that December 2014.

The Variety Company declared Q1 revenues at the beginning of the month, which were actually gone along with through lowered advice for phosphate creation volumes and total profits. Reducing outcome– something several developers have actually concurred to do– are going to inevitably erase the industry’s glut, but it is going to spend some time for the adjustments to function their technique with the international markets.

At the same time, at the end from May, CF Industries revealed the shared firing of a proposed acquisition from certain coordinations and also circulation businesses possessed by the Dutch company OCI. The initial offer would possess produced the globe’s biggest openly traded nitrogen provider, but it experienced insurmountable regulatory challenges after the United States Department from the Treasury placed bull’s- eyes on megamergers. As an end result from the accomplishment failing, CF Industries are going to spend OCI a cost of $ 150 million.

Right now what: The fertilizer market is actually still working its technique with a beautiful centered rut today. Global markets will certainly react to reduced supplies as well as, likely, greater surface costs– should asset prices recuperate– but there won’t be an overnight jump in the health and wellness from the business. Entrepreneurs going after high returns as well as huge reward payments might desire to think about that a possible recovery can be one more year (or additional) away.

A secret billion-dollar stock chance

The globe’s greatest technician provider overlooked to present you one thing, however a couple of Wall structure Street experts and the Blockhead didn’t miss out on a beat: There’s a little business that is actually powering their brand-new gadgets as well as the coming transformation in modern technology. And also our team presume its stock cost possesses nearly limitless space to compete early in-the-know entrepreneurs! To be one of them, < a href

=” http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq” rel=” nofollow” > just visit this site. The views as well as viewpoints revealed here are actually the perspectives as well as viewpoints of the author and also perform certainly not automatically exhibit those of Nasdaq, Inc.

Newest Articles Plantations International