Scalper1 News

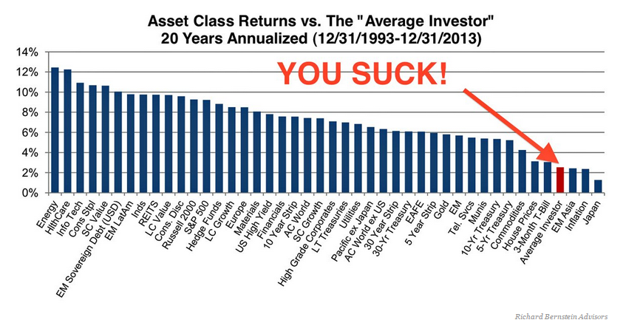

As we know most investors do not get the market returns that are available. Too many investors practice ‘loss aversion’ and sell stocks or funds when they see the stock markets collapse – this can contribute to losses and lower returns. Indexing is called ‘passive investing’ on the investment selection front; but its greatest gift is allowing investors to be passive on the emotional front. Vanguard research shows that indexers and those in low fee funds were able to stay the course and not react emotionally. Most of us likely know that most investors have historically underperformed the broad market indices and benchmarks to a very large degree. It is a very unfortunate trend and it is the reason why I write today, and the reason why I made the switch to a career in the land of finance and investing. Here’s a study that found that investors have turned very generous market returns into very modest returns. In 2001 Dalbar, a financial-services research firm, released a study entitled “Quantitative Analysis of Investor Behavior”, which concluded that average investors fail to achieve market-index returns. It found that in the 17-year period to December 2000, the S&P 500 returned an average of 16.29% per year, while the typical equity investor achieved only 5.32% for the same period – a startling 9% difference! It also found that during the same period, the average fixed-income investor earned only a 6.08% return per year, while the long-term Government Bond Index reaped 11.83%. Investors are attracted by the lure of the stock markets, company ownership, the juicy returns in robust bull markets, and they’re attracted by that gambling mentality – the chance that they might beat the markets, beat their neighbour and beat their brother-in-law. The studies on poor investor behaviour suggest that most investors are simply taking on too much risk. The problem is that gambling has not paid off; emotion gets the better of most investors whether they are individual stock pickers, holders of professionally managed mutual funds or index investors. There’s lots of bad behaviour to go around amongst all types of investors. That’s certainly why for most investors it’s prudent to evaluate that personal emotional risk tolerance level and match the risk or volatility level of the portfolio to said risk tolerance level. Investing should start with a few areas of questions or self-reflection, one being can I watch my paper net worth (the investment portion) get chopped in half or more and not panic? Find your risk tolerance level, create the matching portfolio. The bad behaviour and bad decision-making is across the board. We might conclude that humans do not make very good investors, for the most part. The task at hand might be to convince investors to stop looking, stop reading; even STOP THINKING! There is that wonderful expression that goes something like this … a portfolio is like a bar of soap, the more you handle it the smaller it gets. The most important part of investing is not stock selection or even style of investing. It’s about being able to stay the course. If you are an investor that has an incredibly high risk tolerance level (a very rare breed indeed), then it makes sense to seek out the assets that might deliver the greatest potential returns, risk can take a seat. For the risk averse investors (arguably that list would include the majority of investors), the greatest total return is achieved through the act of matching your portfolio to your risk tolerance level and simply taking the returns offered by that asset mix. The most important factor that might determine an investor’s success is patience, and being able to stick to the plan through thick and thin. Having a plan is key, sticking to that plan is crucial. It will come down to boring consistency and patience. Doing nothing is doing it right. OK, what we can do is invest on a regular schedule and that can often be set up so that the dollar cost averaging happens with a set-it-and-forget-it automatic investment plan. Vanguard has found that those who adopt a long term strategy in their 401k accounts and invest in the indexes or low fee managed funds have recently been able to ignore the market noise and simply stay the course. In 2011 during the European debt crisis the S&P 500 lost nearly 20% Vanguard investors didn’t panic (the correct move in hindsight). This comes from a previous study: In the first eight trading days of August [2011], including two of the most volatile days since 2008, just under 2% of 401(k) participants at Vanguard made a change to their portfolios. In other words, over 98% stayed the course. Ninety-eight percent took no action. Ninety-eight percent took the long-term view. Now it’s true, if choppy markets continue, we’ll see this number inch down. Ninety-eight percent of participants staying the course might become 97%. In October 2008, during the depths of the financial crisis, it became 96%-in other words, 4% of participants made a move. But the fact remains: those trading are a very small subset of investors. When we consider the findings of that Dalbar study and see only 4% of Vanguard 401k investors making any kind of move (reaction) during the most severe market correction since the Great Depression, I think that is very telling. There is value in being a passive investor in the emotional sense. There is value in investing without emotion. Don’t invest like the emotional James T. Kirk, invest like Spock. Letting the index or low fee fund manage your holdings for you simply means that you don’t have to watch, you don’t have to be emotionally involved. That detachment can pay dividends. Not to be morbid but studies have shown that the portfolios of the deceased have done quite well. Portfolios of investors who have forgotten that they have stock and bonds investments can also do quite well. It’s ironic that non-thinking (or less thinking) typically beats thinking when it comes to investing. This from a business insider article and a discussion between Barry Ritzhold and James O’Shaughnessy … O’Shaughnessy relays one anecdote from an employee who recently joined his firm that really makes one’s head spin. O’Shaughnessy: “Fidelity had done a study as to which accounts had done the best at Fidelity. And what they found was…” Ritholtz: “They were dead.” O’Shaughnessy: “…No, that’s close though! They were the accounts of people who forgot they had an account at Fidelity.” Apparently the forgetful make for wonderful investors. I get to deliver that wonderful surprise once a week or more to Tangerine clients. Some investors will forget that they moved some monies to an investment account 3, 4 or 5 years ago and I can deliver the good news on the returns. It’s certainly an opportunity to then remind investors that leaving their investments alone is often wonderful behaviour. Getting emotionally involved with your investments and your ability to fund your retirement years can be dangerous. It’s not surprising that for many, the further they can stay away from their investment decisions, the better. The passive nature of indexing allows for this detachment. We know that most professional managers will not get the market returns that are available, over time. And the Dalbar study shows that individual investors can hamper returns by an even larger degree. Also from that Business Insider Article, here’s an interesting (and very famous chart) that makes the rounds in discussions about investor returns. Please note, the editorial comment (IN RED) is from the link, and perhaps was added by Mr. Ritzhold. 🙂 (click to enlarge) Now that’s not to say that an individual stock picker cannot be a successful investor. If a stock picker is well diversified, is investing within his or her risk tolerance level, and that investor is then very patient and able to stay the course, that investor might do quite well. But again, it might come down to that investor being able to invest without emotion. Investing without emotion appears to be a tough task for the professionals and retail investors alike. I love reading the comments of Seeking Alpha reader and commentor buyandhold 2012 . The comments are generally the same theme … buy and hold, don’t sell. buyandhold states that he has never sold a stock, the holdings can only come and go if a company is acquired or goes out of business. He makes investing more about marriage than dating. He claims to have beat the markets over the decades, and even though this is the world wide web and mr buyandhold is anonymous I believe him. He follows the suggestions of Mr. Benjamin Graham and largely buys companies that have paid dividends (and dividend aristocrats) for an extended period. And then he holds. Buy. And then hold. That seems like a simple strategy that all of us can understand, but very few of us would be able to execute. Here’s one of his recent comments on an Exxon Mobil (NYSE: XOM ) article. DGI, what trips up many investors is that they focus on the short term rather than the long term. It is true that Exxon Mobil is not going to be a rock star growth stock on the price appreciation side in the next 12 months. But Exxon Mobil has a good chance of being a rock star growth stock on the price appreciation side over the next 25 to 50 years. I have been an Exxon Mobil shareholder for 44 years so I know that this stock really delivers the goods over the long term. That comment post says so much in the context of all of the noise surrounding the energy space and energy aristocrats and long term dividend payers. Buy, and hold. On the other side of the ledger and on Seeking Alpha, even within the dividend space, we hear so much on buy and selling and we see chart tools with buy and sell signals, there’s plenty of debate on what to do on a dividend cut or dividend freeze. Buyandhold has a suggestion, buy more when they’re on sale. Investing should be easy. For many it will come down to the advice of Mr. Warren Buffett – buy the broader market indices in the most cost effective manner possible and stay the course, and reinvest on a regular schedule. For stock pickers it may come down to the advise of buyandhold 2012 – buy great companies when they are at reasonable valuations and stick with your companies through thick and thin. Leave that SELL button alone. Thanks for reading. Happy investing, always know your risk tolerance level, and give a thought to the notion of international diversification. Dale Additional disclosure: Dale Roberts is an investment funds associate at Tangerine Investment Funds Limited. The Tangerine Investment Portfolios offer complete, low-fee index-based portfolios to Canadians. Dale’s commentary does not constitute investment advice. The opinions and information should only be factored into an investor’s overall opinion forming process. The views expressed are personal and do not necessarily represent those of Scotiabank Scalper1 News

As we know most investors do not get the market returns that are available. Too many investors practice ‘loss aversion’ and sell stocks or funds when they see the stock markets collapse – this can contribute to losses and lower returns. Indexing is called ‘passive investing’ on the investment selection front; but its greatest gift is allowing investors to be passive on the emotional front. Vanguard research shows that indexers and those in low fee funds were able to stay the course and not react emotionally. Most of us likely know that most investors have historically underperformed the broad market indices and benchmarks to a very large degree. It is a very unfortunate trend and it is the reason why I write today, and the reason why I made the switch to a career in the land of finance and investing. Here’s a study that found that investors have turned very generous market returns into very modest returns. In 2001 Dalbar, a financial-services research firm, released a study entitled “Quantitative Analysis of Investor Behavior”, which concluded that average investors fail to achieve market-index returns. It found that in the 17-year period to December 2000, the S&P 500 returned an average of 16.29% per year, while the typical equity investor achieved only 5.32% for the same period – a startling 9% difference! It also found that during the same period, the average fixed-income investor earned only a 6.08% return per year, while the long-term Government Bond Index reaped 11.83%. Investors are attracted by the lure of the stock markets, company ownership, the juicy returns in robust bull markets, and they’re attracted by that gambling mentality – the chance that they might beat the markets, beat their neighbour and beat their brother-in-law. The studies on poor investor behaviour suggest that most investors are simply taking on too much risk. The problem is that gambling has not paid off; emotion gets the better of most investors whether they are individual stock pickers, holders of professionally managed mutual funds or index investors. There’s lots of bad behaviour to go around amongst all types of investors. That’s certainly why for most investors it’s prudent to evaluate that personal emotional risk tolerance level and match the risk or volatility level of the portfolio to said risk tolerance level. Investing should start with a few areas of questions or self-reflection, one being can I watch my paper net worth (the investment portion) get chopped in half or more and not panic? Find your risk tolerance level, create the matching portfolio. The bad behaviour and bad decision-making is across the board. We might conclude that humans do not make very good investors, for the most part. The task at hand might be to convince investors to stop looking, stop reading; even STOP THINKING! There is that wonderful expression that goes something like this … a portfolio is like a bar of soap, the more you handle it the smaller it gets. The most important part of investing is not stock selection or even style of investing. It’s about being able to stay the course. If you are an investor that has an incredibly high risk tolerance level (a very rare breed indeed), then it makes sense to seek out the assets that might deliver the greatest potential returns, risk can take a seat. For the risk averse investors (arguably that list would include the majority of investors), the greatest total return is achieved through the act of matching your portfolio to your risk tolerance level and simply taking the returns offered by that asset mix. The most important factor that might determine an investor’s success is patience, and being able to stick to the plan through thick and thin. Having a plan is key, sticking to that plan is crucial. It will come down to boring consistency and patience. Doing nothing is doing it right. OK, what we can do is invest on a regular schedule and that can often be set up so that the dollar cost averaging happens with a set-it-and-forget-it automatic investment plan. Vanguard has found that those who adopt a long term strategy in their 401k accounts and invest in the indexes or low fee managed funds have recently been able to ignore the market noise and simply stay the course. In 2011 during the European debt crisis the S&P 500 lost nearly 20% Vanguard investors didn’t panic (the correct move in hindsight). This comes from a previous study: In the first eight trading days of August [2011], including two of the most volatile days since 2008, just under 2% of 401(k) participants at Vanguard made a change to their portfolios. In other words, over 98% stayed the course. Ninety-eight percent took no action. Ninety-eight percent took the long-term view. Now it’s true, if choppy markets continue, we’ll see this number inch down. Ninety-eight percent of participants staying the course might become 97%. In October 2008, during the depths of the financial crisis, it became 96%-in other words, 4% of participants made a move. But the fact remains: those trading are a very small subset of investors. When we consider the findings of that Dalbar study and see only 4% of Vanguard 401k investors making any kind of move (reaction) during the most severe market correction since the Great Depression, I think that is very telling. There is value in being a passive investor in the emotional sense. There is value in investing without emotion. Don’t invest like the emotional James T. Kirk, invest like Spock. Letting the index or low fee fund manage your holdings for you simply means that you don’t have to watch, you don’t have to be emotionally involved. That detachment can pay dividends. Not to be morbid but studies have shown that the portfolios of the deceased have done quite well. Portfolios of investors who have forgotten that they have stock and bonds investments can also do quite well. It’s ironic that non-thinking (or less thinking) typically beats thinking when it comes to investing. This from a business insider article and a discussion between Barry Ritzhold and James O’Shaughnessy … O’Shaughnessy relays one anecdote from an employee who recently joined his firm that really makes one’s head spin. O’Shaughnessy: “Fidelity had done a study as to which accounts had done the best at Fidelity. And what they found was…” Ritholtz: “They were dead.” O’Shaughnessy: “…No, that’s close though! They were the accounts of people who forgot they had an account at Fidelity.” Apparently the forgetful make for wonderful investors. I get to deliver that wonderful surprise once a week or more to Tangerine clients. Some investors will forget that they moved some monies to an investment account 3, 4 or 5 years ago and I can deliver the good news on the returns. It’s certainly an opportunity to then remind investors that leaving their investments alone is often wonderful behaviour. Getting emotionally involved with your investments and your ability to fund your retirement years can be dangerous. It’s not surprising that for many, the further they can stay away from their investment decisions, the better. The passive nature of indexing allows for this detachment. We know that most professional managers will not get the market returns that are available, over time. And the Dalbar study shows that individual investors can hamper returns by an even larger degree. Also from that Business Insider Article, here’s an interesting (and very famous chart) that makes the rounds in discussions about investor returns. Please note, the editorial comment (IN RED) is from the link, and perhaps was added by Mr. Ritzhold. 🙂 (click to enlarge) Now that’s not to say that an individual stock picker cannot be a successful investor. If a stock picker is well diversified, is investing within his or her risk tolerance level, and that investor is then very patient and able to stay the course, that investor might do quite well. But again, it might come down to that investor being able to invest without emotion. Investing without emotion appears to be a tough task for the professionals and retail investors alike. I love reading the comments of Seeking Alpha reader and commentor buyandhold 2012 . The comments are generally the same theme … buy and hold, don’t sell. buyandhold states that he has never sold a stock, the holdings can only come and go if a company is acquired or goes out of business. He makes investing more about marriage than dating. He claims to have beat the markets over the decades, and even though this is the world wide web and mr buyandhold is anonymous I believe him. He follows the suggestions of Mr. Benjamin Graham and largely buys companies that have paid dividends (and dividend aristocrats) for an extended period. And then he holds. Buy. And then hold. That seems like a simple strategy that all of us can understand, but very few of us would be able to execute. Here’s one of his recent comments on an Exxon Mobil (NYSE: XOM ) article. DGI, what trips up many investors is that they focus on the short term rather than the long term. It is true that Exxon Mobil is not going to be a rock star growth stock on the price appreciation side in the next 12 months. But Exxon Mobil has a good chance of being a rock star growth stock on the price appreciation side over the next 25 to 50 years. I have been an Exxon Mobil shareholder for 44 years so I know that this stock really delivers the goods over the long term. That comment post says so much in the context of all of the noise surrounding the energy space and energy aristocrats and long term dividend payers. Buy, and hold. On the other side of the ledger and on Seeking Alpha, even within the dividend space, we hear so much on buy and selling and we see chart tools with buy and sell signals, there’s plenty of debate on what to do on a dividend cut or dividend freeze. Buyandhold has a suggestion, buy more when they’re on sale. Investing should be easy. For many it will come down to the advice of Mr. Warren Buffett – buy the broader market indices in the most cost effective manner possible and stay the course, and reinvest on a regular schedule. For stock pickers it may come down to the advise of buyandhold 2012 – buy great companies when they are at reasonable valuations and stick with your companies through thick and thin. Leave that SELL button alone. Thanks for reading. Happy investing, always know your risk tolerance level, and give a thought to the notion of international diversification. Dale Additional disclosure: Dale Roberts is an investment funds associate at Tangerine Investment Funds Limited. The Tangerine Investment Portfolios offer complete, low-fee index-based portfolios to Canadians. Dale’s commentary does not constitute investment advice. The opinions and information should only be factored into an investor’s overall opinion forming process. The views expressed are personal and do not necessarily represent those of Scotiabank Scalper1 News

Scalper1 News