Scalper1 News

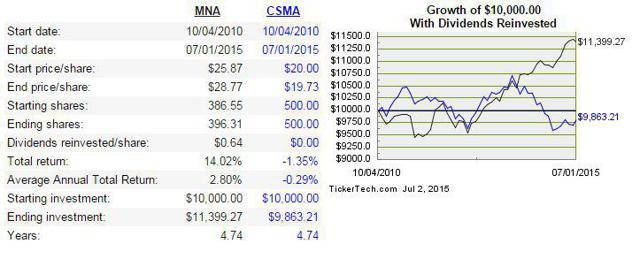

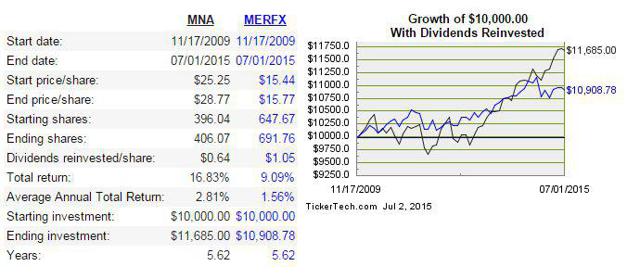

Summary I conducted a review of the IQ Merger Arbitrage ETF. I found that the IQ Merger Arbitrage ETF has significantly outperformed its peers because of the underlying strategy the ETF uses. In addition, the IQ Merger Arbitrage ETF has outperformed stocks on bonds during big down days. In this article, I will be reviewing the IQ ARB Merger Arbitrage ETF (NYSEARCA: MNA ) as an option for investors looking for a fund that is not highly correlated with stocks or bonds. I believe MNA is an ETF that investors can hide out in when the market panic sells like this past week with the crisis flavor of the week Greece, Puerto Rico, etc. MNA fits well into most portfolios because of the low correlation it has to stocks and bonds. The table below shows MNA is inversely correlated to the iShares Core Total U.S. Bond Market ETF (NYSEARCA: AGG ) and only has a 36% correlation to the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). With the bond market and the stock market in significant bull markets, there is a real possibility that both stocks and bonds could fall at the same time, which means non-correlated funds have the potential to be an intriguing addition to portfolio for diversification. MNA AGG SPY MNA 1 AGG -0.07 1 SPY 0.36 -0.11 1 Fund Investment Strategy MNA invests in companies that have been publicly announced as acquisition targets and hedges those positions with a broad market short hedge. When a deal is announced, there is a spread between the current trading price and the actual deal price. For example, stock XYZ is acquired for $50/share and after the announcement, XYZ is trading at $49/share. MNA would invest in shares of XYZ and capture the $1 difference between the acquisition price and the current price. As I will detail below in the performance section, MNA has a vastly different return profile than its competitors because it uses a broad market hedge instead of shorting specific stocks, which the competitors for MNA do. This is extremely important given current market conditions, because many companies that are making the acquisitions and thus the companies in the ProShares Merger ETF ( MRGR) and the Credit Suisse Merger Arbitrage Liquid Index ETN ( CSMA) are shorting increasingly along with the acquired company. The following chart shows a real-life example with CSMA having a long position in Time Warner Cable (NYSE: TWC ) and short position in Comcast (NASDAQ: CMCSA ). I assumed that CSMA purchased TWC on the day the deal was announced and showed the performance until April 24th of this year when the deal was called off. As you can see, this was a losing trade for CSMA because Comcast had a better performance than Time Warner Cable, which means that CSMA shorted the better performing company. (click to enlarge) Competition The three main competitors that MNA has are MRGR, CSMA and The Merger Fund (MUTF: MERFX ), which is a mutual fund. Costs: Below is a table, which shows that MNA is only 1 basis point more expensive than MRGR, which is a miniscule difference and is significantly cheaper than CSMA and MERFX. A low expense ratio does not mean that the performance will be better than its more expensive competitors; however, in this case, MNA has significantly outperformed its competitors because of the unique strategy that MNA uses. Expense Ratio MRGR 0.75% MNA 0.76% CSMA 1.05% MERFX 1.27% Performance The following charts show the total return performance of MNA compared to MRGR, CSMA and MERFX, with the charts and data coming from Dividend Channel’s total return calculator . MNA vs. Competitors As you can see in the chart below, MNA has significantly outperformed MRGR since December 2012, which was the start date for MRGR. The performance is not even close, and the funds are going in opposite directions, which shows the strategy MNA uses is superior to MRGR. (click to enlarge) The next chart shows MNA has significantly outperformed CSMA as well since CSMA started trading in October 2010. Up until the start of 2014, MNA and CSMA performed very closely; however, since then, the performance has diverged, because the stocks of the acquiring companies have rose significantly once a merger or acquisition was announced. (click to enlarge) The final chart shows MNA compared to MERFX, which is the widely held $5.3 billion in assets Merger Arbitrage mutual fund. Once again, the same pattern repeated itself with the performance of MNA diverging from the performance of MRFX over the last two years. (click to enlarge) MNA vs. SPY & AGG on worst days Using my ThinkorSwim platform, I looked at the five worst trading days for stocks [SPY] and bonds [AGG] and found that MNA performed well on those days when the broad stock market or bond market was down significantly. As you can see in the table below, the data clearly shows that MNA performs quite well during big down days in the market. SPY MNA AGG MNA 1/15/2015 -1.80% 0.33% 2/6/2015 -0.58% -0.03% 3/6/2015 -1.40% -0.31% 3/2/2015 -0.67% 0.10% 3/10/2015 -1.62% -0.10% 3/6/2015 -0.65% -0.31% 3/25/2015 -1.46% -0.34% 5/11/2015 -0.63% 0.20% 6/29/2015 -2.10% -0.33% 6/22/2015 -0.49% -0.17% Average -1.68% -0.15% Average -0.60% -0.04% Closing Thoughts In closing, I believe MNA is a quality choice for conservative investors who are looking for a non-correlated fund that can be a place to hide out in the event of some foreseen or unforeseen adverse market conditions. MNA is superior to its competitors, because it does not short the stocks of acquiring companies, which has been an excellent strategy in this market, and MNA performs well on days when stocks or bonds are declining significantly. If you are looking for income, MNA is not the fund for you, because MNA only pays an annual dividend if/when they do pay a dividend. Disclaimer: See here Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MNA over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I may initiate a position in MNA in the next month or two. Scalper1 News

Summary I conducted a review of the IQ Merger Arbitrage ETF. I found that the IQ Merger Arbitrage ETF has significantly outperformed its peers because of the underlying strategy the ETF uses. In addition, the IQ Merger Arbitrage ETF has outperformed stocks on bonds during big down days. In this article, I will be reviewing the IQ ARB Merger Arbitrage ETF (NYSEARCA: MNA ) as an option for investors looking for a fund that is not highly correlated with stocks or bonds. I believe MNA is an ETF that investors can hide out in when the market panic sells like this past week with the crisis flavor of the week Greece, Puerto Rico, etc. MNA fits well into most portfolios because of the low correlation it has to stocks and bonds. The table below shows MNA is inversely correlated to the iShares Core Total U.S. Bond Market ETF (NYSEARCA: AGG ) and only has a 36% correlation to the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). With the bond market and the stock market in significant bull markets, there is a real possibility that both stocks and bonds could fall at the same time, which means non-correlated funds have the potential to be an intriguing addition to portfolio for diversification. MNA AGG SPY MNA 1 AGG -0.07 1 SPY 0.36 -0.11 1 Fund Investment Strategy MNA invests in companies that have been publicly announced as acquisition targets and hedges those positions with a broad market short hedge. When a deal is announced, there is a spread between the current trading price and the actual deal price. For example, stock XYZ is acquired for $50/share and after the announcement, XYZ is trading at $49/share. MNA would invest in shares of XYZ and capture the $1 difference between the acquisition price and the current price. As I will detail below in the performance section, MNA has a vastly different return profile than its competitors because it uses a broad market hedge instead of shorting specific stocks, which the competitors for MNA do. This is extremely important given current market conditions, because many companies that are making the acquisitions and thus the companies in the ProShares Merger ETF ( MRGR) and the Credit Suisse Merger Arbitrage Liquid Index ETN ( CSMA) are shorting increasingly along with the acquired company. The following chart shows a real-life example with CSMA having a long position in Time Warner Cable (NYSE: TWC ) and short position in Comcast (NASDAQ: CMCSA ). I assumed that CSMA purchased TWC on the day the deal was announced and showed the performance until April 24th of this year when the deal was called off. As you can see, this was a losing trade for CSMA because Comcast had a better performance than Time Warner Cable, which means that CSMA shorted the better performing company. (click to enlarge) Competition The three main competitors that MNA has are MRGR, CSMA and The Merger Fund (MUTF: MERFX ), which is a mutual fund. Costs: Below is a table, which shows that MNA is only 1 basis point more expensive than MRGR, which is a miniscule difference and is significantly cheaper than CSMA and MERFX. A low expense ratio does not mean that the performance will be better than its more expensive competitors; however, in this case, MNA has significantly outperformed its competitors because of the unique strategy that MNA uses. Expense Ratio MRGR 0.75% MNA 0.76% CSMA 1.05% MERFX 1.27% Performance The following charts show the total return performance of MNA compared to MRGR, CSMA and MERFX, with the charts and data coming from Dividend Channel’s total return calculator . MNA vs. Competitors As you can see in the chart below, MNA has significantly outperformed MRGR since December 2012, which was the start date for MRGR. The performance is not even close, and the funds are going in opposite directions, which shows the strategy MNA uses is superior to MRGR. (click to enlarge) The next chart shows MNA has significantly outperformed CSMA as well since CSMA started trading in October 2010. Up until the start of 2014, MNA and CSMA performed very closely; however, since then, the performance has diverged, because the stocks of the acquiring companies have rose significantly once a merger or acquisition was announced. (click to enlarge) The final chart shows MNA compared to MERFX, which is the widely held $5.3 billion in assets Merger Arbitrage mutual fund. Once again, the same pattern repeated itself with the performance of MNA diverging from the performance of MRFX over the last two years. (click to enlarge) MNA vs. SPY & AGG on worst days Using my ThinkorSwim platform, I looked at the five worst trading days for stocks [SPY] and bonds [AGG] and found that MNA performed well on those days when the broad stock market or bond market was down significantly. As you can see in the table below, the data clearly shows that MNA performs quite well during big down days in the market. SPY MNA AGG MNA 1/15/2015 -1.80% 0.33% 2/6/2015 -0.58% -0.03% 3/6/2015 -1.40% -0.31% 3/2/2015 -0.67% 0.10% 3/10/2015 -1.62% -0.10% 3/6/2015 -0.65% -0.31% 3/25/2015 -1.46% -0.34% 5/11/2015 -0.63% 0.20% 6/29/2015 -2.10% -0.33% 6/22/2015 -0.49% -0.17% Average -1.68% -0.15% Average -0.60% -0.04% Closing Thoughts In closing, I believe MNA is a quality choice for conservative investors who are looking for a non-correlated fund that can be a place to hide out in the event of some foreseen or unforeseen adverse market conditions. MNA is superior to its competitors, because it does not short the stocks of acquiring companies, which has been an excellent strategy in this market, and MNA performs well on days when stocks or bonds are declining significantly. If you are looking for income, MNA is not the fund for you, because MNA only pays an annual dividend if/when they do pay a dividend. Disclaimer: See here Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MNA over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I may initiate a position in MNA in the next month or two. Scalper1 News

Scalper1 News