Scalper1 News

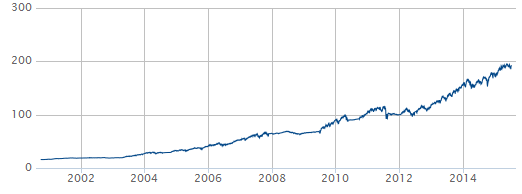

ALFA is a dynamically managed ETF based on hedge fund replication. It embeds a timing rule to hedge its holdings in market-neutral mode. Investors can use the asymmetry in risk-reward offered by this rule. The AlphaClone Alternative Alpha ETF (NYSEARCA: ALFA ) relies on the idea that a collective brain of famous fund managers should deliver a significant and steady return. ALFA selects fund managers based on their past performances after publication of their holdings. It uses a “clone score”, described as below in the factsheet: A proprietary scoring method that measures the efficacy of following a manager based on their public disclosures. AlphaClone’s clone score for each manager is based on the monthly returns in excess of a broad market index and a fixed hurdle rate exhibited by the manager’s follow strategies over time. Clone scores are recalculated bi-annually. In other words, past performances must be good, and also replicable. ALFA has diversification rules: the minimum number of holdings is 13, no single one can be more than 15% of NAV and the largest 5 holdings together cannot be more than 50%. When I write this, the largest holding is Apple (NASDAQ: AAPL ) with 7.43%, the top 5 holdings represent 20.46%. ALFA takes only long positions on individual stocks, it doesn’t follow short sales nor implements other strategies. The Global X Guru ETF (NYSEARCA: GURU ) tracks another index based on a similar duplication model. The main reason why I prefer ALFA over GURU is a hedging rule putting the portfolio in market-neutral mode when the S&P 500 index falls below its 200-day simple moving average. The index can vary between being long only and market hedged (50% short exposure to the S&P 500 index). The hedge is triggered on or off when the S&P 500 crosses its 200-day moving average at any month end. (excerpt of the factsheet) The decision to enter, quit or maintain the hedge is made at the end of each month for the next full month. This blog post by Alphaclone’s CEO explains the choice of an end-of-month timing to avoid whipsaws, with a study on past data since 1950. ALFA was launched on 5/31/2012 and the underlying index in October 2011, but the latter has been calculated starting in 2001. The next hypothetical equity curve shows that ALFA would have been in market-neutral mode during the worst periods of the 2 last recessions, after the flash-crash of 2010 and also the August 2011 correction (chart from solactive.com ). Alphaclone index guidelines specifies that the market-neutral state is attained by Shorting a security that tracks the S&P 500 Index in an amount equal to the market value of 100% of the index’s long positions. No mention is made of selling holdings, so we can suppose that the hedge is taken on margin. When the hedge is on, the ETF returns the alpha of a stock portfolio chosen by some of the best fund managers. ALFA is dynamically hedged smart money. It is possible to make it even safer by buying it at specific times. The risk is lower when the S&P 500 is below or close to its 200-day moving average. It is also lower at the end of the month, just before the hedging decision is made. If the benchmark falls or stays below the moving average, the drawdown is small (except in a flash crash scenario), and the ETF will be protected in market-neutral mode for the next month or more. If the trend is reverted, it may profit by the upside. When adding on an existing position, it is also possible to play on the quantity to control the new average buy price. For M shares at $P per share and N shares at $Q per share, the average price is (MP+NQ)/(M+N). The idea is to calculate N so that it stays below the 200-day moving average. Given the correlation (0.74) and beta (1.08), ALFA follows the market moves quite closely. Using its own 200-day moving average to evaluate the level where the hedge would be triggered is a reasonable rule-of-thumb. It also provides a safety margin when ALFA is in a better position than the SPDR S&P 500 Trust ETF ( SPY) relative to the moving average, like recently. Of course, the price can fall lower before the end of the month. The next table gives an idea of the maximum drawdown before the hedge is activated when we are 1 day, 1 week or 1 month before the next hedging decision, with the confidence interval offered by 87 years of data. It shows the maximum losses of the Dow Jones Industrial Average (NYSEARCA: DIA ) and the S&P 500. Numbers can be multiplied by 1.1 to take the beta into account. Maximum loss… DJIA since 1928 S&P 500 since 1950 …on a single day -22.61% -20.47% …on a single week -18.15% -18.2% …on a single month -30.7% -21.76% When buying in the last week of the month, the maximum drawdown before activating the hedge should be no more than 25% with a good confidence interval. Once in market neutral, ALFA returns its stock portfolio’s alpha whatever happens in the market until the next bullish trend. The long moving average and the monthly trigger are supposed to avoid whipsaws. Conclusion : Past data are not a guarantee for ALFA future returns, but the structure of its underlying index makes it a good buy-and-hold investment with a strong asymmetric bias. Its hedging rule reduces possible drawdowns, and also allows to build a position step by step with a better control of the value-at-risk. Disclosure: I am/we are long ALFA. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

ALFA is a dynamically managed ETF based on hedge fund replication. It embeds a timing rule to hedge its holdings in market-neutral mode. Investors can use the asymmetry in risk-reward offered by this rule. The AlphaClone Alternative Alpha ETF (NYSEARCA: ALFA ) relies on the idea that a collective brain of famous fund managers should deliver a significant and steady return. ALFA selects fund managers based on their past performances after publication of their holdings. It uses a “clone score”, described as below in the factsheet: A proprietary scoring method that measures the efficacy of following a manager based on their public disclosures. AlphaClone’s clone score for each manager is based on the monthly returns in excess of a broad market index and a fixed hurdle rate exhibited by the manager’s follow strategies over time. Clone scores are recalculated bi-annually. In other words, past performances must be good, and also replicable. ALFA has diversification rules: the minimum number of holdings is 13, no single one can be more than 15% of NAV and the largest 5 holdings together cannot be more than 50%. When I write this, the largest holding is Apple (NASDAQ: AAPL ) with 7.43%, the top 5 holdings represent 20.46%. ALFA takes only long positions on individual stocks, it doesn’t follow short sales nor implements other strategies. The Global X Guru ETF (NYSEARCA: GURU ) tracks another index based on a similar duplication model. The main reason why I prefer ALFA over GURU is a hedging rule putting the portfolio in market-neutral mode when the S&P 500 index falls below its 200-day simple moving average. The index can vary between being long only and market hedged (50% short exposure to the S&P 500 index). The hedge is triggered on or off when the S&P 500 crosses its 200-day moving average at any month end. (excerpt of the factsheet) The decision to enter, quit or maintain the hedge is made at the end of each month for the next full month. This blog post by Alphaclone’s CEO explains the choice of an end-of-month timing to avoid whipsaws, with a study on past data since 1950. ALFA was launched on 5/31/2012 and the underlying index in October 2011, but the latter has been calculated starting in 2001. The next hypothetical equity curve shows that ALFA would have been in market-neutral mode during the worst periods of the 2 last recessions, after the flash-crash of 2010 and also the August 2011 correction (chart from solactive.com ). Alphaclone index guidelines specifies that the market-neutral state is attained by Shorting a security that tracks the S&P 500 Index in an amount equal to the market value of 100% of the index’s long positions. No mention is made of selling holdings, so we can suppose that the hedge is taken on margin. When the hedge is on, the ETF returns the alpha of a stock portfolio chosen by some of the best fund managers. ALFA is dynamically hedged smart money. It is possible to make it even safer by buying it at specific times. The risk is lower when the S&P 500 is below or close to its 200-day moving average. It is also lower at the end of the month, just before the hedging decision is made. If the benchmark falls or stays below the moving average, the drawdown is small (except in a flash crash scenario), and the ETF will be protected in market-neutral mode for the next month or more. If the trend is reverted, it may profit by the upside. When adding on an existing position, it is also possible to play on the quantity to control the new average buy price. For M shares at $P per share and N shares at $Q per share, the average price is (MP+NQ)/(M+N). The idea is to calculate N so that it stays below the 200-day moving average. Given the correlation (0.74) and beta (1.08), ALFA follows the market moves quite closely. Using its own 200-day moving average to evaluate the level where the hedge would be triggered is a reasonable rule-of-thumb. It also provides a safety margin when ALFA is in a better position than the SPDR S&P 500 Trust ETF ( SPY) relative to the moving average, like recently. Of course, the price can fall lower before the end of the month. The next table gives an idea of the maximum drawdown before the hedge is activated when we are 1 day, 1 week or 1 month before the next hedging decision, with the confidence interval offered by 87 years of data. It shows the maximum losses of the Dow Jones Industrial Average (NYSEARCA: DIA ) and the S&P 500. Numbers can be multiplied by 1.1 to take the beta into account. Maximum loss… DJIA since 1928 S&P 500 since 1950 …on a single day -22.61% -20.47% …on a single week -18.15% -18.2% …on a single month -30.7% -21.76% When buying in the last week of the month, the maximum drawdown before activating the hedge should be no more than 25% with a good confidence interval. Once in market neutral, ALFA returns its stock portfolio’s alpha whatever happens in the market until the next bullish trend. The long moving average and the monthly trigger are supposed to avoid whipsaws. Conclusion : Past data are not a guarantee for ALFA future returns, but the structure of its underlying index makes it a good buy-and-hold investment with a strong asymmetric bias. Its hedging rule reduces possible drawdowns, and also allows to build a position step by step with a better control of the value-at-risk. Disclosure: I am/we are long ALFA. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News