Scalper1 News

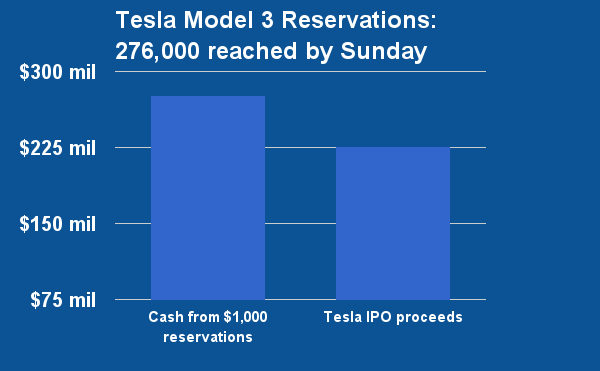

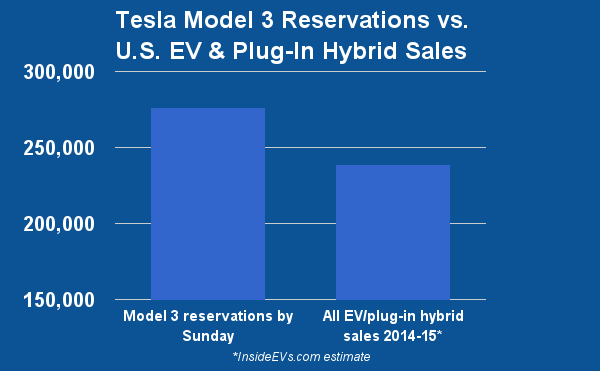

Loading the player… Tesla Motors ( TSLA ) stock fell more than 2% after the close in the stock market today , as the company gave a Q1 deliveries count and mentioned Model X parts shortages. That highlights Tesla’s task ahead as the electric car maker tries to ramp up production dramatically to deliver its new Model 3 starting in late 2017. “Tesla Q1 deliveries consisted of 12,420 Model S vehicles and 2,400 Model X vehicles,” Tesla spokeswoman Alexis Georgeson said in an emailed statement after the market close. “Q1 deliveries were almost 50% more than Q1 last year and Tesla remains on track to deliver 80,000 to 90,000 new vehicles in 2016.” Tesla said the Q1 delivery count was impacted by “severe Model X supplier parts shortages in January and February that lasted much longer than initially expected.” Production rates improved once the issues were solved, the company said. “The root causes of the parts shortages were: Tesla’s hubris in adding far too much new technology to the Model X in version 1, insufficient supplier capability validation, and Tesla not having broad enough internal capability to manufacture the parts in-house,” Georgeson’s email said. “The parts in question were only half a dozen out of more than 8,000 unique parts, nonetheless missing even one part means a car cannot be delivered. Tesla is addressing all three root causes to ensure that these mistakes are not repeated with the Model 3 launch.” Model 3 Reservations Rack Up, With Challenge Ahead Tesla stock closed up 4% Monday at 246.99, compounding Friday’s gain as reservations for its new Model 3 electric car soared far beyond views. CEO Elon Musk tallied 276,000 reservations by the beginning of Sunday and said he’d give another update Wednesday. The pre-order period opened Thursday ahead of a Thursday-night reveal event. Musk said in Twitter posts that he’s definitely going to have to rethink production planning. Tesla had expected only one quarter to one half of the 115,000 reservations that came in before anyone even got to see what the car looked like. The refundable reservations are $1,000 each and worth $11.6 billion dollars in revenue if everybody were to go through with a purchase. “While there was clearly a lot of excitement and optimism around both the car and the company, roughly one-third of the respondents we talked to sounded undecided on whether they would actually purchase when the option came up in two years,” Pacific Crest Securities analyst Brad Erickson said in a research note written Friday and distributed late Sunday. The focus now is on how all the numbers — and Tesla stock — will play out. The company has just effectively crowdfunded more than a quarter billion dollars from reservations. That’s more than it raised in its IPO. The 276,000 reservations worldwide also tops the number of electric and plug-in hybrid vehicles sold around the U.S. in the last two years by the entire auto industry. And it’s more than the 245,000 BMW passenger cars sold in the U.S. last year. Tesla delivered almost 51,000 electric vehicles — its Model S sedan and Model X crossover — last year worldwide. Tesla Stock Analysis Going into Monday, Tesla stock was just below where it started 2016. It closed Friday at 237.59 after hitting its highest point since early October. The stock isn’t highly rated by IBD now, factoring in its history of losses and earnings, stock performance and other factors. The Model 3 is the electric car meant for the entry-level luxury mass market, priced at $35,000 for the base model before any tax credits. Musk expects the average purchase price with add-ons to be $42,000. The car is seen as a challenger to BMW’s 3 Series and similarly priced models from Daimler ’s ( DDAIF ) Mercedes-Benz, Volkswagen ’s ( VLKAY ) Audi and Toyota ’s ( TM ) Lexus, as well as electrics like General Motors ’ ( GM ) Chevrolet Bolt EV. Among the many things analysts and investors will be deconstructing is how much content from Tesla’s tech partners Nvidia ( NVDA ) and Mobileye ( MBLY ) go into the Model 3. Nvidia chips power the entertainment console in Tesla’s current vehicles. Mobileye is a maker of camera-based advanced driver assistance systems, and its technology is used by Tesla in conjunction with Autopilot self-driving car features. Mobileye stock rose 3.2% Monday, while Nvidia was down fractionally. Nvidia gets a top 99 Composite Rating from IBD and Mobileye a 70. RELATED: Tesla Model 3 Reservations Hit 276,000 By Sunday Scalper1 News

Loading the player… Tesla Motors ( TSLA ) stock fell more than 2% after the close in the stock market today , as the company gave a Q1 deliveries count and mentioned Model X parts shortages. That highlights Tesla’s task ahead as the electric car maker tries to ramp up production dramatically to deliver its new Model 3 starting in late 2017. “Tesla Q1 deliveries consisted of 12,420 Model S vehicles and 2,400 Model X vehicles,” Tesla spokeswoman Alexis Georgeson said in an emailed statement after the market close. “Q1 deliveries were almost 50% more than Q1 last year and Tesla remains on track to deliver 80,000 to 90,000 new vehicles in 2016.” Tesla said the Q1 delivery count was impacted by “severe Model X supplier parts shortages in January and February that lasted much longer than initially expected.” Production rates improved once the issues were solved, the company said. “The root causes of the parts shortages were: Tesla’s hubris in adding far too much new technology to the Model X in version 1, insufficient supplier capability validation, and Tesla not having broad enough internal capability to manufacture the parts in-house,” Georgeson’s email said. “The parts in question were only half a dozen out of more than 8,000 unique parts, nonetheless missing even one part means a car cannot be delivered. Tesla is addressing all three root causes to ensure that these mistakes are not repeated with the Model 3 launch.” Model 3 Reservations Rack Up, With Challenge Ahead Tesla stock closed up 4% Monday at 246.99, compounding Friday’s gain as reservations for its new Model 3 electric car soared far beyond views. CEO Elon Musk tallied 276,000 reservations by the beginning of Sunday and said he’d give another update Wednesday. The pre-order period opened Thursday ahead of a Thursday-night reveal event. Musk said in Twitter posts that he’s definitely going to have to rethink production planning. Tesla had expected only one quarter to one half of the 115,000 reservations that came in before anyone even got to see what the car looked like. The refundable reservations are $1,000 each and worth $11.6 billion dollars in revenue if everybody were to go through with a purchase. “While there was clearly a lot of excitement and optimism around both the car and the company, roughly one-third of the respondents we talked to sounded undecided on whether they would actually purchase when the option came up in two years,” Pacific Crest Securities analyst Brad Erickson said in a research note written Friday and distributed late Sunday. The focus now is on how all the numbers — and Tesla stock — will play out. The company has just effectively crowdfunded more than a quarter billion dollars from reservations. That’s more than it raised in its IPO. The 276,000 reservations worldwide also tops the number of electric and plug-in hybrid vehicles sold around the U.S. in the last two years by the entire auto industry. And it’s more than the 245,000 BMW passenger cars sold in the U.S. last year. Tesla delivered almost 51,000 electric vehicles — its Model S sedan and Model X crossover — last year worldwide. Tesla Stock Analysis Going into Monday, Tesla stock was just below where it started 2016. It closed Friday at 237.59 after hitting its highest point since early October. The stock isn’t highly rated by IBD now, factoring in its history of losses and earnings, stock performance and other factors. The Model 3 is the electric car meant for the entry-level luxury mass market, priced at $35,000 for the base model before any tax credits. Musk expects the average purchase price with add-ons to be $42,000. The car is seen as a challenger to BMW’s 3 Series and similarly priced models from Daimler ’s ( DDAIF ) Mercedes-Benz, Volkswagen ’s ( VLKAY ) Audi and Toyota ’s ( TM ) Lexus, as well as electrics like General Motors ’ ( GM ) Chevrolet Bolt EV. Among the many things analysts and investors will be deconstructing is how much content from Tesla’s tech partners Nvidia ( NVDA ) and Mobileye ( MBLY ) go into the Model 3. Nvidia chips power the entertainment console in Tesla’s current vehicles. Mobileye is a maker of camera-based advanced driver assistance systems, and its technology is used by Tesla in conjunction with Autopilot self-driving car features. Mobileye stock rose 3.2% Monday, while Nvidia was down fractionally. Nvidia gets a top 99 Composite Rating from IBD and Mobileye a 70. RELATED: Tesla Model 3 Reservations Hit 276,000 By Sunday Scalper1 News

Scalper1 News