Scalper1 News

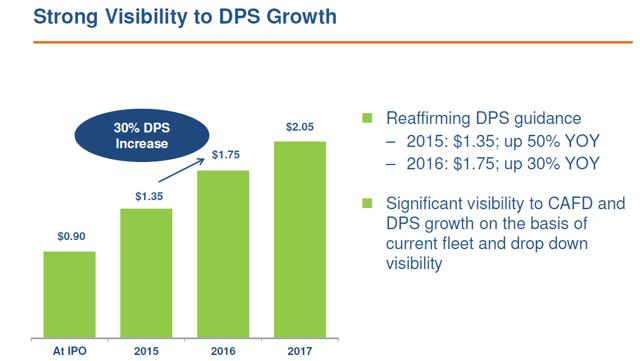

Summary TerraForm’s assets are new and efficient. Dividend guided by management to increase over 50% by 2017; yield on cost of 8% at currrent prices. Yieldco structure gives the company a highly visibile pipeline, external wind power acquisitions change the game. Shares are heavily undervalued at current prices. I’m long and you should be too. TerraForm Power, Inc. (NASDAQ: TERP ) is one of a few relatively new yieldcos trading in the market today. The company was set up to operate SunEdison (NYSE: SUNE ) assets in solar energy, but has since expanded to offer wind energy production as well. The current portfolio totaled 1,883 MW at the end of Q2 2015, but there has been 788MW worth of acquisitions already announced in 2015 and the company has call rights on 3,716MW of production that is under construction by SunEdison. Currently, the majority of assets are held in the United States (71%) and the United Kingdom (20%). From a management perspective, the relationship between TerraForm and SunEdison means that investors stand to benefit from SunEdison’s expertise as a large player in renewable energy design and downstream operations. The majority of TerraForm Power management worked at SunEdison so there is deep industry knowledge in the management suite in regards to predicting capital expenditures and industry ties to other third parties in the industry. Yieldcos have increased in popularity over the past few years, especially within the renewable energy space. Investors new to the concept can view a yieldco in a similar light to the more familiar master limited partnership (MLP) structure. Yieldcos do not pay corporate taxes and only completed, revenue-generating assets are held within the structure, attracting investors seeking low risk and stable cash flow. In return, parent companies get access to lower costs-of-capital while still retaining the majority voting interest on their assets. (click to enlarge) Shares have taken a dive in July and now trade below the initial IPO price in 2014. Is this warranted or does the company present a substantial opportunity at current prices? What steps has management taken over the past year and how does the asset pipeline look? Wind Diversification TerraForm has significantly diversified its power generation into wind assets in 2015. Starting with the FirstWind acquisition that closed in 2015 (500 MW), the company acquired an additional 1,451MW of wind energy from Atlantic Power and Invenergy in June/July 2015. By the end of 2015, all these transactions will have closed and TerraForm will be one of the largest wind power providers in the United States from basically having no wind assets just a year ago. In fact, starting in 2016 TerraForm will derive more power generation from wind than solar. This was a big deal for the company and these transactions catapulted TerraForm forward in the renewable energy markets. I like these acquisitions as they diversify the revenue base and will enhance scale in what currently is a highly fragmented renewable energy market. For a company that many viewed a year ago as just a depository for SunEdison solar assets, this has been a major change and management has a vision for the future. High Leverage Does Present Risks Due to the capital-intensive nature of the business and the corporate structure, traditional metrics like net debt/EBITDA and others are high. Current net debt/run-rate EBITDA stands at 5.1x, which should be something investors weigh before opening a position. Recent cash raises in the equity/debt markets have been all but used up to fund the recent transformative acquisitions mentioned. Current liquidity stands at just $646M (only $50M cash-on-hand plus the open revolver balance). Going forward in the short term, TerraForm’s large transactions are over in my opinion and the company will switch gears to focus on integration and cultivating existing production. Dividend Growth and Eventual Share Price The 2015 dividend is set to be $1.35/share, an annual rate of 4.46% at current prices. However, management has guided for the dividend to increase to $1.75/share in 2016 and $2.05/share in 2017. (click to enlarge) * TerraForm Investor Presentation At current prices of $25.33/share as of this writing, a dividend of $2.05/share in 2017 would give you a yield on cost of over 8% on your original investment. This is extremely solid and I think the market must either not understand the company or believe it cannot meet its dividend growth goals, which have been reiterated quite often in calls. Analysts have been quite direct on management’s view of share value and whether issuing further equity in the pipeline, to which Management has responded adamantly that they view the shares as undervalued at current prices and do not wish to raise capital this way. I think it is unlikely that current shareholders get diluted at current prices. Conclusion Shares are undervalued at current prices and the market sell-off from $40/share to current lows has been overdone. I picked up some shares at current prices today (to go along with my other two utility plays, Calpine Corporation (NYSE: CPN ) and AES Corporation (NYSE: AES )). In general, I think investors in utilities should seek out companies with young power plants with significant holdings in the next generation of power generation (natural gas, wind, solar) at cheap prices. TerraForm fits the bill. Disclosure: I am/we are long TERP. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary TerraForm’s assets are new and efficient. Dividend guided by management to increase over 50% by 2017; yield on cost of 8% at currrent prices. Yieldco structure gives the company a highly visibile pipeline, external wind power acquisitions change the game. Shares are heavily undervalued at current prices. I’m long and you should be too. TerraForm Power, Inc. (NASDAQ: TERP ) is one of a few relatively new yieldcos trading in the market today. The company was set up to operate SunEdison (NYSE: SUNE ) assets in solar energy, but has since expanded to offer wind energy production as well. The current portfolio totaled 1,883 MW at the end of Q2 2015, but there has been 788MW worth of acquisitions already announced in 2015 and the company has call rights on 3,716MW of production that is under construction by SunEdison. Currently, the majority of assets are held in the United States (71%) and the United Kingdom (20%). From a management perspective, the relationship between TerraForm and SunEdison means that investors stand to benefit from SunEdison’s expertise as a large player in renewable energy design and downstream operations. The majority of TerraForm Power management worked at SunEdison so there is deep industry knowledge in the management suite in regards to predicting capital expenditures and industry ties to other third parties in the industry. Yieldcos have increased in popularity over the past few years, especially within the renewable energy space. Investors new to the concept can view a yieldco in a similar light to the more familiar master limited partnership (MLP) structure. Yieldcos do not pay corporate taxes and only completed, revenue-generating assets are held within the structure, attracting investors seeking low risk and stable cash flow. In return, parent companies get access to lower costs-of-capital while still retaining the majority voting interest on their assets. (click to enlarge) Shares have taken a dive in July and now trade below the initial IPO price in 2014. Is this warranted or does the company present a substantial opportunity at current prices? What steps has management taken over the past year and how does the asset pipeline look? Wind Diversification TerraForm has significantly diversified its power generation into wind assets in 2015. Starting with the FirstWind acquisition that closed in 2015 (500 MW), the company acquired an additional 1,451MW of wind energy from Atlantic Power and Invenergy in June/July 2015. By the end of 2015, all these transactions will have closed and TerraForm will be one of the largest wind power providers in the United States from basically having no wind assets just a year ago. In fact, starting in 2016 TerraForm will derive more power generation from wind than solar. This was a big deal for the company and these transactions catapulted TerraForm forward in the renewable energy markets. I like these acquisitions as they diversify the revenue base and will enhance scale in what currently is a highly fragmented renewable energy market. For a company that many viewed a year ago as just a depository for SunEdison solar assets, this has been a major change and management has a vision for the future. High Leverage Does Present Risks Due to the capital-intensive nature of the business and the corporate structure, traditional metrics like net debt/EBITDA and others are high. Current net debt/run-rate EBITDA stands at 5.1x, which should be something investors weigh before opening a position. Recent cash raises in the equity/debt markets have been all but used up to fund the recent transformative acquisitions mentioned. Current liquidity stands at just $646M (only $50M cash-on-hand plus the open revolver balance). Going forward in the short term, TerraForm’s large transactions are over in my opinion and the company will switch gears to focus on integration and cultivating existing production. Dividend Growth and Eventual Share Price The 2015 dividend is set to be $1.35/share, an annual rate of 4.46% at current prices. However, management has guided for the dividend to increase to $1.75/share in 2016 and $2.05/share in 2017. (click to enlarge) * TerraForm Investor Presentation At current prices of $25.33/share as of this writing, a dividend of $2.05/share in 2017 would give you a yield on cost of over 8% on your original investment. This is extremely solid and I think the market must either not understand the company or believe it cannot meet its dividend growth goals, which have been reiterated quite often in calls. Analysts have been quite direct on management’s view of share value and whether issuing further equity in the pipeline, to which Management has responded adamantly that they view the shares as undervalued at current prices and do not wish to raise capital this way. I think it is unlikely that current shareholders get diluted at current prices. Conclusion Shares are undervalued at current prices and the market sell-off from $40/share to current lows has been overdone. I picked up some shares at current prices today (to go along with my other two utility plays, Calpine Corporation (NYSE: CPN ) and AES Corporation (NYSE: AES )). In general, I think investors in utilities should seek out companies with young power plants with significant holdings in the next generation of power generation (natural gas, wind, solar) at cheap prices. TerraForm fits the bill. Disclosure: I am/we are long TERP. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News