Seeing The Forest Through The Trees; Timber ETFs

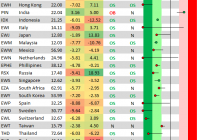

In the never ending search for new and interesting betas, perhaps few betas are as unique as that related to wood products. Perhaps apart from the occasional reality TV show, wood and industries related to it, aren’t the trendiest of products these days, but from snazzy car and home interiors, to humble old fashioned writing tablets and pizza boxes, wood, and its derivatives, everywhere one may look. Though the betas of wood ETFs may not be too far away from 1.0 on average ( WOOD ; 1.09, CUT ; 1.22), they may still perhaps supply a portfolio with an interesting route towards further diversification, and hence perhaps deserve a look. ________ Two of the most notable timber ETFs seem to be the surprisingly named WOOD and CUT. Though they are largely similar there seem to be certain qualities of each which make them slightly different from one another, but none the less interesting perhaps. _________ Apart from the year to date returns(price based); 1.86% for CUT, and 2.39% for WOOD, they also have different dividend based yield profiles per se, with W having a ~1.6% div. yield (according to Google finance), and C having a ~2.6 div yield. Apart from these sorts foreground, if one will, differences, the two ETFs also have different geographical allocations as far as their holdings’ are concerned. While Both have a US centric skew to their holdings, CUT seems to ultimately have a lesser percentage of its holdings invested in US based investments. One might argue that from largest to smallest position, WOOD also seems to be more concentrated(albeit slightly) in top holdings more so than CUT as well. These two ETFs share different subsector concentrations as one might expect, but before we get to that lets spice things up with an exciting picture of paper products. _______ For, though WOOD has so far held the crown in so far as skewness is concerned, CUT does show some more skewness in some regards, most specifically in so far as its subsector concentrations are concerned. For, though one may most often associate timber and wood products ETFs with a gentleman “leaping from tree to tree” in the forests of “British Columbia”, this death of the tree per se, is seemingly just the beginning of the flume ride if one will, that wood and its derivatives take through the world of industry. Image Source , Log Flume rides, soaking innocent bystanders at amusement parks since 1963 For when looking at these two wood ETFs one may notice that while WOOD is more concentrated in the paper products sector and “Reits”, presumably timber bearing land, with ~26% of said assets being held in said Reits, CUT seems to just sort of ” cut to the chase”; with a full 80 percent of its holdings specifically being in the “basic materials” subsector, presumably being wood or timberlands in general. Hence if one will it might be said that WOOD seems to be the more paper or wood derivatives centric of the 2 ETFs, with CUT being the more ” wood” centric of the two. Hence for the more specifically timber heavy play if one will, CUT might be the better ultimate choice, with WOOD being the favorite for paper products, etc. Hence perhaps the choice in between which of these two ETFs to allocate some cap., may come down to that age old discussion of wood vs. paper, and hence perhaps in a way perhaps they are, despite some broad overlap, somewhat complimentary. ______ Hence perhaps discussions of timber ETFs are also very much discussion of paper ETFs if one will. Ultimately whether one is looking for the felling of trees, or for some action regarding that semi-ancient medium of human writing etc., hopefully everyone’s investments are doing great, and everyone is having a good summer, and perhaps enjoying a log-flume ride or two, or whatever one chooses as a method to “beat the heat”. Thanks again for reading. ______ Prose of the post; an excerpt of lumberjack poetry; “spilling the fruit and chipping the bark, measuring, cutting into four by fours, and two by sixes,– numbering now instead of naming, until, even the complicitous apple was felled”