QQQ’s 2015 2nd-Quarter Performance And Seasonality

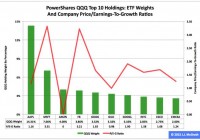

Summary The large-capitalization PowerShares QQQ behaved better in the first half than did the large-cap SPDR S&P 500 ETF. In the second quarter, the adjusted closing daily share price of the derivative of the Nasdaq-100 Index rose by 1.63 percent. In June, the fund’s share price fell by -2.48 percent. PowerShares QQQ’s (NASDAQ: QQQ ) adjusted closing daily share price in 2015’s first half ascended to $107.07 from $103.01, a climb of $4.06, or 3.94 percent. During the period, the ETF behaved better than the SPDR S&P 500 ETF (NYSEARCA: SPY ) by 2.83 percentage points and worse than the SPDR S&P MidCap 400 ETF (NYSEARCA: MDY ) and the iShares Core S&P Small-Cap ETF (NYSEARCA: IJR ) by -14 and -8 basis points, in that order. QQQ last quarter led SPY, IJR and MDY by 1.40, 1.46 and 2.74 percentage points, respectively. And most recently, QQQ last month lagged IJR, MDY and SPY by -3.54 percentage points, 1.21 percentage points and 47 basis points, respectively. Comparisons of changes by percentages in QQQ, SPY, MDY, IJR and the small-cap iShares Russell 2000 ETF (NYSEARCA: IWM ) during the first half, over Q2 and in June can be found in charts published in “SPY’s 2015 2nd-Quarter Performance And Seasonality.” Figure 1: PowerShares QQQ Top 10 Holdings, July 2 (click to enlarge) Notes: 1. The QQQ holding-weight-by-percentage scale is on the left (green), and the company price/earnings-to-growth ratio scale is on the right (red). 2. A meaningful P/E-G ratio is incalculable for the generally unprofitable Amazon.com Inc. ( AMZN ). Source: This J.J.’s Risky Business chart is based on data at Invesco’s PowerShares QQQ microsite and FinViz.com (both current as of July 2). QQQ’s constituent companies in general and its top 10 holdings in particular have a tendency to do big business in both domestic and foreign markets (Figure 1). Their sales’ geographic diversification has been an issue during the past year and will be an issue over the next year primarily because of the bias divergence in monetary policy at large central banks around the world, with the U.S. Federal Reserve oriented toward tightening and all the others oriented toward loosening. This bias divergence has had major effects on multiple financial markets, such as those centered on currencies. It has led to a stronger U.S. dollar on the one hand and a weaker euro, a weaker Japanese yen, a weaker British pound, a weaker Canadian dollar, a weaker Swedish krona and a weaker Swiss franc on the other hand. Accordingly, American products and services can cost more than their foreign-based competitors’ offerings in July 2015 than they did in July 2014. Apple Inc. (NASDAQ: AAPL ) does not compete materially on price, but many of QQQ’s constituent companies do so in their foreign markets. And I suspect the currency issue played a role in the first quarter, when only six of the ETF’s top 10 holdings beat their analysts’ consensus earnings estimates, according to Zacks . Meanwhile, these holdings’ P/E-G ratios indicate they are more dear than cheap, with equity-market participants assigning these firms valuations ranging from the apparently insane, Amazon.com, to the seemingly sane, Gilead Sciences Inc. (NASDAQ: GILD ). Figure 2: QQQ Monthly Change, 2015 Vs. 2000-2014 Mean (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance . QQQ performed a lot better in the first half of this year than it did during the comparable periods in its initial 15 full years of existence based on the monthly means calculated by employing data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the third, with a relatively small negative return, and its strongest quarter was the fourth, with an absolutely large positive return. Figure 3: QQQ Monthly Change, 2015 Vs. 2000-2014 Median (click to enlarge) Source: This J.J.’s Risky Business chart is based on analyses of adjusted closing monthly share prices at Yahoo Finance. QQQ performed a lot worse in the first half of this year than it did during the comparable periods in its initial 15 full years of existence based on the monthly means calculated by using data associated with that historical time frame (Figure 2). The same data set shows the average year’s weakest quarter was the first, with a relatively small positive return, and its strongest quarter was the fourth, with an absolutely large positive return. Disclaimer: The opinions expressed herein by the author do not constitute an investment recommendation, and they are unsuitable for employment in the making of investment decisions. The opinions expressed herein address only certain aspects of potential investment in any securities and cannot substitute for comprehensive investment analysis. The opinions expressed herein are based on an incomplete set of information, illustrative in nature, and limited in scope. In addition, the opinions expressed herein reflect the author’s best judgment as of the date of publication, and they are subject to change without notice. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.