EWM: Does This Former Tiger Economy Merit A Closer Look?

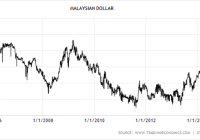

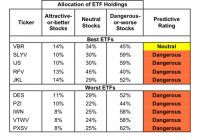

Summary Malaysia has steadily weaned itself off oil revenues and reduced the budget deficit by introducing new taxes and reducing subsidies. Despite high growth, 2.3% inflation and strong foreign currency reserves, the Malaysian dollar has weakened and is close to global financial-crisis lows. Expensive valuations, meager earnings growth and political instability do not provide many incentives to invest in EWM. With a GDP per capita of $12,127, Malaysia is the richest nation state in Southeast Asia. Many investors have avoided Malaysia due to political uncertainties and an over reliance on oil for government revenues. On March 2014, the judiciary found the opposition leader, Anwar Ibrahim, guilty of sodomy and jailed him for five years. While the political situation has not calmed since the verdict, Prime Minister Najib Razak has continued to liberalize the economy. Reforms As of 2015, Malaysia is the 14th most competitive economy in the world, ranked higher than countries like Australia, United Kingdom, South Korea and Japan. Subsidy reforms have not only improved competitiveness but have also bolstered the government’s balance sheet. In December 2014, the government ended all fuel subsidies, saving $5.97 billion annually . The minimum quota for Malay ownership in publicly traded companies has been lowered from 30 percent to 12.5 percent. Changing Economy Economic growth comes with problems as Malaysia’s attractiveness for lower-wage manufacturing has diminished as average wage levels have increased, making Malaysia an upper middle-income country. The government has championed efforts to become the world’s center of Islamic Finance, promoting an appreciation of the currency, even at the cost of exporters. As a result, Malaysia is the global leader in the sukuk (Islamic bond) market, issuing US$17.74 billion worth of sukuk in 2014 – over 66.7% of the global total of US$26.6 billion. Government Budget The Government is hugely reliant on Oil-based revenues from Petronas but has managed to diversify its income sources. While 30% of the government’s total revenue in 2014 still came from oil-based sources, the proportion is lower than 40% in 2009. To further reduce dependence on oil, the government implemented a 6% goods and services tax in April 2015. Due to such measures and a reduction in subsidies, the government debt to GDP ratio has returned to 2010 levels of 52.8%. Currency The Malaysian Dollar (also known as the Ringgit) has been subject to capital controls since September 1998, a consequence of the 1997 Asian financial crisis. The currency was pegged to the dollar at 3.80 from 1998 to 2005. Malaysia ended the peg on July 2005, but the currency is still a managed float, trading within ranges deemed acceptable by the national bank. The currency steady strengthened against the U.S. dollar until the 2013 taper tantrum. (click to enlarge) Despite the weaker currency, the economy has not been stronger since the financial crisis. The economy posted 6.0% GDP growth in 2014 and has averaged 2.3% inflation in the past five years. The benchmark interest rate of 3.25 is unchanged since September 2014, with only one rate hike in the past four years. However, the Current Account to GDP % has decreased from above 15% pre-financial crisis to just 5.7% in the past few years. This decline is unlikely to reverse course as Malaysians utilize their higher incomes to purchase imported goods. Still, the economy is likely to withstand a Fed tightening cycle with over $97 billion in foreign currency reserves . iShares MSCI Malaysia ETF ( EWM) Holdings (click to enlarge) The table above contains the top 16 components of EWM by weight. It should be noted that the numbers presented here, differs from data provided by iShares. While the discrepancy is partially due to the 28.4% weight I did not consider, I believe other factors are at play. For example, the WSJ and iShares disagree on the S&P P/E and dividend yield. The data in the above table was collected from malaysiastock.biz Financial stocks have the highest weight in the ETF at 31% and account for 3 of the top 4 holdings. There is also a divergence in growth between Public Bank ( OTC:PBLOF ) & Malayan Banking ( OTCPK:MLYBY ) vs CIMB ( OTCPK:CIMDF ) & AMMB ( OTC:AMMHF ). The former has enjoyed double digit revenue growth compared the latter at single digits and therefore commands a P/B premium. The utilities are not dividend paying income stocks; rather they are positioned for growth. Both Tenaga Nasional ( OTCPK:TNABY ) and Petronas Gas ( OTC:PNADF ) have dividend yields of 2%, below the 3% yield for the whole ETF. They tend to invest more of their earnings into projects which supply growing electricity demand. Tenaga appears to be the cheapest stock in the ETF but it is merely enjoying the drop in commodity prices last year. The telecoms and financial stocks pay the highest dividends and are the cheapest on a Price/Cash Flow basis. The only consumer staples stock and the only materials stock in the top 16 have negative revenue growth, showing how these sectors are struggling in every market. The stocks with the highest growth rates, the healthcare stock IHH ( OTCPK:IHHHF ) and the consumer discretionary stocks of Genting ( OTC:GEBEY ) also have higher P/E ratios than average. The ETF does not present a bargain in individual stocks or as a whole. The dividend yield is only 1% than yields on developed market stocks. 5yr CAGR growth rates at single digits suggests that there is not much growth to be had by investing in Malaysia. While the P/B and P/Cash Flow ratios seem cheap, it’s only due to the high weighting of financials in the ETF. Conclusion Investing in EWM over the iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ) is not a value, growth or income proposition. While the reforms taken by Prime Minister Najib Razak are encouraging, the political scene remains frothy. An internal power struggle between the PM and his mentor has erupted and respected business leaders are openly criticizing government policies. A possible Fitch downgrade over the $11.5 Billion debt of 1Malaysia Development Berhad (1MDB), a state-owned investment company should also concern current EWM investors. While moves taken to reduce the budget deficit and reliance on oil are encouraging, it would be wiser to revisit the ETF after the Fed raises rates and the political situation improves. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.