PIMCO High Income Fund: Is The Pain Over?

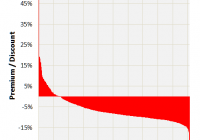

Summary PHK’s premium has fallen from over 50% to around 30%. That’s a big drop and well below the CEF’s 3-year average premium. So is the pain over and now the time to buy back in? The PIMCO High Income Fund (NYSE: PHK ) is a contentious closed-end fund, or CEF, that has a long history of trading at an impressive premium to its net asset value, or NAV. Right up front, I’m not a big fan of any CEF trading above its NAV, particularly at such an extreme premium. However, after such a large drop, some investors may be wondering if the hurt is over and whether now might be a good time to buy in. A little background To understand why a closed-end fund trades at a price different than its net asset value, you have to understand how CEFs differ from their mutual fund cousins. Mutual fund sponsors stand ready to buy and sell shares at the close of every trading day at NAV. Therefore, there’s a premade liquid market at NAV. Closed-end funds, meanwhile, sell a set number of shares to the public. Those shares then trade based on supply and demand on the open market. If investors like a CEF for whatever reason, they will demand a higher price to get them to sell. And if investors don’t like a CEF for some reason, they will take lower prices to get out. Thus, CEFs trade above and below their NAV. The NAV is still what the shares are worth – it is their intrinsic value, if you will. But it isn’t always what they will trade for. Using a simple example, if investors are fond of biotechnology a biotech-focused CEF might find itself trading at a 10% premium to NAV. The reason is investor sentiment; essentially investors are saying they expect good things from the CEF in the future. The important take away is that investor sentiment is the driving factor – not the actual value of the CEF’s shares. People really like PHK Closed-end funds normally trade around their NAV or at a discount. It’s unusual to see a CEF with a long history of trading well above NAV. PHK, then, is an exception to the norm. It’s long traded at a premium, and notably, at an extreme premium to its NAV. For example, its three-year average premium is nearly 50%. Its five-year average is just over 50%. People really like PHK. I’ve posited that the reason for this premium was partially because Bill Gross took over managing the fund in 2009, the year in which the premium started to widen. Since he’s no longer there, others have noted the fund’s steady distribution even through a difficult market period – notably the 2007 to 2009 recession. In the end, it’s probably a combination of the two. But whatever the reason, the CEF has a long history of trading well above its NAV. Which is why some argue that the selloff from an over 50% premium to the more recent 30% premium is a buying opportunity. This is a normal investment approach in the closed-end fund space, buying when a CEF is notably below its average premium/discount. The idea being that investor sentiment likely went too far in one direction and will eventually swing back toward the historical level. On the one hand, this makes sense for PHK. The average premium is close to 50% in recent history, so at a 30% premium, it’s fallen pretty far from the norm. In fact, this isn’t the first time there’s been such a drop. In the back half of 2012, PHK went from a roughly 75% premium down to a 25% premium before recovering to a 40% premium and eventually to the 50% and 60% levels seen earlier this year. I’d say, for aggressive investors who like to trade premiums and discounts, this is a CEF you should be looking at. Still too expensive But if you are a conservative investor, you should still avoid PHK. Why? We know with almost no doubt what PHK is worth; that’s the point of net asset value. That’s the value of PHK, no more and no less. If you buy PHK for a 30% premium, you are paying 30% more than its portfolio is worth on a per share basis. One of the reasons why playing premiums and discounts works is because you know the value of the asset you are buying – its NAV. So when a CEF is trading well below its NAV, there’s a clear catalyst for the discount to narrow. As investors realize the disconnect between price and value, they’ll correct it. PHK, however, is trading below its historical premium . Which means that anyone buying now is betting that investor sentiment will improve so that the premium gets wider. That’s akin to momentum investing in which you buy an expensive stock hoping that you can eventually sell it to someone at an even more expensive price – with little regard to its intrinsic value. There’s nothing wrong with this when it works, and it does work for some people. But it can also go horribly wrong when investors have changed their minds. Think back to the carnage in the dotcom bust, when investors realized that they didn’t like Internet companies as much as they thought they did. The companies didn’t change, investor psychology did. So, if you are a conservative investor, why bother buying something you know is overpriced? There are so many investment options in the market that taking such risks just isn’t worth it. And that’s true even taking into consideration PHK’s 15% yield. I’d rather take a yield half that and sleep well knowing that I don’t have to rely on fickle investors to buy my shares at a higher price. Or, better, yet, I’d rather buy something trading below its NAV and below its average discount, and wait for the market to realize the price disparity. With the NAV being a magnet to draw investors in to an undervalued investment opportunity. So, if you are an aggressive CEF investor looking to play discounts and premiums, PHK is definitely worth a look. Just go in knowing the game you are playing. I’d still suggest caution, but the fall from the average at PHK fits the bill for the trade. For conservative investors, don’t get sucked in by a big yield or the fall in the premium. PHK is still expensive even after its premium has fallen some 20 percentage points, and the yield just isn’t worth paying a still high 30% premium. You’ll be better off investing elsewhere. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.