SLVO: A Safer Way To Invest In Silver

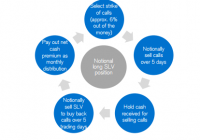

Summary SLVO is an ETN issued by Credit Suisse, benchmarked to the Credit Suisse NASDAQ SilverFLOWSTM 106 Index, a proprietary index designed to track a covered call strategy. The Credit Suisse NASDAQ Silver FLOWSTM 106 Index notionally sells approximately 6% out of the money notional calls each month while maintaining a notional long position in SLV shares. The exchange traded note can potentially lower the downside risk over owning SLV shares outright with the approximately 14% distribution representing the covered call premiums. Unlike in the world of stock and bond investors, the precious metals world has a wide variety of investors, ranging from individuals and institutions who just want to have precious metals exposures, to bullion purists who believe the only “real” way to invest in precious metals is to buy bullion that you hold in your hands, in your safe. This investment… is not for them. This ETN is for someone who would currently invest in silver via an ETF like the iShares Silver Trust ETF (NYSEARCA: SLV ) or the Sprott Physical Silver Trust (NYSEARCA: PSLV ) or a silver mining stock and just wants a bit more income. What Is the Credit Suisse Silver Shares Covered Call ETN (NASDAQ: SLVO )? SLVO is an exchange traded note benchmarked to the Credit Suisse NASDAQ Silver FLOWSTM 106 Index. The index is designed to replicate a strategy where you would write short term options against shares of SLV, the silver ETF. Specifically, Credit Suisse describes the index as follows: The Index was created by Credit Suisse and is published and calculated by NASDAQ OMX. Call options with approximately 40 days to expiry are sold over a 5-day period each month within the Index. Approximately 30 days later, those same call options are repurchased over a 5-day period. The notional premium received, net of notional transaction costs, is paid out following the repurchase of the options on or about the 25th of the month. Source: Credit Suisse Below is a graphical representation of the Index. The Index and ETN were launched approximately 2 years ago, on April 16, 2013. The ETN charges a .65% annual fee. Performance Anyone who has invested in precious metals over the last 5 years, has most likely either lost money, or is sitting on paper losses. Over the last 5 years, investments in silver have lost approximately 22%. If you were unfortunate enough to buy silver at the peaks in 2011, you would have lost more than 60% of your investment value. There are a variety of reasons for the meteoric rise and fall for silver which are not the focus of this article, however I implore you to read an article I recently published dealing with this exact issue here. “Why $8 Silver is Just as Likely.” Theoretically, a covered call strategy will be able to generate more income and outperform a simple buy and hold strategy in falling and flat markets. In order to generate the incremental income, you are giving up your upside over the strike price of the call options. In more volatile markets, writing call options generally makes sense as you are able to monetize the risk you are already taking by holding the underlying investment. Where you end up losing is during rising markets and your investments are called. This is exactly what happened if you held over from inception of the fund. You can see that below. If you invested $10,000 in each, SLV and SLVO at SLVO’s inception, your SLV holding would be worth $6,212 and your SLVO holding would be worth $5,541. The underpformance would come from the few sharp rebound spikes silver went through in the fairly aggressive declines of 2013 where SLVO would pay more to buy back the calls. (click to enlarge) In a more orderly selloff as we had seen over the last year, the numbers look different, and the covered call strategy saved you some losses, particularly as you would purchase back, or let the covered calls expire worthless. If you purchased and held SLV 1 year ago, your $10,000 would be worth $7,191 today. An SLVO investment of that same $10,000 would be worth $7,306. Had you taken your distribution in cash and not reinvested it, I suspect that number would be slightly higher as your reinvestments were worth less today, at the lows of the year. (click to enlarge) So… Is this right for you? Perhaps. If you want to be invested in silver, and would not mind giving up a bit of upside in order to monetize the risk and receive income, you should consider this ETN. The strategy makes sense and the annual expense of .65% is certainly not outrageous, especially if you consider the transaction costs you would incur if you wrote covered calls on your own month in and month out, both selling to open and buying to close. The potential downside here and something that we did not discuss is the product structure. This is an ETN, an exchange traded note, and not an ETF, an exchange traded fund. Unlike an ETF, ETNs are not shares of the actual underlying funds, ETNs are credit obligations, like bonds of the underlying issuer, whose value tracks a specified index. In the event of a default, owners of the ETN would be lining up for the settlement in the liquidation of the issuer. While Credit Suisse is a sound institution, at least today, this is an additional credit risk that you should take into account. If you are not comfortable with taking on additional credit risk, you can consider other covered called strategies such as the GAMCO Global Gold, Natural Resources & Income Trust (NYSEMKT: GGN ) and the BlackRock Resources & Commodities Strategy Trust (NYSE: BCX ). For more discussion about risk faced with ETN investing, feel free to read my previous ETN articles such as RBS ETNS: When A Good Idea Alone is Not Enough . Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: None of the information discussed should be considered investment advice or a solicitation to buy or sell any securities. Please consult your investment advisor for specific recommendations.