NCZ: Is It Time To Enjoy This Fund’s 14% Distribution?

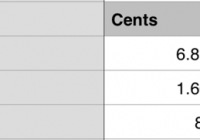

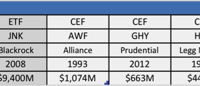

Summary NCV and NCZ offer yields over 13% and near 14% on a diversified corporate bond and convertible bond portfolio. The NAV of both funds has fallen over 6% YTD and premiums have fallen as the funds and corporate bonds have fallen out of favor. Despite these risks, both funds offer a sustainable payout thanks to previous purchases of bonds at modest discounts. Allianz Global Investors offers two funds with very high distributions and similar investment objectives: the AllianzGI Convertible & Income Fund (NYSE: NCV ) and AllianzGI Convertible & Income Fund II (NYSE: NCZ ). The funds get little attention, with average daily volume of a little over 400,000 shares and few articles on this site. The lack of attention is unfair to these funds because, despite the risks involved, they currently trade at a relatively low premium and offer monthly payouts that can buttress an income portfolio without significant risk of a dividend cut in the near term. Instead of a dividend haircut, the bigger risk in both funds is the depletion of net assets, which have fallen 6.5% year-to-date for NCZ and 6% for NCV, according to Allianz’s website (for NCZ ). These are real risks to consider before investing in either fund, although I will not discuss what has driven this trend or whether it is likely to continue in this article. Instead, I want to focus on the sustainability of these funds’ payouts over the next three years by taking a closer look at NCZ. I am choosing this fund because its higher payout (13.9%) will make it more attractive to investors at first glance, although its premium to NAV (5.2%) is higher than its sibling’s premium (NCV is at a 1.9% premium), which would also imply that it offers less value at the moment. For a rundown of the virtues of NCV, the recent article by Betalyst is valuable and illuminating. The Sustainability of the Payout As with all high yield funds, there is substantial fear that these funds’ monthly payouts are unsustainable. NCZ’s distributions to NAV ratio is 14.4%, while the fund’s 33% leverage puts the fund at risk of destructions to the fund’s value if its holdings fall too low in value or default rates spike. Nonetheless, the distribution to NAV ratio is misleading, because the fund has partly funded distributions from capital paid in excess of par. These payments are not returns of capital; they are profits from sold bonds and convertible notes that the fund has held and liquidated. These accounted for 18.9% of the fund’s total payouts in June. Excluding this, we see that the fund’s net investment income to NAV ratio is a much more modest 11.68%: (click to enlarge) With both of these income sources, the fund is earning enough to cover distributions. Thanks to the fund’s past investments, it is able to earn 11.68% on its bond holdings, while bumping returns higher with gains from selling issues above par. Since the fund’s average coupon rate is 7.52%, it is clear that the fund is buying its holdings at a discount. How much of a discount does the fund need to get in the market to sustain its payouts? This is an important question, because the larger the discount, the greater the default risk (at least in theory) and the greater the risk profile of the fund. The fund’s current NII comes out to less than what the fund would get if it purchased issues at an average 3% discount, so the fund is buying bonds at a relatively small discount. This also means the fund’s ability to earn more NII will increase substantially if it finds more issues trading at an even higher discount: With corporate yields rising, the opportunity to buy more bonds in the secondary market at a discount will only increase. As a result, NCZ will be able to make new purchases at steeper discounts and higher yields, although its high use of leverage of course limits how much it can buy. NCV is similarly using 33% leverage and may be limited in purchasing power; on this point, the PIMCO High Income Fund (NYSE: PHK ) is slightly better positioned to buy issues at discounts, thanks to its 29% leverage. Better still are the PIMCO Income Strategy Fund II (NYSE: PFN ) with 23.3% leverage and the AllianceBernstein Global High Income (NYSE: AWF ) with 14.15% leverage. Other funds from other firms may also be well positioned to buy more issues at discounts in the future. Even with its high leverage and limited buying power, both NCZ and NCV should have no difficulty maintaining income payouts with their current holdings, and the low average duration of the funds’ portfolios (2.4 years for NCZ and 2.41 for NCV) suggest that both will have freed up capital in the medium term. If the economy improves and Treasury and corporate bond yields rise throughout 2017 and beyond, the fund will be ideally positioned to buy more issues at higher rates. On this point, it is worth noting that yields on corporate bonds have already begun to rise from the year’s lows: (click to enlarge) Additionally, as of the end of Q1’15, the fund had 10.07 cents in undistributed net investment income (UNII) that it can deploy if necessary. While investors often take solace in UNII, this should not be the primary focus of an investment decision, since UNII tends to be lumpy and too much UNII can indicate an inefficient use of capital. Nonetheless, this buffer does indicate a bit of safety with the fund’s distributions in a pinch, although no pinch is expected by most in the market, regardless of sensationalist headlines about Greece, China and the NYSE blackout. Conclusion: NCV or NCZ? With the similarities of both funds, investors looking for a high monthly distributions may find it difficult to choose between the two. At the moment, NCV is trading at a premium of less than 1%, while NCZ is trading at a 5.2% premium. For those who abhor buying CEFs at a premium, NCV may be more tolerable; for those looking for a high yield in the short term, NCZ may be more appropriate. However, if you believe interest rates are going to rise in the short term and the value of these funds’ holdings will fall, both face the threat of further declines in the short term as NAV has fallen 6.5% year-to-date. If not, these funds can be an attractive addition to an income-producing portfolio on their ability to maintain payouts and see NAVs rise when redemptions come and issues at higher rates are for sale. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NCV over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.