Investment Plan For The 2015 Financial Armageddon

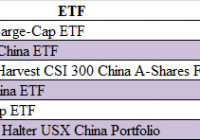

Summary From Europe to China, the world’s economies are in turmoil. Don’t buy gold, silver, or U.S. equities, or long-term U.S. bonds. Consider short-term trades with Greece/China. And remember, cash is king. The world’s economies are a mess. Below I outline a manual to guide investors through the impending 2015 financial armageddon by pointing to several problems and providing an investment plan to help survive a crash. The Problems Chinese stock markets have nosedived 30% to 40% in the past few weeks. China’s market has yet to experience such a crash and government is in full panic mode trying to slow the decline. Official GDP growth still states at 7% but real estimates are likely to be only 4% growth. Still good, but not double digits like some years prior. China’s real estate bubble may be a major contributor to this bloodbath. The Greece debacle is still unfolding. Simply put, Europe is in a lot of mess. The Euro has declined dramatically and it will be some time for it to recover. Some European nations have taken the drastic step of reducing interest rates to negative levels (meaning banks get charged by the central bank if they don’t lend). Even if a Euro-Greek deal is reached, this will only delay a final solution as Greece’s people are not determined to change their ways. Pessimists believe that a Grexit could be followed by a dismantling of the European Union as the rest of the PIGS decide also to not pay their debt. One can only hope that Germany’s economic sway will keep the continent from falling apart. U.S. stock and bond markets are still at post-recession highs. There has not been a correction in the stock market in over 7 years; the S&P (NYSEARCA: SPY ) is up 170% since the 2008 recession ended. Irrational exuberance appears to be the only supporter of the economy. I’m not sure what will make market pop, but in my view, it is not worth the risk of holding U.S. equities. As the saying goes: What goes up must come down. Geopolitical nightmares continues. With ISIS dismantling the Middle East, Russia still making advances on Ukraine, and China slowly encroaching in the Pacific, it is clear that the U.S. has lost control as being the world’s policeman. The end of Pax Americana has come. These overhanging geopolitical issues will likely continue to plague the markets with detrimental volatility. The prospective U.S. interest rate increase terrifies investors. Yellen appears to be capriciously dying to increase the interest rates. Her veiled remarks point more and more to an imminent rate increase. Economists are betting she will do so in September . This will be a poor move, as the already shaky U.S. economy will be hurt as borrowing rates increase. Yellen’s decision might trigger a recession if her decision is too drastic. One can only hope that she further delays her decision. The Investment Plan Don’t buy bonds unless you hold intend to hold them until maturity. With interest rates most likely rising, your newly purchased bond’s price will decrease. If you are compelled to buy bonds, buy short-term bonds that will be less effected by rises in interest rate. Avoid long-term holdings in U.S. equities. Market has been too hot for too long. Would wait for a market correction for buying opportunities. Opportunities shorting equities, particularly the overheated tech sector, may arise when the market does finally selloff for the risk-taking. Others may want to consider hedging the S&P 500 with the ProShares UltraShort S&P500 (NYSEARCA: SDS ). Don’t be fooled into buying gold or silver. In previous times of turmoil these precious metals have historically been seen as safe-haven investments, however both commodities continue to downtrend. The SPDR Gold Trust (NYSEARCA: GLD ), the largest gold ETF, has declined more than 37% since its peak in 2011 bubble. In addition, iShares Silver Trust (NYSEARCA: SLV ), the largest silver ETF, is down an astonishing 67% since its 2011 peak. Both metals are to be avoided. GLD data by YCharts Those with an appetite for risk should consider small, short-term bets on both Chinese and Greek stocks. Personally holding National Bank of Greece (NYSE: NBG ) which has been having a wild wide this week. Worth the risk if trade is well timed. The Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) may a “safer” bet. Buyer beware as investing in Greece is certainly not for the faint of heart. If trading, consider limit orders and stops to minimize losses. GREK data by YCharts China has had a rough couple of weeks, but in the past two days has begun to recover (though some are reporting this as a dead-cat bounce forced by the Red Army). The 30% selloff is steep for a market correction. For instance, the S&P historically typically experiences corrections of only10-20%. Should this be more than a correction, may go down more, but don’t think the paper dragon is burning yet. Recommend iShares MSCI China Index Fund (NYSEARCA: MCHI ) or iShares FTSE/Xinhua China 25 Index (NYSEARCA: FXI ), the two largest China-focused ETFs. MCHI data by YCharts Cash is king. In periods of immense market uncertainty, holding cash may be the best option. Not only has the dollar been appreciating, but its liquidity will be appreciated when markets takes a turn for the worse. When blood is in the streets, opportunities will be plentiful. Best of luck with the 2015 financial armageddon and try not to follow the herd to the slaughterhouse. Disclosure: I am/we are long NBG. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague