India Small-Cap ETFs: Best Of Emerging Markets Now?

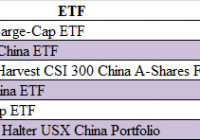

After witnessing two months of lull, the Indian stock market finally belied cynics in July as it easily combated global issues like the bursting of the Chinese stock market bubble, nagging Greek debt deal negotiations, looming Fed rate hike and the strength in the greenback. Investors also rushed to capitalize on this grit and poured Rs. 5,300 crore (net) in Indian equities last month. Reduced worries over monsoon deficiency, a timely correction in the stock market and rising domestic investment led the key Indian bourse to bounce back from late June. Earlier, investors were unnerved by apprehensions of lower rains this monsoon which would take a toll on the all-important agricultural sector and push up inflation. The fear was not baseless either as RBI cut India’s growth forecast for fiscal 2015-16 from 7.8% to 7.6%. However, contrary to this apprehension, rain deficiency has not been as severe as predicted. The Indian market surged over 30% last year. While most of the gains were wiped out this year on Fed rate hike concerns and a spate of downbeat economic indicators including weak corporate earnings and political gridlock causing hindrance in intended reforms, the correction opened the door to further expansion. This was truer given the extremely muted levels of energy and gold prices. This was because India imports more than 75% of its oil requirements and accounts for about 25% of the global gold demand. This makes the country highly susceptible to these commodities’ prices. India’s foreign-exchange reserves are close to a staggering $355 billion, which gives the economy the power to fight the expected volatility post Fed tightening, per Bloomberg . Unlike taper tantrums in 2013, Indian rupee remains largely stable and shed only 0.6% in the last one month (as of August 5, 2015) relative to the U.S. dollar. In fact, the uproar in global markets, mainly in Greece and China, brightened India’s appeal as a safer bet in the high-risk emerging market (EM) pack. The economy expanded 7.3% in 2014-15 versus 6.9% in 2013-14, indicating that the Indian economy is taking root. Of course, it has its set of issues like political gridlock, inflation woes, and a still-muted investment backdrop, but the economy appears much more stable than other emerging markets. A Look at Other Emerging Giants At this point of time, India scores higher than its other EM cousins like China, Brazil, Russia and South Africa. Chinese stocks are now infamous for extreme volatility having experienced recurrent market crashes since June. The country’s economy has also been displaying offhand economic data for long, leaving expectations for further monetary easing as the only hope in the China Investing theme. Popular Chinese equity ETF FXI was 7.8% down in the last one month. Coming to Brazil , the condition is more worrisome. As much as a 7.4% fall in the Brazilian real in the last one month (as of August 5, 2015) against the U.S. dollar, a commodity market slump, spiraling inflation and raise in rates (presently as high as 14.25% , almost double that of India’s) have crippled the Brazilian economy. Analysts have raised the 2015 inflation outlook for Brazil from 9.23% to 9.25% while its GDP is expected to shrink by 1.8% from the prior forecast of 1.76% contraction. The largest Brazilian ETF EWZ was down about 13% in the last one month. Russia is yet another emerging market which turned a bear from once-a-bull country. An unbelievably prolonged and steep fall in oil prices, Western bans and an 11.7% one-month slide in the Russian currency clearly explain the pains for this oil-rich nation. The IMF now expects the Russian economy to skid into ” deep recession ” (down 3.4%) in 2015. The most popular Russian ETF RSX lost 4.7% in the last one month. The Indonesian currency was almost resilient to dollar gains but weak corporate earnings and a spate of soft economic data weighed heavily on investors’ sentiments. Dollar gained just 1.2% in the last one month against Indonesian Rupiah. The World Bank also slashed its projection for Indonesia’s 2015 economic growth from 5.2% to 4.7%. Indonesia ETF EIDO was off 3% in the last one month. South Africa’s currency shed about 3.3% in strength in the last one month (as of August 5, 2015) and growth prospects remain bleak. This is also a commodity-rich nation and will likely the bear the brunt of the commodity market crash. South African ETF EZA retreated 2.2% in the last one month. Turkish lira also slipped 3.3% last month (as of August 5, 2015). Along with this, political upheaval and still-subdued growth in the EM pack led the Turkey ETF TUR to shed about 9% in the past 30 days. Reasons to Cheer for Indian Small Caps Since small caps better reflect an economy’s strength and are largely unruffled by global shocks, Indian small caps should be the best-positioned EM options right now. Investors are advised to take a peek into our top-ranked ETFs, India Small Cap ETF (NYSEARCA: SCIN ), India Small-Cap Index ETF (NYSEARCA: SCIF ) and iShares MSCI India Small Cap Index Fund (BATS: SMIN ). Each carries a Zacks ETF Rank #2 (Buy). SCIN, SCIF and SMIN added 9.2%, 9.7% and 6.8%, respectively, in the last one-month period while in the past one-week frame, the trio advanced 5.5%, 4.7% and 4.8% (as of August 5, 2015). Original Post