ALFA: A Market-Beating ETF About To Go Market-Neutral

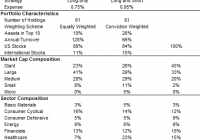

Summary ALFA allows the retail investor to “invest with the best”. ALFA has shown market-beating performances since inception, with superior upside and downside capture ratios, but also higher volatility. Barring a final-day rally, ALFA is about to go into market-neutral mode. The AlphaClone Alternative Alpha ETF (NYSEARCA: ALFA ) is an ETF that tracks the AlphaClone Hedge Fund Long/Short Index. This index contains U.S.-listed equity securities to which hedge funds and institutional investors have disclosed significant exposure. An interesting feature of the index is that it uses AlphaClone’s proprietary “Clone Score” methodology to aggregate the ideas of hedge funds for which historically it has made the most sense to follow based on their disclosures. Additionally, index constituents are equal weighted but have an overlap bias (i.e., securities held by twice the number of managers have twice the weight). In a recent article entitled ” The AlphaClone Alternative Alpha ETF May Be The Safest Equity Ticker ,” Seeking Alpha author Fred Piard elegantly summarizes the methodology of ALFA as thus: ALFA selects fund managers based on their past performances after publication of their holdings…In other words, past performances must be good, and also replicable. Investing in ALFA therefore allows the retail investor to “invest with the best” (while avoiding 2 and 20 fee structure associated with investing in hedge funds). Only holdings from top managers are chosen for inclusion in the index – holdings from mediocre managers are not considered. ALFA was incepted in May 2012, and charges an expense ratio of 0.95%. Another hedge fund-duplicating ETF is the Global X Guru Index ETF (NYSEARCA: GURU ). Performance The following chart shows the total return performance of ALFA and the U.S. market (NYSEARCA: SPY ) since inception of ALFA. ALFA Total Return Price data by YCharts We can see from the chart above that ALFA has pretty much led SPY wire-to-wire since inception. However, the higher return of ALFA has been accompanied by higher volatility. The following chart shows the 3-year annualized standard deviation (volatility), return, Sharpe and Sortino ratios for ALFA and SPY (source: Morningstar ). We can see from the above chart that ALFA has been about 30% more volatile than SPY over the past three years. This has led to ALFA’s Sharpe ratio of 1.78 being lower than SPY’s at 1.93. Interestingly, however, the Sortino ratio, which unlike Sharpe ratio only takes into account downside (and not upside) volatility, slightly favors ALFA at 4.36 vs. SPY at 4.26. This is consistent with ALFA’s impressive upside and downside capture ratios over the past 1 and 3-year periods, as shown in the chart below (source: Morningstar ). The chart above shows that over the past 3 years, ALFA has managed to return an extra 7% over the S&P 500 in positive months for the market, while decreasing 18% less than the S&P 500 in negative months for the market. Its 1-year upside and downside capture ratios are even more impressive, at 130% and 52% respectively. Obviously, SPY captures 100% of both the upside and downside of the S&P 500. Additionally, ALFA has had a 0.84 correlation with SPY since inception (source: InvestSpy ). Holdings The higher volatility of ALFA compared to SPY may be partially attributed to the fact that ALFA’s portfolio is quite concentrated, with the top 10 holdings accounting for 31.85% of assets, compared to only 173.03% for SPY. Moreover, ALFA currently holds only 73 stocks, compared to the 500 in the S&P 500. The following table shows the top 10 stocks held in ALFA and SPY. ALFA SPY Stock Ticker % Assets Stock Ticker % Assets Apple Inc. (NASDAQ: AAPL ) 7.25 Apple Inc. AAPL 3.75 Valeant Pharmaceuticals (NYSE: VRX ) 7.19 Microsoft Corporation (NASDAQ: MSFT ) 2.03 Celgene Corporation (NASDAQ: CELG ) 2.55 Exxon Mobil Corporation Common (NYSE: XOM ) 1.78 Horizon Pharma plc (NASDAQ: HZNP ) 2.53 Johnson & Johnson Common Stock (NYSE: JNJ ) 1.49 Allergan PLC (NYSE: AGN ) 2.41 Wells Fargo & Company Common St (NYSE: WFC ) 1.46 The Priceline Group Inc. (NASDAQ: PCLN ) 2.36 General Electric Company Common (NYSE: GE ) 1.41 Transdigm Group Incorporated Tr (NYSE: TDG ) 2.22 Berkshire Hathaway Inc. Class B (NYSE: BRK.B ) 1.4 Oracle Corporation Common Stock (NYSE: ORCL ) 2.05 JPMorgan Chase & Co. Common St (NYSE: JPM ) 1.37 Biogen Idec Inc. (NASDAQ: BIIB ) 1.79 Pfizer, Inc. Common Stock (NYSE: PFE ) 1.19 Skechers U.S.A., Inc. Common St (NYSE: SKX ) 1.5 AT&T Inc. (NYSE: T ) 1.15 Besides AAPL, which constitutes 7.25% and 3.75% of ALFA and SPY, respectively, the two funds do not have any top-10 holdings in common. Hedging mechanism ALFA has an interesting hedging mechanism, which when enforced shorts the S&P 500 in an amount equal to the value of the fund’s long holdings. In other words, ALFA becomes market neutral when the hedge is activated. The trigger for the activation is simple – almost too simple, at first glance – it’s when the S&P 500 falls below its 200-day simple moving average [SMA] at month’s end. Why month’s end, which seems like an arbitrary day to choose? Why not the 15th of each month, or the 19th? Surprisingly, choosing the end of each month as the trigger was more effective than the seemingly more logical “5 consecutive days below 200 SMA” rule on data from 1950 to 2014, presumably because the portfolio was hedged less in a long-term secular rising market. Which brings us to the main purpose of this post, which is to inform investors that, unless the S&P 500 gains in excess of 4.35% (from 1988.87 to 2075.41) on the last trading day of August, i.e. in one trading day’s time, ALFA’s hedging mechanism is about to be activated for the first time . Interestingly, this is not the first time that the S&P 500 has dipped below its 200 SMA since ALFA’s inception. As can be seen from the chart below, this has happened at least twice since May 2012. But now let’s take a closer look at each of those two instances. The first event took place in November 2012, around the time of the “fiscal cliff” negotiations. We can see from the above chart that the S&P 500 dipped below the 200 SMA in mid-November, but then recovered above the 200 SMA by month’s end. Hence, ALFA’s hedge was not activated. A similar phenomenon was observed in October 2014: Takeaway What does this mean for investors? If you already own ALFA, you have two basic choices (assuming that the S&P 500 does not rally 4.35% over the weekend). HOLD . You prefer to take a “passive” approach to market timing (an oxymoron, perhaps), and are comfortable with ALFA’s hedging strategy. You understand that ALFA will probably return close to flat in the month of September, plus or minus ALFA’s alpha, and then for every month after that until the S&P 500 breaks above its 200 SMA at month’s end. SELL . You have a strong conviction that the market will resume its uptrend in September and in the months beyond. You do not want to have part of your holdings invested in a market-neutral position, so you sell ALFA and replace it with SPY or another long-only instrument. You will only rotate back into ALFA when the S&P 500 breaks above its 200 SMA at month’s end. For investors who do not yet own ALFA and are considering whether or not to buy this fund, they should be aware that the ETF, if purchased in September, will be a market-neutral fund for at least that month, and then for every month after that until the S&P 500 breaks above its 200 SMA at month’s end. Disclosure: I am/we are long ALFA. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.