Inside WisdomTree’s New Dividend Growth ETF

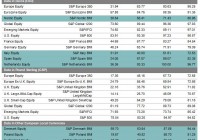

Demand for safe-haven assets peaked amid an uncertain global economic outlook and growing volatility across many asset classes. With safe-haven assets in demand, dividend has been an area to watch out for as not all income products are devoid of risks. Stocks that are hiking dividend continuously are on the other hand said to be the best bets. Meanwhile, treasury yields are also showing a downtrend. Yield on 10-year Treasury notes fell by almost 44 bps to 1.80% as of April 14, 2016. This has made investors thirstier for yields lately (read: High Dividend Sector ETFs Hitting All-Time Highs ). Meanwhile, chances of the Fed hiking rates in the near-term have also dropped significantly after the Fed Chair Janet Yellen’s dovish comments, which were further reinforced by Fed Bank of New York President William C. Dudley. Dudley said that due to uncertain outlook for the U.S. economy, a cautious and gradual approach to interest-rate increases is expected. Yield on Japan’s benchmark 10-year government bond has been hitting record lows after it slid to sub-zero for the first time in February. Bank of Japan introduced negative interest rates earlier this year following the European Central Bank (ECB) footsteps. Denmark, Sweden and Switzerland adopted similar measures. Meanwhile, in March, the ECB came up with a more intensified economic stimulus and opted for multiple rate cuts and the expansion of its quantitative easing program to boost the economy. Monthly asset purchases were raised to EUR 80 billion from 60 billion previously (read: Surprise ETF Winners & Losers Post ECB Easing ). Because of these factors, dividend ETFs have gained a lot of popularity as investors continue to search for attractive and stable yield in this ultralow rate interest environment. Probably, this is why WisdomTree recently rolled out a dividend growth ETF targeting international economies. In fact, the global footprint made the fund more attractive given the ultralow interest rate backdrop prevailing in most developed economies. Below, we have highlighted the newly launched fund – WisdomTree International Quality Dividend Growth Fund (BATS: IQDG ) . IQDG in Focus IQDG tracks the WisdomTree International Quality Dividend Growth Index, which provides exposure to dividend paying developed market companies. Index comprises 300 companies from the WisdomTree International Equity Index selected on the basis of both growth factors – long-term earnings growth expectations and quality factors – three-year historical averages for return on equity and return on assets, which are then weighted on the basis of annual cash dividends paid. The fund has a net expense ratio of 0.38%. However, the net expense ratio reflects a contractual waiver of 0.1% through July 31, 2017. As of April 13, 2016, the fund had 207 dividend-paying companies from the developed world, excluding Canada and the U.S. in its basket. The fund is well diversified with none of the stocks holding more than 4% except the top two holdings, British American Tobacco plc (NYSEMKT: BTI ) (5.3%) and Roche Holding AG ( OTCQX:RHHBY ) (4.9%). From a country perspective, U.K. takes the top spot with about 19.4% of the basket followed by Japan (14%), Switzerland (10.1%), Germany (7%) and the Netherlands (6.9%). As for a sector point of view, Consumer Staples dominates the fund with about 22.7% exposure, followed by Consumer Discretionary and Industrials with 18.7% and 16.4% allocation, respectively. Launched on April 7, the fund has already amassed $2.5 million in its asset base. The fund is up 3.5% in the last 5 days. How Could it Fit in a Portfolio? The ETF could be well suited for investors looking for higher dividend paying securities across the globe. It also offers diversification benefits. These low-risk vehicles are excellent options for investors looking to protect their portfolio in a bearish environment. With interest rates being low in most developed nations, the appeal of dividend ETFs has increased as these offer strong yields. However, investors looking for high growth may not be satisfied with this product. Additionally, changes in currency exchange rates may affect the value of the fund’s investment adversely. Competition The ETF could face competition from other dividend ETFs with a global perspective. There are quite a few international dividend ETFs which specifically target this market. Of these, the popular fund, the iShares International Select Dividend ETF (NYSEARCA: IDV ) , has a total asset base of $2.6 billion. This fund tracks the Dow Jones EPAC Select Dividend Index and trades in heavy volume of 911,000 shares per day and charges 50 bps in annual fees. Another fund targeting the international dividend market space, the SPDR S&P International Dividend ETF (NYSEARCA: DWX ) , has AUM of nearly $856.8 million and exchanges 190,000 shares a day. The fund has an expense ratio of 45 bps. Apart from these, IQDG could also face competition from the FlexShares International Quality Dividend Index ETF (NYSEARCA: IQDF ) with an asset base of $342 million and the PowerShares International Dividend Achievers Portfolio ETF (NYSEARCA: PID ) with AUM of $700.1 million. IQDG looks attractive with a lower expense ratio as compared to IDV and DWX. The fund has a chance of making a name for itself if it manages to generate returns net of fees greater than the currently available products in this ETF space. IQDG’s focus on selecting high dividend paying stocks with both quality and growth looks to be a great strategy. Link to the original post on Zacks.com Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.