Timing Is Everything

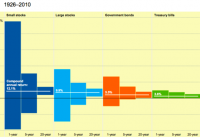

The length of time investors have to plan for is the single most powerful factor in their investment process. If time is short, investments with the highest potential return are the least desirable, because they entail the greatest risk. But given enough time, assets that appear risky become desirable. Time transforms investments from least attractive to most attractive – and vice versa. Our time horizon has a major impact on our investment strategy. This is true in the natural world as well. I’ve been to the coastal redwoods in California, and they’re awesome. John Steinbeck called them “ambassadors from another time.” In many ways, they are. They regularly reach ages of 600 years or more, and some are over 2000 years old. Their natural resistance to disease and insects allows them to grow slowly and gradually. But they have to. The high rainfall in their coastal habitat leaves the soil with few nutrients. By contrast, stumbling into a thicket of pin cherries in the Northeast woods can leave you breathless, but in a different way. The undergrowth can be so thick it’s easy to get disoriented. Pin cherry trees sprout and grow quickly, taking advantage of any disturbance in the forest canopy. But they only live 20 to 40 years, and they’re an important source of food for many types of animals. It would be foolish to say that either tree is more successful. Each has adapted to its environment. What works in one context doesn’t work in another. That’s why, for investors, the typical time period we use to calculate returns – one year – may be misleading. A single year simply doesn’t match the time available to different investors with their differing objectives and constraints. Different assets – and asset mixes – are appropriate in different circumstances. (click to enlarge) Average return and dispersion of return for various asset classes over different time periods, 1926-2010. Source: Jay Sanders, CPA So if you’re worried about the market, be sure to ask yourself how much time you have until you need the money. Because the quickest way to turn a temporary fluctuation into a permanent loss is to sell the asset. Share this article with a colleague