The Refined ETF Approach To Emerging Markets Consumers

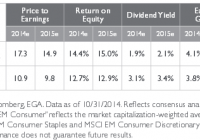

Summary More investors are diversifying with overseas exposure. Why investors should take a look at consumer sectors in emerging markets. Emerging market consumer sector ETF options. Investors have heard plenty about the rise of the emerging markets consumer in recent times, a theme easily accessed by a growing number of exchange-traded funds. Emerging markets investing, including doing so with ETFs, is changing, presenting investors with opportunities to take more tactical, thematic approaches to tap into the rise of developing world consumers. With many traditional emerging markets ETFs either too concentrated in the BRIC nations, excessively exposed to state-run enterprises or both, investors should rethink how they access emerging markets consumer trends. That includes making bets on some of the least developed developing markets. “Investors should focus on buying EM consumer companies in the least developed economies, as well as those EM companies geared towards domestic demand, rather than external demand through exports. Investors should look for stocks in the discretionary sector in countries where the consumption of staples has been satisfied, but consumption of durable goods has not,” according to Emerging Global Advisors , the company behind the EGShares family of ETFs. EGShares’ ETFs include consumer-focused offerings such as the EGShares India Consumer ETF (NYSEArca: INCO ) , the EGShares Emerging Markets Consumer ETF (NYSEArca: ECON ) and the EGShares Emerging Markets Domestic Demand ETF (NYSEArca: EMDD ). ECON, which carries a four-star rating from Morningstar, is up 15.4% over the past three years, enough to easily outpace the Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO ) and the iShares MSCI Emerging Markets ETF (NYSEArca: EEM ) . The allure of ECON, one of the original dedicated emerging markets consumer ETFs, comes from its large combined weight to reform minded countries. For example, China, Mexico and India combine for over 41% of the ETF’s weight. “The new Indian government, led by Prime Minister Narendra Modi, intends to privatize state assets, increase foreign direct investment and reduce the fiscal deficit by cutting subsidies. There are also plans to deregulate the labor market and upgrade infrastructure. These improvements should unleash investment, increase efficiency, raise productivity and boost growth,” said EGShares in a whitepaper . If Modi delivers on the expected reforms, that could power INCO even higher. Often overlooked compared to other India ETFs , INCO also carries a Morningstar four-star rating. More important than that accolade is INCO’s performance. For much of the past year, India ETFs have been BRIC leaders, but INCO has shined especially bright with a gain of almost 77%. EMDD tracks the S&P Emerging Markets Domestic Demand Index, and draws from a country universe of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Thailand, and Turkey. Though not a pure consumer ETF, EMDD does allocate a combined 56.6% of its weight to staples and discretionary sectors. The weight to those sectors is important because consumer sectors have been key contributors to emerging markets earnings growth in recent years. “Emerging market consumer sectors have delivered higher earnings growth in four of the last seven years when compared to the broader emerging market equity index. Although earnings have disappointed over the last two years, we believe this should be a temporary relapse since consensus earnings are forecast to rebound in 2014 and 2015. Based on these estimates, EGA calculates that the EM consumer sectors would deliver earnings growth of 4.1% in 2014 and 16.2% in 2015, respectively, surpassing the rates of growth offered by the overall emerging markets index (3.8% in 2014 and 9.0% in 2015),” according to EGShares. South Africa, China and Mexico combine for over 55% of EMDD’s country weight. The ETF’s index has an impressive dividend yield of almost 3.4%. EM Consumer Fundamentals Table Courtesy: Emerging Global Advisors Tom Lydon’s clients own shares of EEM.