Tag Archives: graphics

Time To Bet Against Japan?

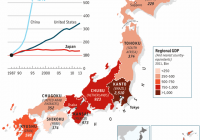

Summary Japan is struggling with economic decline, debt, and demographics. Abenomics has yet to show promised and needed progress. We see opportunity investing in a rising Dollar against a falling Yen. Global Context The world is presently full of economic and financial concern. Central banks in nations around the globe are trying to work their magic in order to increase economic growth and financial returns. A primary method of choice is currency devaluation. This simply means that countries are creating more currency with the goal of watering down its value. When this happens, it is easier to stimulate the economy and to sell and export goods and services to other countries. Why is that? Because your goods and services in your weakening currency are now cheaper for outsiders to buy in their stronger currency. The problem is that other countries also want to sell and export their goods. This is how we end up in what is known as a “currency war.” This means countries are fighting to have the weakest currency to boost exports and economic growth. We have seen this actively done in the U.S., Japan, China, and now Europe. Those also happen to be the four major economies in the world. In spite of the efforts of the U.S. Federal Reserve, the U.S. Dollar has been gaining strength since July 2014; gaining around 17% in that time frame. In contrast, since the beginning of 2013, the Japanese Yen has lost nearly 50% of its value compared to the U.S. Dollar. Since May of 2014, the Euro has lost around 18% of its value compared to the U.S. Dollar. Japan’s Three Struggles All of this information begs the question, is there still an opportunity to make money on these trends? We have been watching the falling value of the Euro and the Yen for a few months now. As we have waited, it appears we missed a pretty great opportunity to buy put options on the Euro via the CurrencyShares Euro Trust (NYSEARCA: FXE ). Unfortunately, that is the reality of investing sometimes. While there is still the potential for further downside in the Euro, the trade carries more uncertainty than when FXE was sitting around $125 as opposed to around $115 now. Unless someone expects the Euro to collapse or fail, shorting FXE has less certainty from here. What about the Yen and a short position on the CurrencyShares Japanese Yen Trust (NYSEARCA: FXY )? Japan currently faces three major problems: economic growth, debt, and demographics. Economic Growth (click to enlarge) As you can see from the chart, Japan has experienced either flat or negative economic growth over the last 25 years. Even so, it is still the third largest economy in the world behind the U.S. and China. After these “lost decades,” in hopes of reviving the economy, the Japanese people elected Shinzo Abe. Abe campaigned on the premise that he would enact a bold three-part plan of stimulus spending, monetary easing, and structural reforms that would turn things around. Together these are known as the “three arrows” of “Abenomics.” Debt So far, Abenomics has done much to boost the Japanese stock market, but little to boost the overall economy. In the process, Japanese debt has soared to nearly 250% of GDP, the highest debt to GDP ratio in the world. (click to enlarge) As spending and debt grow, the theory has been that taxes would also increase to help balance the equation. One tax increase has gone into effect, but future increases have been postponed because of economic weakness. To further complicate the issue, Japan is facing a losing battle of demographics. Demographics (click to enlarge) The population of Japan is shrinking, rather quickly. The current population of 127 million is expected to fall to 100 million by 2050. This means less people to work to provide economic growth and to pay taxes, and more elderly people dependent on government healthcare. In summary, Japan has a shrinking economy, shrinking population, and ballooning debt. That all sounds pretty bleak, but none of this is entirely new information. People have written of gloom for Japan for years, expecting decline and even collapse as the Japanese economy has marched on free of catastrophe. Japanese Desperation So, what makes this time potentially different? Two primary factors: By electing Abe the Japanese people have shown they are ready for change, even if it means drastic measures. Japan is no longer alone. Europe, China, and the U.S. are also fighting something between economic stagnation (U.S., China) and outright decline (Euro). Re-Election of Abe By electing and re-electing Abe, the Japanese people appear ready to do whatever is necessary to revive their economy. So far, their efforts have lead to a 50% decrease in the value of the Yen compared to the U.S. Dollar and there has been little to show for it on the economic front. Abe and Bank of Japan governor, Haruhiko Kuroda have made the eradication of deflation their chief gauge of success. They have concluded that inflation of 2% is what is needed to jump start Japan out of deflation. What is one of the prime means of fighting deflation? Boosting inflation. Creating more currency and thereby devaluing the Yen is among the preferred methods for creating inflation. Currency War To add even more challenge to Japan’s situation, they are now competing with other major economies to devalue their currencies in an attempt to stimulate growth and exports. This presents a scenario of competing desperation, commonly referred to as a currency war. So far, Abe has been true to his word with the first two arrows of Abenomics, but the third arrow of structural reform seems to still be in question. Corporate tax cuts are the latest announced move to help bring about the structural reform promised in the third arrow. Shooting Blanks not Arrows None of these measures can compensate for the major demographic problem that Japan is facing. How can an economy continue to grow when the population is shrinking? How can a shrinking population manage a ballooning debt that is already the largest in the world? Japan is in a desperate place, and the Japanese people have finally acknowledged it through their election and re-election of Abe. The primary methods of developed economies to stimulate growth have been stimulus spending and monetary easing. It seems to be a reasonable conclusion that a desperate Abe, with the backing of the Bank of Japan and the Japanese people, will only add more fuel to the fire in order to heat up their frozen economy. This means that the value of the Yen is very likely to continue to fall, particularly in relation to the strengthening U.S. Dollar. In addition, there is the possibility of an outright monetary or financial collapse in Japan. For the sake of the Japanese people, we hope it doesn’t come to that. As investors, it would be wise to consider and prepare for the possibility. Potential Opportunity How can investors respond to a declining Yen and a strengthening U.S. Dollar? We have chosen to invest simultaneously in the strengthening U.S. Dollar and a weakening Yen by buying put options on the CurrencyShares Japanese Yen Trust. One writer has put a target of around $70 on FXY by year-end; roughly a 15% drop from when I began writing this article. That level of decline could offer a nice gain and the potential of a significant one if the Yen experiences a major loss of confidence. Conversely, the likelihood of the Yen gaining much on the U.S. Dollar seems pretty low. That makes for a relatively low risk investment that offers a potentially high reward. Let us know if we have missed anything or if you have any questions. Note: All charts are from The Economist, 12/15/14, ” Japan in Graphics: Falling Blossom “. Disclaimer : This article is for information purposes only. There are risks involved with investing including loss of principal. All readers must be responsible for and make their own investing decisions. Each reader bears the full responsibility for any decision to buy, sell, or hold any securities, precious metals, real estate, or other asset class as well as any decision regarding the starting or running of a business. Nothing in this newsletter is to be considered investment advice, a formal recommendation, or solicitation to buy or sell any security. Investor in the Family LLC makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made. There is no guarantee that the goals of the strategies discussed by Investor in the Family LLC will be met. Investor in the Family LLC may receive payment for promoting some products found in this article. Even so, Investor in the Family LLC aims to promote products that it has tested and believes will add value to readers. Please see full Disclaimer . Disclosure: The author is long JAN 16 FXY PUTS. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.

Blocky Roads – Dogbyte Games Kft.

Blocky Roads Dogbyte Games Kft. Genre: Games Price: $1.99 Release Date: November 6, 2013 Jump into your car and discover green hills, snowy mountains and desert dunes in this unique blocky adventure! The hurricane ripped your farm apart and scattered it around the Globe. Collect the missing parts to restore the farm to its former glory! Choose one of the 9 cars or build your own block by block! Main Features: – 12 tracks to conquer – 4 challenge tracks to test your skills – 9 awesome vehicles – Customizable character – Car Editor! Build and Paint Your own car block by block! (Unlocks after track 3 is finished) – Beautiful Voxel Graphics – GameCenter achievements and leaderboards © © Dogbyte Games Kft.