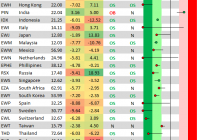

Summary From a population of 35 actively traded, substantial, and growing Energy ETFs, this is a currently attractive addition to a portfolio where investing selections are made by risk-to-reward tradeoffs. We evaluate future near-term price gain prospects for quality, market-seasoned ETFs daily, based on the expectations of market-makers [MMs], drawing on their insights from client order flows. The analysis of our subject ETF’s price prospects is reinforced by parallel MM forecasts for each of the fund’s ten largest holdings. Qualitative appraisals of the forecasts are derived from how well the MMs have foreseen subsequent price behaviors following prior forecasts similar to today’s. The size of prospective gains, the odds of winning transactions, worst-case price drawdowns, and marketability measures are all taken into account. Today’s most attractive energy ETF… … is the Vanguard Energy ETF (NYSEARCA: VDE ) “The investment seeks to track the performance of a benchmark index. The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index (IMI)/Energy 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the energy sector, as classified under the Global Industry Classification Standard (GICS). It attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. The fund is non-diversified.” (source: Yahoo Finance) The fund currently holds assets of $5.03 billion and has had a YTD price return of -0.51%. Its average daily trading volume of 301,960 produces a complete asset turnover calculation in 158 days at its current price of $105.71. Low liquidity is its principal limitation. Behavioral analysis of market-maker hedging actions undertaken while providing market liquidity for volume block trades in the ETF by interested major investment funds has produced the recent past (6-month) daily history of implied price range forecasts as pictured in Figure 1. Figure 1 (used with permission) The vertical lines of Figure 1 are a visual history of forward-looking expectations of coming prices for the subject ETF. They are NOT a backward-in-time look at actual daily price ranges, but the heavy dot in each range is the ending market quote of the day the forecast was made. What is important in the picture is the balance of upside prospects in comparison to downside concerns. That ratio is expressed in the Range Index [RI], whose number tells what percentage of the whole range lies below the then current price. Today’s Range Index is used to evaluate how well prior forecasts of similar RIs for this ETF have worked out. The size of that historical sample is given near the right-hand end of the data line below the picture. The current RI’s size in relation to all available RIs of the past 5 years is indicated in the small blue thumbnail distribution at the bottom of Figure 1. The first items in the data line are current information: the current high and low of the forecast range, and the percent change from the market quote to the top of the range, as a sell target. The Range Index is of the current forecast. Other items of data are all derived from the history of prior forecasts. They stem from applying a T ime- E fficient R isk M anagement D iscipline to hypothetical holdings initiated by the MM forecasts. That discipline requires a next-day closing price cost position be held no longer than 63 market days (3 months), unless first encountered by a market close equal to or above the sell target. The net payoffs are the cumulative average simple percent gains of all such forecast positions, including losses. Days held are average market rather than calendar days held in the sample positions. Drawdown exposure indicates the typical worst-case price experience during those holding periods. Win odds tells what percentage proportion of the sample recovered from the drawdowns to produce a gain. The cred(ibility) ratio compares the sell target prospect with the historical net payoff experiences. Figure 2 provides a longer-time perspective by drawing a once-a-week look from the Figure 1 source forecasts, back over two years. Figure 2 (used with permission) What does this ETF hold, to cause such price expectations? Figure 3 is a table of securities held by the subject ETF, indicating its concentration in the top ten largest holdings and their percentage of the ETF’s total value. Figure 3 (click to enlarge) (Source: Yahoo Finance) Figure 4 is a table of data lines, similar to that contained in Figure 1, for each of the top ten holdings of VDE. Figure 4 (click to enlarge) There is a shocking discontinuity, among knowledgeable investment appraisers, between the prospects of VDE and the prospects of the VDE fund’s holdings. MMs are making bets with firm capital that say the beliefs of the MM community are that VDE has no price downside from its present market quote and has an upside price change prospect of +7%. When prior forecasts for VDE like this have been made before, all (seven) of them were profitable, producing average gains of +8.1%. Further, the worst price drawdowns experienced in the average 24 market-day holding periods involved was only a bit worse than -½%. Seven prior experiences is a smallish sample, but because the price range forecast being implied by the hedging markets is quite extreme, a small sample is to be expected. And the sample of seven is much more than only one or two, which reason says to ignore. The forecast says that it is time for VDE’s price to soon turn around and start rising. Not to giant absolute amounts, but if prior history were duplicated +8%, even +7% achieved in 24 market days (about 5 weeks), when compounded 10+ times in a year, easily produces an annual rate of 100% or more. The forecast is not that VDE will repeat the gain ten times, but experience has shown that many other securities are frequently present with similar opportunities, or even better ones, throughout the course of a year. OK, so VDE may be an attractive bet, as it is being knowledgeably perceived. What in its fund holdings is supporting that notion? Nothing, among the history of forecasts for 60%+ of its holdings, the ten largest, listed in Figure 4. Well, to be fair, those ten stocks have average upside forecasts seen possible averaging +10%, so maybe. But in an average of more than 100 experiences for each of the ten stocks, (that’s over a thousand times altogether) from prior forecasts like today’s, the best they could do as a group was a – ½% loss. That’s not how credibility is built. And in the process, the ten averaged worst-case losses of about -10%. Losses which they recovered from less than half the time to achieve any profit, a 48% win rate. Ouch! Conclusion Our logic must be missing something. The hedging markets say that VDE could indeed go up in price by 7%, and any outfit short the ETF is justified in protecting against such a price move. But there is practically no credible history in the last five years of forecasts for the ten biggest VDE holdings to encourage confidence in their going up +10%, or even +7%. One solution to the perplexity is that what may be about to happen is not to be found in history. Many strange things happen in market movements. Quite possibly, the buying enthusiasm for VDE comes from a different investor group than the ones typically trafficking in the VDE’s ten big holdings. Perhaps individual investors, rather than institutional investors. After all, this is a Vanguard fund. Individuals may sense a turn in crude prices, a rise that would be welcomed by big-money managers, but has not yet provided the big guns with satisfactory conviction. Could the investing public be ahead of the big smart money? Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.