Scalper1 News

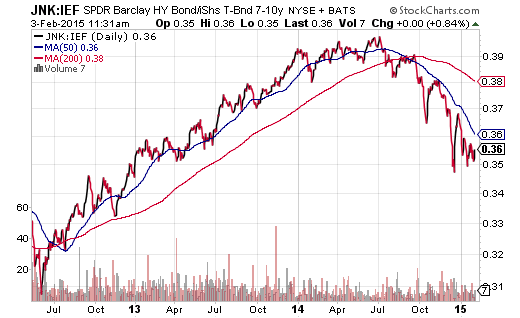

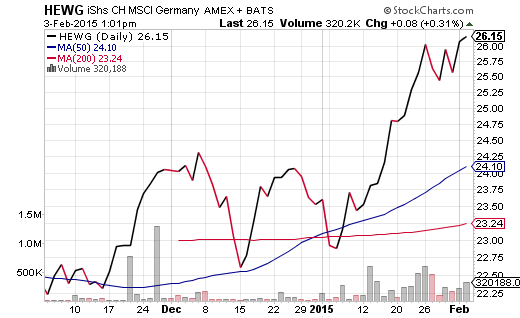

There is little doubt that the appeal of traditional safer havens is on the rise. What may be worthy of debate is whether or not stock assets will find their footing. Whether it is risk aversion, relative value or limited supply, the only thing that will dampen my enthusiasm for treasuries would be remarkable evidence of a worldwide turnaround in growth. The case for investing in riskier assets has often been described as a sensible quest for yield and/or capital appreciation in a world with ultra-low interest rates. That helps to explain why the S&P 500 has defied the odds with respect to corrective activity, garnering double-digit percentage gains in 2012, 2013 and 2014. Yet the preference for risk averse treasuries over higher-yielding debt since July of last year puts a dent in the notion that speculation is still in vogue; rather, investors have been balking at funds like the SPDR Barclays Capital High Yield Bond ETF (NYSEARCA: JNK ) in favor of safer bond funds with similar average maturity data such as the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ). Note the indisputable shift towards safety that the JNK:IEF price ratio depicts. Of course, there are other ways to interpret widening credit spreads between high yield and U.S. sovereign debt. Struggling oil companies may represent as much as 20 percentage points of junk bond proxies. And, since one cannot sell a fraction of an ETF, investors may feel forced to liquidate baskets in their entirety. There’s some truth in that. What’s more, there is truth in the notion that the popularity of longer-maturity Treasury ETFs – IEF, the iShares 10-20 Year Treasury Bond ETF (NYSEARCA: TLH ), the Vanguard Extended Duration Treasury ETF (NYSEARCA: EDV ), the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA: ZROZ ) – is a function of relative value ; indeed, foreign money may prefer 1.7% from a 10-year U.S. treasury to a 10-year German bund yielding 0.3%. On the other hand, this downplays the notion that risk aversion has been gaining momentum. For instance, nearly every component of the FTSE Custom Multi-Asset Stock Hedge Index has gained ground since the Federal Reserve ended its QE3 program at the tail end of October, while U.S. stock assets have been relatively flat amid increasing intra-day volatility. What’s more, ETFScreen.com shows the relative strength factor (Rsf) for all ETFs as they change each week across a three-month span. This helps investors get a feel for potential momentum changes in the ETF universe. Risk Aversion Gains Momentum And Risk Taking Loses It Risk (U.S. Stocks and High Yield Bond) 5-Nov 3-Feb SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) 83.5 73.0 iShares Russell 2000 ETF (NYSEARCA: IWM ) 65.5 62.3 JNK 46.7 41.9 Multi-Asset Stock Hedge Components PowerShares DB USD Bull ETF (NYSEARCA: UUP ) 72.1 88.6 iShares 10-20 Year Treasury Bond ETF ( TLH ) 60.6 82.9 SPDR Gold Trust ETF (NYSEARCA: GLD ) 10.8 47.7 In sum, there is little doubt that the appeal of traditional safer havens is on the rise. What may be worthy of debate is whether or not stock assets will find their footing. For what it is worth, I have not given up on them. I continue to favor those ETF assets that should benefit from deflationary global pressures, worldwide stimulus measures and a belief that the Federal Reserve will ultimately push off a token rate hike into Q4 of 2015. Germany should benefit more for the European Central Bank’s QE than the rest of its euro-zone partners. It should also benefit more than the other members from the euro-dollar’s depreciation, as it is the largest exporter to countries outside of Europe. I am favoring the iShares Currency Hedged MSCI Germany ETF (NYSEARCA: HEWG ). The gains have been substantial over a three-month period where mainstay U.S. benchmarks have floundered. By the same token, as I have done for nearly fourteen months, I continue to add to long-duration treasury funds like TLH and EDV, particularly on pullbacks to the 50-day moving average. Whether it is risk aversion, relative value or limited supply, the only thing that will dampen my enthusiasm for treasuries would be remarkable evidence of a worldwide turnaround in growth. For now, however, global growth appears more likely to weaken further. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

There is little doubt that the appeal of traditional safer havens is on the rise. What may be worthy of debate is whether or not stock assets will find their footing. Whether it is risk aversion, relative value or limited supply, the only thing that will dampen my enthusiasm for treasuries would be remarkable evidence of a worldwide turnaround in growth. The case for investing in riskier assets has often been described as a sensible quest for yield and/or capital appreciation in a world with ultra-low interest rates. That helps to explain why the S&P 500 has defied the odds with respect to corrective activity, garnering double-digit percentage gains in 2012, 2013 and 2014. Yet the preference for risk averse treasuries over higher-yielding debt since July of last year puts a dent in the notion that speculation is still in vogue; rather, investors have been balking at funds like the SPDR Barclays Capital High Yield Bond ETF (NYSEARCA: JNK ) in favor of safer bond funds with similar average maturity data such as the iShares 7-10 Year Treasury Bond ETF (NYSEARCA: IEF ). Note the indisputable shift towards safety that the JNK:IEF price ratio depicts. Of course, there are other ways to interpret widening credit spreads between high yield and U.S. sovereign debt. Struggling oil companies may represent as much as 20 percentage points of junk bond proxies. And, since one cannot sell a fraction of an ETF, investors may feel forced to liquidate baskets in their entirety. There’s some truth in that. What’s more, there is truth in the notion that the popularity of longer-maturity Treasury ETFs – IEF, the iShares 10-20 Year Treasury Bond ETF (NYSEARCA: TLH ), the Vanguard Extended Duration Treasury ETF (NYSEARCA: EDV ), the PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF (NYSEARCA: ZROZ ) – is a function of relative value ; indeed, foreign money may prefer 1.7% from a 10-year U.S. treasury to a 10-year German bund yielding 0.3%. On the other hand, this downplays the notion that risk aversion has been gaining momentum. For instance, nearly every component of the FTSE Custom Multi-Asset Stock Hedge Index has gained ground since the Federal Reserve ended its QE3 program at the tail end of October, while U.S. stock assets have been relatively flat amid increasing intra-day volatility. What’s more, ETFScreen.com shows the relative strength factor (Rsf) for all ETFs as they change each week across a three-month span. This helps investors get a feel for potential momentum changes in the ETF universe. Risk Aversion Gains Momentum And Risk Taking Loses It Risk (U.S. Stocks and High Yield Bond) 5-Nov 3-Feb SPDR S&P 500 Trust ETF (NYSEARCA: SPY ) 83.5 73.0 iShares Russell 2000 ETF (NYSEARCA: IWM ) 65.5 62.3 JNK 46.7 41.9 Multi-Asset Stock Hedge Components PowerShares DB USD Bull ETF (NYSEARCA: UUP ) 72.1 88.6 iShares 10-20 Year Treasury Bond ETF ( TLH ) 60.6 82.9 SPDR Gold Trust ETF (NYSEARCA: GLD ) 10.8 47.7 In sum, there is little doubt that the appeal of traditional safer havens is on the rise. What may be worthy of debate is whether or not stock assets will find their footing. For what it is worth, I have not given up on them. I continue to favor those ETF assets that should benefit from deflationary global pressures, worldwide stimulus measures and a belief that the Federal Reserve will ultimately push off a token rate hike into Q4 of 2015. Germany should benefit more for the European Central Bank’s QE than the rest of its euro-zone partners. It should also benefit more than the other members from the euro-dollar’s depreciation, as it is the largest exporter to countries outside of Europe. I am favoring the iShares Currency Hedged MSCI Germany ETF (NYSEARCA: HEWG ). The gains have been substantial over a three-month period where mainstay U.S. benchmarks have floundered. By the same token, as I have done for nearly fourteen months, I continue to add to long-duration treasury funds like TLH and EDV, particularly on pullbacks to the 50-day moving average. Whether it is risk aversion, relative value or limited supply, the only thing that will dampen my enthusiasm for treasuries would be remarkable evidence of a worldwide turnaround in growth. For now, however, global growth appears more likely to weaken further. Click here for Gary’s latest podcast. Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships. Scalper1 News

Scalper1 News