Scalper1 News

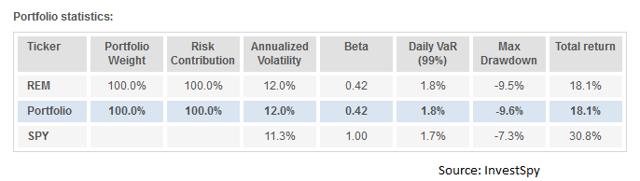

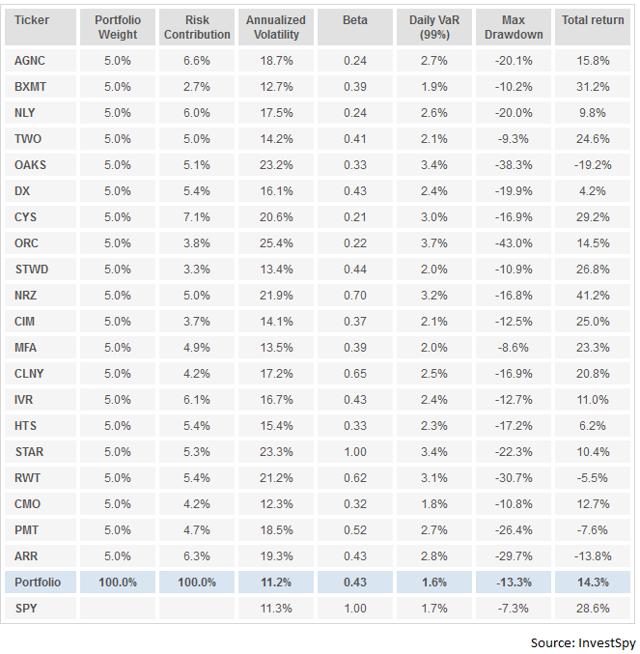

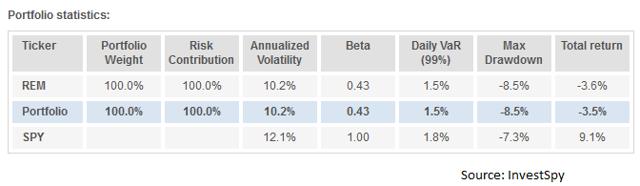

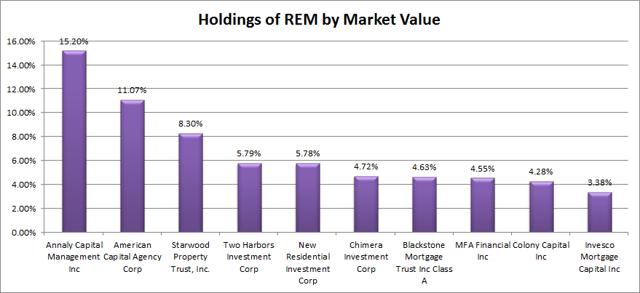

Summary REM holds up better than I would have expected. Market capitalization weighting is easy, but may be less than ideal for reducing risk. REM is compared over a two-year period and a one-year period against hypothetical mREIT portfolios built at equal weights. When I was taking a look at the iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ), one of my thoughts was that the portfolio would be more attractive with a different weighting scheme. My views on that have changed some since Annaly Capital Management (NYSE: NLY ) reported an excellent second quarter and its new strategy sounds much better . However, I still wondered from a risk-adjusted viewpoint how different an ETF might look if it held the same holdings, but applied an equal weight methodology rather than using market cap weights. The Benefits of Market Capitalization Weighting The biggest advantage to using market capitalization is that it is remarkably easy. The fund establishes the volume of assets and the total market cap of each company. They spend on the shares accordingly, and if they were not trying to grow assets in the ETF (to generate more fees), they would simply leave that same structure in place. The only modifications to be made would be to adjust for the new shares issued and old shares repurchased. In general, this is a very simple kind of ETF to run. The Problem When using market cap weighting, if a company becomes relatively overvalued, it is also likely to have a higher weight in the portfolio. Unless the overvalued status is coinciding with repurchasing shares to shrink the market cap, the weighting will grow. That is unfortunate. It also means a portfolio may have substantially less diversification if some holdings grow large enough to dominate a large chunk of the portfolio. Equal Weighting My theory was that even though smaller companies will on average be more volatile (as demonstrated in the charts I will provide), the benefit of better diversification could cancel out those effects. Equal weighting is rarely going to be the ideal method, but it provides a simple alternative to market capitalization. Findings I originally built a spreadsheet to run an analysis of correlations and simulate different portfolios, but I find the tools at InvestSpy.com were faster than running it through my spreadsheets. Therefore, I simulated the portfolios using its website. REM has a total of 39 holdings, but I ran my first comparison using only 20 mREITs. The names included several of the largest from the REM portfolio and some that I cover that are not given material weights in the portfolio. The analysis was based on comparing the last 2 years of returns. REM 2 Years (click to enlarge) The primary factor that I’m looking at here is that the annualized volatility of the portfolio is 12% and the beta is .42. I’m focused on testing for risk rather than testing for historical returns since using historical returns would create an enormous bias into the test, as I could simply avoid selecting mREITs that have cratered when designing my comparable 20 mREIT portfolio. Equal Weighted 20 The next table is going to be dramatically larger because it is showing the numbers for each individual mREIT. (click to enlarge) This portfolio made of 20 mREITs with equal weights shows a lower annualized volatility at 11.2%; however, it also shows a beta that is slightly higher at .43. I would say that given the sample size (only 2 years), the beta comparison is within the margin of error. Some other factors jump out when we look at this as well. The stock that generated the highest risk contribution was CYS Investments (NYSE: CYS ). It was not the highest volatility, it was not the highest beta, and yet it contributed the most to the portfolio. It also had one of the best return percentages. On the other hand, Blackstone Mortgage Trust (NYSE: BXMT ) delivered in every way. The risk contribution was low and the annualized volatility was the lowest within the group. Despite that, it had a total return of 31.2%, which should remind readers that not all risk and return tradeoffs are created equally. Both the highest-risk contributor and the lowest-risk contributor were near the top of the chart in their total return over the last 2 years. One-Year Comparisons The following chart has REM’s performance over the last year: (click to enlarge) For comparison, this time I wanted to replicate a larger portfolio, so I am only excluding one security from the portfolio. That security has a very short history and thus is not viable for the statistics. It should be noted that I have cropped the following image to make it substantially shorter since the site struggles with displaying longer charts. (click to enlarge) In this second comparison, there are about 37 mREITs all under equal weighting, but the annualized volatility for the portfolio is within a margin of error. In the context of a year, .1% is not reliable. Interesting Notes When I shifted to using 37 mREITs for the one-year measure, I was expecting it to result in a larger reduction in volatility, but it did not. It would seem the volatility of those smaller mREITs was enough to outweigh the benefits of more diversification. Investing in ETFs is generally relying on diversification within moderately efficient markets to be worth the costs. For the mREIT investor that has the best information, I don’t think the diversification is adding any advantages. However, for the mREIT investor who just wants to set it and forget it, the REM portfolio has done remarkably well. Comparison of Holdings The following chart shows the top 10 holdings of REM: (click to enlarge) As you can see Annaly Capital Management and American Capital Agency Corp. (NASDAQ: AGNC ) dominate the portfolio and combine to be over 26% of the portfolio value. Conclusion The way REM designs the portfolio is not perfect in my opinion; however, it is still done well enough to offer investors some fairly substantial reduction in risk. The expense ratio is high for my tastes at .48%, but at least investors are receiving a fairly substantial reduction in volatility, and when compared to other weighting methods, such as going equal weight, REM has done fairly well. If you are curious about the risk factors for REM, you’ll want to see my last piece on the ETF . Next time I cover REM I’m going to establish comparisons to the portfolio I would create if I were aiming to produce an ETF full of mREITs. Scroll up to the top of the article and hit the follow button so you don’t miss it. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary REM holds up better than I would have expected. Market capitalization weighting is easy, but may be less than ideal for reducing risk. REM is compared over a two-year period and a one-year period against hypothetical mREIT portfolios built at equal weights. When I was taking a look at the iShares Mortgage Real Estate Capped ETF (NYSEARCA: REM ), one of my thoughts was that the portfolio would be more attractive with a different weighting scheme. My views on that have changed some since Annaly Capital Management (NYSE: NLY ) reported an excellent second quarter and its new strategy sounds much better . However, I still wondered from a risk-adjusted viewpoint how different an ETF might look if it held the same holdings, but applied an equal weight methodology rather than using market cap weights. The Benefits of Market Capitalization Weighting The biggest advantage to using market capitalization is that it is remarkably easy. The fund establishes the volume of assets and the total market cap of each company. They spend on the shares accordingly, and if they were not trying to grow assets in the ETF (to generate more fees), they would simply leave that same structure in place. The only modifications to be made would be to adjust for the new shares issued and old shares repurchased. In general, this is a very simple kind of ETF to run. The Problem When using market cap weighting, if a company becomes relatively overvalued, it is also likely to have a higher weight in the portfolio. Unless the overvalued status is coinciding with repurchasing shares to shrink the market cap, the weighting will grow. That is unfortunate. It also means a portfolio may have substantially less diversification if some holdings grow large enough to dominate a large chunk of the portfolio. Equal Weighting My theory was that even though smaller companies will on average be more volatile (as demonstrated in the charts I will provide), the benefit of better diversification could cancel out those effects. Equal weighting is rarely going to be the ideal method, but it provides a simple alternative to market capitalization. Findings I originally built a spreadsheet to run an analysis of correlations and simulate different portfolios, but I find the tools at InvestSpy.com were faster than running it through my spreadsheets. Therefore, I simulated the portfolios using its website. REM has a total of 39 holdings, but I ran my first comparison using only 20 mREITs. The names included several of the largest from the REM portfolio and some that I cover that are not given material weights in the portfolio. The analysis was based on comparing the last 2 years of returns. REM 2 Years (click to enlarge) The primary factor that I’m looking at here is that the annualized volatility of the portfolio is 12% and the beta is .42. I’m focused on testing for risk rather than testing for historical returns since using historical returns would create an enormous bias into the test, as I could simply avoid selecting mREITs that have cratered when designing my comparable 20 mREIT portfolio. Equal Weighted 20 The next table is going to be dramatically larger because it is showing the numbers for each individual mREIT. (click to enlarge) This portfolio made of 20 mREITs with equal weights shows a lower annualized volatility at 11.2%; however, it also shows a beta that is slightly higher at .43. I would say that given the sample size (only 2 years), the beta comparison is within the margin of error. Some other factors jump out when we look at this as well. The stock that generated the highest risk contribution was CYS Investments (NYSE: CYS ). It was not the highest volatility, it was not the highest beta, and yet it contributed the most to the portfolio. It also had one of the best return percentages. On the other hand, Blackstone Mortgage Trust (NYSE: BXMT ) delivered in every way. The risk contribution was low and the annualized volatility was the lowest within the group. Despite that, it had a total return of 31.2%, which should remind readers that not all risk and return tradeoffs are created equally. Both the highest-risk contributor and the lowest-risk contributor were near the top of the chart in their total return over the last 2 years. One-Year Comparisons The following chart has REM’s performance over the last year: (click to enlarge) For comparison, this time I wanted to replicate a larger portfolio, so I am only excluding one security from the portfolio. That security has a very short history and thus is not viable for the statistics. It should be noted that I have cropped the following image to make it substantially shorter since the site struggles with displaying longer charts. (click to enlarge) In this second comparison, there are about 37 mREITs all under equal weighting, but the annualized volatility for the portfolio is within a margin of error. In the context of a year, .1% is not reliable. Interesting Notes When I shifted to using 37 mREITs for the one-year measure, I was expecting it to result in a larger reduction in volatility, but it did not. It would seem the volatility of those smaller mREITs was enough to outweigh the benefits of more diversification. Investing in ETFs is generally relying on diversification within moderately efficient markets to be worth the costs. For the mREIT investor that has the best information, I don’t think the diversification is adding any advantages. However, for the mREIT investor who just wants to set it and forget it, the REM portfolio has done remarkably well. Comparison of Holdings The following chart shows the top 10 holdings of REM: (click to enlarge) As you can see Annaly Capital Management and American Capital Agency Corp. (NASDAQ: AGNC ) dominate the portfolio and combine to be over 26% of the portfolio value. Conclusion The way REM designs the portfolio is not perfect in my opinion; however, it is still done well enough to offer investors some fairly substantial reduction in risk. The expense ratio is high for my tastes at .48%, but at least investors are receiving a fairly substantial reduction in volatility, and when compared to other weighting methods, such as going equal weight, REM has done fairly well. If you are curious about the risk factors for REM, you’ll want to see my last piece on the ETF . Next time I cover REM I’m going to establish comparisons to the portfolio I would create if I were aiming to produce an ETF full of mREITs. Scroll up to the top of the article and hit the follow button so you don’t miss it. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News