Scalper1 News

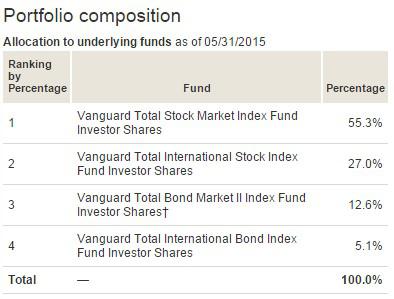

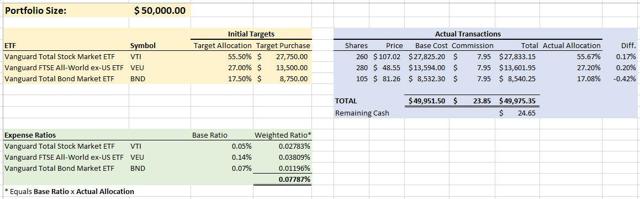

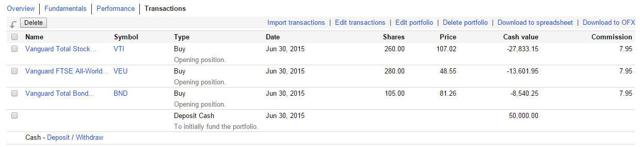

Summary This article is the “wrapper” that packages my first three articles for Seeking Alpha. We will build and track the ETF Monkey Vanguard Core Portfolio. The complete methodology used to build the portfolio will be outlined, as well as statistics outlining its contents, diversification, and weighted expense ratio. Lastly, I will share details on how to use a cool, free tool to track the portfolio such that you can try it yourself, if interested. In summary, all modesty aside, this is the article that you will want to share with any friends who are interested in trying out ETF investing for the first time. This article is intended as the “wrapper” for the package containing my first three articles for Seeking Alpha. The title of each article led off with the words “Building The Core With Vanguard.” The reasons I selected Vanguard for my first efforts are enumerated in this article from my personal blog. The first article in the series featured domestic stocks, and introduced readers to the very first ETF ever offered by Vanguard, the Vanguard Total Stock Market ETF (NYSEARCA: VTI ). The second featured domestic bonds, and discussed the Vanguard Total Bond Market ETF (NYSEARCA: BND ). The third and final article in the series moved to foreign stocks, and highlighted the Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ). Beautiful Simplicity What we will now do is build and track a simple portfolio using just these three ETFs. At first glance, this might seem overly simplistic. After all, there are many ways we could enhance the portfolio, perhaps adding in some REITs, some targeted exposure to a particular country, or the like. I plan to talk about such ideas in future articles. But, for the purpose of this beginning series, the key takeaway will be that simple can also be beautiful . Remember, no less than investing luminaries John C. Bogle and Warren Buffett have featured this concept. Bogle built his career on preaching the advantages of simple index investing, as compared to active management with its accompanying expenses. And Buffett, in his 2013 Shareholder Letter , famously wrote: What I advise here is essentially identical to certain instructions I’ve laid out in my will… My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund . (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers. (Bold highlight mine, for emphasis) And please, don’t confuse the simplicity of holding 3 ETFs with some lack of comprehensiveness or diversification . Here are just a few numbers to consider: Between VTI and VEU , coverage of some 6,316 equities (3,824 in VTI and 2,492 in VEU) as of the latest published statistics, with measurable weightings in at least 46 countries . In BND , 7,364 bonds covering the range of governmental to corporate. In total, then, a combined 13,680 financial instruments. Building Your Portfolio The next question, then, is what relative place, or weighting, should each ETF hold in your portfolio? As you will no doubt quickly surmise, there is no single answer to that question. A whole host of factors can come into play, including one’s age, tolerance for risk, and the like. Where could you look for some help with your decision? One guideline that has commonly been featured over the years is that your stock allocation percentage should equal 100 minus your age . In other words, if you are 30 years of age, 70% of your portfolio should be in stocks, with the remaining 30% in bonds and other “safe” assets. If you are 70 years of age, that ratio should be flipped, such that you only maintain 30% of your portfolio in stocks. However: 1) If you take the time to do any contemporary reading on that generalization, you will find that it has fallen out of favor, in part because (happily) average life expectancy has increased. 2) Of that percentage in stocks, what portion should be domestic and what portion foreign? Wouldn’t it be nice if there were sources to which we could turn to examine precise allocations developed by professional portfolio managers? As it turns out, there are. Many investment houses maintain what are called Target-Date Funds . These are professionally-maintained portfolios designed to steer you towards a projected retirement date. Typically, they use a “fund of funds” approach; investing in various targeted funds they offer per a designed weighting. Since this series of articles has been featuring Vanguard, I decided to turn to them to help us construct our portfolio. Vanguard offers several different such target-date funds, but here are links to four, for any who would like to review them: Vanguard Target Retirement 2025 Fund (MUTF: VTTVX ) Vanguard Target Retirement 2035 Fund (MUTF: VTTHX ) Vanguard Target Retirement 2045 Fund (MUTF: VTIVX ) Vanguard Target Retirement 2055 Fund (MUTF: VFFVX ) Working from the allocations Vanguard uses, and adjusted to reflect the fact that our portfolio only contains 3 ETFs, the following table offers some suggested weightings across four different age groups: Suggested Portfolio Weightings Age 25 35 45 55 Vanguard VTI 55.5% 58.5% 55.5% 45.5% Vanguard VEU 34.5% 31.5% 27.0% 22.0% Vanguard BND 10.0% 10.0% 17.5% 32.5% TOTAL 100.0% 100.0% 100.0% 100.0% Here are a couple of interesting things that I noticed from Vanguard’s model portfolios: Between the ages of 25 and 35, the overall allocation of stocks vs. bonds is actually the same. However, in the allocation for a 25-year old, the stock portion is weighted an additional 3% in favor of international equities, reflecting Vanguard’s apparent belief in the higher growth prospects these offer to a young person with a longer investment horizon. This offers some philosophical “food for thought” as you determine your own comfort level with foreign stocks. Despite what is often characterized as a horrible current environment for bonds, Vanguard maintains a substantial 32.5% weighting in these instruments for an individual in the 55-age group and what I would describe as a consequential weighting of 17.5% even for someone 45 years of age. This reinforces a related point I made in my Seeking Alpha article featuring BND. The ETF Monkey Vanguard Core Portfolio From the above four, I have selected the portfolio designed for someone in their mid-40s as the one that I will build and track. Below is the composition of the Vanguard Target Retirement 2035 Fund that we will work from. The actual allocations we will use are those shown in the column marked 45 (the approximate current age of an individual planning to retire 20 years from now) in the Suggested Portfolio Weightings table above. With that background, have a look at the picture below, and then I’ll offer some comments about the portfolio. (click to enlarge) I decided to base the portfolio on an initial investment of $50,000. With a portfolio of this size, we will receive some decent dividends along the way. I will track these and reinvest them as I see fit, along with possibly rebalancing the portfolio from time to time. I may also make adjustments to the weightings as the Vanguard Target Retirement 2035 Fund on which it is based adjusts over time. In the upper-left-hand corner, you see the target purchases required to establish our desired allocations. On the right, you will see the actual number of shares, and prices, that I was able to obtain based on the closing prices of the 3 ETFs on June 30, 2015. I decided to buy shares in increments of no less than 5 (i.e. the 105 for BND), so my actual allocations are just slightly off from the target. I also wind up with $24.65 in cash moving forward. To make this exercise as realistic as possible, as a Fidelity Brokerage client, I reflected the actual commissions that I would have to pay to obtain the shares. As we move forward, I have purposely “handicapped” myself in that I will have to take into consideration what commissions will cost as I ponder any further incremental investment or rebalancing transactions. I did that intentionally because this is a challenge you will likely face as well when making decisions. I also calculated the weighted expense ratio for the overall portfolio by multiplying the expense ratio for each ETF by its allocation in the portfolio and then summing. You will note that, given our allocation, our overall expense ratio is just a hair under .08%. Not bad. I plan to use the S&P 500 – simply because it is a diversified, commonly accepted, and easily tracked index – to evaluate the overall performance of our portfolio. The closing price of the S&P 500 index on June 30, 2015, was 2,063.11 . Lastly, for some historical context, as time moves forward, on the day this portfolio was established, a long-running drama between Greece, the International Monetary Fund (IMF) and the European Union reached a crisis point, with Greece announcing that it would default on a 1.5 billion euro debt repayment to the IMF. The S&P 500 index closed on 6/30 a mere 4.22 points higher than it began the year, and international indexes (as measured by the price of VEU) had dropped approximately 6.5% from their highs earlier in the year. It will be interesting to watch how this drama affects our portfolio, and what decisions I may make as a result. If Seeking Alpha will accept them, I hope to provide brief articles updating the progress of the portfolio, perhaps on a quarterly basis. I may also use my blog for more minor updates, such as alerts featuring reinvestment of dividends and/or rebalancing. Google Finance One last tip before I leave you. If you are looking for a free source that can help you build and track your portfolio, have a look at Google Finance. I have an account there as ETF Monkey, and so I built my core portfolio there. Have a look: (click to enlarge) If you look closely, you will see the four transactions I entered to build the portfolio. First, I used the “Cash – Deposit/Withdraw” functionality to “deposit” $50,000 in cash to the account. Next, once I knew the closing June 30, 2015, price, I entered 3 “purchases” of ETFs, including the $7.95 commission for each transaction. Note that, in the above picture, you are looking at the “Transactions” view. If you switched to the “Overview” view, you would see my positions, as well as a cash balance of $24.65, exactly matching what is shown in my Excel sheet above. In other words, the tool automatically subtracts your purchases from the cash balance you established. It will also keep track of all dividends we receive in the future as well as any further transactions I decide to initiate. If you want to get a little practice, feel free to try it out by duplicating what I have done. Then, you will feel more comfortable using the tool to track an actual portfolio you either have or establish in the future. Happy investing! Disclosure: I am/we are long BND, VEU, VTI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Summary This article is the “wrapper” that packages my first three articles for Seeking Alpha. We will build and track the ETF Monkey Vanguard Core Portfolio. The complete methodology used to build the portfolio will be outlined, as well as statistics outlining its contents, diversification, and weighted expense ratio. Lastly, I will share details on how to use a cool, free tool to track the portfolio such that you can try it yourself, if interested. In summary, all modesty aside, this is the article that you will want to share with any friends who are interested in trying out ETF investing for the first time. This article is intended as the “wrapper” for the package containing my first three articles for Seeking Alpha. The title of each article led off with the words “Building The Core With Vanguard.” The reasons I selected Vanguard for my first efforts are enumerated in this article from my personal blog. The first article in the series featured domestic stocks, and introduced readers to the very first ETF ever offered by Vanguard, the Vanguard Total Stock Market ETF (NYSEARCA: VTI ). The second featured domestic bonds, and discussed the Vanguard Total Bond Market ETF (NYSEARCA: BND ). The third and final article in the series moved to foreign stocks, and highlighted the Vanguard FTSE All-World ex-US ETF (NYSEARCA: VEU ). Beautiful Simplicity What we will now do is build and track a simple portfolio using just these three ETFs. At first glance, this might seem overly simplistic. After all, there are many ways we could enhance the portfolio, perhaps adding in some REITs, some targeted exposure to a particular country, or the like. I plan to talk about such ideas in future articles. But, for the purpose of this beginning series, the key takeaway will be that simple can also be beautiful . Remember, no less than investing luminaries John C. Bogle and Warren Buffett have featured this concept. Bogle built his career on preaching the advantages of simple index investing, as compared to active management with its accompanying expenses. And Buffett, in his 2013 Shareholder Letter , famously wrote: What I advise here is essentially identical to certain instructions I’ve laid out in my will… My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund . (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers. (Bold highlight mine, for emphasis) And please, don’t confuse the simplicity of holding 3 ETFs with some lack of comprehensiveness or diversification . Here are just a few numbers to consider: Between VTI and VEU , coverage of some 6,316 equities (3,824 in VTI and 2,492 in VEU) as of the latest published statistics, with measurable weightings in at least 46 countries . In BND , 7,364 bonds covering the range of governmental to corporate. In total, then, a combined 13,680 financial instruments. Building Your Portfolio The next question, then, is what relative place, or weighting, should each ETF hold in your portfolio? As you will no doubt quickly surmise, there is no single answer to that question. A whole host of factors can come into play, including one’s age, tolerance for risk, and the like. Where could you look for some help with your decision? One guideline that has commonly been featured over the years is that your stock allocation percentage should equal 100 minus your age . In other words, if you are 30 years of age, 70% of your portfolio should be in stocks, with the remaining 30% in bonds and other “safe” assets. If you are 70 years of age, that ratio should be flipped, such that you only maintain 30% of your portfolio in stocks. However: 1) If you take the time to do any contemporary reading on that generalization, you will find that it has fallen out of favor, in part because (happily) average life expectancy has increased. 2) Of that percentage in stocks, what portion should be domestic and what portion foreign? Wouldn’t it be nice if there were sources to which we could turn to examine precise allocations developed by professional portfolio managers? As it turns out, there are. Many investment houses maintain what are called Target-Date Funds . These are professionally-maintained portfolios designed to steer you towards a projected retirement date. Typically, they use a “fund of funds” approach; investing in various targeted funds they offer per a designed weighting. Since this series of articles has been featuring Vanguard, I decided to turn to them to help us construct our portfolio. Vanguard offers several different such target-date funds, but here are links to four, for any who would like to review them: Vanguard Target Retirement 2025 Fund (MUTF: VTTVX ) Vanguard Target Retirement 2035 Fund (MUTF: VTTHX ) Vanguard Target Retirement 2045 Fund (MUTF: VTIVX ) Vanguard Target Retirement 2055 Fund (MUTF: VFFVX ) Working from the allocations Vanguard uses, and adjusted to reflect the fact that our portfolio only contains 3 ETFs, the following table offers some suggested weightings across four different age groups: Suggested Portfolio Weightings Age 25 35 45 55 Vanguard VTI 55.5% 58.5% 55.5% 45.5% Vanguard VEU 34.5% 31.5% 27.0% 22.0% Vanguard BND 10.0% 10.0% 17.5% 32.5% TOTAL 100.0% 100.0% 100.0% 100.0% Here are a couple of interesting things that I noticed from Vanguard’s model portfolios: Between the ages of 25 and 35, the overall allocation of stocks vs. bonds is actually the same. However, in the allocation for a 25-year old, the stock portion is weighted an additional 3% in favor of international equities, reflecting Vanguard’s apparent belief in the higher growth prospects these offer to a young person with a longer investment horizon. This offers some philosophical “food for thought” as you determine your own comfort level with foreign stocks. Despite what is often characterized as a horrible current environment for bonds, Vanguard maintains a substantial 32.5% weighting in these instruments for an individual in the 55-age group and what I would describe as a consequential weighting of 17.5% even for someone 45 years of age. This reinforces a related point I made in my Seeking Alpha article featuring BND. The ETF Monkey Vanguard Core Portfolio From the above four, I have selected the portfolio designed for someone in their mid-40s as the one that I will build and track. Below is the composition of the Vanguard Target Retirement 2035 Fund that we will work from. The actual allocations we will use are those shown in the column marked 45 (the approximate current age of an individual planning to retire 20 years from now) in the Suggested Portfolio Weightings table above. With that background, have a look at the picture below, and then I’ll offer some comments about the portfolio. (click to enlarge) I decided to base the portfolio on an initial investment of $50,000. With a portfolio of this size, we will receive some decent dividends along the way. I will track these and reinvest them as I see fit, along with possibly rebalancing the portfolio from time to time. I may also make adjustments to the weightings as the Vanguard Target Retirement 2035 Fund on which it is based adjusts over time. In the upper-left-hand corner, you see the target purchases required to establish our desired allocations. On the right, you will see the actual number of shares, and prices, that I was able to obtain based on the closing prices of the 3 ETFs on June 30, 2015. I decided to buy shares in increments of no less than 5 (i.e. the 105 for BND), so my actual allocations are just slightly off from the target. I also wind up with $24.65 in cash moving forward. To make this exercise as realistic as possible, as a Fidelity Brokerage client, I reflected the actual commissions that I would have to pay to obtain the shares. As we move forward, I have purposely “handicapped” myself in that I will have to take into consideration what commissions will cost as I ponder any further incremental investment or rebalancing transactions. I did that intentionally because this is a challenge you will likely face as well when making decisions. I also calculated the weighted expense ratio for the overall portfolio by multiplying the expense ratio for each ETF by its allocation in the portfolio and then summing. You will note that, given our allocation, our overall expense ratio is just a hair under .08%. Not bad. I plan to use the S&P 500 – simply because it is a diversified, commonly accepted, and easily tracked index – to evaluate the overall performance of our portfolio. The closing price of the S&P 500 index on June 30, 2015, was 2,063.11 . Lastly, for some historical context, as time moves forward, on the day this portfolio was established, a long-running drama between Greece, the International Monetary Fund (IMF) and the European Union reached a crisis point, with Greece announcing that it would default on a 1.5 billion euro debt repayment to the IMF. The S&P 500 index closed on 6/30 a mere 4.22 points higher than it began the year, and international indexes (as measured by the price of VEU) had dropped approximately 6.5% from their highs earlier in the year. It will be interesting to watch how this drama affects our portfolio, and what decisions I may make as a result. If Seeking Alpha will accept them, I hope to provide brief articles updating the progress of the portfolio, perhaps on a quarterly basis. I may also use my blog for more minor updates, such as alerts featuring reinvestment of dividends and/or rebalancing. Google Finance One last tip before I leave you. If you are looking for a free source that can help you build and track your portfolio, have a look at Google Finance. I have an account there as ETF Monkey, and so I built my core portfolio there. Have a look: (click to enlarge) If you look closely, you will see the four transactions I entered to build the portfolio. First, I used the “Cash – Deposit/Withdraw” functionality to “deposit” $50,000 in cash to the account. Next, once I knew the closing June 30, 2015, price, I entered 3 “purchases” of ETFs, including the $7.95 commission for each transaction. Note that, in the above picture, you are looking at the “Transactions” view. If you switched to the “Overview” view, you would see my positions, as well as a cash balance of $24.65, exactly matching what is shown in my Excel sheet above. In other words, the tool automatically subtracts your purchases from the cash balance you established. It will also keep track of all dividends we receive in the future as well as any further transactions I decide to initiate. If you want to get a little practice, feel free to try it out by duplicating what I have done. Then, you will feel more comfortable using the tool to track an actual portfolio you either have or establish in the future. Happy investing! Disclosure: I am/we are long BND, VEU, VTI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am not a registered investment advisor or broker/dealer. Readers are advised that the material contained herein should be used solely for informational purposes, and to consult with their personal tax or financial advisors as to its applicability to their circumstances. Investing involves risk, including the loss of principal. Scalper1 News

Scalper1 News