Scalper1 News

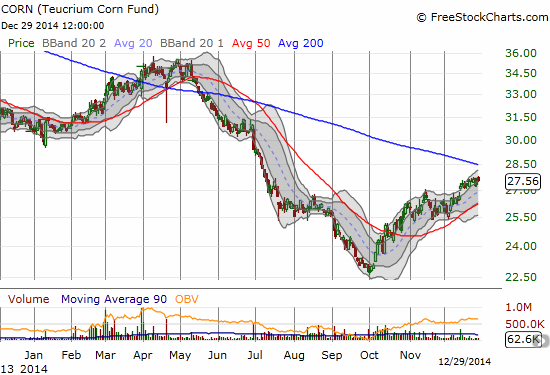

The Teucrium Corn ETF finally seems to be bottoming although technical challenges remain overhead at the 200-day moving average. China’s massive consumption of pig meat creates tremendous demand for imported soy beans and corn to feed these pigs. Assuming this demand for pigs is sustainable, it promises to support corn prices, and thus dip-buying in Teucrium Corn ETF, over the longer-term. After an additional dip, my thesis for playing another bottom in Teucrium Corn ETF (NYSEARCA: CORN ) seems to finally be working. Since that article in mid-August, CORN is up 5.3% versus a 6.0% gain in the S&P 500 (NYSEARCA: SPY ). However, on the way to this gain, CORN first lost as much as 13%…so the ETF has a lot of work to do to balance out risk and reward. The next challenge for Teucrium Corn ETF : a downtrending 200-day moving average (DMA) Source: FreeStockCharts.com As I continue to patiently wait for this trade to unfold, I occasionally check in on relevant news to support or refute the thesis of a supply correction coupled with on-going strength in demand. One of the more fascinating pieces I have read along these lines comes from the Economist on December 20, 2014 titled ” Swine in China: Empire of the pig .” Before reading this piece, I had almost no understanding of the pig’s importance in Chinese history and diet. China’s increase in wealth in recent decades has simultaneously encouraged a massive increase in the consumption of pig meat: Since the late 1970s, when the government liberalised agriculture, pork consumption has increased nearly sevenfold in China. It now produces and consumes almost 500m swine a year, half of all the pigs in the world. This increase has brought a whole host of challenges to China’s government, farmers, and society as a whole. There are even environmental threats reaching into other countries. Since pig feed mainly consists of soy beans and corn (food scraps off the family table have long ceased being sufficient!), China’s demand for these crops has soared along with pig consumption. China cannot feed all its pigs and thus relies on imports. The International Institute of Social Studies in The Hague estimates… …more than half of the world’s feed crops will soon be eaten by Chinese pigs. Already in 2010 China’s soy imports accounted for more than 50% of the total global soy market. The kicker for corn comes from the trade organization, the US Grains Council: …by 2022 China will need to import 19m-32m tonnes of corn. That equates to between a fifth and a third of the world’s entire trade in corn today. China’s need for pig feed is so great that the International Institute for Sustainable Development claims China has (discreetly) purchased 5m hectares in developing countries for farming purposes. The Economist notes that, when Shuanghui, China’s largest pork producer, bought Smithfield Foods, an American firm, in 2013, it acquired huge stretches of Missouri and Texas. While the sustainability of China’s pig consumption is far from clear, it appears that China will imminently help pressure corn markets over the long-term. Along with this strength comes support for prices over time – the kind of support that makes dip-buying particularly attractive. The China/pig factor provides additional (and important) context to the on-going insistence from Deere’s CEO that corn prices will come back. Be careful out there! Scalper1 News

The Teucrium Corn ETF finally seems to be bottoming although technical challenges remain overhead at the 200-day moving average. China’s massive consumption of pig meat creates tremendous demand for imported soy beans and corn to feed these pigs. Assuming this demand for pigs is sustainable, it promises to support corn prices, and thus dip-buying in Teucrium Corn ETF, over the longer-term. After an additional dip, my thesis for playing another bottom in Teucrium Corn ETF (NYSEARCA: CORN ) seems to finally be working. Since that article in mid-August, CORN is up 5.3% versus a 6.0% gain in the S&P 500 (NYSEARCA: SPY ). However, on the way to this gain, CORN first lost as much as 13%…so the ETF has a lot of work to do to balance out risk and reward. The next challenge for Teucrium Corn ETF : a downtrending 200-day moving average (DMA) Source: FreeStockCharts.com As I continue to patiently wait for this trade to unfold, I occasionally check in on relevant news to support or refute the thesis of a supply correction coupled with on-going strength in demand. One of the more fascinating pieces I have read along these lines comes from the Economist on December 20, 2014 titled ” Swine in China: Empire of the pig .” Before reading this piece, I had almost no understanding of the pig’s importance in Chinese history and diet. China’s increase in wealth in recent decades has simultaneously encouraged a massive increase in the consumption of pig meat: Since the late 1970s, when the government liberalised agriculture, pork consumption has increased nearly sevenfold in China. It now produces and consumes almost 500m swine a year, half of all the pigs in the world. This increase has brought a whole host of challenges to China’s government, farmers, and society as a whole. There are even environmental threats reaching into other countries. Since pig feed mainly consists of soy beans and corn (food scraps off the family table have long ceased being sufficient!), China’s demand for these crops has soared along with pig consumption. China cannot feed all its pigs and thus relies on imports. The International Institute of Social Studies in The Hague estimates… …more than half of the world’s feed crops will soon be eaten by Chinese pigs. Already in 2010 China’s soy imports accounted for more than 50% of the total global soy market. The kicker for corn comes from the trade organization, the US Grains Council: …by 2022 China will need to import 19m-32m tonnes of corn. That equates to between a fifth and a third of the world’s entire trade in corn today. China’s need for pig feed is so great that the International Institute for Sustainable Development claims China has (discreetly) purchased 5m hectares in developing countries for farming purposes. The Economist notes that, when Shuanghui, China’s largest pork producer, bought Smithfield Foods, an American firm, in 2013, it acquired huge stretches of Missouri and Texas. While the sustainability of China’s pig consumption is far from clear, it appears that China will imminently help pressure corn markets over the long-term. Along with this strength comes support for prices over time – the kind of support that makes dip-buying particularly attractive. The China/pig factor provides additional (and important) context to the on-going insistence from Deere’s CEO that corn prices will come back. Be careful out there! Scalper1 News

Scalper1 News