Scalper1 News

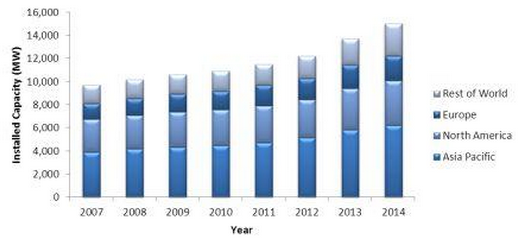

Summary Geothermal power generation will likely stagnate or outright decline in the coming years, putting Ormat Technologies in a bad position. Ormat’s strategy of expansion could backfire if subsidies/incentives dry up, which has a high likelihood of happenings given the arrival of more promising alternative energies. With stagnating revenues and industry pressures, Ormat is much too expensive at a P/E ratio of 40. The geothermal power industry has seen some impressive growth over the past few years, and is currently an important part of the renewable energy mix. By harnessing the enormous amounts of thermal energy stored in the earth, clean energy can be produced in relative abundance. Ormat Technologies (NYSE: ORA ) is a standout in the geothermal space, with approximately 2 GW in power plants supplied worldwide. Although Ormat has grown tremendously over the past few years, there are reasons to believe that it is headed for a long-term decline. While many have touted geothermal’s potential on the basis that there are terawatts of thermal energy that could theoretically be harvested, the technology it takes to actually harness this energy may be questionable in the long run. On top of this, rapid battery innovation may take away geothermal’s big advantage of having base-load qualities. Once other forms of renewables, e.g. wind, will be able to cost effectively store energy, geothermal loses its base-load edge to other potentially more promising clean energies. Ormat is especially vulnerable given that it is relatively more expensive than its peers. Technology Risks Geothermal technologies are especially capital intensive, as massive amounts of resources are needed to build geothermal plants. Ormat’s fast expansion rate could ironically be a negative for the company. If Ormat overextends its reach to more questionable regions in terms of profitability, its expensive geothermal plants could end up costing the company in lost sunk costs if subsidies dry up in the future. Given how many other forms of clean energies are showing more growth potential, namely wind and solar PV, future alternative energy subsidies/incentives will likely be concentrated on these clean energy technologies. While Ormat’s own growth projections of the geothermal electricity and product segments are optimistic, with the global geothermal markets growing eight-fold by 2020, such projections are likely overestimations given that more promising energy technologies are abound. In addition to the fact that other forms of clean energies look to have more inherent growth potential, geothermal is a centralized energy generation technology. If the future energy landscape is indeed one dominated by more distributed forms of energy, this is just one more negative for the geothermal industry. With prime geothermal locations hard to come by and costs likely to be increasingly less competitive compared to other alternative energies, Ormat is facing an uphill battle. Although geothermal technologies are nowhere near mature and still have much more room for improvement, geothermal likely remains a niche market. While the hype surrounding ORA is somewhat justified given its status as the second largest geothermal company in the U.S. and its general cost competitiveness against it peers, it is likely overvalued given its pessimistic growth prospects. With technologies as large and unwieldy as those in geothermal plants, there are much better ways to go about clean energy production. Ormat’s own geothermal growth projections are likely too optimistic in light of industry pressures. While geothermal has indeed grown over the past couple of years, as is clearly shown in the graph below, such growth is likely not sustainable. Source: Frost & Sullivan Analysis Growth Prospects At a P/E ratio of 40 , investors are much too optimistic about Ormat’s growth potential. Given how Ormat’s growth has stagnated in recent years, with both its 2013 and 2014 revenues hovering around the mid-$500M level, it seems unlikely that the company will fulfill such lofty growth expectations. With Q1 revenues at $120M, this growth slowdown trend seems to be continuing. Although Ormat is focusing on expanding by increasing its geographical reach, the company should have a hard time growing in the mid/long term. Ormat’s revenues from third-party sales, which constitute a sizable portion of the company’s total revenues, have long stagnated around the $180M-$200M range. Its products, which make up for a majority of its revenues, have just recently started slowing down. On top of this, 2015 is the first year in a long time where its product sales could actually come in lower than sales in 2014. While Ormat has considerably outperformed the broader market over the past few years, it would not be surprising to see the company underperform moving forward. Although Ormat is highly diversified on the global scene, this may not matter for much longer as the global energy market seems to be gravitating towards solar PV in particular. Many governments are increasingly looking towards solar PV as the main long-term answer to global warming and pollution, which means that geothermal will increasingly be relegated towards more niche situations. While a case could certainly be made that Ormat will have a long-term place in the energy landscape, the company does not seem to be a wise investment on balance. Conclusion Ormat’s long-term prospects are not looking too bright in the long term. While geothermal will likely end up playing a permanent role in the renewable landscape, Ormat is valued much too high. At a market capitalization of $1.89B and a P/E ratio of 40, investors are putting too much confidence in the company’s growth potential. With stagnating revenues and the rise of more promising alternative energies, Ormat will have very little chance of beating the market in the future. There is a high probability that geothermal is not the disruptive technology that many investors are hoping it to be, with Ormat likely to be one of the first to feel the effects of a possible decline in geothermal. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Geothermal power generation will likely stagnate or outright decline in the coming years, putting Ormat Technologies in a bad position. Ormat’s strategy of expansion could backfire if subsidies/incentives dry up, which has a high likelihood of happenings given the arrival of more promising alternative energies. With stagnating revenues and industry pressures, Ormat is much too expensive at a P/E ratio of 40. The geothermal power industry has seen some impressive growth over the past few years, and is currently an important part of the renewable energy mix. By harnessing the enormous amounts of thermal energy stored in the earth, clean energy can be produced in relative abundance. Ormat Technologies (NYSE: ORA ) is a standout in the geothermal space, with approximately 2 GW in power plants supplied worldwide. Although Ormat has grown tremendously over the past few years, there are reasons to believe that it is headed for a long-term decline. While many have touted geothermal’s potential on the basis that there are terawatts of thermal energy that could theoretically be harvested, the technology it takes to actually harness this energy may be questionable in the long run. On top of this, rapid battery innovation may take away geothermal’s big advantage of having base-load qualities. Once other forms of renewables, e.g. wind, will be able to cost effectively store energy, geothermal loses its base-load edge to other potentially more promising clean energies. Ormat is especially vulnerable given that it is relatively more expensive than its peers. Technology Risks Geothermal technologies are especially capital intensive, as massive amounts of resources are needed to build geothermal plants. Ormat’s fast expansion rate could ironically be a negative for the company. If Ormat overextends its reach to more questionable regions in terms of profitability, its expensive geothermal plants could end up costing the company in lost sunk costs if subsidies dry up in the future. Given how many other forms of clean energies are showing more growth potential, namely wind and solar PV, future alternative energy subsidies/incentives will likely be concentrated on these clean energy technologies. While Ormat’s own growth projections of the geothermal electricity and product segments are optimistic, with the global geothermal markets growing eight-fold by 2020, such projections are likely overestimations given that more promising energy technologies are abound. In addition to the fact that other forms of clean energies look to have more inherent growth potential, geothermal is a centralized energy generation technology. If the future energy landscape is indeed one dominated by more distributed forms of energy, this is just one more negative for the geothermal industry. With prime geothermal locations hard to come by and costs likely to be increasingly less competitive compared to other alternative energies, Ormat is facing an uphill battle. Although geothermal technologies are nowhere near mature and still have much more room for improvement, geothermal likely remains a niche market. While the hype surrounding ORA is somewhat justified given its status as the second largest geothermal company in the U.S. and its general cost competitiveness against it peers, it is likely overvalued given its pessimistic growth prospects. With technologies as large and unwieldy as those in geothermal plants, there are much better ways to go about clean energy production. Ormat’s own geothermal growth projections are likely too optimistic in light of industry pressures. While geothermal has indeed grown over the past couple of years, as is clearly shown in the graph below, such growth is likely not sustainable. Source: Frost & Sullivan Analysis Growth Prospects At a P/E ratio of 40 , investors are much too optimistic about Ormat’s growth potential. Given how Ormat’s growth has stagnated in recent years, with both its 2013 and 2014 revenues hovering around the mid-$500M level, it seems unlikely that the company will fulfill such lofty growth expectations. With Q1 revenues at $120M, this growth slowdown trend seems to be continuing. Although Ormat is focusing on expanding by increasing its geographical reach, the company should have a hard time growing in the mid/long term. Ormat’s revenues from third-party sales, which constitute a sizable portion of the company’s total revenues, have long stagnated around the $180M-$200M range. Its products, which make up for a majority of its revenues, have just recently started slowing down. On top of this, 2015 is the first year in a long time where its product sales could actually come in lower than sales in 2014. While Ormat has considerably outperformed the broader market over the past few years, it would not be surprising to see the company underperform moving forward. Although Ormat is highly diversified on the global scene, this may not matter for much longer as the global energy market seems to be gravitating towards solar PV in particular. Many governments are increasingly looking towards solar PV as the main long-term answer to global warming and pollution, which means that geothermal will increasingly be relegated towards more niche situations. While a case could certainly be made that Ormat will have a long-term place in the energy landscape, the company does not seem to be a wise investment on balance. Conclusion Ormat’s long-term prospects are not looking too bright in the long term. While geothermal will likely end up playing a permanent role in the renewable landscape, Ormat is valued much too high. At a market capitalization of $1.89B and a P/E ratio of 40, investors are putting too much confidence in the company’s growth potential. With stagnating revenues and the rise of more promising alternative energies, Ormat will have very little chance of beating the market in the future. There is a high probability that geothermal is not the disruptive technology that many investors are hoping it to be, with Ormat likely to be one of the first to feel the effects of a possible decline in geothermal. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News