Scalper1 News

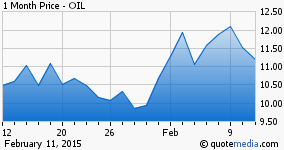

Summary I have noticed a trend in oil trading around the EIA Petroleum Status Report release. The data showing an ongoing build in inventory to record high crude oil levels reassures energy bears and resets energy prices lower this time each of the last two weeks. Longer term investors are looking forward to an eventual end of oil inventory build, and are setting a floor for oil prices. I would use this weakness to buy into the iPath S&P GSCI Crude Oil ETN and other relative investments for the long-term. Over the last two weeks I have noted a trend in oil prices that can be exploited by investors and traders alike. Oil prices have slipped each of the last two weeks heading into the EIA’s Petroleum Status Report, on fear that the inventory data might show large inventory builds. However, once the report is released, despite it’s showing of inventory build, oil prices have found some support likely from long-term investors looking to forward developments. As a result, there’s an opportunity for entry in the iPath S&P GSCI Crude Oil ETN (NYSE: OIL ) here. 1-Month Chart of the OIL at Seeking Alpha The one-month chart of the iPath S&P GSCI Crude Oil ETN shows a recent double-dip. For each of the last two weeks, oil prices and the shares of the OIL ETN have dipped ahead of and into the EIA Petroleum Status Report . The reason for concern is a greater than expected build in oil inventory, which strengthens the glut argument and forces oil prices lower. This week’s data followed trend. The EIA Report Just like last week, this week’s data for the period ending February 6 showed another build in oil inventory. The EIA Report shows that crude oil refinery inputs averaged 15.6 million barrels per day, which was 20K more than the prior week. Crude oil inventory increased by 4.9 million barrels through the week. Importantly, at 417.9 million barrels, crude oil inventory stands now at its highest point in at least 80 years and likely its highest level in history. This news again reinforced the argument about an oil glut, and it gives reason for lower oil prices and lower distillate prices, like gasoline. Thus, once again, fear of this news and the realization of this news drove a dip in the price of oil. Just after the report was released, WTI Crude futures were down 2.5% and Brent Crude was down 3.0%. The iPath S&P GSCI Crude Oil ETN was off 2.8%, but had come up off its lows. The United States Oil ETF (NYSE: USO ) was down 2.5%. Last week, oil prices moved higher off the lows set around the data release and they appear to want to do the same this week. Already crude oil futures have hemmed in their losses. Why is that? It’s because energy experts see this crude oil build ending eventually, at which point inventory can begin to see draws instead of builds, and the level of inventory can come off its high. It will eventually happen, because the rig count is coming off as we flirt with the level of oil prices where drilling is no longer profitable for the average driller. The least efficient of drillers are being squeezed out of the market as well, and so supply should come off. Even the largest of energy sector players are now reducing workforce (see my report on Halliburton ). So as producers of oil cut back, the flow of crude into inventory must come off to meet demand levels. This makes a long-term argument for the purchase of energy sector issues, especially those tracking the commodity here like the OIL ETF. The oil stocks have already enjoyed a significant burst higher, but they are now dealing with news of layoffs and earnings estimate reductions, and eventually disappointing earnings results. The OIL ETF gives investors a vehicle now to avoid all that noise and still benefit from the long-term recovery of oil prices on continuing global growth and a lesser supply environment to meet demand. In conclusion, I think you can use this bad news event as an opportunity for best entry to buy the OIL ETF security and other relative investment securities for the long-term. I am following energy closely now and so my column might prove valuable to relative interests. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in OIL over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary I have noticed a trend in oil trading around the EIA Petroleum Status Report release. The data showing an ongoing build in inventory to record high crude oil levels reassures energy bears and resets energy prices lower this time each of the last two weeks. Longer term investors are looking forward to an eventual end of oil inventory build, and are setting a floor for oil prices. I would use this weakness to buy into the iPath S&P GSCI Crude Oil ETN and other relative investments for the long-term. Over the last two weeks I have noted a trend in oil prices that can be exploited by investors and traders alike. Oil prices have slipped each of the last two weeks heading into the EIA’s Petroleum Status Report, on fear that the inventory data might show large inventory builds. However, once the report is released, despite it’s showing of inventory build, oil prices have found some support likely from long-term investors looking to forward developments. As a result, there’s an opportunity for entry in the iPath S&P GSCI Crude Oil ETN (NYSE: OIL ) here. 1-Month Chart of the OIL at Seeking Alpha The one-month chart of the iPath S&P GSCI Crude Oil ETN shows a recent double-dip. For each of the last two weeks, oil prices and the shares of the OIL ETN have dipped ahead of and into the EIA Petroleum Status Report . The reason for concern is a greater than expected build in oil inventory, which strengthens the glut argument and forces oil prices lower. This week’s data followed trend. The EIA Report Just like last week, this week’s data for the period ending February 6 showed another build in oil inventory. The EIA Report shows that crude oil refinery inputs averaged 15.6 million barrels per day, which was 20K more than the prior week. Crude oil inventory increased by 4.9 million barrels through the week. Importantly, at 417.9 million barrels, crude oil inventory stands now at its highest point in at least 80 years and likely its highest level in history. This news again reinforced the argument about an oil glut, and it gives reason for lower oil prices and lower distillate prices, like gasoline. Thus, once again, fear of this news and the realization of this news drove a dip in the price of oil. Just after the report was released, WTI Crude futures were down 2.5% and Brent Crude was down 3.0%. The iPath S&P GSCI Crude Oil ETN was off 2.8%, but had come up off its lows. The United States Oil ETF (NYSE: USO ) was down 2.5%. Last week, oil prices moved higher off the lows set around the data release and they appear to want to do the same this week. Already crude oil futures have hemmed in their losses. Why is that? It’s because energy experts see this crude oil build ending eventually, at which point inventory can begin to see draws instead of builds, and the level of inventory can come off its high. It will eventually happen, because the rig count is coming off as we flirt with the level of oil prices where drilling is no longer profitable for the average driller. The least efficient of drillers are being squeezed out of the market as well, and so supply should come off. Even the largest of energy sector players are now reducing workforce (see my report on Halliburton ). So as producers of oil cut back, the flow of crude into inventory must come off to meet demand levels. This makes a long-term argument for the purchase of energy sector issues, especially those tracking the commodity here like the OIL ETF. The oil stocks have already enjoyed a significant burst higher, but they are now dealing with news of layoffs and earnings estimate reductions, and eventually disappointing earnings results. The OIL ETF gives investors a vehicle now to avoid all that noise and still benefit from the long-term recovery of oil prices on continuing global growth and a lesser supply environment to meet demand. In conclusion, I think you can use this bad news event as an opportunity for best entry to buy the OIL ETF security and other relative investment securities for the long-term. I am following energy closely now and so my column might prove valuable to relative interests. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in OIL over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News