Scalper1 News

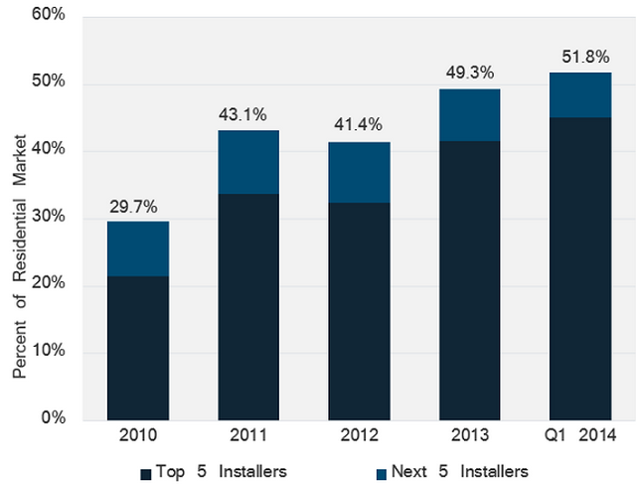

Summary NRG Energy recently acquired Verengo Solar’s Northeast U.S. sales and operations teams, adding on to a list of recent solar acquisitions. The sale of the previous residential solar standout Verengo has been a golden opportunity for NRG Energy to bolster its infrastructure. The addition of Verengo’s sales and operations teams will significantly strengthen NRG Energy’s Northeast residential solar segments. The acquisition-heavy strategy of NRG Energy’s solar segment is in keeping with the vertical integration and consolidations taking place within the distributed solar industry. While NRG Energy’s highly ambitious residential solar strategy is fraught with risks, the potential payoff is enormous. NRG Energy (NYSE: NRG ) has accelerated its move into the distributed solar industry over the past few months. With wild ambitions of overtaking SolarCity (NASDAQ: SCTY ) as the top residential solar company in a few years time, NRG Energy is wise to move into the distributed solar space as fast as possible. The company has already set up a huge distributed solar infrastructure, with its CEO even claiming that the company has “an embedded SolarCity within it. ” In fact, the company is already proclaiming that it will beat out Vivint Solar (NYSE: VSLR ) for the number 2 spot by the end of 2015, which is a tall order considering the companies’ currently huge market share disparity, and Vivint Solar’s rapid growth. NRG Energy has recently announced that it had bought out Verengo Solar’s Northeast U.S. sales and operations planning teams, which marks the latest in a series of ambitious acquisitions. Over the span of a year, the company has acquired the likes of Roof Diagnostics and Solar Pure Energies Group, clearly showing NRG Energy’s intentions of making a big entrance into the residential solar arena. The company’s most recent buyout of Verengo’s NorthEast S&O teams highlights its almost frenzied approach towards residential solar. Verengo Advantage Verengo Solar was the #3 distributed residential solar company before the company’s baffling decision to put itself up for sale. Verengo Solar already has a strong presence in the NorthEast, which was the primary reason for its NorthEast sales and operations teams’s acquisition by NRG Energy. Kelcy Pegler Jr., who is the head of NRG Energy’s solar segment, stated that the acquisition “solidifies some advantages we have, and we have a ton of momentum in the Northeast.” While the reasons behind Verengo’s sale are somewhat confusing (especially in light of the fact that its sale occurred right after the company reached the number 3 spot ), it represents a golden opportunity for NRG Energy to snatch up some of Verengo’s talent. Given NRG Energy’s relative lack of experience in the distributed solar arena, Verengo’s employees complement NRG Energy perfectly. The company’s addition of Verengo’s Northeast sales and operations teams will certainly make the NRG Energy’s rapid transition into residential solar a much smoother one. Trend of Vertical Integration Given NRG Energy’s relatively late start and aspirations for solar dominance, it is only logical for the company to pick up whatever advantages they can through acquisitions. Thus far, NRG Energy has wisely acquired companies that already have infrastructures in place to augment its own, rather than wasting time by building its entire distributed solar infrastructure from scratch. The frequency of such acquisitions are not surprising given the fact that intense consolidations are still occurring among top residential solar companies. The distributed solar industry has gone through a rapid trend of vertical integration and market share consolidation over the past few years. The larger corporations like SolarCity and Vivint Solar have increasingly pushed out more regional competition, implying that vertical integration is not only beneficial, but also essential for success in the distributed solar arena. Vertical integration reduces logistics costs and more importantly, allows for unified system cost-reductions. Such unified cost reductions would be impossible if different segments of distributed solar, such as financing, installations, inverters, etc, were operating under separate entities with varying goals. Bringing all these elements under one roof allows for a more focused, and cohesive approach. This graph depicts the residential solar market share consolidation that has occurred over the past few years. This consolidation has largely been a result of the vertical integration taking place among the top companies, which has pushed out weaker and more regional competition. Note that this graph only captures up to quarter 1 of 2014. As of quarter 2 of 2014, SolarCity and Vivint Solar (the #1 and #2 installers) already have a combined market share of more than 50% . Amazingly, this means that consolidation is actually accelerating, despite the already top-heavy dominance of the solar industry. (click to enlarge) Source: GTM Research NRG Energy has clearly studied these distributed solar market trends, and is applying such knowledge to its own residential solar business model. The company emphasized the important of vertical integration by stating that “it’s an ever-consolidating space in residential solar” and that “with the corporate sophistication of NRG as a Fortune 250 company… it really puts us in an advantaged position to bring on team members, like Verengo, and leverage our position in the space to become the ultimate winner.” Risks Making such an ambitious entrance into a new industry comes with massive risks. NRG Energy has taken the decidedly riskier route of acquiring numerous companies/teams in order to bolster its distributed residential solar infrastructure, rather than growing in a completely organic fashion. While the company has indeed grown many parts of its solar infrastructure organically, such ambitious goals cannot be achieved through organic growth alone. This could very well be the primary motivating factor for the company’s heavy acquisitions strategy. Of course, if NRG Energy’s plans do not pan out, the company would have essentially wasted hundred of millions, and perhaps billions of dollars acquiring and building out its massive residential solar infrastructure. Despite such risks, the rewards are almost certainly worth it, as distributed solar is a potentially transformative industry. If NRG Energy can manage to grab a foothold of this market in its early stages, the company should be rewarded its initial investment many times over. Conclusion While companies like SolarCity and Vivint Solar have already cemented themselves as leading distributed residential solar companies, large portions of the industry’s market share are effectively still up for grabs. The industry is, after all, still in relatively in its infant stages, which means that sufficiently motivated new industry players could muscle their way in. If NRG Energy manages to succeed at even a fraction of its ambitions, the company is set to gain immensely. Given potential market size of distributed generation, and the exponential growth path of solar power, NRG Energy is making an incredibly smart move by moving into the distributed residential solar arena. If NRG Energy keeps up its distributed solar ambitions, the company is set to gain immensely. Disclosure: The author is long SCTY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary NRG Energy recently acquired Verengo Solar’s Northeast U.S. sales and operations teams, adding on to a list of recent solar acquisitions. The sale of the previous residential solar standout Verengo has been a golden opportunity for NRG Energy to bolster its infrastructure. The addition of Verengo’s sales and operations teams will significantly strengthen NRG Energy’s Northeast residential solar segments. The acquisition-heavy strategy of NRG Energy’s solar segment is in keeping with the vertical integration and consolidations taking place within the distributed solar industry. While NRG Energy’s highly ambitious residential solar strategy is fraught with risks, the potential payoff is enormous. NRG Energy (NYSE: NRG ) has accelerated its move into the distributed solar industry over the past few months. With wild ambitions of overtaking SolarCity (NASDAQ: SCTY ) as the top residential solar company in a few years time, NRG Energy is wise to move into the distributed solar space as fast as possible. The company has already set up a huge distributed solar infrastructure, with its CEO even claiming that the company has “an embedded SolarCity within it. ” In fact, the company is already proclaiming that it will beat out Vivint Solar (NYSE: VSLR ) for the number 2 spot by the end of 2015, which is a tall order considering the companies’ currently huge market share disparity, and Vivint Solar’s rapid growth. NRG Energy has recently announced that it had bought out Verengo Solar’s Northeast U.S. sales and operations planning teams, which marks the latest in a series of ambitious acquisitions. Over the span of a year, the company has acquired the likes of Roof Diagnostics and Solar Pure Energies Group, clearly showing NRG Energy’s intentions of making a big entrance into the residential solar arena. The company’s most recent buyout of Verengo’s NorthEast S&O teams highlights its almost frenzied approach towards residential solar. Verengo Advantage Verengo Solar was the #3 distributed residential solar company before the company’s baffling decision to put itself up for sale. Verengo Solar already has a strong presence in the NorthEast, which was the primary reason for its NorthEast sales and operations teams’s acquisition by NRG Energy. Kelcy Pegler Jr., who is the head of NRG Energy’s solar segment, stated that the acquisition “solidifies some advantages we have, and we have a ton of momentum in the Northeast.” While the reasons behind Verengo’s sale are somewhat confusing (especially in light of the fact that its sale occurred right after the company reached the number 3 spot ), it represents a golden opportunity for NRG Energy to snatch up some of Verengo’s talent. Given NRG Energy’s relative lack of experience in the distributed solar arena, Verengo’s employees complement NRG Energy perfectly. The company’s addition of Verengo’s Northeast sales and operations teams will certainly make the NRG Energy’s rapid transition into residential solar a much smoother one. Trend of Vertical Integration Given NRG Energy’s relatively late start and aspirations for solar dominance, it is only logical for the company to pick up whatever advantages they can through acquisitions. Thus far, NRG Energy has wisely acquired companies that already have infrastructures in place to augment its own, rather than wasting time by building its entire distributed solar infrastructure from scratch. The frequency of such acquisitions are not surprising given the fact that intense consolidations are still occurring among top residential solar companies. The distributed solar industry has gone through a rapid trend of vertical integration and market share consolidation over the past few years. The larger corporations like SolarCity and Vivint Solar have increasingly pushed out more regional competition, implying that vertical integration is not only beneficial, but also essential for success in the distributed solar arena. Vertical integration reduces logistics costs and more importantly, allows for unified system cost-reductions. Such unified cost reductions would be impossible if different segments of distributed solar, such as financing, installations, inverters, etc, were operating under separate entities with varying goals. Bringing all these elements under one roof allows for a more focused, and cohesive approach. This graph depicts the residential solar market share consolidation that has occurred over the past few years. This consolidation has largely been a result of the vertical integration taking place among the top companies, which has pushed out weaker and more regional competition. Note that this graph only captures up to quarter 1 of 2014. As of quarter 2 of 2014, SolarCity and Vivint Solar (the #1 and #2 installers) already have a combined market share of more than 50% . Amazingly, this means that consolidation is actually accelerating, despite the already top-heavy dominance of the solar industry. (click to enlarge) Source: GTM Research NRG Energy has clearly studied these distributed solar market trends, and is applying such knowledge to its own residential solar business model. The company emphasized the important of vertical integration by stating that “it’s an ever-consolidating space in residential solar” and that “with the corporate sophistication of NRG as a Fortune 250 company… it really puts us in an advantaged position to bring on team members, like Verengo, and leverage our position in the space to become the ultimate winner.” Risks Making such an ambitious entrance into a new industry comes with massive risks. NRG Energy has taken the decidedly riskier route of acquiring numerous companies/teams in order to bolster its distributed residential solar infrastructure, rather than growing in a completely organic fashion. While the company has indeed grown many parts of its solar infrastructure organically, such ambitious goals cannot be achieved through organic growth alone. This could very well be the primary motivating factor for the company’s heavy acquisitions strategy. Of course, if NRG Energy’s plans do not pan out, the company would have essentially wasted hundred of millions, and perhaps billions of dollars acquiring and building out its massive residential solar infrastructure. Despite such risks, the rewards are almost certainly worth it, as distributed solar is a potentially transformative industry. If NRG Energy can manage to grab a foothold of this market in its early stages, the company should be rewarded its initial investment many times over. Conclusion While companies like SolarCity and Vivint Solar have already cemented themselves as leading distributed residential solar companies, large portions of the industry’s market share are effectively still up for grabs. The industry is, after all, still in relatively in its infant stages, which means that sufficiently motivated new industry players could muscle their way in. If NRG Energy manages to succeed at even a fraction of its ambitions, the company is set to gain immensely. Given potential market size of distributed generation, and the exponential growth path of solar power, NRG Energy is making an incredibly smart move by moving into the distributed residential solar arena. If NRG Energy keeps up its distributed solar ambitions, the company is set to gain immensely. Disclosure: The author is long SCTY. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News