Scalper1 News

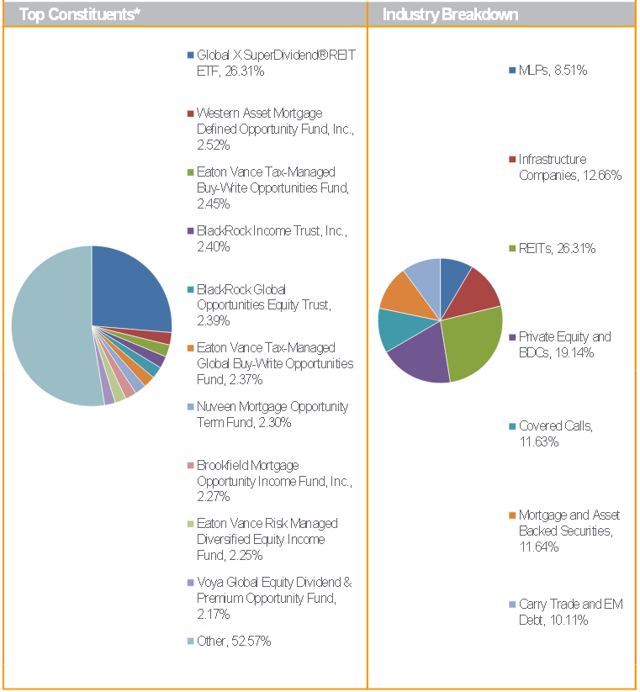

Income investors may look at alternative assets to garner attractive yields. ETF options that provide attractive dividends. Focus on the Global X suite of SuperDividend ETFs. By Todd Shriber & Tom Lydon Investors are still searching for ways to generate income. Home to asset classes including business development companies (BDCS), private equity, closed-end funds, covered call funds and others, the alternatives space is a credible source of high income and yields. Enter the Global X SuperDividend Alternatives ETF (NASDAQ: ALTY ) , which debuted today. ALTY is the latest member of Global X’s SuperDividend suite , becoming the sixth ETF in a group that includes well-known products such as the Global X SuperDividend ETF (NYSEARCA: SDIV ) and the Global X SuperDividend U.S. ETF (NYSEARCA: DIV ). ALTY tracks the Indxx SuperDividend Alternatives Index. The new ETF offers investors exposure to an array of income-generating asset classes including a 26.3% weight to real estate investment trusts (REITs), a 19.1% allocation to BDCs and private equity and an 8.5% weight to master limited partnerships (MLPs). The new ETF also features 11.6% weights to covered call strategies and mortgage- and asset-backed securities, according to Global X data . BDCs have increased in popularity among investors for one big reason: Tantalizing dividend yields. However, with Treasury yields on the rise, some high-yielding asset classes are proving vulnerable, meaning investors should take the time to assess positions in BDCs and the corresponding exchange traded funds. BDCs are closed-end investment companies created under the Investment Company Act of 1940 that invest in debt and equity of small public and privately-held companies. The companies essentially help fund small $5 million to $100 million businesses. Ever since the financial crisis, regulators have clamped down on traditional lenders and made it harder for businesses to access public capital, which has forced smaller business to take loans from BDCs. ALTY delivers on the income promise via of a fund-of-funds approach as top 10 holdings are other funds, including a 26.3% weight to the Global X SuperDividend REIT ETF (NASDAQ: SRET ) . SRET, by far ALTY’s largest holding, debuted in March. “As a result of their stable earnings, REITs have demonstrated less volatility than equity prices. Global REIT volatility from 2010 – 2014 was 15.3% as compared to 16% of S&P 500. This stability has contributed to higher risk-adjusted returns as observed by Sharpe Ratio. The Sharpe Ratio for global REITs in 2014 was 2.11 as compared to a Sharpe Ratio of 1.01 for S&P 500,” said Global X, citing Bloomberg data. Alternative assets have other advantages in addition to income-generating potential. “Alternatives are generally known for lower volatility compared to equities. ALTY’s index methodology seeks to further reduce volatility through its selection and weighting of components. Alternative income is often generated from sources with low correlation to equities and traditional fixed income, such as real assets, private equity, and derivative strategies,” according to Global X . However, those advantages come at a cost. As ALTY holds multiple asset classes across multiple funds, the new ETF’s expense ratio is 3.03%, which is high by the standards of most actively-managed mutual funds, let alone passively-managed ETFs. ALTY pays its dividend on a monthly basis. (click to enlarge) Charts Courtesy: Global X Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Income investors may look at alternative assets to garner attractive yields. ETF options that provide attractive dividends. Focus on the Global X suite of SuperDividend ETFs. By Todd Shriber & Tom Lydon Investors are still searching for ways to generate income. Home to asset classes including business development companies (BDCS), private equity, closed-end funds, covered call funds and others, the alternatives space is a credible source of high income and yields. Enter the Global X SuperDividend Alternatives ETF (NASDAQ: ALTY ) , which debuted today. ALTY is the latest member of Global X’s SuperDividend suite , becoming the sixth ETF in a group that includes well-known products such as the Global X SuperDividend ETF (NYSEARCA: SDIV ) and the Global X SuperDividend U.S. ETF (NYSEARCA: DIV ). ALTY tracks the Indxx SuperDividend Alternatives Index. The new ETF offers investors exposure to an array of income-generating asset classes including a 26.3% weight to real estate investment trusts (REITs), a 19.1% allocation to BDCs and private equity and an 8.5% weight to master limited partnerships (MLPs). The new ETF also features 11.6% weights to covered call strategies and mortgage- and asset-backed securities, according to Global X data . BDCs have increased in popularity among investors for one big reason: Tantalizing dividend yields. However, with Treasury yields on the rise, some high-yielding asset classes are proving vulnerable, meaning investors should take the time to assess positions in BDCs and the corresponding exchange traded funds. BDCs are closed-end investment companies created under the Investment Company Act of 1940 that invest in debt and equity of small public and privately-held companies. The companies essentially help fund small $5 million to $100 million businesses. Ever since the financial crisis, regulators have clamped down on traditional lenders and made it harder for businesses to access public capital, which has forced smaller business to take loans from BDCs. ALTY delivers on the income promise via of a fund-of-funds approach as top 10 holdings are other funds, including a 26.3% weight to the Global X SuperDividend REIT ETF (NASDAQ: SRET ) . SRET, by far ALTY’s largest holding, debuted in March. “As a result of their stable earnings, REITs have demonstrated less volatility than equity prices. Global REIT volatility from 2010 – 2014 was 15.3% as compared to 16% of S&P 500. This stability has contributed to higher risk-adjusted returns as observed by Sharpe Ratio. The Sharpe Ratio for global REITs in 2014 was 2.11 as compared to a Sharpe Ratio of 1.01 for S&P 500,” said Global X, citing Bloomberg data. Alternative assets have other advantages in addition to income-generating potential. “Alternatives are generally known for lower volatility compared to equities. ALTY’s index methodology seeks to further reduce volatility through its selection and weighting of components. Alternative income is often generated from sources with low correlation to equities and traditional fixed income, such as real assets, private equity, and derivative strategies,” according to Global X . However, those advantages come at a cost. As ALTY holds multiple asset classes across multiple funds, the new ETF’s expense ratio is 3.03%, which is high by the standards of most actively-managed mutual funds, let alone passively-managed ETFs. ALTY pays its dividend on a monthly basis. (click to enlarge) Charts Courtesy: Global X Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News