Scalper1 News

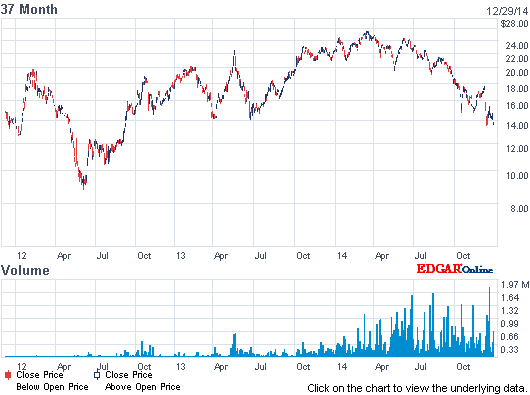

Summary The Syriza party seems poised to win the general election scheduled for January 25th. Party leader Alexis Tsipras will not back away from seeking relief in austerity measures previously accepted. Should the country seek to leave the euro currency, it may be made an example for others that might follow. Expect to see the Global X FTSE Greek 20 ETF shares succumb to further pressure. In May of 2010, Greece accepted a bailout package. Then Finance Minister George Papaconstantinou described the deal as including, “tough austerity measures.” The Greek people understood why the deal had to be done, though. The country was on the precipice of Armageddon, with many bankers using the phrase “difficult but necessary.” Mr. Papaconstantinou would go on to say that Greece had a choice between destruction or saving the country and that, “we have chosen of course to save the country.” Today, the same warnings are being launched from all directions. Only this time, the people aren’t listening. Or, if they are, no longer believe them. The Greeks can now vote from experience, having lived for nearly five years with the austerity measures that Syriza, the political party currently leading in the polls, vehemently opposes. For them, more than enough time to discover they don’t care much for the taste of austerity; so much so that the country appears to be ready to explore what life is like outside of the euro. And if voters are anything like Anastasis Chrisopoulos, they probably don’t feel as if there is much to lose . When asked for his feelings on the original bailout, the 31-year-old Athens taxi driver said, “So what? Things will only get worse. We have reached a point where we’re trying to figure out how to survive just the next day, let alone the next 10 days, the next month, the next year.” But investors in Greek assets do have something at risk, and the market showed its disapproval of the country’s predicament by dropping the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) to within pennies of its 52-week low. If today’s -6.70% fall is an indication of future performance under a Syriza-led government, then prepare for more pain. Germany Says Austerity Is Working; The Greek People Disagree What we know is that, earlier today , the Greek parliament rejected Prime Minister Antonis Samaras’s nominee for president, and the country is now set to hold a general election on January 25th. Opinion polls point to victory for the Syriza party, which is set on eliminating the austerity terms accepted in exchange for a bailout package now valued near $300B. To hammer home this point, Syriza leader Alexis Tsipras said that , “In a few days the Samaras government, which pillaged the country, will belong to the past, as will the memoranda of austerity.” In response, German finance minister Wolfgang Schäuble indicated his position on the issue, stating that whoever assumed power must respect the agreements already in place and that, “the tough reforms are bearing fruit and there is no alternative to them.” To support this claim, the German’s can point to the fact that the Greek economy has returned to growth for the first time in six years, and that signs of a recovery are beginning to take hold. But the people will counter this argument not with numbers, but with experiences; their own experiences, which emphatically say that their lives have not improved during austerity’s reign. For all of the pain, unemployment for 3Q2014 came in at 25.5%, which is down from its peak of 28% in 2013 but almost twice as high as the number from 2010. (click to enlarge) More damning, though, is a statistic from the International Labor Organization that says the number of Greeks at risk of poverty has more than doubled in the last five years. The support for Syriza and frustration with austerity might be related to the lack of correlation with statistical growth and quality of living. What Does It All Mean I think the wheels are in motion and that Syriza will win the general election in January. While some believe Mr. Tsipras is only talking tough, I would disagree. He has softened his rhetoric a bit, but he and the party will not back away from demanding changes in austerity that are more than symbolic. However, the eurozone barely flinched at the news, which indicates that it may be quite comfortable with letting Greece forge its own path. For me, whether Greece is better or worse off in the euro over the long run is irrelevant to my investment thesis. I would be a seller of the Greece 20 ETF because I believe the shares will be pressured in the nearer term for a couple of reasons. For one, with the election of Syriza, there will be an extended period of uncertainly regardless of the path the country chooses. If Greece attempts to stay in the euro, it will have to meet the German’s somewhere further away than Mr. Tsipras’ current rhetoric places it. This negotiation would be intense and take some time. Conversely, if it decides to exit the euro, there will be an even longer period of uncertainty, with significantly more questions to answer. Secondly, and more importantly, Greece may be made an example for any other country thinking of following its path. There is talk that the fear in the eurozone isn’t of Greece leaving but rather that other countries may follow their lead. To alleviate this concern, game theory would suggest that interested parties attempt to make the transition difficult enough to give others pause. As cynical as this opinion may seem, I do believe it is a risk that must be accounted for. While it may seem tempting to buy Greek equities sitting at or near their 52-week lows, I would be a seller as I believe that uncertainly will persist through the January 25th elections, and the increasing risk of a euro exit will push shares further south. Scalper1 News

Summary The Syriza party seems poised to win the general election scheduled for January 25th. Party leader Alexis Tsipras will not back away from seeking relief in austerity measures previously accepted. Should the country seek to leave the euro currency, it may be made an example for others that might follow. Expect to see the Global X FTSE Greek 20 ETF shares succumb to further pressure. In May of 2010, Greece accepted a bailout package. Then Finance Minister George Papaconstantinou described the deal as including, “tough austerity measures.” The Greek people understood why the deal had to be done, though. The country was on the precipice of Armageddon, with many bankers using the phrase “difficult but necessary.” Mr. Papaconstantinou would go on to say that Greece had a choice between destruction or saving the country and that, “we have chosen of course to save the country.” Today, the same warnings are being launched from all directions. Only this time, the people aren’t listening. Or, if they are, no longer believe them. The Greeks can now vote from experience, having lived for nearly five years with the austerity measures that Syriza, the political party currently leading in the polls, vehemently opposes. For them, more than enough time to discover they don’t care much for the taste of austerity; so much so that the country appears to be ready to explore what life is like outside of the euro. And if voters are anything like Anastasis Chrisopoulos, they probably don’t feel as if there is much to lose . When asked for his feelings on the original bailout, the 31-year-old Athens taxi driver said, “So what? Things will only get worse. We have reached a point where we’re trying to figure out how to survive just the next day, let alone the next 10 days, the next month, the next year.” But investors in Greek assets do have something at risk, and the market showed its disapproval of the country’s predicament by dropping the Global X FTSE Greece 20 ETF (NYSEARCA: GREK ) to within pennies of its 52-week low. If today’s -6.70% fall is an indication of future performance under a Syriza-led government, then prepare for more pain. Germany Says Austerity Is Working; The Greek People Disagree What we know is that, earlier today , the Greek parliament rejected Prime Minister Antonis Samaras’s nominee for president, and the country is now set to hold a general election on January 25th. Opinion polls point to victory for the Syriza party, which is set on eliminating the austerity terms accepted in exchange for a bailout package now valued near $300B. To hammer home this point, Syriza leader Alexis Tsipras said that , “In a few days the Samaras government, which pillaged the country, will belong to the past, as will the memoranda of austerity.” In response, German finance minister Wolfgang Schäuble indicated his position on the issue, stating that whoever assumed power must respect the agreements already in place and that, “the tough reforms are bearing fruit and there is no alternative to them.” To support this claim, the German’s can point to the fact that the Greek economy has returned to growth for the first time in six years, and that signs of a recovery are beginning to take hold. But the people will counter this argument not with numbers, but with experiences; their own experiences, which emphatically say that their lives have not improved during austerity’s reign. For all of the pain, unemployment for 3Q2014 came in at 25.5%, which is down from its peak of 28% in 2013 but almost twice as high as the number from 2010. (click to enlarge) More damning, though, is a statistic from the International Labor Organization that says the number of Greeks at risk of poverty has more than doubled in the last five years. The support for Syriza and frustration with austerity might be related to the lack of correlation with statistical growth and quality of living. What Does It All Mean I think the wheels are in motion and that Syriza will win the general election in January. While some believe Mr. Tsipras is only talking tough, I would disagree. He has softened his rhetoric a bit, but he and the party will not back away from demanding changes in austerity that are more than symbolic. However, the eurozone barely flinched at the news, which indicates that it may be quite comfortable with letting Greece forge its own path. For me, whether Greece is better or worse off in the euro over the long run is irrelevant to my investment thesis. I would be a seller of the Greece 20 ETF because I believe the shares will be pressured in the nearer term for a couple of reasons. For one, with the election of Syriza, there will be an extended period of uncertainly regardless of the path the country chooses. If Greece attempts to stay in the euro, it will have to meet the German’s somewhere further away than Mr. Tsipras’ current rhetoric places it. This negotiation would be intense and take some time. Conversely, if it decides to exit the euro, there will be an even longer period of uncertainty, with significantly more questions to answer. Secondly, and more importantly, Greece may be made an example for any other country thinking of following its path. There is talk that the fear in the eurozone isn’t of Greece leaving but rather that other countries may follow their lead. To alleviate this concern, game theory would suggest that interested parties attempt to make the transition difficult enough to give others pause. As cynical as this opinion may seem, I do believe it is a risk that must be accounted for. While it may seem tempting to buy Greek equities sitting at or near their 52-week lows, I would be a seller as I believe that uncertainly will persist through the January 25th elections, and the increasing risk of a euro exit will push shares further south. Scalper1 News

Scalper1 News