Scalper1 News

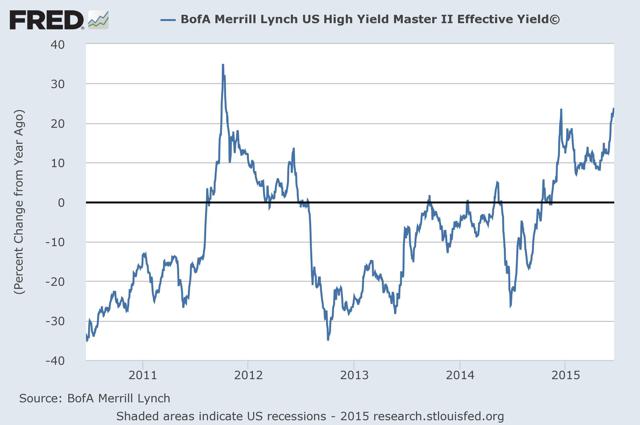

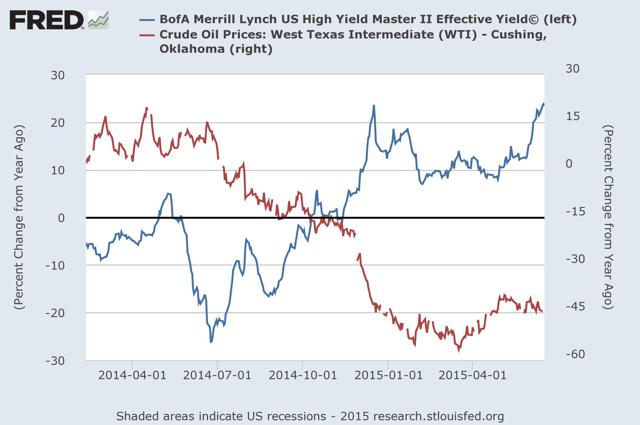

Summary Since bottoming on May 27, junk bond yields have begun steadily rising again. Corporate profits indicate that yields will continue to rise. With default risk increasing, buy credit protection for high upside. Starting around the latter half of 2014, one of the major changes to take hold in the market (besides the rise of the dollar index and collapse in oil prices) has been with bond yields. Junk bond yields have been rising substantially and quickly over the past few months. Much of the change has been due to oil prices, but another cause has been the weakening of corporate profits starting in 2014. With the trend continuing strong through the first half of 2015, there is still time to buy protection against rising yields. As profits fall and oil prices stay low, rising default rates are likely in the future. In fact, default rates in junk bonds have risen to their highest level in 6 years. This article will examine the current state of the junk bond market, the sustainability of current trends, and also recommend a way to play the rising yields and default risks using a credit default swap ETF. Current State of Bond Yields (click to enlarge) Since the European Debt Crisis, which peaked in 2012, junk bond yields had been steadily falling outside of a small blip in 2014. Starting around the end of 2014, however, the increase in yields began in earnest and is now accelerating to the quickest pace since 2011. Yields are spiking, and while this is still far from what is seen during a credit crisis, the warning signs are there. Junk bond yields are now more than 20% higher than they were just a year ago, and there is no sign of an impending correction. On the contrary, the fundamentals seem to be pointing toward a further rise in junk bond yields. Explaining Recent Price Action (click to enlarge) Much of the current trend in junk bond yields can be explained by referring back to oil prices. As oil prices started to fall in 2014, yields immediately began to rise in response. When the oil price bottomed at the start of 2015, yields steadied a bit, though the trend toward rising yields remained. There was hope that oil prices would continue to rebound in the second quarter of the year, but those hopes have been dashed as oil has stood its ground around $60 a barrel. At this point, yields have responded by rising even more and accelerating. While oil explains much of this phenomenon, the increase in yields cannot be blamed totally on the black liquid. (click to enlarge) Another major trend that came about starting in 2014 has been falling corporate profits. These numbers have been showing consistent deterioration since then, and while the Q1 2015 numbers give a sign of possible hope, the historical record does not look good. The last time that corporate profits fell this much, bond yields soared in response after about a year and a half. If that sets any precedent, then bond yields are again about to soar either at the end of this quarter or in the next, especially if corporate profits are weak yet again. Given the past, now is absolutely the time to buy protection against rising yields and bond defaults. The ProShares CDS Short North American HY Credit ETF (BATS: WYDE ) may be the perfect way to play the current situation. As the ETF is short high yield credit, it profits when default rates rise, as the ETF owns a broad basket of high yield credit default swaps. While offering protection against default risk, WYDE has also shown itself to protect against time decay. Since its inception in August of 2014, WYDE has lost less than 5% of its value. CDS protection does have a cost over time, and given that it has lost so little over the time, WYDE is a safe way to play the high yield bond market with little time decay. Summary and Action to Take Junk bonds are a risky proposition right now. Oil prices look to have stalled and a quick recovery to previous levels looks a long way off. In addition, corporate profits have been weak and have been deteriorating at a pace not seen since the onset of the financial crisis. Now is the perfect time to buy protection against a spike in junk bond yields by buying credit default swaps. For the small retail investor, CDS exposure is difficult, and thus gaining exposure via the WYDE ETF may be the perfect way to do so. Disclosure: I am/we are long WYDE. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Since bottoming on May 27, junk bond yields have begun steadily rising again. Corporate profits indicate that yields will continue to rise. With default risk increasing, buy credit protection for high upside. Starting around the latter half of 2014, one of the major changes to take hold in the market (besides the rise of the dollar index and collapse in oil prices) has been with bond yields. Junk bond yields have been rising substantially and quickly over the past few months. Much of the change has been due to oil prices, but another cause has been the weakening of corporate profits starting in 2014. With the trend continuing strong through the first half of 2015, there is still time to buy protection against rising yields. As profits fall and oil prices stay low, rising default rates are likely in the future. In fact, default rates in junk bonds have risen to their highest level in 6 years. This article will examine the current state of the junk bond market, the sustainability of current trends, and also recommend a way to play the rising yields and default risks using a credit default swap ETF. Current State of Bond Yields (click to enlarge) Since the European Debt Crisis, which peaked in 2012, junk bond yields had been steadily falling outside of a small blip in 2014. Starting around the end of 2014, however, the increase in yields began in earnest and is now accelerating to the quickest pace since 2011. Yields are spiking, and while this is still far from what is seen during a credit crisis, the warning signs are there. Junk bond yields are now more than 20% higher than they were just a year ago, and there is no sign of an impending correction. On the contrary, the fundamentals seem to be pointing toward a further rise in junk bond yields. Explaining Recent Price Action (click to enlarge) Much of the current trend in junk bond yields can be explained by referring back to oil prices. As oil prices started to fall in 2014, yields immediately began to rise in response. When the oil price bottomed at the start of 2015, yields steadied a bit, though the trend toward rising yields remained. There was hope that oil prices would continue to rebound in the second quarter of the year, but those hopes have been dashed as oil has stood its ground around $60 a barrel. At this point, yields have responded by rising even more and accelerating. While oil explains much of this phenomenon, the increase in yields cannot be blamed totally on the black liquid. (click to enlarge) Another major trend that came about starting in 2014 has been falling corporate profits. These numbers have been showing consistent deterioration since then, and while the Q1 2015 numbers give a sign of possible hope, the historical record does not look good. The last time that corporate profits fell this much, bond yields soared in response after about a year and a half. If that sets any precedent, then bond yields are again about to soar either at the end of this quarter or in the next, especially if corporate profits are weak yet again. Given the past, now is absolutely the time to buy protection against rising yields and bond defaults. The ProShares CDS Short North American HY Credit ETF (BATS: WYDE ) may be the perfect way to play the current situation. As the ETF is short high yield credit, it profits when default rates rise, as the ETF owns a broad basket of high yield credit default swaps. While offering protection against default risk, WYDE has also shown itself to protect against time decay. Since its inception in August of 2014, WYDE has lost less than 5% of its value. CDS protection does have a cost over time, and given that it has lost so little over the time, WYDE is a safe way to play the high yield bond market with little time decay. Summary and Action to Take Junk bonds are a risky proposition right now. Oil prices look to have stalled and a quick recovery to previous levels looks a long way off. In addition, corporate profits have been weak and have been deteriorating at a pace not seen since the onset of the financial crisis. Now is the perfect time to buy protection against a spike in junk bond yields by buying credit default swaps. For the small retail investor, CDS exposure is difficult, and thus gaining exposure via the WYDE ETF may be the perfect way to do so. Disclosure: I am/we are long WYDE. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News