Scalper1 News

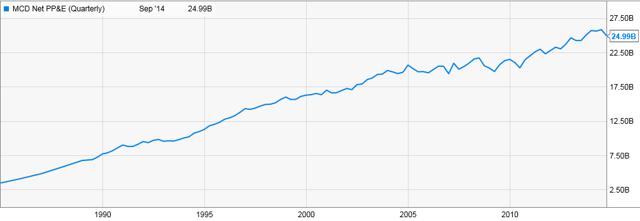

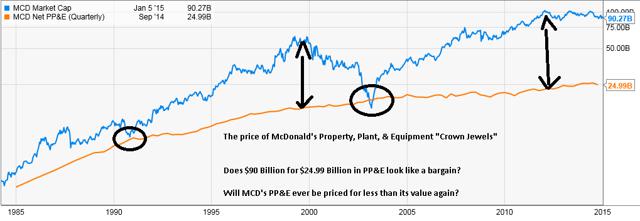

Value investing requires one to find a bargain before investing. This is known as a margin of safety. Some investors may identify value in McDonald’s by examining price compared to property, plant & equipment. At almost four times the level of PP&E, those now considering an investment in McDonald’s must provide a detailed thesis why it makes sense to buy at this price. There are many different ways to make and lose money in the market. There is growth investing, commodity trading, arbitrage, spread trading, big-picture macro trading, currency trading, and then there is value investing. The key is to find a method you are comfortable with. For many successful investors like billionaire, philanthropist, investor and author of Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor , Seth Klarman, their method happens to be value investing. Although there are different approaches to value investing, the primary tenet is buying something thought to be a bargain . Although the holding period and entry point may be different for every value investor, the concept is still the same. The community often uses the term, “margin of safety.” Millions of people get exposure to this concept when shopping for groceries each week. Piggly Wiggly grocery store, created by: liberalmind1012 [commons.wikimedia.org/wiki/File:Piggly_Wiggly.jpg] What entry point, how long you hold it and what percentage of your portfolio the security will represent is up to you. Each and every person approaches the market in a different way . N o one recommendation is appropriate for a diverse audience. Beware of the charlatans that tell you otherwise. There are, however, concepts that are important. Value investing with a margin of safety happens to be an often lucrative one. Today we delve into the concept of, “margin of safety,” and how one may choose to find it. Because the margin of safety concept is finding a bargain on something , we must clarify what this something is. This something may happen to be different for every person. Many value investors find safety in buying stocks when there is a discount on earnings. Those investors may use a P/E ratio, or Price to Earnings ratio. Others look to find a bargain on something tangible , like real assets. Just as every ancient civilization’s royalty collected treasures, businesses today collect treasures too. Businesses are modern-day kingdoms. Instead of accumulating marginally useful objects like rubies, the most successful businesses collect assets of a different form. Not the useless assets hoarded by kingdoms of eras past, but productive assets that create things for the wants and needs of society. They are the modern day Crown Jewels . Imperial Crown of India: created by CSvBibra posted at the site: https://www.flickr.com/photos/33257058@N00/3285807144 These Crown Jewels, in fact, have real value. The government mandates corporations state the value of these assets every quarter . Knowing this number and studying its past price is of utmost importance to the fiduciary duty of any investor. It is your choice to use this freely accessible information. Ignore it at your own risk. Have you ever heard some people say McDonald’s (NYSE: MCD ) is a real estate company that sells hamburgers? In fact, there is some validity to this, as observed in the 1987 article: Big Macs, Fries, and Real Estate . Picture of McDonald’s: By Bruce Marlin (Own work) [CC BY-SA 2.5 ( http://commons.wikimedia.org/wiki/File:McDonalds_Museum.jpg )], via Wikimedia Commons The reason why some people say McDonald’s is a real estate company that sells burgers is because their property is a major asset. Property happens to be a very important crown jewel. For, without the land and building there would be no place to enjoy a signature Egg McMuffin. Egg McMuffin Picture: By Evan-Amos (Own work) [Public domain], via Wikimedia Commons [ commons.wikimedia.org/wiki/File:McD-Egg-… ] Displayed below is the value of McDonald’s’ property, plant and equipment . At a figure of $24.99 billion, McDonald’s sure has a lot of Golden Arches. Almost everyone living on this planet would recognize the growth of McDonald’s over the last twenty years. A new McDonald’s location pops up somewhere at a continuous rate. From the start of this chart in 1984 at a level of $3 billion, growth is represented in the blue PP&E line increasing. Graphic: www.Ycharts.com The chart below is the cost to buy McDonald’s’ PP&E. This is what investors call Market Capitalization. It is the cost of buying the entire equity stake in a company. Investors are more familiar with stock price, which is the price of one share out of the total number of shares. At a current figure of $90.18 billion, this line has also increased over time. Graphic: www.Ycharts.com The astute investor should recognize the increase in price was not as steady as the plot of PP&E. This fluctuation is due to the sometimes irrational behavior of Mr. Market. This erratic behavior of the market is what causes heartache for those that overpay and gives wealth to the diligent bargain hunter. Bubble Cartoon of “J.P. Morgan”: By Udo J. Keppler (a.k.a. Joseph Keppler, Jr.; 1872-1956), cartoonist [Public domain], via Wikimedia Commons What is necessary to be successful in the investing world is not commonplace. Only but a few value oriented investors treat investing like grocery shopping. Too frequently, we do not connect price to an asset, as we would with 1-gallon of milk or 1-gallon of gas. Most people do not equate buying a business as buying a company’s assets. Whether it is because the media leads them into believing it is just a piece of paper designed to be traded or they were never taught in school matters not. Thinking this way, we do not see it as an entity that owns property. This way of thinking must change. Examine the chart below. Spaghetti Chart: www.Ycharts.com , Created By: The Socratic Investor The blue line represents price. The orange line represents some, “Crown Jewel,” asset. Observe some of the best times to buy McDonald’s, 1992 and 2009, happened to be when price was near the value of assets. Contrarily, like after 1999, major draw-downs occurred the further the price was from assets. Was this a mere coincidence? Or was Mr. Market simply not willing to pay 3.5 times the value of MCD’s property, plant and equipment holdings anymore? No matter what the answer is, these tangible assets ended up going on sale shortly after. There is a specific dollar value of assets McDonald’s has in possession. For PP&E, the current number is $24.99 billion. There is also a specific price for that PP&E, which is $90.27 billion. The price for nearly $25 billion in PP&E is currently priced about $90 billion. If you are considering MCD as an investment, ask yourself if you think Mr. Market might ever again not be willing to pay 3.5 times the value of McDonald’s’ PP&E. Think about it as purchasing a $266,666 home from a great realtor. She is a well known star realtor. She explains to you the potential for the land to appreciate and the ability for the basement to produce rental income. The only problem is she is asking $1,000,000. Behind the realtor’s back, you speak to the homeowner and find out she would sell it you directly for $266,666. Would you be able to explain to your spouse why buying from the realtor is a good idea? Perhaps you believe the value of the home will triple in five years. There may be a plethora of reasons why you would pay that much for a home. But if you had the chance of buying that same property from the homeowner for 1/3 the price and still had the potential to produce income and increase in value, would that make more sense? Of course, this is not a perfect example. In addition to PP&E, McDonald’s has cash in the bank, receivables, and inventory. It is your job to find the real assets that give value to a company. Every company has different assets . Some companies’ crown jewels are in their inventory, like retailers. For others, their assets might be in receivables, like banks. YouTube Clip: Do your homework to find those assets real value and identify a margin of safety where you could clearly explain to your spouse why it makes sense to pay the asking price. Be able to present a clear argument in its favor. Otherwise, especially if you are responsible for other people’s money, you might just be neglecting your fiduciary responsibility. Scalper1 News

Value investing requires one to find a bargain before investing. This is known as a margin of safety. Some investors may identify value in McDonald’s by examining price compared to property, plant & equipment. At almost four times the level of PP&E, those now considering an investment in McDonald’s must provide a detailed thesis why it makes sense to buy at this price. There are many different ways to make and lose money in the market. There is growth investing, commodity trading, arbitrage, spread trading, big-picture macro trading, currency trading, and then there is value investing. The key is to find a method you are comfortable with. For many successful investors like billionaire, philanthropist, investor and author of Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor , Seth Klarman, their method happens to be value investing. Although there are different approaches to value investing, the primary tenet is buying something thought to be a bargain . Although the holding period and entry point may be different for every value investor, the concept is still the same. The community often uses the term, “margin of safety.” Millions of people get exposure to this concept when shopping for groceries each week. Piggly Wiggly grocery store, created by: liberalmind1012 [commons.wikimedia.org/wiki/File:Piggly_Wiggly.jpg] What entry point, how long you hold it and what percentage of your portfolio the security will represent is up to you. Each and every person approaches the market in a different way . N o one recommendation is appropriate for a diverse audience. Beware of the charlatans that tell you otherwise. There are, however, concepts that are important. Value investing with a margin of safety happens to be an often lucrative one. Today we delve into the concept of, “margin of safety,” and how one may choose to find it. Because the margin of safety concept is finding a bargain on something , we must clarify what this something is. This something may happen to be different for every person. Many value investors find safety in buying stocks when there is a discount on earnings. Those investors may use a P/E ratio, or Price to Earnings ratio. Others look to find a bargain on something tangible , like real assets. Just as every ancient civilization’s royalty collected treasures, businesses today collect treasures too. Businesses are modern-day kingdoms. Instead of accumulating marginally useful objects like rubies, the most successful businesses collect assets of a different form. Not the useless assets hoarded by kingdoms of eras past, but productive assets that create things for the wants and needs of society. They are the modern day Crown Jewels . Imperial Crown of India: created by CSvBibra posted at the site: https://www.flickr.com/photos/33257058@N00/3285807144 These Crown Jewels, in fact, have real value. The government mandates corporations state the value of these assets every quarter . Knowing this number and studying its past price is of utmost importance to the fiduciary duty of any investor. It is your choice to use this freely accessible information. Ignore it at your own risk. Have you ever heard some people say McDonald’s (NYSE: MCD ) is a real estate company that sells hamburgers? In fact, there is some validity to this, as observed in the 1987 article: Big Macs, Fries, and Real Estate . Picture of McDonald’s: By Bruce Marlin (Own work) [CC BY-SA 2.5 ( http://commons.wikimedia.org/wiki/File:McDonalds_Museum.jpg )], via Wikimedia Commons The reason why some people say McDonald’s is a real estate company that sells burgers is because their property is a major asset. Property happens to be a very important crown jewel. For, without the land and building there would be no place to enjoy a signature Egg McMuffin. Egg McMuffin Picture: By Evan-Amos (Own work) [Public domain], via Wikimedia Commons [ commons.wikimedia.org/wiki/File:McD-Egg-… ] Displayed below is the value of McDonald’s’ property, plant and equipment . At a figure of $24.99 billion, McDonald’s sure has a lot of Golden Arches. Almost everyone living on this planet would recognize the growth of McDonald’s over the last twenty years. A new McDonald’s location pops up somewhere at a continuous rate. From the start of this chart in 1984 at a level of $3 billion, growth is represented in the blue PP&E line increasing. Graphic: www.Ycharts.com The chart below is the cost to buy McDonald’s’ PP&E. This is what investors call Market Capitalization. It is the cost of buying the entire equity stake in a company. Investors are more familiar with stock price, which is the price of one share out of the total number of shares. At a current figure of $90.18 billion, this line has also increased over time. Graphic: www.Ycharts.com The astute investor should recognize the increase in price was not as steady as the plot of PP&E. This fluctuation is due to the sometimes irrational behavior of Mr. Market. This erratic behavior of the market is what causes heartache for those that overpay and gives wealth to the diligent bargain hunter. Bubble Cartoon of “J.P. Morgan”: By Udo J. Keppler (a.k.a. Joseph Keppler, Jr.; 1872-1956), cartoonist [Public domain], via Wikimedia Commons What is necessary to be successful in the investing world is not commonplace. Only but a few value oriented investors treat investing like grocery shopping. Too frequently, we do not connect price to an asset, as we would with 1-gallon of milk or 1-gallon of gas. Most people do not equate buying a business as buying a company’s assets. Whether it is because the media leads them into believing it is just a piece of paper designed to be traded or they were never taught in school matters not. Thinking this way, we do not see it as an entity that owns property. This way of thinking must change. Examine the chart below. Spaghetti Chart: www.Ycharts.com , Created By: The Socratic Investor The blue line represents price. The orange line represents some, “Crown Jewel,” asset. Observe some of the best times to buy McDonald’s, 1992 and 2009, happened to be when price was near the value of assets. Contrarily, like after 1999, major draw-downs occurred the further the price was from assets. Was this a mere coincidence? Or was Mr. Market simply not willing to pay 3.5 times the value of MCD’s property, plant and equipment holdings anymore? No matter what the answer is, these tangible assets ended up going on sale shortly after. There is a specific dollar value of assets McDonald’s has in possession. For PP&E, the current number is $24.99 billion. There is also a specific price for that PP&E, which is $90.27 billion. The price for nearly $25 billion in PP&E is currently priced about $90 billion. If you are considering MCD as an investment, ask yourself if you think Mr. Market might ever again not be willing to pay 3.5 times the value of McDonald’s’ PP&E. Think about it as purchasing a $266,666 home from a great realtor. She is a well known star realtor. She explains to you the potential for the land to appreciate and the ability for the basement to produce rental income. The only problem is she is asking $1,000,000. Behind the realtor’s back, you speak to the homeowner and find out she would sell it you directly for $266,666. Would you be able to explain to your spouse why buying from the realtor is a good idea? Perhaps you believe the value of the home will triple in five years. There may be a plethora of reasons why you would pay that much for a home. But if you had the chance of buying that same property from the homeowner for 1/3 the price and still had the potential to produce income and increase in value, would that make more sense? Of course, this is not a perfect example. In addition to PP&E, McDonald’s has cash in the bank, receivables, and inventory. It is your job to find the real assets that give value to a company. Every company has different assets . Some companies’ crown jewels are in their inventory, like retailers. For others, their assets might be in receivables, like banks. YouTube Clip: Do your homework to find those assets real value and identify a margin of safety where you could clearly explain to your spouse why it makes sense to pay the asking price. Be able to present a clear argument in its favor. Otherwise, especially if you are responsible for other people’s money, you might just be neglecting your fiduciary responsibility. Scalper1 News

Scalper1 News