Scalper1 News

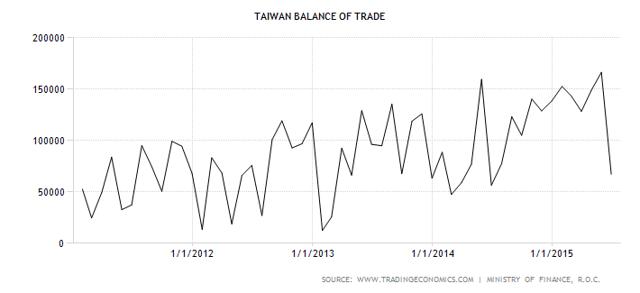

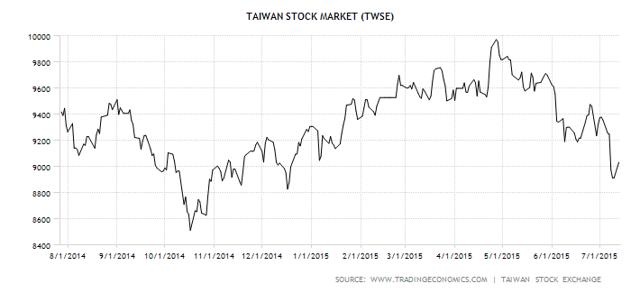

Summary The iShares MSCI Taiwan ETF has extremely low valuation at the moment. Taiwan experienced a large drop in exports in June, while exports are expected to begin increasing in the 3rd quarter of 2015; this has created a buy opportunity. Taiwan is a very stable country to invest in; there has been conservative economic growth, low inflation, consistent trade surpluses, and negligible exchange rate movements. In previous articles, I have mentioned investment opportunities into fast growing economies such as the Phillipines and Indonesia through ETFs, and believe these regions have ample potential. However, Taiwan presents itself as a more stable investment option, and valuation is extremely attractive at the moment. I have decided to turn my attention to the iShares MSCI Taiwan ETF (NYSEARCA: EWT ), as a means for investors to gain exposure to Taiwan. GDP Growth GDP growth in Taiwan can be characterized as very consistent and moderate. Future projections provide the same results more or less, with a slightly more beneficial outlook; GDP growth is expected to rise 2.7% year on year until 2019 . Other forecasts, after assessing China’s threat to Taiwan’s exports, have lowered GDP growth projections from 3.78% to 3.28% in 2015 . The benefit with Taiwan thus can be characterized as stability, coupled with moderate and consistent growth projected for the future. (click to enlarge) Source: Trading Economics. FX Risks One benefit of investing in Taiwan is its extremely stable currency and low inflation rate. The exchange rate movement for this currency has been negligent, with an average rate of 31.25 since 1979, and has most recently been consistently close to 30 in recent years. Inflation has also been very low, and has mostly recently been -0.56% in June 2015. Towards the end of 2015, inflation averaged between 0.6% to 2%. Taiwan has the comparative advantage of low inflation and negligent exchange rate movement, when compared to other countries in Asia. The rise of Taiwan’s currency, which is rising faster than Japan, South Korea, and China, does present a threat to its tech exports , as this contributes vastly to its economy. Consistent Trade Surplus As a strong tech export country, it is favorable to note that Taiwan’s balance of trade has been on the rise in recent years. Projection for future balance of trade in Taiwan provides mixed results: Demand from developed markets continues to improve, mainly in the USA and Europe. This is balanced with caution, as the demand from emerging countries such as China has been decreasing. June has been a particularly challenging month for Taiwan, as export demands decreased by 13.9% , the largest decrease since February of 2015. (click to enlarge) Source: Trading Economics. Exports in Taiwan are projected to grow at a moderate rate for the next year. TWD Million Last Q3 2015 Q4 2015 Q1 2016 Q2 2016 Exports 709,860 752,876 755,280 754,089 751,775 Investors wishing to profit off of growth in exports, may find it beneficial to develop a short strategy, by waiting until the 4th quarter of 2015 when exports increase by 6.4%. While exports do not have substantial potential for growth based on these projections, having moderate growth in an export heavy country, with a stable currency and low inflation, makes this investment very conservative. Moreover, the valuation is incredibly low, and investors may determine it beneficial to hold this stock longer, and to choose a higher exit P/E. Economic Cooperation Framework Agreement The Economic Cooperation Framework Agreement , a significant trade deal completed with China in 2010, has already proved to be a catalyst for economic growth; the agreement has not been able to expand beyond its initial stages, due to protests beginning in March last year. The agreement was created to reduce tariffs and commercial barriers between the two countries. Currently, statistics have shown that the trade agreement has saved Taiwan $2.4 billion on tariffs and could boost the country’s GDP by 1.5% if fully implemented. With decreased demand from China and high dependency on exports for revenue, the full implementation of this agreement clearly has the ability to give Taiwan’s economy the boost necessary to achieve further growth. Taiwan Stock Market One last benefit of investment in Taiwan has been the consistent rise of the stock market since late 2014, coupled with the recent index plunge beginning in May of 2015. The Taiwan Stock Market is expected to increase to 9,390.06 points in 2016 , which represents a 5.3% increase. A moderate increase in the TSWE will be attractive, especially after examining the fast financial performance of the fund’s holdings later in this article. (click to enlarge) Source: Trading Economics. Diverse Growth Taiwan has had substantial growth in a wide variety of industries and areas in 2015: Taiwan’s industrial production index gained 6.49% year on year in March of 2015. During this time, construction also grew by 15.06%, and manufacturing of electronic components rose by 11.41%. Machinery and Equipment grew by 14.4% and chemical materials rose by 13.6%. Food services and retail both gained 1.9% and 1.3% respectively. Consumer spending has been significantly increasing since 2012, with a most recent annual increase of 2% in the 1st quarter of 2015. Taiwan’s manufacturing sector also reached an all time high in 2014, with a 3.5% year on year increase in revenue . Increased consumption and exports from Taiwan’s tech sectors have all contributed to the country’s economic growth. Moreover, increased wages has also been a catalyst for increased consumer spending, further contributing to economic growth. Taiwan has a strong advantage as a high tech export company, that domestically also has a very favorable outlook. While it is certainly not at its most strategic growth point, there is still growth ahead, and investors can feel confident regarding the country’s past economic performance. Moreover, the growth in manufacturing in Taiwan is crucial, as this will be another factor that will boost the economy and increase consumer’s confidence. Buy Opportunity EWT data by YCharts Things started to look less favorable in Taiwan beginning in June, when industrial production dropped -3.18%, as oppose to the 1.21% gain anticipated. As previously mentioned exports also decreased substantially during this month, at a two year record low. Poor performance in June attributed to the drop in the fund price; this creates a short term opportunity for the anticipated increase in exports and also an opportunity for long term investors to take advantage of the low valuation this has created. Price/Earnings 12.93 Price/Book 1.74 Price/Sales 0.94 Source: Yahoo Finance . Conclusion While Taiwan certainly has major threats ahead and will be no means among the fastest growing economies, the country can be characterized as a conservative country to invest in, that has acceptable levels of growth ahead. The current valuation of this fund is a key reason to invest in Taiwan at the moment, while investing in equity in Taiwan with higher valuation is not a very strategic investment objective; the economic environment in Taiwan is favorable, but there is not enough growth ahead to justify investing in companies with moderate or high valuation. Therefore, the investment approach to Taiwan should be considered accordingly, as it may not be the best environment for long term investment. Unless there is a considerable boost in Taiwan’s position as a tech export country, with increased exports to emerging countries specifically, it is best to sell this fund once the valuation is high or even average. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary The iShares MSCI Taiwan ETF has extremely low valuation at the moment. Taiwan experienced a large drop in exports in June, while exports are expected to begin increasing in the 3rd quarter of 2015; this has created a buy opportunity. Taiwan is a very stable country to invest in; there has been conservative economic growth, low inflation, consistent trade surpluses, and negligible exchange rate movements. In previous articles, I have mentioned investment opportunities into fast growing economies such as the Phillipines and Indonesia through ETFs, and believe these regions have ample potential. However, Taiwan presents itself as a more stable investment option, and valuation is extremely attractive at the moment. I have decided to turn my attention to the iShares MSCI Taiwan ETF (NYSEARCA: EWT ), as a means for investors to gain exposure to Taiwan. GDP Growth GDP growth in Taiwan can be characterized as very consistent and moderate. Future projections provide the same results more or less, with a slightly more beneficial outlook; GDP growth is expected to rise 2.7% year on year until 2019 . Other forecasts, after assessing China’s threat to Taiwan’s exports, have lowered GDP growth projections from 3.78% to 3.28% in 2015 . The benefit with Taiwan thus can be characterized as stability, coupled with moderate and consistent growth projected for the future. (click to enlarge) Source: Trading Economics. FX Risks One benefit of investing in Taiwan is its extremely stable currency and low inflation rate. The exchange rate movement for this currency has been negligent, with an average rate of 31.25 since 1979, and has most recently been consistently close to 30 in recent years. Inflation has also been very low, and has mostly recently been -0.56% in June 2015. Towards the end of 2015, inflation averaged between 0.6% to 2%. Taiwan has the comparative advantage of low inflation and negligent exchange rate movement, when compared to other countries in Asia. The rise of Taiwan’s currency, which is rising faster than Japan, South Korea, and China, does present a threat to its tech exports , as this contributes vastly to its economy. Consistent Trade Surplus As a strong tech export country, it is favorable to note that Taiwan’s balance of trade has been on the rise in recent years. Projection for future balance of trade in Taiwan provides mixed results: Demand from developed markets continues to improve, mainly in the USA and Europe. This is balanced with caution, as the demand from emerging countries such as China has been decreasing. June has been a particularly challenging month for Taiwan, as export demands decreased by 13.9% , the largest decrease since February of 2015. (click to enlarge) Source: Trading Economics. Exports in Taiwan are projected to grow at a moderate rate for the next year. TWD Million Last Q3 2015 Q4 2015 Q1 2016 Q2 2016 Exports 709,860 752,876 755,280 754,089 751,775 Investors wishing to profit off of growth in exports, may find it beneficial to develop a short strategy, by waiting until the 4th quarter of 2015 when exports increase by 6.4%. While exports do not have substantial potential for growth based on these projections, having moderate growth in an export heavy country, with a stable currency and low inflation, makes this investment very conservative. Moreover, the valuation is incredibly low, and investors may determine it beneficial to hold this stock longer, and to choose a higher exit P/E. Economic Cooperation Framework Agreement The Economic Cooperation Framework Agreement , a significant trade deal completed with China in 2010, has already proved to be a catalyst for economic growth; the agreement has not been able to expand beyond its initial stages, due to protests beginning in March last year. The agreement was created to reduce tariffs and commercial barriers between the two countries. Currently, statistics have shown that the trade agreement has saved Taiwan $2.4 billion on tariffs and could boost the country’s GDP by 1.5% if fully implemented. With decreased demand from China and high dependency on exports for revenue, the full implementation of this agreement clearly has the ability to give Taiwan’s economy the boost necessary to achieve further growth. Taiwan Stock Market One last benefit of investment in Taiwan has been the consistent rise of the stock market since late 2014, coupled with the recent index plunge beginning in May of 2015. The Taiwan Stock Market is expected to increase to 9,390.06 points in 2016 , which represents a 5.3% increase. A moderate increase in the TSWE will be attractive, especially after examining the fast financial performance of the fund’s holdings later in this article. (click to enlarge) Source: Trading Economics. Diverse Growth Taiwan has had substantial growth in a wide variety of industries and areas in 2015: Taiwan’s industrial production index gained 6.49% year on year in March of 2015. During this time, construction also grew by 15.06%, and manufacturing of electronic components rose by 11.41%. Machinery and Equipment grew by 14.4% and chemical materials rose by 13.6%. Food services and retail both gained 1.9% and 1.3% respectively. Consumer spending has been significantly increasing since 2012, with a most recent annual increase of 2% in the 1st quarter of 2015. Taiwan’s manufacturing sector also reached an all time high in 2014, with a 3.5% year on year increase in revenue . Increased consumption and exports from Taiwan’s tech sectors have all contributed to the country’s economic growth. Moreover, increased wages has also been a catalyst for increased consumer spending, further contributing to economic growth. Taiwan has a strong advantage as a high tech export company, that domestically also has a very favorable outlook. While it is certainly not at its most strategic growth point, there is still growth ahead, and investors can feel confident regarding the country’s past economic performance. Moreover, the growth in manufacturing in Taiwan is crucial, as this will be another factor that will boost the economy and increase consumer’s confidence. Buy Opportunity EWT data by YCharts Things started to look less favorable in Taiwan beginning in June, when industrial production dropped -3.18%, as oppose to the 1.21% gain anticipated. As previously mentioned exports also decreased substantially during this month, at a two year record low. Poor performance in June attributed to the drop in the fund price; this creates a short term opportunity for the anticipated increase in exports and also an opportunity for long term investors to take advantage of the low valuation this has created. Price/Earnings 12.93 Price/Book 1.74 Price/Sales 0.94 Source: Yahoo Finance . Conclusion While Taiwan certainly has major threats ahead and will be no means among the fastest growing economies, the country can be characterized as a conservative country to invest in, that has acceptable levels of growth ahead. The current valuation of this fund is a key reason to invest in Taiwan at the moment, while investing in equity in Taiwan with higher valuation is not a very strategic investment objective; the economic environment in Taiwan is favorable, but there is not enough growth ahead to justify investing in companies with moderate or high valuation. Therefore, the investment approach to Taiwan should be considered accordingly, as it may not be the best environment for long term investment. Unless there is a considerable boost in Taiwan’s position as a tech export country, with increased exports to emerging countries specifically, it is best to sell this fund once the valuation is high or even average. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News