Scalper1 News

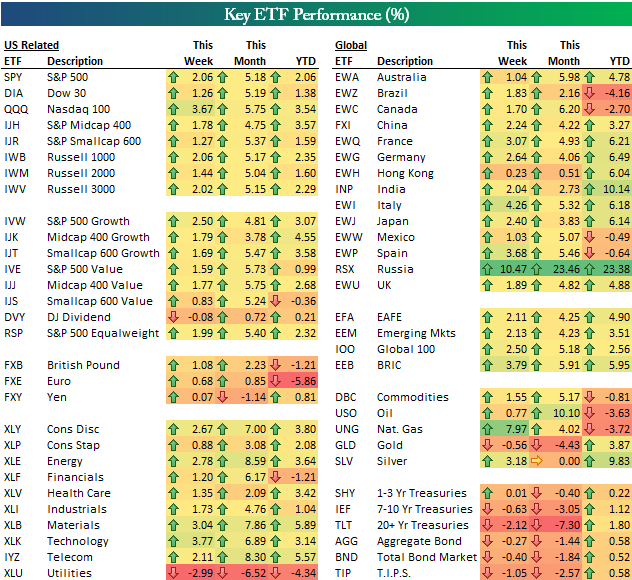

Below is a look at the performance of various asset classes through President’s Day 2015 using key ETFs from our daily ETF Trends report available to Bespoke Premium members. For each ETF, we show its performance last week, so far in February, and so far in 2015. US-related ETFs are generally on the left side of the matrix, while international, commodity and fixed income ETFs are on the right side of the matrix. US equities are up sharply so far in February, which has allowed them to erase January losses and move into the green for the year. The S&P 500 (NYSEARCA: SPY ) and Dow 30 (NYSEARCA: DIA ) ETFs are both up more than 5% in February, while the Nasdaq 100 (NASDAQ: QQQ ) is up 5.75%. Largecaps and midcaps are outperforming smallcaps year-to-date, while growth is outperforming value. Looking at the ten sectors, Energy (NYSEARCA: XLE ), Materials (NYSEARCA: XLB ), Telecom (NYSEARCA: IYZ ) and Consumer Discretionary (NYSEARCA: XLY ) are all up 7%+ this month already. On the flip side, the Utilities (NYSEARCA: XLU ) sector has plummeted this month, leaving it down more than 4% on the year. Outside of the US, most countries are in the green for the year, with the exception of Brazil (NYSEARCA: EWZ ), Canada (NYSEARCA: EWC ), Mexico (NYSEARCA: EWW ) and Spain (NYSEARCA: EWP ). The Russia ETF (NYSEARCA: RSX ) is up the most of any ETF in the matrix with a year-to-date gain of 23.38%. Commodities have been all over the place this year. Oil (NYSEARCA: USO ) is up 10% in February, but it’s still down 3.63% year-to-date. Gold (NYSEARCA: GLD ) is down 4.43% in February, but it’s up 3.87% YTD. Finally, fixed income ETFs have run into a rough patch over the last couple of weeks, especially the 20+Yr Treasury (NYSEARCA: TLT ) with a decline of 7.3% on the month. Even after the pullback, though, fixed income ETFs remain in the green on the year. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Below is a look at the performance of various asset classes through President’s Day 2015 using key ETFs from our daily ETF Trends report available to Bespoke Premium members. For each ETF, we show its performance last week, so far in February, and so far in 2015. US-related ETFs are generally on the left side of the matrix, while international, commodity and fixed income ETFs are on the right side of the matrix. US equities are up sharply so far in February, which has allowed them to erase January losses and move into the green for the year. The S&P 500 (NYSEARCA: SPY ) and Dow 30 (NYSEARCA: DIA ) ETFs are both up more than 5% in February, while the Nasdaq 100 (NASDAQ: QQQ ) is up 5.75%. Largecaps and midcaps are outperforming smallcaps year-to-date, while growth is outperforming value. Looking at the ten sectors, Energy (NYSEARCA: XLE ), Materials (NYSEARCA: XLB ), Telecom (NYSEARCA: IYZ ) and Consumer Discretionary (NYSEARCA: XLY ) are all up 7%+ this month already. On the flip side, the Utilities (NYSEARCA: XLU ) sector has plummeted this month, leaving it down more than 4% on the year. Outside of the US, most countries are in the green for the year, with the exception of Brazil (NYSEARCA: EWZ ), Canada (NYSEARCA: EWC ), Mexico (NYSEARCA: EWW ) and Spain (NYSEARCA: EWP ). The Russia ETF (NYSEARCA: RSX ) is up the most of any ETF in the matrix with a year-to-date gain of 23.38%. Commodities have been all over the place this year. Oil (NYSEARCA: USO ) is up 10% in February, but it’s still down 3.63% year-to-date. Gold (NYSEARCA: GLD ) is down 4.43% in February, but it’s up 3.87% YTD. Finally, fixed income ETFs have run into a rough patch over the last couple of weeks, especially the 20+Yr Treasury (NYSEARCA: TLT ) with a decline of 7.3% on the month. Even after the pullback, though, fixed income ETFs remain in the green on the year. Are you Bullish or Bearish on ? Bullish Bearish Neutral Results for ( ) Thanks for sharing your thoughts. Submit & View Results Skip to results » Share this article with a colleague Scalper1 News

Scalper1 News