Scalper1 News

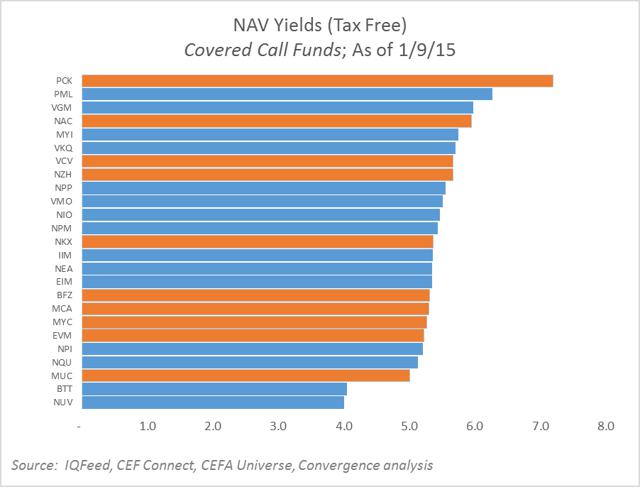

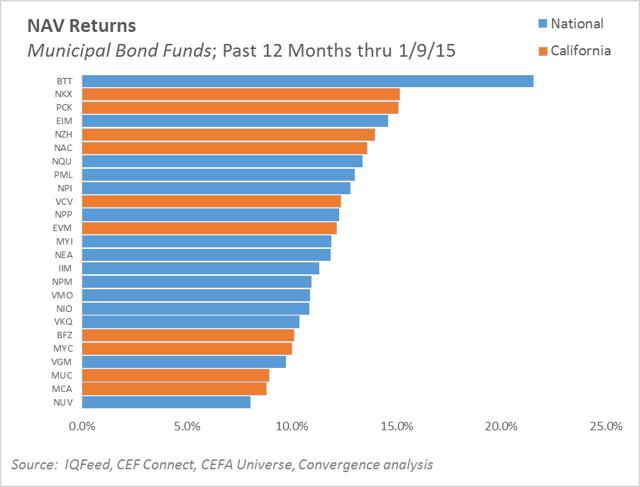

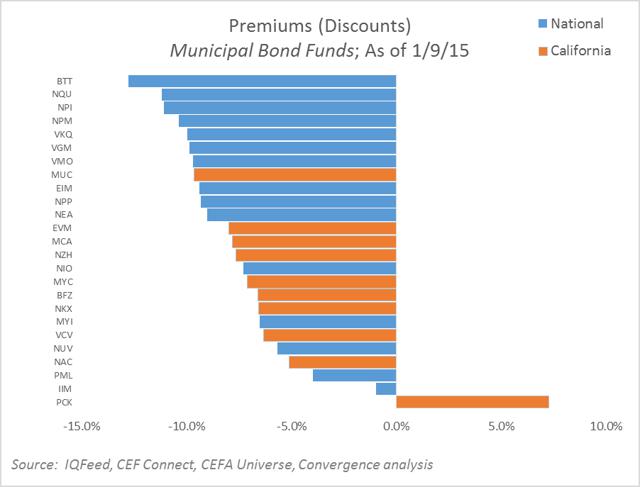

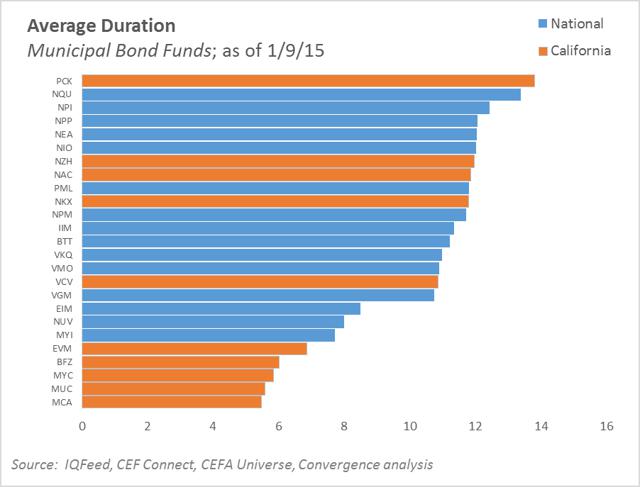

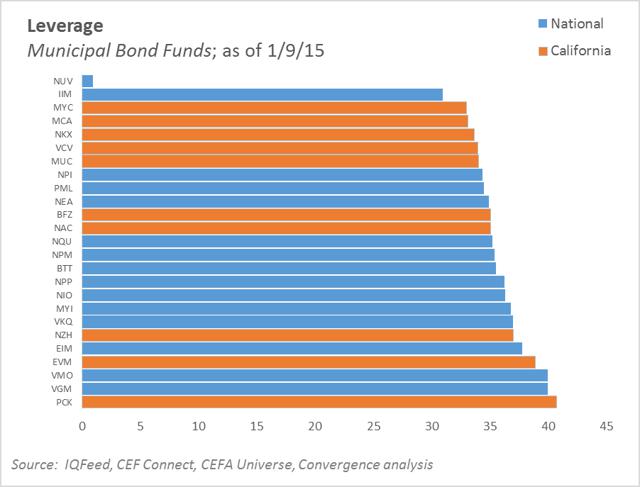

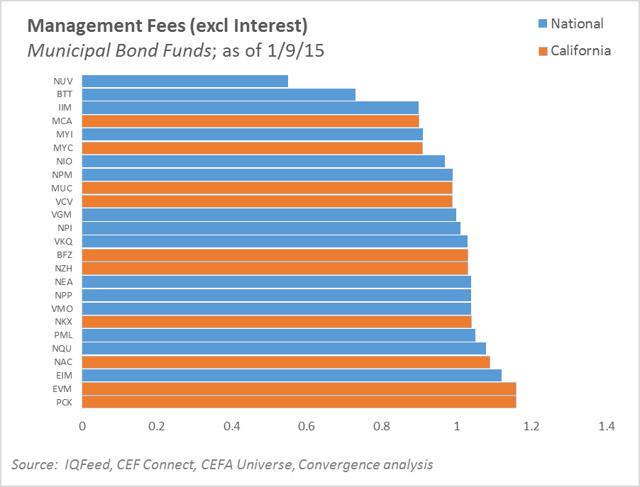

Summary Municipal bond funds currently offer high-tax-bracket investors with very attractive yields that can exceed 10% on a taxable-equivalent basis. Potential muni fund investors should consider, among other factors, yield, duration, and expense ratios when selecting from the more than 150 muni CEF choices. We recommend VCV and MCA to California-based investors, and MYI and VGM to non-Californians as well balanced choices for tax-free income. Our previous article profiled and analyzed the rewards and risks of closed-end funds that invest in municipal bonds. Please refer to that article for a background on the sector as a whole. This article will dig deeper into specific recommendations of especially attractive muni bond CEFs for income-seeking investors to consider. Universe of Included Funds The Convergence investing universe consists of more than 475 closed-end funds across all available equity and bond sectors, after filtering for funds that we consider not investable for a variety of reasons. The municipal bond sector is the largest of closed-end fund category with 150+ different fund choices. This analysis concentrates on 25 of the larger and more liquid muni bond funds. The Muni Bond segment consists of the following closed-end funds: BlackRock California Municipal Income Trust (NYSE: BFZ ) Blackrock Municipal Target Term Trust (NYSE: BTT ) Eaton Vance Municipal Bond Fund (NYSEMKT: EIM ) Eaton Vance California Municipal Bond Fund (NYSEMKT: EVM ) Invesco Value Municipal Income Trust (NYSE: IIM ) BlackRock MuniYield California Insured Fund (NYSE: MCA ) BlackRock MuniHoldings California Quality Fund (NYSE: MUC ) BlackRock MuniYield California Fund (NYSE: MYC ) BlackRock MuniYield Quality III Fund (NYSE: MYI ) Nuveen California Dividend Advantage Municipal Fund (NYSE: NAC ) Nuveen AMT-Free Municipal Income Fund (NYSE: NEA ) Nuveen Municipal Opportunity Fund (NYSE: NIO ) Nuveen California AMT-Free Municipal Income Fund (NYSE: NKX ) Nuveen Premium Income Municipal Fund (NYSE: NPI ) Nuveen Premium Income Municipal Fund 2 (NYSE: NPM ) Nuveen Performance Plus Municipal Fund (NYSE: NPP ) Nuveen Quality Income Municipal Fund (NYSE: NQU ) Nuveen Municipal Value Fund (NYSE: NUV ) Nuveen California Dividend Advantage Municipal Fund 3 (NYSEMKT: NZH ) Pimco California Municipal Income Fund II (NYSE: PCK ) PIMCO Municipal Income Fund II (NYSE: PML ) Invesco California Value Municipal Income Trust (NYSE: VCV ) Invesco Trust for Investment Grade Municipals (NYSE: VGM ) Invesco Municipal Trust (NYSE: VKQ ) Invesco Municipal Opportunity Trust (NYSE: VMO ) Evaluating Investment in Muni Bond Funds There are many qualitative and quantitative factors that prospective investors can consider when evaluating a closed-end fund. Convergence Investments summarizes these many factors into six dimensions useful for comparing and choosing investments: Distribution Yield – How much – and what type(s) – of distribution (aka “yield”) does the fund offer? How likely is it that the fund can maintain or increase this distribution in future? NAV Performance – How has a sector’s or individual fund’s NAV changed in the recent past? What is the outlook for future NAV trends? Valuation – Where is the current market price relative to current NAV for a fund or sector? How does this premium (or discount) to NAV compare to the past and to other fund categories? Risk – What level and type of risk is an investor bearing to earn distributions and potential capital gains? Stewardship – Does a fund have strong management? Are its management fees reasonable? Does the board have shareholder-friendly policies in place? Tradeability – How readily can we take a position (long or short) in a particular fund? What are the liquidity (market cap, average daily volume) and trading costs (average spreads, short borrow fees) involved? Distribution Yield Significant distribution yields are among the top motivators for closed-end fund investors. While there are many nuances to fund distributions, including how they’re generated and how sustainable they appear to be, the top-line yield number drives much of the sentiment and investor behavior. Generally, funds within the segment offer a NAV yield* of between 5 and 6% (tax-free). However, investors seeking maximum yield may give special consideration to NAC, VGM, or PML. The truly risk tolerant yield maximizers may consider PCK. * Note that numbers quoted here are calculated as a percentage of NAV rather than market price to provide a more accurate measure of the income generated from portfolio assets. Investors holding closed-end funds at a discount to NAV will earn yields greater than the NAV yields. For instance, a fund trading at a 10% discount will have a price yield of 10/9 ths or 1.11x the NAV yield. (click to enlarge) Please see the previous article for analysis of how tax-free yields compare to taxable yields. NAV Performance Investors disagree about how to interpret recent increases in net asset value. Momentum-oriented investors may see this as a trend likely to continue while mean reversion investors may see exactly the opposite. Convergence generally views recent increases in NAV as a positive factor at both the sector and fund level because we believe that sentiment-driven fund flows tend to play out over months & quarters, not days & weeks. We also view increasing NAV as an indicator of manager skill and of protection against cuts to a fund’s distribution. Muni bond funds have shown remarkable NAV growth strength in the past 12 months. As the chart shows, fund NAV values have generally risen between 10 and 15% in the past year. We believe this strength is a positive as it can provide a cushion against near-term distribution cuts. (click to enlarge) Valuation A major reason to invest in closed-end funds rather than ETFs or traditional mutual funds is the possibility for informed investors to take advantage disconnects between fund price and fund NAV, often referred to as the fund’s premium or discount. We seek to purchase funds at sizeable discounts, and ideally at discounts beyond that which is normal relative to history and/or relative to a fund’s peers in category. Purchasing at a discount offers two attractions. First, purchasing at a discount enhances yields since an investor can own the rights to the income generated from a hypothetical $10 of net assets with only $9 of investment. Second, for investors willing to actively manage their holdings, funds purchased at particularly wide discounts can be sold at narrower discounts – or even premiums – for capital gains that enhance the total returns from a fund. Note: Convergence follows the convention of representing all premiums (price > NAV) as a positive number and all discounts (price < NAV) as a negative value. Funds in this sector are generally trading at moderate discounts of 5 and 10%, with BTT, NQU, and NPI offering the widest discounts. For California fund buyers, MUC stands out with a nearly 9% discount. (click to enlarge) Risk There are no investment free lunches. Municipal Bond CEFs offer significant yields to investors as compensation for the various risks that investors are being asked to take. The principal risk that municipal bond investors are being paid to bear is that of interest rate risk. The most common measure of how sensitive a certain bond or bond fund is to shifts in the yield curve is the duration of that fund. Funds that have bonds further from maturity tend to have longer durations and are more sensitive to interest rate changes. The evaluated funds typically have average duration of between 7 and 12 years, though several of the (click to enlarge) (click to enlarge) Expenses Expense ratios are almost universally accepted as an important criteria in fund selection. However, the unique structure of closed-end funds makes the calculation of relevant expense ratios non-trivial. Convergence favors using a measure of management fees, excluding cost of leverage, as a percent of gross assets instead of the typically higher ratio that complies with "40 act" reporting requirements. In our opinion, ability of CEFs to use leverage with borrowing costs far below what we would pay a broker is to our benefit and cost of capital borrowed for investors' benefit should not be a strike against fund managers. Further, we believe that measuring the expense ratio we pay to fund managers per dollar of portfolio assets they are managing is a more fair way of measuring value-for-money when comparing fees among CEFs or when comparing CEFs to unlevered structures like mutual funds and ETFs. On this adjusted basis, management fees generally fall in the neighborhood of 1.0%. Some of the larger funds, like NUV and BTT, offer significantly lower management fees for investors that balk at 1% expense ratios. (click to enlarge) Conclusion As this article has outlined, there are many dimensions on which you may compare funds. However, we highlight four funds of interest based on their across-the-board attractiveness - two with National portfolios and two that are specific to California issues. National BlackRock MuniYield Quality III Fund - This fund is a high income and relatively low risk candidate. It has a high dividend of 5.73% on NAV and an average duration of 7.7 years, which is low by municipal bond fund standards. Its management, BlackRock reported that as of 2013, 86% of its portfolio was insured. Moreover, it holds $0.21 per share of Undistributed Net Investment Income (UNII) which covers it for about three months of distributions. Invesco Trust for Investment Grade Municipals - This choice offers high income (5.94%) despite a relatively low duration (i.e., sensitivity to interest rate changes) of 5.48 years, though its leverage ratio of 38.61% of NAV is relatively aggressive. At present the fund is selling for 9.57% below NAV, further amplifying distribution yield. Note that the fund does carry a relatively high adjusted expense ratio of 1.03%. California Invesco California Value Municipal Income Trust - This well rounded choice offers a distribution yield near the top of California munis with a 5.63% tax-free yield that can exceed 11% on a tax-equivalent basis for high bracket taxpayers. Founded in 1993 it has performed well over the years. Its discount to NAV has narrowed recently, currently at -5.9% as compared to its -8.4% average for 2014. Average credit quality of its portfolio is BBB. BlackRock MuniYield California Insured Fund - This fund is a conservative choice which still generates moderate income. BlackRock reports an extremely low duration of 5.5 years and carries by a very healthy average credit rating of AA-. Yet, despite the relatively lower risk, it still generates meaningful distribution yield of 5.6%, which could equate to greater than 10% taxable-equivalent yield for some individuals. Additional disclosure: Convergence Investment Management may recommend various securities included within this article for inclusion for individual client portfolios. These recommendations may change at any time and are specific to the individual client's objectives and risk tolerance. Scalper1 News

Summary Municipal bond funds currently offer high-tax-bracket investors with very attractive yields that can exceed 10% on a taxable-equivalent basis. Potential muni fund investors should consider, among other factors, yield, duration, and expense ratios when selecting from the more than 150 muni CEF choices. We recommend VCV and MCA to California-based investors, and MYI and VGM to non-Californians as well balanced choices for tax-free income. Our previous article profiled and analyzed the rewards and risks of closed-end funds that invest in municipal bonds. Please refer to that article for a background on the sector as a whole. This article will dig deeper into specific recommendations of especially attractive muni bond CEFs for income-seeking investors to consider. Universe of Included Funds The Convergence investing universe consists of more than 475 closed-end funds across all available equity and bond sectors, after filtering for funds that we consider not investable for a variety of reasons. The municipal bond sector is the largest of closed-end fund category with 150+ different fund choices. This analysis concentrates on 25 of the larger and more liquid muni bond funds. The Muni Bond segment consists of the following closed-end funds: BlackRock California Municipal Income Trust (NYSE: BFZ ) Blackrock Municipal Target Term Trust (NYSE: BTT ) Eaton Vance Municipal Bond Fund (NYSEMKT: EIM ) Eaton Vance California Municipal Bond Fund (NYSEMKT: EVM ) Invesco Value Municipal Income Trust (NYSE: IIM ) BlackRock MuniYield California Insured Fund (NYSE: MCA ) BlackRock MuniHoldings California Quality Fund (NYSE: MUC ) BlackRock MuniYield California Fund (NYSE: MYC ) BlackRock MuniYield Quality III Fund (NYSE: MYI ) Nuveen California Dividend Advantage Municipal Fund (NYSE: NAC ) Nuveen AMT-Free Municipal Income Fund (NYSE: NEA ) Nuveen Municipal Opportunity Fund (NYSE: NIO ) Nuveen California AMT-Free Municipal Income Fund (NYSE: NKX ) Nuveen Premium Income Municipal Fund (NYSE: NPI ) Nuveen Premium Income Municipal Fund 2 (NYSE: NPM ) Nuveen Performance Plus Municipal Fund (NYSE: NPP ) Nuveen Quality Income Municipal Fund (NYSE: NQU ) Nuveen Municipal Value Fund (NYSE: NUV ) Nuveen California Dividend Advantage Municipal Fund 3 (NYSEMKT: NZH ) Pimco California Municipal Income Fund II (NYSE: PCK ) PIMCO Municipal Income Fund II (NYSE: PML ) Invesco California Value Municipal Income Trust (NYSE: VCV ) Invesco Trust for Investment Grade Municipals (NYSE: VGM ) Invesco Municipal Trust (NYSE: VKQ ) Invesco Municipal Opportunity Trust (NYSE: VMO ) Evaluating Investment in Muni Bond Funds There are many qualitative and quantitative factors that prospective investors can consider when evaluating a closed-end fund. Convergence Investments summarizes these many factors into six dimensions useful for comparing and choosing investments: Distribution Yield – How much – and what type(s) – of distribution (aka “yield”) does the fund offer? How likely is it that the fund can maintain or increase this distribution in future? NAV Performance – How has a sector’s or individual fund’s NAV changed in the recent past? What is the outlook for future NAV trends? Valuation – Where is the current market price relative to current NAV for a fund or sector? How does this premium (or discount) to NAV compare to the past and to other fund categories? Risk – What level and type of risk is an investor bearing to earn distributions and potential capital gains? Stewardship – Does a fund have strong management? Are its management fees reasonable? Does the board have shareholder-friendly policies in place? Tradeability – How readily can we take a position (long or short) in a particular fund? What are the liquidity (market cap, average daily volume) and trading costs (average spreads, short borrow fees) involved? Distribution Yield Significant distribution yields are among the top motivators for closed-end fund investors. While there are many nuances to fund distributions, including how they’re generated and how sustainable they appear to be, the top-line yield number drives much of the sentiment and investor behavior. Generally, funds within the segment offer a NAV yield* of between 5 and 6% (tax-free). However, investors seeking maximum yield may give special consideration to NAC, VGM, or PML. The truly risk tolerant yield maximizers may consider PCK. * Note that numbers quoted here are calculated as a percentage of NAV rather than market price to provide a more accurate measure of the income generated from portfolio assets. Investors holding closed-end funds at a discount to NAV will earn yields greater than the NAV yields. For instance, a fund trading at a 10% discount will have a price yield of 10/9 ths or 1.11x the NAV yield. (click to enlarge) Please see the previous article for analysis of how tax-free yields compare to taxable yields. NAV Performance Investors disagree about how to interpret recent increases in net asset value. Momentum-oriented investors may see this as a trend likely to continue while mean reversion investors may see exactly the opposite. Convergence generally views recent increases in NAV as a positive factor at both the sector and fund level because we believe that sentiment-driven fund flows tend to play out over months & quarters, not days & weeks. We also view increasing NAV as an indicator of manager skill and of protection against cuts to a fund’s distribution. Muni bond funds have shown remarkable NAV growth strength in the past 12 months. As the chart shows, fund NAV values have generally risen between 10 and 15% in the past year. We believe this strength is a positive as it can provide a cushion against near-term distribution cuts. (click to enlarge) Valuation A major reason to invest in closed-end funds rather than ETFs or traditional mutual funds is the possibility for informed investors to take advantage disconnects between fund price and fund NAV, often referred to as the fund’s premium or discount. We seek to purchase funds at sizeable discounts, and ideally at discounts beyond that which is normal relative to history and/or relative to a fund’s peers in category. Purchasing at a discount offers two attractions. First, purchasing at a discount enhances yields since an investor can own the rights to the income generated from a hypothetical $10 of net assets with only $9 of investment. Second, for investors willing to actively manage their holdings, funds purchased at particularly wide discounts can be sold at narrower discounts – or even premiums – for capital gains that enhance the total returns from a fund. Note: Convergence follows the convention of representing all premiums (price > NAV) as a positive number and all discounts (price < NAV) as a negative value. Funds in this sector are generally trading at moderate discounts of 5 and 10%, with BTT, NQU, and NPI offering the widest discounts. For California fund buyers, MUC stands out with a nearly 9% discount. (click to enlarge) Risk There are no investment free lunches. Municipal Bond CEFs offer significant yields to investors as compensation for the various risks that investors are being asked to take. The principal risk that municipal bond investors are being paid to bear is that of interest rate risk. The most common measure of how sensitive a certain bond or bond fund is to shifts in the yield curve is the duration of that fund. Funds that have bonds further from maturity tend to have longer durations and are more sensitive to interest rate changes. The evaluated funds typically have average duration of between 7 and 12 years, though several of the (click to enlarge) (click to enlarge) Expenses Expense ratios are almost universally accepted as an important criteria in fund selection. However, the unique structure of closed-end funds makes the calculation of relevant expense ratios non-trivial. Convergence favors using a measure of management fees, excluding cost of leverage, as a percent of gross assets instead of the typically higher ratio that complies with "40 act" reporting requirements. In our opinion, ability of CEFs to use leverage with borrowing costs far below what we would pay a broker is to our benefit and cost of capital borrowed for investors' benefit should not be a strike against fund managers. Further, we believe that measuring the expense ratio we pay to fund managers per dollar of portfolio assets they are managing is a more fair way of measuring value-for-money when comparing fees among CEFs or when comparing CEFs to unlevered structures like mutual funds and ETFs. On this adjusted basis, management fees generally fall in the neighborhood of 1.0%. Some of the larger funds, like NUV and BTT, offer significantly lower management fees for investors that balk at 1% expense ratios. (click to enlarge) Conclusion As this article has outlined, there are many dimensions on which you may compare funds. However, we highlight four funds of interest based on their across-the-board attractiveness - two with National portfolios and two that are specific to California issues. National BlackRock MuniYield Quality III Fund - This fund is a high income and relatively low risk candidate. It has a high dividend of 5.73% on NAV and an average duration of 7.7 years, which is low by municipal bond fund standards. Its management, BlackRock reported that as of 2013, 86% of its portfolio was insured. Moreover, it holds $0.21 per share of Undistributed Net Investment Income (UNII) which covers it for about three months of distributions. Invesco Trust for Investment Grade Municipals - This choice offers high income (5.94%) despite a relatively low duration (i.e., sensitivity to interest rate changes) of 5.48 years, though its leverage ratio of 38.61% of NAV is relatively aggressive. At present the fund is selling for 9.57% below NAV, further amplifying distribution yield. Note that the fund does carry a relatively high adjusted expense ratio of 1.03%. California Invesco California Value Municipal Income Trust - This well rounded choice offers a distribution yield near the top of California munis with a 5.63% tax-free yield that can exceed 11% on a tax-equivalent basis for high bracket taxpayers. Founded in 1993 it has performed well over the years. Its discount to NAV has narrowed recently, currently at -5.9% as compared to its -8.4% average for 2014. Average credit quality of its portfolio is BBB. BlackRock MuniYield California Insured Fund - This fund is a conservative choice which still generates moderate income. BlackRock reports an extremely low duration of 5.5 years and carries by a very healthy average credit rating of AA-. Yet, despite the relatively lower risk, it still generates meaningful distribution yield of 5.6%, which could equate to greater than 10% taxable-equivalent yield for some individuals. Additional disclosure: Convergence Investment Management may recommend various securities included within this article for inclusion for individual client portfolios. These recommendations may change at any time and are specific to the individual client's objectives and risk tolerance. Scalper1 News

Scalper1 News