Scalper1 News

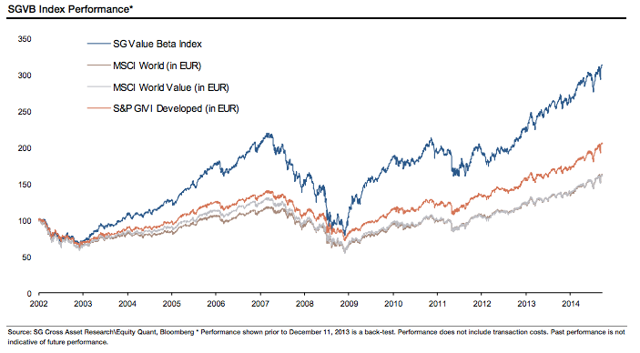

Everyone loves a bargain but choosing a strategy for finding mispriced shares isn’t as simple as it seems. Eighty years after Ben Graham and David Dodd laid the groundwork for what’s known as value investing , some of the brightest minds in finance are still working on the best ways of capturing deep value. Given that research has long shown that cheap beats expensive over the long run, honing a value strategy is clearly worth exploring. So where do you start? When Graham and Dodd wrote Security Analysis in 1934, they changed the rules on how investors should think about stocks. Chastened by catastrophic stock market losses a few years earlier, they urged investors to stop chasing expensive “glamor” and obsessing about earnings growth. Instead, they showed that it was mispriced and undervalued stocks that offered the best chance of outperformance. Ever since, investors have deployed an armory of metrics to help them find shares that don’t reflect the expected value of the companies behind them. Usually, they compare a company’s share price against what it earns — such as the price to earnings ratio — or against what it owns — such as the price to book ratio . One value ratio is never enough When it comes to these value ratios, investors often stick to their favourites. Just take a look at the the guru strategies we track at Stockopedia — many of them use just one valuation metric. But others think it’s too simplistic to use a single ratio to find and compare value stocks. In 2014 the equity research team at investment bank Societe Generale tackled this head on. Led by quant strategist Andrew Lapthorne, they’d already been tracking one value strategy called Quality Income . As the name suggests, it looks for good quality, dividend paying companies. But the focus on relatively high dividend yield is also a signpost to shares that might be cheaply priced. Quality Income was devised for what SocGen call “patient” value investors. These are the ones who are happy to let dividends compound over time in return for less volatility than you see in other types of value strategies. But Quality Income doesn’t get its hands dirty with another major source of value in the market. This is the one that most of us think of when it comes to deep value — buying beaten up, distressed, unloved and ignored stocks. Some of these laggards will never recover but others will bounce back and then some. So SocGen created an alternative strategy for the “brave” investor. Rather than rely on one single ratio, it combines five well known value factors to find stocks that are cheap relative to their sectors. Bravery is needed because these could well be companies with problems. And that means there can be sharp initial losses before the value in them eventually “outs.” The factors include: Book to Price Earnings to Price One Year forward Earnings to Price EBITDA to Enterprise Value Free Cash Flow to Price In 2014, its SG Value Beta index of the 200 cheapest companies globally returned 18.7%, which was broadly in line with other value-based indices. Since 2002, based mainly on back testing, it has consistently outperformed those benchmarks. (click to enlarge) Screening for “brave” deep value stocks Of course on reading the research it became very clear to us that the SocGen team had chosen a strikingly similar set of value ratios to Stockopedia.com’s own ValueRank — with which we already score over 18,000 European and US Stocks. Out in the cold… It’s pretty clear which sectors are currently out in the cold. Oil & gas producers like Ophir Energy ( OTC:OPHRY ) and oilfield services businesses like Petrofac ( OTCPK:POFCY ) and Hunting ( OTCPK:HNTIY ) have been beaten down of late. Likewise, there is a handful of industrials like Serco ( OTCPK:SECCY ), which slumped after issuing a series of profit warnings last year. Troubled cyclicals like pub groups Punch Taverns ( OTCPK:PCTVD ) and Enterprise Inns ( OTCPK:ETINY ) make the list, as does retailer Debenhams ( OTCPK:DBHSY ). Interestingly Debenhams had a ValueRank of 94 back in October 2014, but a gradual edging up in price has trimmed that back to 90. Financial stocks also feature heavily, with Standard Chartered ( OTCPK:SCBFF ) easily the largest by market cap. TSB Banking ( OTCPK:TSBBY ) is also there, as are insurance groups Friends Life ( OTC:RSLLF ) and Phoenix ( OTC:IPHXF ). Name Mkt Cap £m Value Rank Sector Standard Chartered 22,625 93 Financials Petrofac 2,627 91 Energy Phoenix 1,884 97 Financials Indivior 1,276 95 Healthcare Vedanta Resources 1,212 94 Basic Materials Serco 942.5 90 Industrials Debenhams 933.4 90 Consumer Cyclicals MHP SA 637.5 96 Consumer Defensives Deep Value is not for the faint hearted… It’s important to remember that digging around among the cheapest stocks in the market isn’t for the faint hearted. Often these companies come with uncertainty surrounding their financial strength or business viability. It was for that reason that Graham and Dodd encouraged wide diversification — a portfolio approach should harvest the deep value premium and absorb the inevitable losses. In the decades since they introduced the concept of buying undervalued stocks, numerous financial ratios have been used as a measure of what’s cheap. But rather than relying on a single measure, a value composite using several of those value factors is proving to be an effective way of navigating one of the trickiest parts of the market. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Scalper1 News

Everyone loves a bargain but choosing a strategy for finding mispriced shares isn’t as simple as it seems. Eighty years after Ben Graham and David Dodd laid the groundwork for what’s known as value investing , some of the brightest minds in finance are still working on the best ways of capturing deep value. Given that research has long shown that cheap beats expensive over the long run, honing a value strategy is clearly worth exploring. So where do you start? When Graham and Dodd wrote Security Analysis in 1934, they changed the rules on how investors should think about stocks. Chastened by catastrophic stock market losses a few years earlier, they urged investors to stop chasing expensive “glamor” and obsessing about earnings growth. Instead, they showed that it was mispriced and undervalued stocks that offered the best chance of outperformance. Ever since, investors have deployed an armory of metrics to help them find shares that don’t reflect the expected value of the companies behind them. Usually, they compare a company’s share price against what it earns — such as the price to earnings ratio — or against what it owns — such as the price to book ratio . One value ratio is never enough When it comes to these value ratios, investors often stick to their favourites. Just take a look at the the guru strategies we track at Stockopedia — many of them use just one valuation metric. But others think it’s too simplistic to use a single ratio to find and compare value stocks. In 2014 the equity research team at investment bank Societe Generale tackled this head on. Led by quant strategist Andrew Lapthorne, they’d already been tracking one value strategy called Quality Income . As the name suggests, it looks for good quality, dividend paying companies. But the focus on relatively high dividend yield is also a signpost to shares that might be cheaply priced. Quality Income was devised for what SocGen call “patient” value investors. These are the ones who are happy to let dividends compound over time in return for less volatility than you see in other types of value strategies. But Quality Income doesn’t get its hands dirty with another major source of value in the market. This is the one that most of us think of when it comes to deep value — buying beaten up, distressed, unloved and ignored stocks. Some of these laggards will never recover but others will bounce back and then some. So SocGen created an alternative strategy for the “brave” investor. Rather than rely on one single ratio, it combines five well known value factors to find stocks that are cheap relative to their sectors. Bravery is needed because these could well be companies with problems. And that means there can be sharp initial losses before the value in them eventually “outs.” The factors include: Book to Price Earnings to Price One Year forward Earnings to Price EBITDA to Enterprise Value Free Cash Flow to Price In 2014, its SG Value Beta index of the 200 cheapest companies globally returned 18.7%, which was broadly in line with other value-based indices. Since 2002, based mainly on back testing, it has consistently outperformed those benchmarks. (click to enlarge) Screening for “brave” deep value stocks Of course on reading the research it became very clear to us that the SocGen team had chosen a strikingly similar set of value ratios to Stockopedia.com’s own ValueRank — with which we already score over 18,000 European and US Stocks. Out in the cold… It’s pretty clear which sectors are currently out in the cold. Oil & gas producers like Ophir Energy ( OTC:OPHRY ) and oilfield services businesses like Petrofac ( OTCPK:POFCY ) and Hunting ( OTCPK:HNTIY ) have been beaten down of late. Likewise, there is a handful of industrials like Serco ( OTCPK:SECCY ), which slumped after issuing a series of profit warnings last year. Troubled cyclicals like pub groups Punch Taverns ( OTCPK:PCTVD ) and Enterprise Inns ( OTCPK:ETINY ) make the list, as does retailer Debenhams ( OTCPK:DBHSY ). Interestingly Debenhams had a ValueRank of 94 back in October 2014, but a gradual edging up in price has trimmed that back to 90. Financial stocks also feature heavily, with Standard Chartered ( OTCPK:SCBFF ) easily the largest by market cap. TSB Banking ( OTCPK:TSBBY ) is also there, as are insurance groups Friends Life ( OTC:RSLLF ) and Phoenix ( OTC:IPHXF ). Name Mkt Cap £m Value Rank Sector Standard Chartered 22,625 93 Financials Petrofac 2,627 91 Energy Phoenix 1,884 97 Financials Indivior 1,276 95 Healthcare Vedanta Resources 1,212 94 Basic Materials Serco 942.5 90 Industrials Debenhams 933.4 90 Consumer Cyclicals MHP SA 637.5 96 Consumer Defensives Deep Value is not for the faint hearted… It’s important to remember that digging around among the cheapest stocks in the market isn’t for the faint hearted. Often these companies come with uncertainty surrounding their financial strength or business viability. It was for that reason that Graham and Dodd encouraged wide diversification — a portfolio approach should harvest the deep value premium and absorb the inevitable losses. In the decades since they introduced the concept of buying undervalued stocks, numerous financial ratios have been used as a measure of what’s cheap. But rather than relying on a single measure, a value composite using several of those value factors is proving to be an effective way of navigating one of the trickiest parts of the market. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks. Scalper1 News

Scalper1 News