Scalper1 News

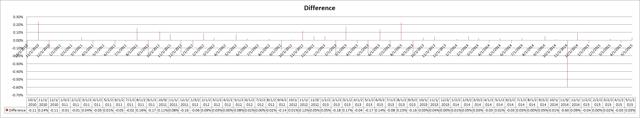

Summary The Vanguard S&P 500 ETF has a strong correlation to SPDR’s S&P 500 ETF. Despite the very strong correlation in returns, there is a clear way to pick which ETF is a better investment. The difference is more than expense ratios. The fund underperforming in one month regularly outperforms in the next using dividend adjusted close values. Investors in the Vanguard S&P 500 ETF (NYSEARCA: VOO ) have plenty of reasons to be happy with their investment. The fund tracks a reasonably stable portion of the U.S. economy and offers investors a lower expense ratio than a major competitor, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). The ratio isn’t substantially lower, but the difference is meaningful if the investment horizon is long enough. For VOO the expense ratio is .05% and for SPY it is .09%. The difference should imply that VOO would outperform over the long term by increasing the compound annual growth rate by about .04%. The difference isn’t huge, but it does add up over time. The correlation Returns between the two ETFs have an extremely high correlation, over 99.9%. The strong correlation in returns gives investors reason to believe that the two ETFs should move almost perfectly in unison. However, there are occasionally meaningful differences in the share price of the two major ETFs and those differences result in opportunities for investors. Looking back I ran some regression on returns since the start of October 2010. Since then, the Vanguard S&P 500 ETF has largely mirrored the SPDR S&P 500 ETF. Both were up between 94.1% and 93.6% and the movements generally occur at almost precisely the same time. The interesting thing was when I decided to track the differences in the dividend adjusted closes for each month. The premise is that for each month I would look at the returns on VOO and subtract the returns on SPY. This gave me the difference in the percentage return for the month. I put together a chart to demonstrate, but the volume of data points may make it a little difficult to read. (click to enlarge) What investors should notice is that the bars are regularly trading direction. Not only do the bars swing back and forth, the longest bars going in any direction are precisely between two bars heading in the opposite direction. When the bars are fairly short, it provides little indication of which way the bars will move in the future. The theory My prediction upon glancing at the numbers was that we should expect to see serial negative correlation in the difference of the returns. In simpler words, we should expect the two ETFs to move together and treat any deviation from that connection as an error by the market. When one ETF has meaningfully outperformed the other in the previous month, the one with weaker performance should be purchased. I tested that by running a correlation between the difference for each month and the difference reported in the next month. If my theory was correct, there should be a negative correlation. The test showed a negative correlation of 35.7% (rounded). With a decent sample size, I’m comfortable taking that as confirmation. In my opinion, the deviations in the market value of these two ETFs can be used as a clear indication on which ETF investors should be buying if they are investing with a time frame of a few years. If the time frame is multiple decades If investors are planning to buy and hold the shares for a few decades, the difference in expense ratios should overwhelm the regression between the two ETFs and I would expect VOO to provide slightly superior returns over the next 20 or 30 years due to the difference in expense ratios. Conclusion Vanguard S&P 500 ETF is a great investment for keeping up with the S&P 500 over the long time. It offers a lower expense ratio than SPY and very similar returns. When the time frame is measured in months or only a couple of years, investors may want to look at the recent difference in returns and choose the ETF that has seen weaker share price performance since there is a very solid history of the differences in performance reversing over the following month. For investors that can trade VOO without commissions, the benefit of removing commissions could eliminate the short term advantages of investing in the fund with a weaker short term history. However, that depends entirely on the share volume trading hands. If there was a meaningful movement in price between the two ETFs, I would expect the weaker one on average to capable of outperforming by about .10% in the following month. For the investor contemplating investing in VOO and capable of trading it without commissions, the most attractive time to do so is when it has just fallen short of SPY. If we assume SPY is the most accurate gauge of the movement in the economy, then any time that VOO becomes cheaper relative to SPY is a time when the ETF is more attractive to purchase. It doesn’t matter if SPY moved up or down last month, it simply matters whether VOO underperformed SPY. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Summary The Vanguard S&P 500 ETF has a strong correlation to SPDR’s S&P 500 ETF. Despite the very strong correlation in returns, there is a clear way to pick which ETF is a better investment. The difference is more than expense ratios. The fund underperforming in one month regularly outperforms in the next using dividend adjusted close values. Investors in the Vanguard S&P 500 ETF (NYSEARCA: VOO ) have plenty of reasons to be happy with their investment. The fund tracks a reasonably stable portion of the U.S. economy and offers investors a lower expense ratio than a major competitor, the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). The ratio isn’t substantially lower, but the difference is meaningful if the investment horizon is long enough. For VOO the expense ratio is .05% and for SPY it is .09%. The difference should imply that VOO would outperform over the long term by increasing the compound annual growth rate by about .04%. The difference isn’t huge, but it does add up over time. The correlation Returns between the two ETFs have an extremely high correlation, over 99.9%. The strong correlation in returns gives investors reason to believe that the two ETFs should move almost perfectly in unison. However, there are occasionally meaningful differences in the share price of the two major ETFs and those differences result in opportunities for investors. Looking back I ran some regression on returns since the start of October 2010. Since then, the Vanguard S&P 500 ETF has largely mirrored the SPDR S&P 500 ETF. Both were up between 94.1% and 93.6% and the movements generally occur at almost precisely the same time. The interesting thing was when I decided to track the differences in the dividend adjusted closes for each month. The premise is that for each month I would look at the returns on VOO and subtract the returns on SPY. This gave me the difference in the percentage return for the month. I put together a chart to demonstrate, but the volume of data points may make it a little difficult to read. (click to enlarge) What investors should notice is that the bars are regularly trading direction. Not only do the bars swing back and forth, the longest bars going in any direction are precisely between two bars heading in the opposite direction. When the bars are fairly short, it provides little indication of which way the bars will move in the future. The theory My prediction upon glancing at the numbers was that we should expect to see serial negative correlation in the difference of the returns. In simpler words, we should expect the two ETFs to move together and treat any deviation from that connection as an error by the market. When one ETF has meaningfully outperformed the other in the previous month, the one with weaker performance should be purchased. I tested that by running a correlation between the difference for each month and the difference reported in the next month. If my theory was correct, there should be a negative correlation. The test showed a negative correlation of 35.7% (rounded). With a decent sample size, I’m comfortable taking that as confirmation. In my opinion, the deviations in the market value of these two ETFs can be used as a clear indication on which ETF investors should be buying if they are investing with a time frame of a few years. If the time frame is multiple decades If investors are planning to buy and hold the shares for a few decades, the difference in expense ratios should overwhelm the regression between the two ETFs and I would expect VOO to provide slightly superior returns over the next 20 or 30 years due to the difference in expense ratios. Conclusion Vanguard S&P 500 ETF is a great investment for keeping up with the S&P 500 over the long time. It offers a lower expense ratio than SPY and very similar returns. When the time frame is measured in months or only a couple of years, investors may want to look at the recent difference in returns and choose the ETF that has seen weaker share price performance since there is a very solid history of the differences in performance reversing over the following month. For investors that can trade VOO without commissions, the benefit of removing commissions could eliminate the short term advantages of investing in the fund with a weaker short term history. However, that depends entirely on the share volume trading hands. If there was a meaningful movement in price between the two ETFs, I would expect the weaker one on average to capable of outperforming by about .10% in the following month. For the investor contemplating investing in VOO and capable of trading it without commissions, the most attractive time to do so is when it has just fallen short of SPY. If we assume SPY is the most accurate gauge of the movement in the economy, then any time that VOO becomes cheaper relative to SPY is a time when the ETF is more attractive to purchase. It doesn’t matter if SPY moved up or down last month, it simply matters whether VOO underperformed SPY. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis. Scalper1 News

Scalper1 News